Aave Coin Price Prediction 2024-2030

- 尊渡假赌尊渡假赌尊渡假赌Original

- 2024-03-21 13:51:191114browse

AAVE hit an all-time high (ATH) of $666.86 on May 18, 2021. By the end of 2023, AAVE began testing the psychological $100 mark, starting the year at $51.92 and trading between $50 and $75 for much of the year. With the Bitcoin halving approaching in 2024 - the effects of which will be felt in 2025 - regulations in place and cryptocurrency adoption increasing, we predict a positive future for AAVE.

#As one of the top-ranked DeFi protocols and with an excellent security record, Aave’s future price seems easy to predict. But with regulators poised to target the protocol after completing their oversight of the leading layer 1 blockchain, and the fact that Aave adopts a decentralized governance model, everything is suddenly not as clear as it initially seemed.

Here we’ll take a deeper dive into our Aave price prediction, looking at what factors influence AAVE price, and how we can use it to create an informed price prediction.

Aave Coin Price Prediction 2024-2030

- Aave’s token AAVE debuted in October 2020 at a price of $52.68. It was created by combining the old EthLend, Created by migrating LEND tokens to AAVE tokens.

- Aave is one of the highest-ranked and longest-lived DeFi protocols by Total Value Locked (TVL) and has an excellent security record.

- AAVE hit an all-time high (ATH) of $666.86 on May 18, 2021.

- Towards the end of 2023, AAVE began testing the psychological $100 mark, starting the year at $51.92 and trading between $50 and $75 for much of the year.

- With the 2024 Bitcoin halving approaching - the effects of which will be felt in 2025 - regulations in place and cryptocurrency adoption increasing, we predict that the future of AAVE is positive, reaching 2025 Highs of $436.

| Low price | Meal average budget | High price | |

| 2024 | 98 USD | 125 USD | 175 USD |

| 2025 | $220 | $382 | $436 |

| 2030 | $250 | $325 | $530 |

Aave Historical Price

According to CoinMarketCap data, the AAVE token was launched on October 5, 2020 at a price of $52.68, the same day it launched from the old EthLend , token migration from LEND tokens to new AAVE tokens. A month later, AAVE hit an all-time low of $27.72 before steadily rising alongside the rest of the cryptocurrency market, starting 2021 at $87.54, a 66% increase from its price in early October.

The AAVE token then went on to hit ATH during the 2021 bull run, with a price of $666.86 on May 18. From there, it dropped significantly over the course of 1 week to $293.32 on May 24, a drop of 56%. After that, AAVE struggled to recover and was on a downward trajectory, even as many other currencies, including Bitcoin and Ethereum, hit ATH in November 2021.

AAVE’s steady decline continued until around June 2022, when it began to find itself between $50 and $100. AAVE started at $51.92 in early 2023 and has since traded between $50 and $95, rising and falling with some big news in the crypto market, such as the SEC suing Binance and its CEO 6 The U.S. Securities and Exchange Commission (SEC) charged Coinbase on June 5 — after which AAVE’s price dropped 16%.

After trading between $50 and $75 in mid-2023, AAVE was charged a late fee of $100 at the end of the year. It rose more than 90% from a low of $52.12 on September 12 to test $100 on November 6 — the first time this level was tested since August 2022. Time will tell whether AAVE can overcome this psychological resistance and turn it into significant support in 2024.

Key Points in Aave Price History

- AAVE entered the market on October 5, 2020 at a price of $52.68, having previously started trading from the old LEND Token migration. A month later, AAVE hit an all-time low of $27.72.

- From that low, it climbed upwards, with AAVE reaching an ATH of $666.86 on May 18 during the 2021 bull run. Unlike most other coins, it did not continue to create new ATH in November.

- Instead, the AAVE token price continued its steady decline, eventually settling in the $50 to $95 range in June 2022.

- AAVE started 2023 at $51.92 and has traded between $50 and $75 for much of the year.

- In the two months from September 12 to November 6, AAVE price climbed more than 90% from $52.12, testing the psychological resistance level of $100.

Aave Price Prediction for 2024

Looking ahead to 2024, there are a lot of positives for Aave. First, Aave is a mature and battle-tested DeFi protocol trusted by many DeFi users, both institutional and independent (Aave’s Aave Arc serves institutional investors from permissioned and KYC-compliant liquidity pools) . As DeFi continues to grow in popularity, Ethereum, the second most popular DeFi dApp when sorted by volume on DAppRader, will continue to see more users and the token price will benefit from this activity.

There are a number of Bitcoin ETFs awaiting SEC approval, and the approval of one or more of them — which many expect to happen soon — would be good news for the entire crypto market.

However, what is interesting for the future of Aave is the arrival of the Ethereum ETF proposal, which may happen in 2024. Current SEC Chairman, Gary Gensler, refused to say during an April 2023 hearing whether Ethereum was a security. However, in 2018, William Hinman, director of the SEC’s corporate finance division ) said that Ethereum is not a security.

If the Ethereum ETF is passed - although it looks like a lengthy law at this point - it will open the door for institutional investors to start taking a serious look at Ethereum-based of DeFi, where Aave is one of the top protocols. On the other hand, if the SEC decides that Ethereum is a security, it would be bad news for all altcoins, especially those based on Ethereum since they track Ethereum price very closely.

Also in the news is the Bitcoin halving event, scheduled to take place in early 2024. While historically the event itself would not have a direct impact on the price of a cryptocurrency, this year is different as interest and adoption in cryptocurrencies are at an all-time high.

News that could negatively impact Aave is any possible hack of the DeFi protocol, or worse, a hack of the Aave protocol itself. Each version of the Aave protocol will undergo multiple security audits to minimize the risk of hacker attacks before release, but the risk can only be minimized, not eliminated.

Finally, there’s the progress made on the Aave protocol. Because it is through Knife, who proposes and approves proposed changes and improvements to the Aave protocol, there is no roadmap for Aave's future growth and development. This means that, as of now, there are no future developments that one can speculate on the price of AAVE.

With all of this in mind, our Aave price forecast for 2024 is positive, as long as news from the wider market remains positive throughout the year. For 2024, we forecast a low of $98, a high of $175, and an average of $125.

Aave Price Forecast Long Term Outlook – 2025-2030 Forecast

As we look further into the future, trends and news events become more difficult to predict with certainty and more gray areas enter into any Aave Coin Prediction. However, there are some broad strokes we can consider in our long-term Aave price predictions.

First of all, judging from the historical trend after all previous Bitcoin halving events, Bitcoin and altcoins tend to reach new ATH 12-18 months after the event. With Bitcoin halving in early 2024, these ATHs will drop in 2025. This is expected to be the dominant narrative throughout 2025 and the main driver of prices.

As long as no major bad news emerges to distract from this bull run, and the regulatory framework shouldn’t throw up any major surprises at this point, our Aave price forecast for 2025 shows AAVE reaching $436 The high, low is $220, and the median price is $382.

Looking ahead to 2030, we can expect a well-laid global regulatory framework for institutional investors, many of whom have already diversified their portfolios to include now-very popular DeFi products. Since Aave is currently the leading DeFi lending platform, coupled with its excellent security record, it is well-suited to become one of the most trusted and used DeFi protocols by institutional investors.

We expect that by 2030, the global adoption of cryptocurrencies will grow significantly, and more of the public will be familiar with and use some of the features of DeFi, such as over-collateralized loans provided by Aave.

One of the big dark clouds hanging over Aave cryptocurrency price predictions is the lack of a roadmap for the protocol. However, Aave has been undergoing decentralized governance since early 2022 and has so far been successful in upgrading and managing the direction of the protocol. The longer this happens, the more likely people are to trust the DAO governance mechanism and the future of the Aave protocol.

By 2030, we will also have a pullback from the 2029 highs resulting from the 2028 Bitcoin halving. After all these insights, our Aave price prediction for 2030 is a high of $530, a low of $250, and an average price of $325.

Potential Highs and Lows for Aave Coin Price

Like all assets, the price of AAVE will rise and fall throughout the year. However, past data can help us make informed price predictions for the future. After looking at these historical data points, our price prediction for AAVE is as follows.

| 年 | Low Price | Meal Average Budget | High Price |

| 2024 | 98 USD | 125 USD | 175 USD |

| 2025 | $220 | $382 | $436 |

| 2030 | $250 | $325 | $530 |

What are other analysts predicting for Aave Coin?

Aave is one of the most popular DeFi protocols available to users. As a result, some speculate on the value of the protocol tokens.

AMBCrypto website predicts that the AAVE token will reach $115.48 by the end of 2024 and will rise steadily by 2030, with a projected valuation of $144.36.

AMBCrypto’s

CoinCodex predictions for AAVE’s future vary, with a projected low of $89.82 and high of $702.50 in 2024 . Their forecasts for 2025 are more stable, with a low of $242.44 and a high of $603.26.

CoinCodex

Changelly Blog predicts that AAVE will surpass $1,000 for the first time in 2030, with a peak price of $1,199.50.

Changelly

AAVE is also expected to cross $1,000 for the first time in 2030, reaching a high of $1,029.18 on the DigitalCoinPrice website. Near future highs in 2024 and 2025 are $251.10 and $357.80.

DigitalCoin Price

#Bitnation predicts that AAVE will reach a high of $274.32 in 2024 and $372.29 in 2025 . Lows were $215.53 and $313.50.

Bit

What is Aave Coin and what is it used for?

AAVE is the native token of the algorithmic lending protocol of the same name, Ghost. Aave was originally called EthLend before changing its name to Aave, and swapping the ETHLend platform’s LEND token for the new AAVE token.

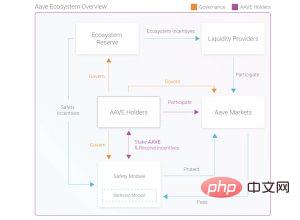

# The ##Aave protocol operates on 7 different networks and over 14 different markets, with over $8 billion in locked liquidity at the time of writing. According to DappRadar, Aave is the 4th and 5th most popular (version 3 and 2 of the protocol respectively) dApps among all cryptocurrencies when ranked by TVL. What does the Aave protocol do? In the first line of the Aave developer documentation, the protocol is described as a “decentralized non-custodial liquidity protocol in which users can participate as suppliers, borrowers or liquidators. Let’s break it down .Aave allows any indiscriminate individual to borrow cryptocurrency by providing collateral. The assets they borrow are deposited into the protocol by a provider. A provider is any indiscriminate individual who owns the cryptocurrency and Want to use it for "be the bank".How does Aave work?

The Aave protocol is non-custodial, which means everything runs through smart contracts and there are no intermediaries between suppliers and borrowers. Vendors deposit cryptocurrencies, such as ETH, USDC, USDT, into the protocol that they wish to borrow. Borrowing is now available, and providers will receive a variable APY on their deposits, depending on how much of their pool has been borrowed.

Borrowers select the pool they want to borrow from, the cryptocurrency they want to borrow from, and deposit their applicable cryptocurrency as collateral (collateral is limited to specific currencies). They can then use their borrowed assets. These loans are over-collateralized because the borrower must deposit more value than they borrow. This allows for fluctuations in the valuation of the token price prior to liquidation.

The loan has no end date, meaning borrowers can keep the loan as long as they want as long as their collateral remains in good shape compared to their loan and the interest that accrues over time. Interest rates for loans through AAVE fluctuate between 2-30%, depending on the asset being borrowed and the utilization of the specific pool the user is borrowing from.

When a borrower's collateral-to-loan ratio approaches equality, they must repay the loan (in the same currency they borrowed), deposit more collateral, or liquidate their collateral, This means they keep the assets they lent and lose the collateral they deposited.

This collateral is then sold to the liquidator at a slight discount to the asset, and the funds received are then used to replenish the pool from which the loans are drawn.

Flash Loans

As an alternative to the over-collateralized loans mentioned above, Aave and many other lending protocols also allow “flash loans”, which do not require the borrower to put up funds. These are aimed at developers who can write smart contracts that meet the requirements of these loans - although some options created for non-developers are on Aave's Flash Loans page.

Flash Loans allow individuals to borrow anything from the protocol amount of funds as long as they return them in the same block as when they were withdrawn. This is primarily used for arbitrage, taking advantage of price differences between the same asset in two different markets. Flash loans have a fixed fee of 0.09%.

Security of the Aave protocol

Aave is a completely open source protocol, which means that anyone can inspect the code and build a front end or interface that links to the Aave protocol. There are numerous security audits and formal verifications performed by different companies on each version of the protocol, and there is a bug bounty that allows white hat hackers to be compensated for anything they find.

For financial security, the Aave protocol also has a security module. This is the protocol’s insurance fund, funded by users. Users deposit ETH or AAVE into the security module and earn a portion of the platform’s fees as rewards. The content of the security module covers a certain percentage of the funds locked in the Aave protocol should a shortage event occur, i.e. a hacker attack or technical failure that results in the loss of funds. Among them, with the security module in place, the Aave protocol is insured in a non-custodial and decentralized manner.

What is the use of AAVE tokens?

AAVE is an ERC-20 native token of Ethereum with over 160,000 holders and two use cases in the Aave economy and ecosystem.

Protocol Governance: The Aave protocol has one of the most mature governance procedures of any Ethereum dApp. AAVE tokens are used to vote on Aave Improvement Proposals (AIPs), which are proposed in the governance forum before voting occurs. Each AAVE has equal voting rights, and voting rights can be delegated to protocol politicians. AAVE is also required to create proposals.

Security module staking: The security module is the insurance fund of the AAVE protocol. AAVE holders can pledge their AAVE to the security module to obtain rewards for protecting the protocol.

Aave Coin Overview

Hundreds of millions of dollars of AAVE are exchanged every day, and these statistics help us inform Aave price predictions.

| Cryptocurrency | 鬼 |

| Stock Code | 鬼 |

| 行 | #39 |

| Price | 97.88 USD |

| Price change 24 hours | 0.00% |

| Market value | 1,431,973,889 yuan |

| Circulating supply | 14,630,011 AAVE |

| 265,414,501 USD | |

| Historical High | $666.86 |

| Historical Low | $27.72 |

What affects the price of Aave?

As the dominant protocol in the DeFi space, AAVE’s price impact comes from multiple directions, some of which are more resilient than others.

Cryptocurrency and DeFi Regulation and Adoption

As Bitcoin ETF controversy continues, SEC sues Binance and Coinbase, and SEC targets Ripple ) case has not yet been resolved and everything is still not smooth sailing in the world of cryptocurrencies, with both positive and negative news affecting the prices of most coins.

Going forward, Aave will be both a winner and a loser on this topic. As regulators begin to focus on different areas of the crypto economy, DeFi will almost certainly be one of their top targets.

Being at the top of the DeFi stack means that it will directly be in the crosshairs of any regulatory agency and subject to strict scrutiny. This could be good news and bad news for the price of AAVE, if regulators have issues with the decentralized lending protocol then the price will drop significantly, and once the Aave protocol seems to have the blessing of the regulators, the price will rise .

Bitcoin Halving

The Bitcoin halving event affects the entire crypto market. Historically, new ATH occurs approximately 12-18 months after each halving, and then the price plummets, leaving the coin approximately 75% higher than before the halving-induced bull run.

Hack

A hack of the Aave protocol, depending on its severity, could significantly reduce the price of AAVE before it can begin to recover. However, Aave does have its security module, which should help mitigate some, if not all, of the damage caused by hackers.

Large-scale and well-publicized hacks of other protocols could also have a negative impact on Aave price, as those new to the market exit their positions in DeFi protocols, leaving Aave guilty. Conversely, these hacks could also have a positive impact on AAVE’s price as investors move to safer DeFi assets.

No Roadmap

As mentioned before, Aave does a great job under the guidance of its DAO. However, this limits how quickly the protocol can grow, adapt, and respond, potentially leaving it vulnerable to being overtaken by faster-growing competitors or not responding quickly enough to hackers, as was the case with the 2016 DAO hack on Ethereum.

Is Aave worth buying?

As one of the most popular DeFi protocols and a top P2P lending protocol according to DappRadar, Aave will become one of the most popular Dapps in the DeFi ecosystem as cryptocurrencies inevitably gain global popularity spread within. Its decentralized governance model and non-custodial nature could also prove tricky for regulators if they try to crack down on DeFi activity to protect traditional financial institutions.

With its security module as an insurance fund and the practice of completing multiple audits of its smart contracts, as well as formal verification and an active bug bounty, Aave can also be counted among the most secure dApps.

Finally, Aave also has a deflationary token model, which means that the value of tokens still in circulation increases as other tokens are removed from the market as they are burned. This, along with the security factor and continued adoption of crypto and blockchain applications, makes Aave a buy.

Conclusion

Any Aave price prediction is based on technical charting and information analysis to understand how the coin's price will react to future events. Unlike many other protocols, Aave is the governance token of a mature and successful protocol that has processes in place to mitigate any attacks and issues that could disrupt other less prepared protocols.

The above is the detailed content of Aave Coin Price Prediction 2024-2030. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Ferrari accepts cryptocurrency payments in US, plans to expand to Europe

- What are the differences between the Ethereum Shanghai upgrade and the Cancun upgrade?

- Binance's 2023 report reveals: the number of users increased by more than 40 million! Focus on investing in Web3 and DeFi fields

- What is the MEV known as the 'Dark Forest' of Ethereum?

- Bitcoin surges, three altcoins about to soar!