Bloomberg Analyst: GBTC selling pressure stems from bankruptcy Genisis! The worst is over

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-03-23 11:26:34656browse

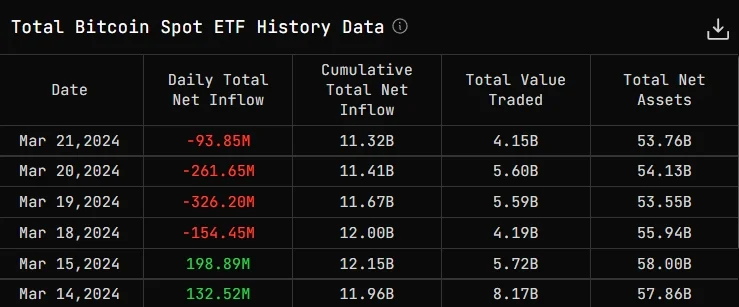

According to SoSoValue data, the Bitcoin spot ETF experienced a net outflow for the fourth consecutive trading day on the 21st, with an amount as high as US$94 million. This situation has not occurred since January 25. It hasn't happened since.

Changes in net inflows and outflows of Bitcoin spot ETFs

On the 21st, the largest net outflow was Grayscale’s GBTC in a single day The net outflow was US$358 million. In the previous week, Grayscale had a large-scale net outflow. On the 18th, the net outflow was US$642 million, setting a record high. The current historical net outflow of GBTC has reached US$13.63 billion.

Bitcoin spot ETF net inflows and changes

However, Bloomberg ETF analyst Eric Balchunas predicted on Twitter that most of Grayscale’s capital outflows may It may end soon, as most of the recent increase in net outflows has come from the liquidation of bankrupt cryptocurrency companies, as shown by its "scale and consistency": any outflows from Gemini/Genisis are likely to be converted into Buy Bitcoin so the market will remain strong. The point is, the worst may be coming to an end, and once it does, all that will be left is retail outflows, which should be more like the trickle seen in February.

Genisis sells GBTC

In addition, anonymous independent researcher Ergo BTC discovered that in the past few weeks, GBTC capital outflows worth approximately US$1.1 billion seemed to come from the bankrupt cryptocurrency lender Genesis. Genesis In the past few weeks, more than 16,800 BTC have been transferred to 2 new addresses, and these Bitcoins may have originated from GBTC outflows.

Genesis, which is in bankruptcy proceedings, sought court approval in early February to sell about $1.6 billion of its Grayscale trust assets, including more than $1.3 billion worth of GBTC shares, while the bankruptcy court has Genesis' request was approved in mid-month, allowing the agency to sell the assets to repay creditors.

The above is the detailed content of Bloomberg Analyst: GBTC selling pressure stems from bankruptcy Genisis! The worst is over. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Focusing on the digital business ecosystem and metaverse industry, Lujiazui Digital Intelligence World strives to create a data element industry cluster

- Gathering forces and symbiosis: wonderful moments of the second Metaverse Academic and Commercial Application Forum!

- OKX cryptocurrency exchange has officially been granted a VASP license by the Dubai authorities to further expand into the Middle East market

- Summary of the latest rankings of the top 10 cryptocurrency trading platforms in the global currency circle

- What is Arbitrum Coin? What are the characteristics of Arbitrum coin?