The correlation between Bitcoin and Nvidia stock prices reached a new high in the past year! Will the AI bubble burst or lead to a currency market collapse?

- 王林forward

- 2024-03-16 14:10:111121browse

This site (120btC.coM): Bitcoin has fallen sharply since it rose above a new high of US$73,000 on Thursday, and the stock price of AI chip leader Nvidia has also begun to fall recently. The stock price fell nearly 8% on the 5th. According to Coindesk, the simultaneous fluctuations of Bitcoin and Nvidia are noteworthy, because some analysts believe that the AI bubble promoted by Nvidia may burst soon.

In the past five years, the market value of Bitcoin has jumped from US$70 billion to US$1.43 trillion, and the market value of NVIDIA has also surged from about US$100 billion to more than US$2 trillion. So far this year, Bitcoin has risen by 60%. Nvidia rose 77.5%.

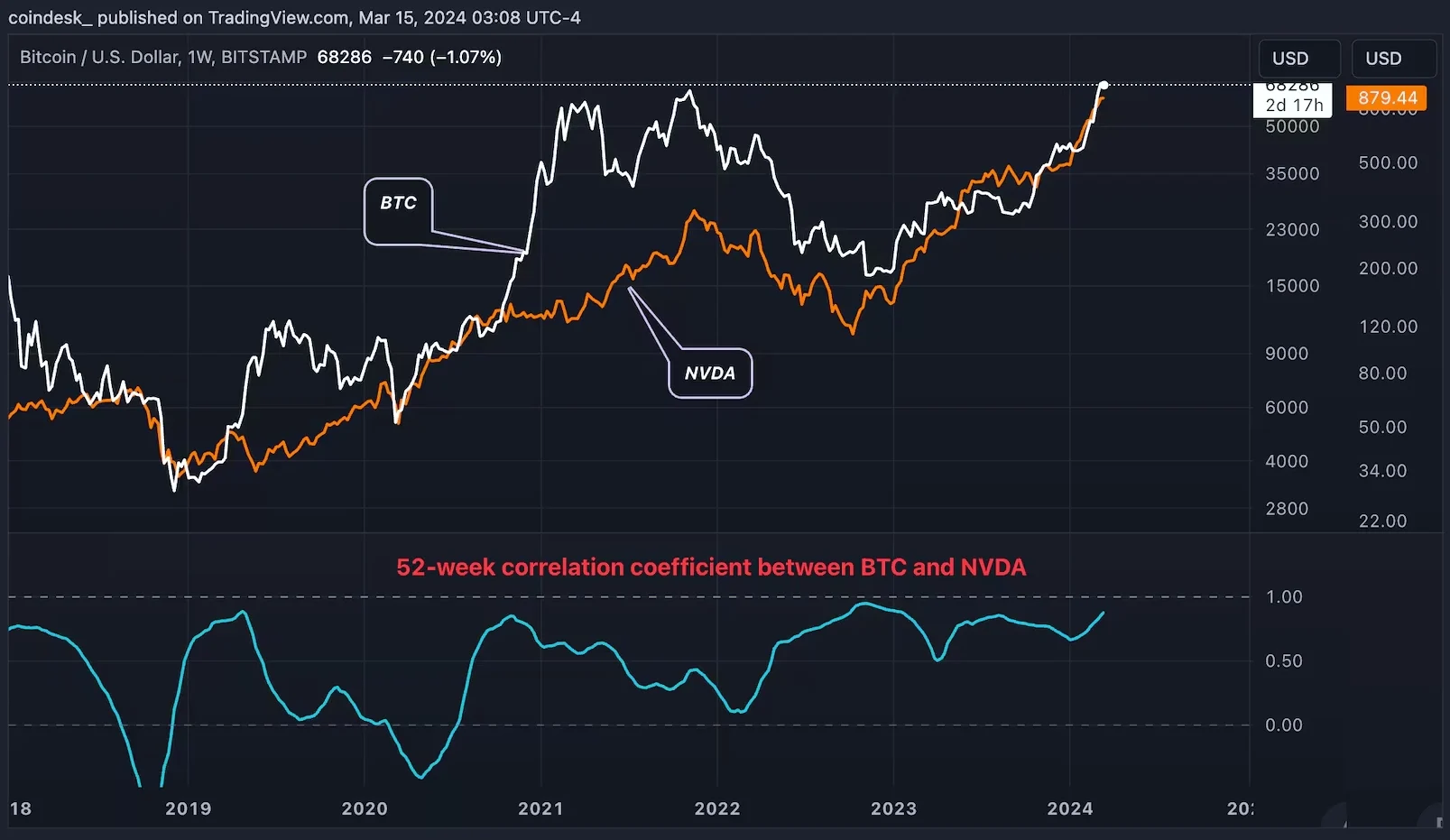

TradingView data shows that the 90-day correlation coefficient between Bitcoin and Nvidia has risen to 0.86, the highest level since May 2023, and turned positive in November last year, and since 2020 Since July, the 52-week correlation coefficient has been positive and has now risen to 0.88, the highest level since January 2023.

A level exceeding 0.8 indicates that Bitcoin and Nvidia fluctuations are highly correlated and tend to fluctuate in tandem.

Is the AI bubble about to burst?

This correlation is noteworthy because some market observers, including investment management firm GMO, worry that the AI boom is similar to the dot-com bubble burst in 2000. GMO founder Jeremy Grantham wrote on Monday that, The AI stock craze is like "a new bubble within a bubble," and this bubble may be about to burst: Every technological revolution like this, from the web to the telephone to the railroad or the canal, is accompanied by early hype and a stock market In a bubble, investors focus on the ultimate possibilities of a technology, pricing much of the long-term potential immediately into current market prices. Many of these revolutions often end up being as transformative as those early investors see them, and sometimes even more transformative, but only after the initial bubble bursts and there is a considerable period of disillusionment.

However, some experts are optimistic. Jeremy Siegel, a long-term bull on U.S. stocks and a finance professor at Wharton School of Business, said that if NVIDIA’s stock price follows the development trajectory of Cisco (CSCO.US) in the Internet era, NVIDIA’s stock price is expected to Doubling or even tripling the current level, that is, the stock price is US$2,700 and the market value reaches US$6.8 trillion.

The above is the detailed content of The correlation between Bitcoin and Nvidia stock prices reached a new high in the past year! Will the AI bubble burst or lead to a currency market collapse?. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Node.Js generates Bitcoin address (with code)

- Detailed explanation of how Bitcoin contract trading works on Eureka Exchange

- How are Bitcoin platform handling fees calculated?

- Which domestic formal BTC Bitcoin trading platform apps are better? Recommended sharing of the top ten domestic BTC Bitcoin trading software!

- Polyhedra completes US$20 million in financing! Public chain Berachain raises another 69 million?