DAO token evolution, an overview of current practicality and potential use cases

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-03-23 13:20:22623browse

Global Crypto Research (GCR) and Friends With Benefits (FWB) have conducted a collaborative study to conduct a comprehensive study of decentralized autonomous organization (DAO) tokens and their current application landscape. Despite growing interest in and investment in DAO tokens, their utility and application are still limited by a range of technical, regulatory and operational challenges. Our main goal is to explore potential use cases for the DAO token and propose a roadmap for its future development. Through this collaborative research, we hope to help deepen understanding of the DAO token, foster innovation and drive stronger, more versatile and fairer applications in the crypto-economy.

Current Status of DAO Tokens

Many DAO tokens help incentivize, coordinate, and govern communities in various ways.

Cryptoassets can play both sides when it comes to finances. Whether positive or negative, the value of a token affects how people view a project. When the value of a coin rises, it creates a positive feedback loop of positive sentiment. Conversely, when a currency loses value, it can have a negative impact on the morale of communities with a financial stake in it, and ripple through the wider industry. Therefore, it is crucial to create a DAO token that can maintain a balance between supply and demand. We explored various use cases for DAO tokens to determine the most efficient ways to build DAO tokens in the future.

DAO’s tokens are generally regarded as the main financial source of DAO. DAOs typically invest the majority of their financial reserves into their own tokens. These tokens are used to incentivize contributors, cover operating costs, and support the further growth and operation of the DAO. However, as mentioned earlier, it is crucial to ensure that the tokens have real utility to maintain a balance between spending and income.

Access and Membership

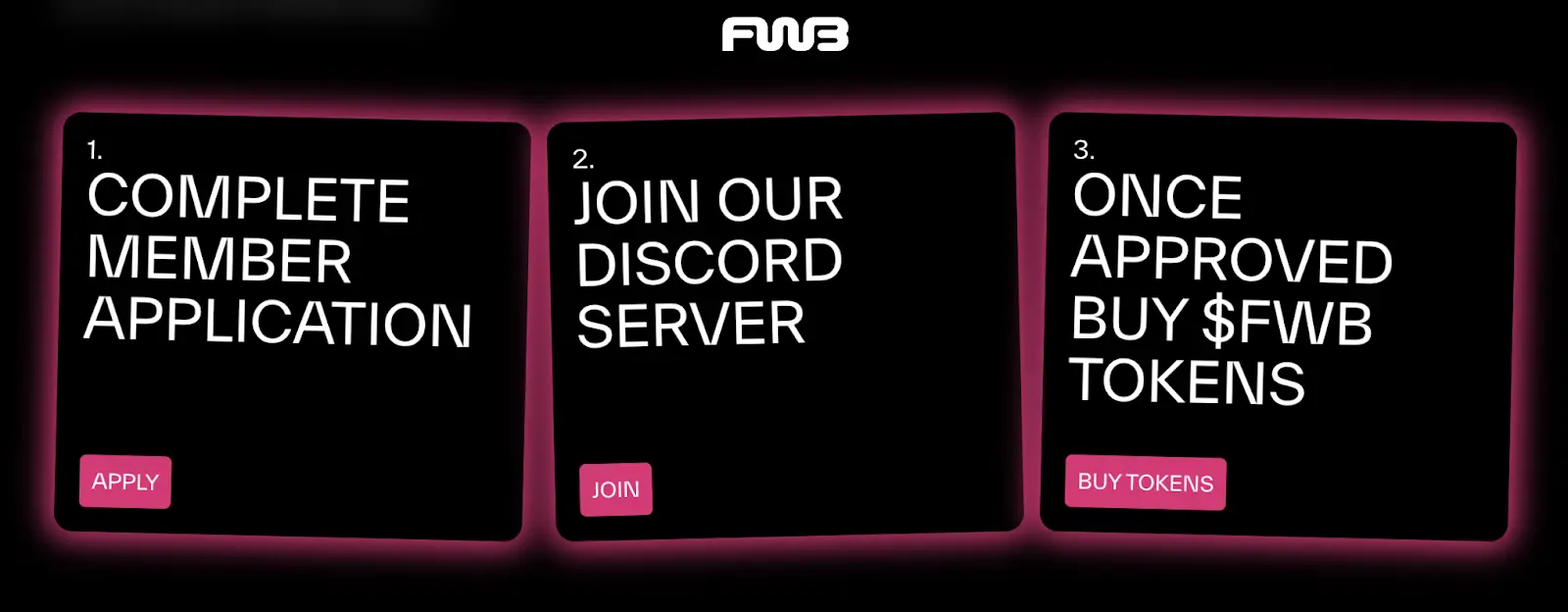

Token ownership can be multifaceted, and in some cases it represents the right to participate in the governance of a project or community treasury, In other cases it represents a connection to the community at large. For Friends With Benefits, having at least 75 FWB is a prerequisite for applying to join the private and token-gated Discord server, which is the community’s private “town square” where members can share information, organize projects, and coordinate Community governance. In addition, events held by FWB require a small amount of FWB to participate. This mechanism effectively expands the membership of the DAO rather than being limited to community members on the Discord server. Requiring community participants to own tokens is an effective method for generating initial demand for tokens and aligning interests. However, this approach is unsustainable as a stand-alone strategy, as it only requires users to “buy once and hold” and does not induce repeated demand for the token itself.

Governance

DAO tokens typically include governance rights, giving holders the power to make suggestions and vote on all aspects of the DAO. These matters may include decisions about new organizational structures, initiatives, partnerships, team compensation, and even financial asset allocation. Some tokens grant voting rights without any additional obligations, while other token designs require DAO tokens to be "locked" for a period of time before voting rights can be obtained. For example, FWB and GCR tokens can be used for voting purposes without any lock-up period.

In contrast, Curve uses a popular voting hosting model that is different from other platforms. In this model, CRV tokens are locked for a period of time in exchange for voting rights. Holders can obtain corresponding voting rights based on the length of time they lock their tokens. This mechanism is designed to incentivize holders to hold tokens for the long term, thereby increasing their voice and influence in governance decisions.

Unfortunately, most DAOs only vote on sporadic proposals, and voting participation rates are usually low. Charmverse estimates that most DAOs have voting participation rates in the single digits.

Value Growth

One way for a token to generate demand is to make it a financial asset worth investing in or having speculative demand for. This is most prevalent among DAOs that govern DeFi protocols. For example, Curve Finance has a revenue sharing mechanism similar to dividends. Other DAOs have adopted buyback and burn mechanisms to accumulate value.

These value accrual mechanisms generally apply to projects that can generate fees or revenue. Community DAO tokens may not have this option. Token issuers should first conduct legal considerations to ensure that the value accumulation model does not cause DAO tokens to be deemed securities by regulators.

Staking

Some projects offer the option of staking tokens, usually in order to earn an income by contributing economic resources to the project. Aave, for example, allows users to stake AAVE tokens into its security module in exchange for a portion of the protocol fees. By staking AAVE, you can act as a backstop in the event of bad debts in the protocol, providing financial security for the project.

However, poorly designed staking mechanisms occur when the act of staking does not provide any economic purpose or benefits paid to stakers resulting in the circulating supply of the token being diluted. In this case, staking serves no purpose other than to incentivize token holders not to sell. Cryptocurrency opinion leader Cobie has previously spoken out against this staking design. Since the last bull market, many projects have abandoned dilutive earnings in favor of "real earnings," or earnings generated by real economic activity.

Potential Use Cases

In the previous example, we introduced the current state of DAO token utility. However, we are still in the early stages of experimentation. In the following sections, we will explore the many different options for DAOs to deploy their tokens in innovative ways.

Launching a Custom Blockchain

One potential use case is launching a community-specific custom blockchain. These blockchains can generate transaction fees, which generates demand for the tokens. There are many services and SDKs that make launching a custom blockchain easier, but it can still be a daunting task. In order to justify the cost of launching and maintaining a blockchain, there must be a sufficiently large and engaged community. While launching a blockchain provides greater control over the user experience for existing members, it also creates challenges for new members to come on board, such as the need for new wallets, gas tokens, and cross-chain bridges. All of these factors must be carefully considered.

Token Migration

Many DAOs were initially launched on the Ethereum mainnet. Gas fees on Ethereum can be prohibitively high, which increases the barriers to growing the community and trying more experimental token designs and mechanisms. While using the OG smart contract chain (Ethereum) certainly comes with some reputation bonuses, migrating tokens to cheaper L1 or L2 can help unlock new use cases. This is a great alternative to launching a custom chain that is expensive to maintain.

Creating Token Utility Around Core Community Activities

Creating additional utility for DAO tokens is important to maintaining demand for the token. For example, Global Coin Research (GCR) recently passed a proposal to allow members to purchase DAO tokens to reduce the commissions they pay on syndicated investments. If members feel good about their early investment through GCR, they can choose to purchase additional GCR tokens to be burned in exchange for reduced fees. The motivation behind this mechanism is to tie additional token utility and demand to the quantity and quality of early-stage investment facilitated by GCR.

Unbinding Token Usage

Is a token bound to too many uses? In Web2, each use case has its own separate corresponding asset. If you want to own equity in a company, you buy shares. Sometimes there are even different voting share classes. Starbucks will give you loyalty points for frequenting their coffee shops, rather than an ownership stake. In Web3, all use cases are bundled in a token. We think this is a good thing: users are also stakeholders and should have ownership of the business they contribute to. But does a token need to represent all of these? Or will this limit growth? With the rise of semi-fungible tokens, we need to explore different dynamic use cases.

Airdrop to your community

Many Web3 communities are more than just a club. They are on a mission to advance the Web3 industry. If successful, this mission will create value in the form of incubation projects. The value of these incubated projects can accumulate into a vault managed by DAO tokens, but what happens if you airdrop that value to token holders? Crypto Oracle Collective (COC), a DAO co-founded by Lou Kerner of Crypto Mondays, intends to do just that. They will start with an airdrop of Crypto Monday tokens and plan to promote this approach among projects incubated by COC.

Rewards and Gamified Participation

The community token should be easily accessible so that it can spread widely and build attachment to the token and the community. People interested in the community can get a small gift of tokens to build relationships. Members who attend community events should be rewarded with a small amount of tokens. Communities should explore rewards and gamification for participation. A greater number of tokens gives the holder a higher social status within the community.

It should be noted that token farming (farming) may destroy the community, so some locking periods should be set, and the unlocking mechanism will refer to the holder's contribution to the community. In this way, first place does not mean getting the biggest reward, but those who contribute to the community can actually get the reward, and the tokens of those who extract will be redistributed.

In terms of rewarding community members with greater contributions, the Optimism PGF (Public Welfare Fund) model may be a good choice. Community members will be incentivized to make meaningful contributions, knowing that their contributions can be retroactively rewarded.

Of course, airdrops may increase selling pressure on the token. On the other hand, with micro-rewards for small participants, selling tokens makes less sense. This approach creates an emotional connection between the token and the community. Some people may still sell tokens, but the mechanism can self-select community participants who do not sell tokens and are therefore more in line with the long-term vision of the community.

Summary

The emergence of DAO tokens has created one of the best coordination mechanisms in the world. Tokens incentivize and enable complete strangers to pool their resources to accomplish a common mission. Having said that, we are still in the early stages of the tokenization community’s development, and we should all continue to experiment and explore new token mechanisms and use cases.

The above is the detailed content of DAO token evolution, an overview of current practicality and potential use cases. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- What are the programming languages?

- What programming languages do you need to learn to make mobile games?

- Practical Notes on Blockchain Technology: Sharing Go Language Development Experience

- How to use Go language for public blockchain development?

- Is Optimism Coin worth holding for the long term? Is Optimism Coin worth investing in?