Technology peripherals

Technology peripherals It Industry

It Industry SpaceX internal documents reveal: Additional terms for buybacks lead to "chilling effect" on employees

SpaceX internal documents reveal: Additional terms for buybacks lead to "chilling effect" on employeesNews from this site on March 16, foreign technology media TechCrunch recently disclosed an internal SpaceX document, showing that employees participating in the "employee stock ownership" plan must sign special terms, resulting in a "chilling effect."

SpaceX employees will repurchase relevant shares within 6 months after their resignation, but one of the regulations is quite special. If SpaceX has the right to ban past and current employees from participating in buybacks if they are deemed to have acted "dishonestly toward the company" or violated the company's written policies, among other reasons.

A former employee said that when employees register on the equity compensation management platform, they often do not know the condition of "dishonesty". If SpaceX prohibits an employee from selling stock in a tender offer, the employee would have to wait until SpaceX goes public to cash out the stock, and it's unclear when SpaceX will go public.

Like most tech companies, SpaceX uses stock options and restricted stock units (RSUs) as part of its compensation package to attract top talent.

There’s no doubt it’s already paying off: SpaceX’s 13,000 employees are helping push the limits of aerospace, including flying astronauts to and from the International Space Station and building the largest satellite constellation in history.

Unlike shares of a public company, shares of a private company cannot be sold without the company's permission. Therefore, employees can convert this portion of their compensation into cash only if their employer allows such transactions.

SpaceX typically holds buyback events twice a year, meaning it buys back stock from employees; this schedule has been pretty reliable in recent years, meaning employees have two opportunities to cash out every year.

And once the resignation is caused by "dishonest behavior towards the company", then SpaceX's stock repurchase price will be $0.

Lawyer and stock options expert Mary Russell said it would be highly unusual to include an exclusion clause in a tender offer agreement, which typically involves departures and buybacks. Rights have nothing to do with it.

A former employee said that Musk uses this method to control employees and cannot make radical remarks even after leaving. Translated by this site, the employee disclosed the following:Even if you pay thousands of dollars in taxes and fees, since SpaceX is not eager to go public, being prohibited from participating in the tender offer means that it will be very difficult in the future. The value of your holdings over a long period of time is zero. When you leave, they will force you to sign a non-disparagement agreement with a carrot and a stick (if they have a stick).

The above is the detailed content of SpaceX internal documents reveal: Additional terms for buybacks lead to "chilling effect" on employees. For more information, please follow other related articles on the PHP Chinese website!

人体试验要泡汤?马斯克Neuralink面临联邦调查,实验动物死亡频发Apr 12, 2023 pm 05:37 PM

人体试验要泡汤?马斯克Neuralink面临联邦调查,实验动物死亡频发Apr 12, 2023 pm 05:37 PM上周,马斯克举办了 Neuralink 的 Show & Tell 演示活动,向世人展示了脑机接口的最新进展。会上,马斯克表示,从原型到生产非常困难,面临诸多挑战。Neuralink 一直在努力启动人体试验,并且已向 FDA 提交了开始人体试验所需的所有文件。马斯克估计,第一个 Neuralink 设备可能会在 5-6 个月内进入人脑。会上马斯克强调, Neuralink 尊重动物受试者,并且脑机接口设备植入动物体内之前已经进行了广泛的基准测试。两只猴子 Pager 和

马斯克反讽人工智能AI炒作:“机器学习”本质就是统计Jun 13, 2023 pm 12:13 PM

马斯克反讽人工智能AI炒作:“机器学习”本质就是统计Jun 13, 2023 pm 12:13 PM驱动中国2023年6月12日消息,近日,特斯拉CEO埃隆·马斯克周六在推特上发布了一张图片,疑似讽刺当前关于“人工智能”的炒作现象。图文显示,一位戴着“MachineLearning”面罩的路人,将其面罩摘下是一张写着“Statistics(统计)”的面孔。寓意当前大火的人工智能AI本质就是数据统计的结果。值得注意的是,持此类意见的科技领袖恐不在少数,之前马斯克曾与苹果联合创始人史蒂夫沃兹尼亚克以及上千名AI研究人员联署公开信,呼吁暂停研究更先进的AI技术。然而,此信遭到许多专家甚至签名者的质疑

X 网站出现无法屏蔽的广告,会诱导用户点击Oct 10, 2023 pm 04:37 PM

X 网站出现无法屏蔽的广告,会诱导用户点击Oct 10, 2023 pm 04:37 PM根据Mashable的报道,据称在X网站(原名Twitter)的移动应用程序中,用户在他们的ForYou信息流中发现了一些没有标注的广告。当用户点击这些广告时,会跳转到其他网站,而且没有办法屏蔽或举报这些广告这些新出现的广告与普通广告有所不同。普通广告只是来自X网站账号的帖子,并且带有一个“Ad”的标签。而这些新广告没有与之相关联的账号,仅由书面文本、照片和虚假头像组成,使其看起来像正常的推文。它们旨在诱导用户点击。以下是它们的样子:如果用户只是随意地滑动屏幕,嵌入的图片和吸引眼球的文本可能会让

马斯克,脑机接口,第一刀Jun 04, 2023 am 09:49 AM

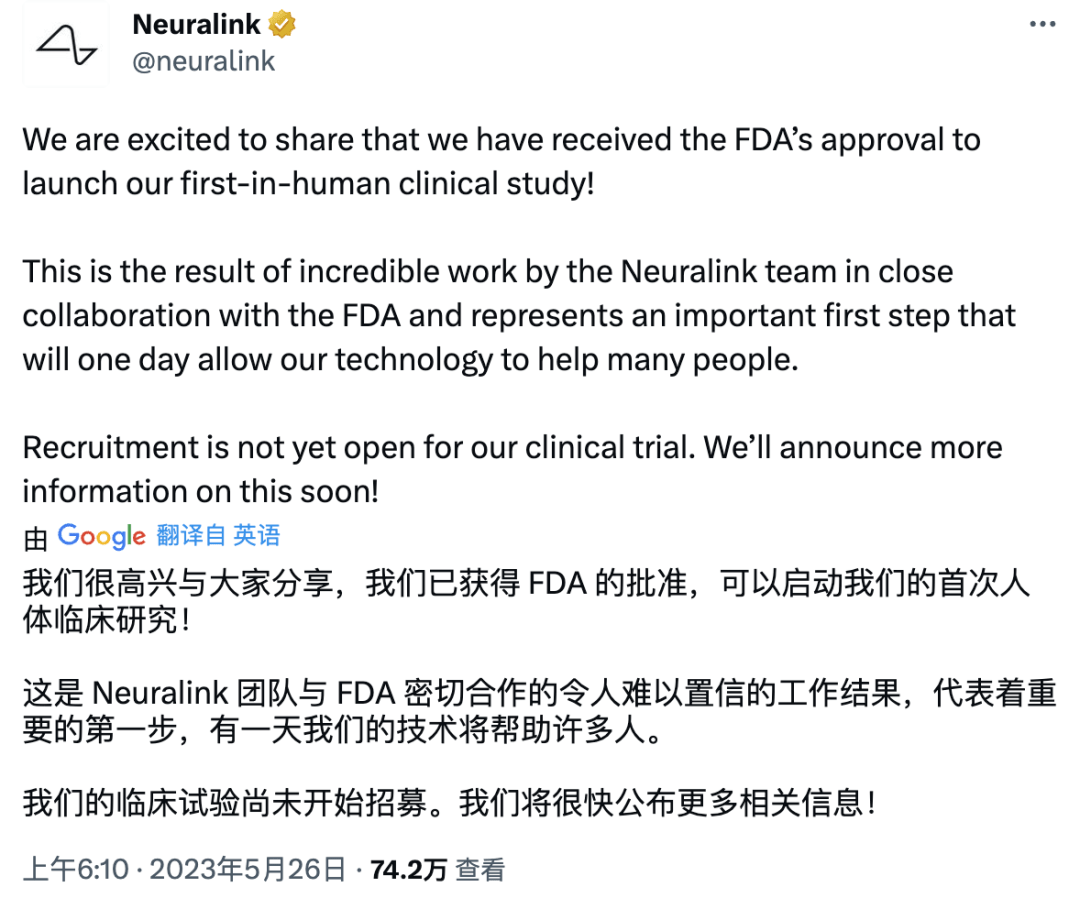

马斯克,脑机接口,第一刀Jun 04, 2023 am 09:49 AM从“硅谷钢铁侠”到“现实钢铁侠”,马斯克成为“人类托尼・史塔克”,正在逐渐成为现实。就在几天前,马斯克脑机接口公司Neuralink宣布迎来重大进展——已经获得美国食品和药物管理局(FDA)的批准,将启动其首个人体临床研究,这意味着,他们的设备将植入人类的大脑中。据悉他们会专注于两个应用:恢复人类视力,帮助无法移动肌肉的人控制智能手机等设备。在去年11月,马斯克曾放出豪言,称Neuralink距离首次人体试验还有大约6个月的时间。可是后来,由于安全风险大、违反动物权益、涉嫌非法运输危险病原体..

新推特CEO曾为马斯克工作20年,带全家居住在办公室!May 06, 2023 pm 08:43 PM

新推特CEO曾为马斯克工作20年,带全家居住在办公室!May 06, 2023 pm 08:43 PM自从马斯克在推特上搞的关于「自己要不要辞职CEO」的投票结果出炉以来,从媒体到公众都在关心一个问题:谁来接班?据外媒theinformation报道,接班人可能是一位马斯克的忠实拥护者,马斯克的隧道挖掘公司TheBoringCompany的CEO,宇航工程师SteveDavis。据TheInformation报道,今年43岁SteveDavis是和马斯克一样,也是一位「拼命三郎」。此前,他已经在Twitter总部的办公室里睡了两个月。而且还是和他刚刚分娩的妻子,和他们刚刚出生的孩子一起搬过来

马斯克:致力于在 X 平台上实现“真正的金钱”运作,不计划推出自家加密货币Sep 14, 2023 pm 09:53 PM

马斯克:致力于在 X 平台上实现“真正的金钱”运作,不计划推出自家加密货币Sep 14, 2023 pm 09:53 PM马斯克昨日在X平台上引用了此前设计了X平台图标的设计师的发言。他表示,X平台将专注于让真正的金钱在平台上运行,同时不会开发自己的加密货币据悉,X用户“DogeDesigner”昨日发布贴文声称:“X不会推出任何X币。该团队更专注于让真正的金钱在这个App上运作,而不是一些‘替代货币’。”▲图源X用户“DogeDesigner”的发言对此,马斯克回应称:“正确”。▲图源马斯克的发言我们之前报道过,这位“DogeDesigner”实际上是一家加密货币公司的首席执行官,同时也是X平台图标的设计师。马斯

马斯克返老还童?实际是AI生成的本人婴儿照Jun 07, 2023 am 10:00 AM

马斯克返老还童?实际是AI生成的本人婴儿照Jun 07, 2023 am 10:00 AM2023-06-0705:29:10作者:人宝宝最近,一张由AI生成的马斯克婴儿照片在社交媒体上流传开来,引起了网友热议和质疑。据悉,这张照片是一个名为“NotJeromePowel”的用户分享的。在发布时,他幽默地说:“据报道,埃隆·马斯克正在研究一种抗衰老配方,但结果失控了。”该照片很快引起了广泛关注,并获得了数万个点赞。马斯克本人也加入了这场对话,他以幽默的方式回应了粉丝们:“伙计们,我想我可能吃太多了。”并附有一个婴儿表情符号。发布照片的用户同样风趣回应称:“这样你就有足够的时间去火星了

马斯克:人工智能毁灭人类的可能性很小,但绝非不可能May 29, 2023 pm 08:02 PM

马斯克:人工智能毁灭人类的可能性很小,但绝非不可能May 29, 2023 pm 08:02 PM5月24日消息,美国当地时间周二,亿万富翁埃隆·马斯克(ElonMusk)参加《华尔街日报》CEO委员会伦敦峰会时表示,他认为有必要建立能与谷歌和微软竞争的人工智能公司,这可能涉及其商业帝国的不同部分,包括推特。在伦敦峰会开幕式上,马斯克表示他去年斥资440亿美元收购推特的努力正在取得成果。他说,推特目前还不是很赚钱,但最快下个月就可能实现现金流正增长。自马斯克将其私有化以来,推特不再公开报告财务业绩,自2019年以来始终没有盈利。马斯克表示,推特可能是他创建人工智能业务的重要组成部分。特斯拉也

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Dreamweaver Mac version

Visual web development tools

SublimeText3 Chinese version

Chinese version, very easy to use

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft