ether.fi’s ETHFI airdrop will go live this morning! Who is eligible for the airdrop and how do you claim your allocation?

At the current price of $3.40 per ETHFI, the protocol’s 68 million token airdrop created $230 million in free wealth for early members of its community!

90% of the airdrop shares are allocated to staking users; as long as they obtain more than 1,000 points (equivalent to staking 1 ETH in one day or 0.1 ETH in ten days), they are eligible to participate in the distribution, and those who hold Users with successful badges or referrals will receive additional rewards.

Quick View:

1. We gave away 68 million tokens in the first quarter, accounting for 6.8% of the supply;

We have considered the community’s feedback, The decision was made to increase the token allocation to over 12 million, accounting for an additional 1.2% of the total supply. This move injects capital into smaller stakeholders without compromising whales.

3. The average number of airdrops received by each user is 575 tokens, with a median of 175 tokens;

4. The largest allocation is approximately 3 million tokens , this person deposited $480 million during the final countdown event;

5. Deposits during the final countdown event resulted in others adding 7.7 million tokens!

Season 1 Token Distribution:

90% to stakers;

6% to partners;

4% to early adopters (fan NFT holders and EAP participants).

Stakers received 90% of the proportional share (61 million tokens), the distribution is linear but biased towards smaller stakers;

ranked lower 50% of wallets contributed 1.8% of TVL and received 18% of the token allocation;

The top 10% of wallets contributed 88% of TVL and received 65% of the token allocation.

Qualifications for airdrops:

-

Pledge 1,000 points to get more than 1,000 points, which is equivalent to pledging 1 ETH/day, or pledging 0.1 ETH/10 days;

Fan NFT holders can receive 430 tokens per NFT;

Independent pledgers participating in "Solo Staker Operation" received 4,200 tokens Coins;

Badge holders and referrers receive more allocations.

Who is not eligible?

Users who have earned less than 1,000 points through staking activities (i.e., if a user’s points come entirely from badges, they will not receive an airdrop);

Users who have not been converted out of EAP.

Frequently asked questions:

1. Why choose a linear model instead of a hierarchical model?

For staking protocols, especially those integrated with Pendle, where layered airdrops are highly susceptible to manipulation and generally subject to Sybil attacks, (mostly) linear airdrops are critical in order to respect YT holders.

2. Did last week’s whale dilute the value of everyone else?

No, in fact large deposits increase everyone's allocation. The Final Countdown Promotion is a matching model where every 50,000 ETH staked will earn 0.125% of tokens and existing stakers will receive a matching 0.125%. As a result of the final countdown, the community received an additional 7.7 million tokens allocated to them.

While the distribution of ether.fi is primarily a linear distribution based on ETH deposits, it is biased in favor of certain stakeholder groups, with the bottom 50% of wallets contributing 1.8% of TVL and receiving 18% of tokens.

Due to this allocation, later whales also managed to cash out large sums, Justin Sun received nearly 3.5 million ETHFI tokens (worth 1170 at the time of analysis) after depositing 120,000 ETH into ether.fi Ten thousand U.S. dollars).

For those of you who missed out on the ether.fi airdrop, do not despair, because now is the time to turn your regrets about not taking advantage of this opportunity into action and prepare for future airdrop opportunities! Not only is ether.fi promising an additional 5% of the token supply during the second airdrop, but there are multiple other token-less restaking projects, making interacting with projects in this space a lucrative prospect.

The above is the detailed content of Who is eligible to receive ether.fi's ETHFI airdrop?. For more information, please follow other related articles on the PHP Chinese website!

Top 10 Reliable Digital Currency Exchange Rankings Summary of the Top 10 Digital Currency Apps in the WorldApr 30, 2025 pm 03:36 PM

Top 10 Reliable Digital Currency Exchange Rankings Summary of the Top 10 Digital Currency Apps in the WorldApr 30, 2025 pm 03:36 PMTop 10 reliable digital currency exchanges rankings: 1. Binance, 2. OKX, 3. Coinbase, 4. Kraken, 5. Huobi Global, 6. Bitfinex, 7. KuCoin, 8. Gemini, 9. Bitstamp, 10. Bittrex, these platforms offer high security and a variety of trading options, suitable for different user needs.

Top 10 Virtual Digital Currency Exchange App Rankings Top 10 Virtual Currency Trading Platforms in the WorldApr 30, 2025 pm 03:33 PM

Top 10 Virtual Digital Currency Exchange App Rankings Top 10 Virtual Currency Trading Platforms in the WorldApr 30, 2025 pm 03:33 PMTop 10 virtual digital currency exchange app rankings: 1. Binance, 2. OKX, 3. Coinbase, 4. Kraken, 5. Huobi, 6. KuCoin, 7. Bitfinex, 8. Bittrex, 9. Gemini, 10. Bitstamp, these platforms have their own characteristics, covering the advantages of efficient trading systems, rich trading pairs, multi-level security measures, relatively low transaction fees, and innovative products, to meet the needs of different users.

SEC recently announced delays in its decision to Dogecoin and XRP ETFs, which could reshape Altcoin's landscapeApr 30, 2025 pm 03:30 PM

SEC recently announced delays in its decision to Dogecoin and XRP ETFs, which could reshape Altcoin's landscapeApr 30, 2025 pm 03:30 PMAfter the approval of the Bitcoin ETF last year, crypto asset managers have turned their attention to Altcoin ETF, increasing the possibility of investment choices. According to the regulator's latest timetable, the Securities and Exchange Commission (SEC) will make a decision on the proposed DogecoinETF for Bitwise and Franklin Templeton's XRP products in mid-June. There are also proposals pending, including applications from Factorial’s Grayscale and Cardano Futures ETFs, as well as Solana and Litecoin ETFs, which highlight diversified pathways to invest in cryptocurrencies beyond Bitcoin. This year, as asset managers approve spot stock

Will Sui Bulls or Bears control after a 63% intense rally once a week?Apr 30, 2025 pm 03:27 PM

Will Sui Bulls or Bears control after a 63% intense rally once a week?Apr 30, 2025 pm 03:27 PMIf there is a coin, because the bull and bear are throwing punches for control, it is sui[sui]. And, can you blame them? If there is a coin with a bull and a bear punch for control, it is sui[sui]. And, can you blame them? 63% of the hot rally once a week just pushed into S

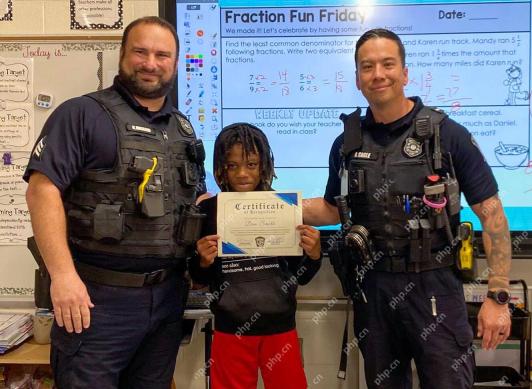

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AM

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AMFayetteville Police Department officers Kevin Ingram and David Cagle present Spring Hill Elementary fifth grader Dan Smith with a certificate of recognition for his heroic actions. By FPD

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AM

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AMArtificial Intelligence (AI) has begun to penetrate all aspects of human life, and governance is next. On April 14, the government of the United Arab Emirates (UAE) approved the implementation of what the media is calling the first AI-powered legisla

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AM

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AMOn-chain data reveals that large Shiba Inu investors, referred to as whales, sold their tokens as the coin's value declined.

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AM

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AMSmart crypto investors are looking for an asset with real-world utility and early potential gains in 2025. XRP and Chainlink (LINK) remain the bedrock of solid portfolios but new opportunities

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

SublimeText3 English version

Recommended: Win version, supports code prompts!

SublimeText3 Linux new version

SublimeText3 Linux latest version

Notepad++7.3.1

Easy-to-use and free code editor