Coinbase-backed Base leads Ethereum layer 2 network fees as trading activity surges

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-03-22 21:16:10826browse

Base said the high fees are caused by high network traffic.

Coinbase Powered by Base In the current wave of attention from crypto traders, Ethereum is the chain with the highest transaction fees on the second-tier network.

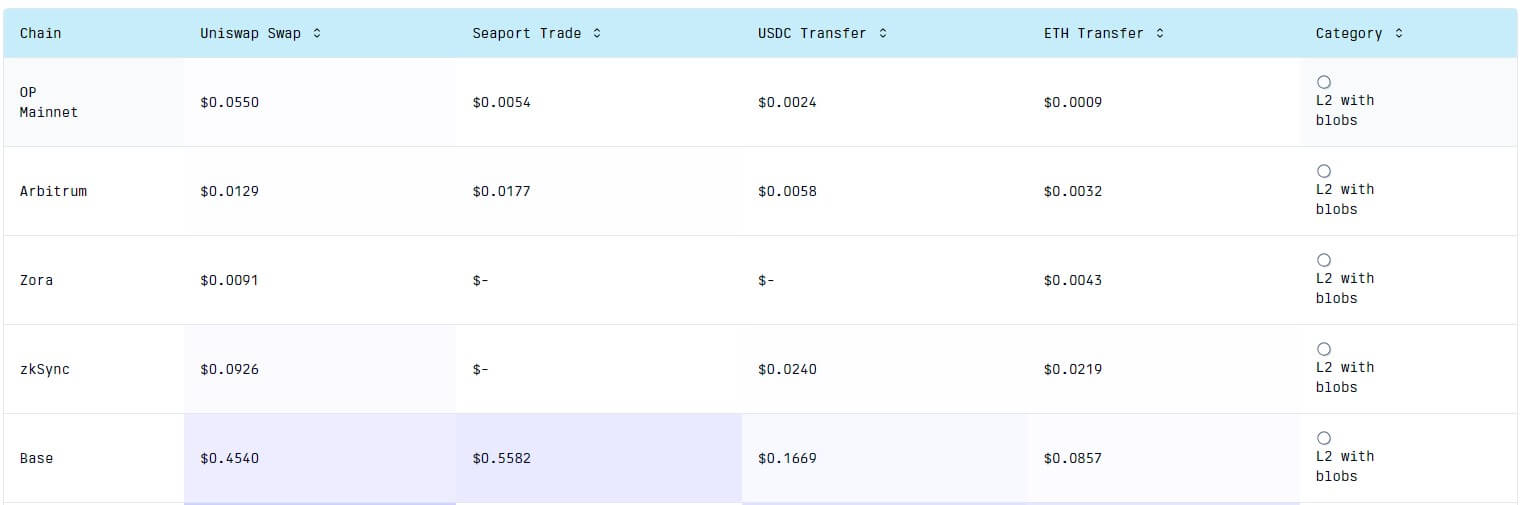

Data from Gasfees shows that Base is the most expensive Layer 2 protocol among scaling solutions that implement Dencun’s upgraded Blobs feature. This feature significantly reduces transaction fees and increases the throughput of the Layer 2 network by allowing rollup data to be published in a more efficient and cost-effective manner.

Ethereum Layer 2 network fees | Source: Gasfees

In fact, the average transaction fee on Base hovers between $0.0857 and can be as high as $0.5582 for the average NFT transaction on Seaport, compared to the average transaction fee on Optimism which ranges between $0.0009 and $0.0550.

Meanwhile, the blockchain network also confirmed the high fee situation, stating that it was caused by "high network traffic." However, it claimed that the issue had been corrected by press time.

Base The reasons why transaction fees soar

Crypto analyst Kofi attributes the situation to increased trading activity from bots willing to pay “high-priority fees.”

Michael Silberling, another on-chain data analyst, provided a more comprehensive insight into the phenomenon of rising fees. He highlighted that automated players focused on memecoins and arbitrage opportunities on the Base network are key factors in the surge in fees.

Silberling noted that these traders are typically less fee-sensitive than the average user, thus sustaining increases in Base network fees due to increased demand.

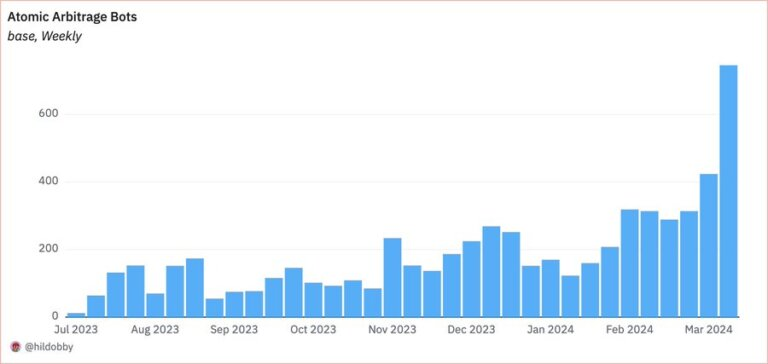

Notably, a dune analytics dashboard curated by analyst Hildobby shows that the number of atomic arbitrage bots on Base has increased recently.

Robots on Base | Source: Dune

Analytics

Base DEXTransactionSurge in volume

Increased bot trading activity has pushed daily trading volume on decentralized exchanges (DEXs) on the Ethereum second-layer network to a new high of $374 million in the past day.

This milestone reflects Base’s growing popularity among crypto traders following the successful completion of the Dencun upgrade. According to data from DeFiLlama, trading volume on the platform surged 71% in the past week to approximately $1.5 billion.

Additionally, the total value of assets locked on the network has surged to a new high of $775 million.

The above is the detailed content of Coinbase-backed Base leads Ethereum layer 2 network fees as trading activity surges. For more information, please follow other related articles on the PHP Chinese website!