Technology peripherals

Technology peripherals It Industry

It Industry The ninth generation of Camry is launched, sounding the clarion call for the counterattack of the 'B-segment Big Three' of Toyota, Hyundai and Volkswagen.

The ninth generation of Camry is launched, sounding the clarion call for the counterattack of the 'B-segment Big Three' of Toyota, Hyundai and Volkswagen.After the Spring Festival in 2024, the automobile market ushered in a fierce price war, allowing all participants to experience the cruelty of competition for the first time: only by surviving the price war can they have a chance to enter the next round of competition.

In the fierce price war, Toyota, Volkswagen and Hyundai, as the three global top car companies, almost simultaneously started the collective replacement of their B-class representative models "Camry, Sonata and Magotan". What is the intention of this kind of collective play that seems to have reached a certain "tacit understanding"?

In a word, as the leaders of the global automobile market, Toyota and Volkswagen , Hyundai's three major B-class models are trying to re-anchor the value system of mid- to high-end sedans, join the market competition full of variables with a comprehensively upgraded product value and price system, and finally launch a comprehensive counterattack in the chaotic market order.

The collective replacement of the three global B-class flagships: it is not only a counterattack, but also a war to improve user experience

The Chinese market has always had a saying that "if you get a B-class car, you will win the market". As a German The B-class representatives of the three major Japanese and Korean car series, Camry, Magotan, and Sonata, have a very strong influence. They are not only the most powerful fortress of joint ventures in China, but also an important trump card in the battle between oil and electricity. Even in the Chinese market with high-speed electrification, it still has the dominant power to influence the market order.

Therefore, in response to the chaotic situation in the New Year market, the ninth-generation Camry, Magotan and eleventh-generation Sonata have adopted similar strategies to deal with the challenges of the B-class car market. .

The first thing is to adjust product pricing to better participate in price competition. Just like BYD, a company with the advantage of scale effect, launched a price war in the field of electric vehicles at the beginning of the new year, pushing its compact models into the market segment with the most fierce competition between gasoline and electricity. Once joint venture car companies with strong technical and financial reserves start to fight back, the B-class car market will also set off a fierce competition.

The price of the eleventh-generation Sonata once again exceeded industry expectations. Compared with the ninth-generation Camry's starting price of 171,800, the Sonata's starting price is 150,000, breaking the usual pricing rules of joint venture brands and becoming a benchmark in the industry.

More importantly, just like the tacit understanding that Mercedes-Benz and BMW have formed in the field of luxury cars for many years, the user experience differences between Camry, Magotan, and Sonata are equally clear: "Buy if you want sports." The car buying philosophy of "Sonata, Magotan for business, and Camry for luxury" has long been deeply rooted in the B-class car market, and has once again strengthened the market positions of these three major models.

Among them, as the "luxury flagship" in the current B-class car market, the excellent comfort and luxurious configuration are still the absolute highlights of the new generation car Camry; the Magotan, which is about to be launched, is in the exposed Ministry of Industry and Information Technology application pictures It embodies the classic German calm temperament; as a representative model among Korean B-class cars and a master of modern technology, the eleventh-generation Sonata also continues the previous sporty style, and its overall shape is still very dynamic, especially The rear is equipped with a through-type LED taillight set and a slightly upturned ducktail spoiler, showing a strong sports aesthetic.

Although no more detailed information about the new generation Magotan has been disclosed, with Volkswagen’s understanding and emphasis on the Chinese market, it will definitely follow Toyota and Hyundai’s new product strategies. It can be said that with the support of a series of favorable factors such as timely follow-up price wars, inheritance of product genes, and optimized user experience, the collective replacement of the three global B-class car representatives in China, Camry, Magotan, and Sonata, has already made an impact in the B-class market. Each segment of the track has achieved accurate positioning, and has been able to continue its current dominance, and help the brand's performance in the A-level and high-end markets, leaving room for the brand's upward and downward growth, and maintaining the brand's sales volume. Basic disk.

However, new questions also arise. Although the joint venture fuel-class B-class vehicles are still strong at the moment, how can the brand maintain its development position in the Chinese market for a long time?

The sharing of gasoline and electricity is not a matter of life and death. Fuel vehicles will maintain development for a long time.

We must be clear that fuel vehicles and new energy are not antagonistic. They are symbiotic, not replacements. Relationships, they are also an important part of the automotive market. The battle for oil and electricity is not a life-and-death "decisive battle", but a "long-term battle" in which both sides continue to highlight their characteristics and draw on each other's advantages.

And the old models do not mean "old school", but a trustworthy inheritance.

In the long term, although the new energy vehicle market is growing, it is definitely a fantasy to say that fuel vehicles will cease to exist. At present, fuel vehicles still occupy a dominant position in the global automobile market. As the basic base of automobiles, fuel vehicles will definitely exist for a long time. This not only conforms to the basic understanding of most people, but has also been actually verified in life: During the Spring Festival in 2024, extreme weather of rain and snow across the country greatly restricted the travel of new energy vehicles and also aroused social concern. Another reflection on the true value of fuel vehicles.

As Akio Toyoda said: "No matter how much progress electric vehicles make, hybrid vehicles, fuel cell vehicles, and hydrogen fuel vehicles will still account for 70% of the market." Coincidentally, the electrification trend It is also being tested in the global market. Last month, Mercedes-Benz officially announced plans to postpone its electrification goals. Fuel vehicles will continue to exist as the representative brand of luxury brands for a long time.

Secondly, as mentioned above, as the backbone of the sedan market, the fuel-based orientation of B-class sedans is very stable, and joint venture fuel occupies an absolute dominance in sales.

The data speaks for itself. Taking the sales list in January this year as an example, the top eight mid-size sedans are all fuel vehicles, while the best-selling new energy mid-size car is still Wuling, which focuses on cost-effectiveness. The sales volume of Starlight PHEV barely exceeded 10,000. B-class cars are still "synonymous" with fuel vehicles.

However, during this transition period between old and new cars, fuel brands must take the initiative to further consolidate their advantages.

So, as the biggest trump card in the oil and electricity industry, how should the joint venture fuel-class B-vehicle develop?

In short: keep pace with the times and learn from each other’s strengths.

This concept is actually reflected in the replacement of the three giants of the joint venture B-level. Putting aside the ninth-generation Magotan, for which no more information has been released, the ninth-generation Camry and the eleventh-generation Sonata have achieved product breakthroughs while maintaining the basic advantages of stable and durable fuel vehicles without range anxiety.

Among these, intelligence is an area that joint venture brands must pay attention to. At present, China has become the vanguard of global intelligent transformation, and Chinese consumers have higher expectations for intelligent automotive products than any other market in the world.

To this end, in the face of the intelligent experience that is the main focus of new energy vehicles, the response speed of various functions of the ninth-generation Camry's system has been greatly improved, and the operation smoothness has reached the mainstream leading level; while the eleventh-generation Sonata is equipped with Hyundai Motor ccNC (connected car navigation Cockpit) intelligent network architecture, equipped with dual large screens and providing intelligent voice control functions, forming an intelligent experience consistent with mainstream new energy vehicles, making intelligent functions a product highlight, with price advantages and battery life advantages. Under this situation, a "strength suppression" of a large number of new energy vehicles has been formed.

At this point, we can boldly judge that through the major replacement of Camry, the counterattack of mid-to-high-end sedans by Toyota, Hyundai, and Volkswagen’s “B-class Big Three” has officially begun. Horn, and achieved a stage victory. The same-cycle replacement of the three "global flagships" of B-class cars, Camry, Magotan and Sonata, is bound to boost the market's focus on B-class cars and even the fuel vehicle market. Among them, compared with the Camry that has already "launched its name", the subsequent product moves of the Sonata and Magotan are worthy of the industry's unanimous expectations.

The above is the detailed content of The ninth generation of Camry is launched, sounding the clarion call for the counterattack of the 'B-segment Big Three' of Toyota, Hyundai and Volkswagen.. For more information, please follow other related articles on the PHP Chinese website!

迷你版普拉多:丰田全新小型越野车亮相Oct 23, 2023 pm 08:05 PM

迷你版普拉多:丰田全新小型越野车亮相Oct 23, 2023 pm 08:05 PM10月23日消息,日本汽车巨头丰田公司早前曾透露将推出一款更为小型的越野车,被寓意为普拉多的微型版本。最近,一张“迷你版普拉多”的渲染图在海外媒体上曝光。根据渲染图,这款全新车型的外观酷似最新款丰田普拉多,保留了其标志性的分层式前脸设计和凸显的轮眉。此外,预告图也显示,车身尺寸并不特别紧凑,仍然采用了五门设计,为乘客提供了宽敞的内部空间。车辆前后排将享有宽大的车窗,有望提供出色的视野。车辆尾部预计将延续侧开门的设计。尽管丰田尚未正式为这款新车命名,但有传闻称其可能被称为“FCCruiser”,表

丰田及子公司全球销量达1120万辆,油电混合动力车型占三分之一Jan 30, 2024 pm 03:09 PM

丰田及子公司全球销量达1120万辆,油电混合动力车型占三分之一Jan 30, 2024 pm 03:09 PM据丰田汽车公司发布的数据显示,2023年,丰田及其子公司日野和大发汽车在全球范围内实现了显著增长,销量同比上升7.2%,总计售出了1120万辆汽车,创下了历史新高。这一成绩反映了丰田持续提升产品质量和满足消费者需求的努力。丰田汽车公司将继续致力于创新和可持续发展,为全球消费者提供更好的汽车产品和服务。具体来看,丰田品牌和高端品牌雷克萨斯的汽车销量达到了1030万辆,创下了新的历史高峰。这些销量中,约三分之一的份额来自油电混合动力车型,而纯电动汽车的占比不到1%。这显示出丰田在新能源汽车领域仍有巨

丰田全面增持Primearth EV Energy,加速电动汽车电池布局Mar 07, 2024 pm 03:40 PM

丰田全面增持Primearth EV Energy,加速电动汽车电池布局Mar 07, 2024 pm 03:40 PM丰田汽车公司最近宣布计划全面收购PrimearthEVEnergy的股份,PrimearthEVEnergy是与松下合资的电池制造公司。这一举措旨在加强丰田在纯电动汽车电池生产领域的地位,并进一步扩大市场份额。PrimearthEVEnergy,原名PanasonicEVEnergy,成立于1996年,由松下和丰田共同出资设立,松下持股60%,丰田持股40%。经过丰田的两次增持,目前丰田已持有该公司80.5%的股份,而松下持股19.5%。此次丰田决定全面收购松下的股份,旨在进一步提升其在各类型汽

丰田计划未来在华推出采用比亚迪DMI技术的插电混动车型May 09, 2024 pm 05:58 PM

丰田计划未来在华推出采用比亚迪DMI技术的插电混动车型May 09, 2024 pm 05:58 PM今年5月9日消息,据国内相关资讯,丰田在中国的合资企业正酝酿在未来两三年内引入插电式混合动力车型。这一策略转变显著,丰田可能会摒弃其传统的Hybrid油电混合动力系统,转而采用比亚迪的DMI超级混动技术。请注意,以上内容是微调后的重写,并未续写。根据小编了解,该计划涉及两三款新车型。然而,这些新型混动车是否能如期推出尚无更多确切信息。有消息人士指出,丰田此次倾向于采用比亚迪的DMI技术,主要是考虑到其低成本和技术成熟度。丰田与比亚迪的合作关系已经有先例。去年3月,双方联合开发的丰田bZ3电动车上

广汽丰田凌尚智能电混双擎正式上市,开启新能源时代Jul 16, 2023 pm 09:41 PM

广汽丰田凌尚智能电混双擎正式上市,开启新能源时代Jul 16, 2023 pm 09:41 PM7月16日消息,广汽丰田今日正式发布了旗下全新车型——凌尚智能电混双擎。作为一款定位于紧凑型轿车的新车,凌尚智能电混双擎共推出三款车型,售价分别为14.98万元、16.18万元和16.98万元。据小编了解,新车的外观基本保持与燃油版的一致,但在细节处进行了巧妙的改动。最显著的是将车身标志换成了蓝色LOGO,这是混动车型的标志。同时,在翼子板的位置加入了Hybrid标识,凸显了其混合动力的身份。另外,尾标也从"GT2.0"变为"GTHYBRID",突出了其独

人工智能助力丰田设计师创造出更具工程与美学的汽车外观Jun 21, 2023 pm 08:28 PM

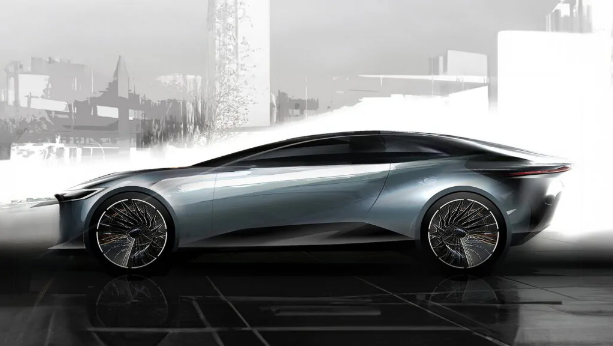

人工智能助力丰田设计师创造出更具工程与美学的汽车外观Jun 21, 2023 pm 08:28 PM6月21日消息,丰田日前推出了一项基于生成式人工智能(AIGC)的工具,旨在加速员工设计汽车外形的过程。根据丰田研究所(TRI)的介绍,这一工具将应用于汽车设计的初期阶段,通过将提示性文本转化为图像,帮助设计师更快地获得设计灵感并进行选择与完善。据小编了解,该工具并非完全替代人类设计师,而是根据设计师的需求生成图像草案。例如,设计师只需输入关键词如“流畅线条”或“SUV造型”,以及工程学要求如“低风阻”,工具即可根据这些要求生成相应的样图,辅助设计师进行设计。丰田研究所人类互动驾驶(HID)部门

丰田新纯电SUV“bZ3X”即将亮相,现代科技外观令人期待Sep 22, 2023 pm 06:25 PM

丰田新纯电SUV“bZ3X”即将亮相,现代科技外观令人期待Sep 22, 2023 pm 06:25 PM丰田将在不久的将来发布备受期待的全新纯电SUV车型,该车型名为“bZ3X”。这款电动SUV将定位于紧凑型SUV市场,预计将于10月25日在日本移动车展上正式亮相,与比亚迪宋PLUS、ID.4等竞争对手一决高下据我们了解,丰田的“bZ3X”采用了充满未来感的外观设计,突出了日系SUV车型的特色。前脸设计独具特色,贯穿式日间行车灯与黑色进气闸相得益彰,塑造出独特锐利的外观。车身侧面采用了溜背式设计,前门隐藏式门把手的设计增添了一份科技感,而后门的门把手则巧妙地隐藏在C柱之中。全车黑色的车顶和车窗设计

丰田盯紧特斯拉Jul 27, 2024 pm 03:58 PM

丰田盯紧特斯拉Jul 27, 2024 pm 03:58 PM据华尔街见闻报道,时隔五年,丰田汽车董事长丰田章男罕见来华,在上海GR赛车嘉年华上大秀车技。随他而来的,还有雷克萨斯国产化的动向。有消息显示,丰田章男此次来华的行程之一,是欲在上海设立雷克萨斯工厂,专门生产高端电车;且寻求与特斯拉相似的待遇,包括税收减免、政策支持、土地授予,以及独资运营的条件。对于该传闻,丰田中国方面一改往日坚决否认的态度,表示,“不作回应”。但无可否认,现在是雷克萨斯离国产最近的一次。如果传闻为真,丰田这回是准备摸着特斯拉的成功路径过河了。1、雷克萨斯的转变眼下,雷克萨斯在中

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Dreamweaver Mac version

Visual web development tools

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

Dreamweaver CS6

Visual web development tools

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

SublimeText3 Linux new version

SublimeText3 Linux latest version