Michael Saylor: Bitcoin spot ETF is competing with the S&P 500! The future is beyond gold

- PHPzforward

- 2024-03-07 22:25:02864browse

Michael Saylor, founder and executive chairman of MicroStrategy, said earlier at the Madeira Bitcoin Conference: Facts have proved that Bitcoin spot ETFs such as BlackRock and Fidelity are better than him Even more successful than I thought, I thought Bitcoin might be a competitor to gold, but it has actually performed better and has begun to compete with the S&P 500 ETF.

Michael Saylor said that the gold ETF is still the largest commodity ETF in the United States, but it will be surpassed by the Bitcoin ETF in the near future.

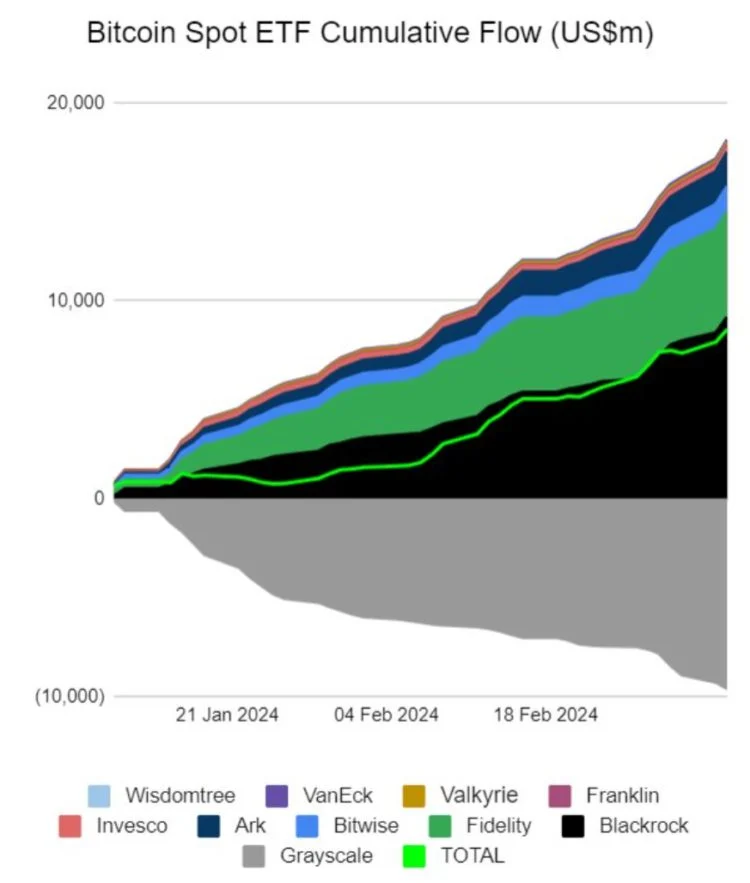

According to data from BitMEX Research, the Bitcoin Spot ETF has attracted more than $8.5 billion in net capital inflows since its launch on January 11. iShares’ IBIT and Fidelity’s FBTC also recorded their largest ever inflows within 30 days of launch. Currently, the Bitcoin spot ETF remains among the top 20 most actively traded on a daily basis.

Changes in capital inflows of Bitcoin spot ETFs

Like ETFs to make it easy for investors to enter the market

In Michael Saylor’s view, ETFs It is a "universal API" that allows investors to easily trade in and out of different funds. Through these funds, investors can now obtain Bitcoin exposure. The API serves as a standardized data channel and can simplify the interaction between computer systems.

Michael Saylor also believes that ETFs are global protocols for trading fluctuations or issuing credit. Before the emergence of ETFs, lending with Bitcoin as collateral was very slow and the interest rates were high, but now people can Broker-dealers such as Chase and Merrill Lynch use ETF shares as mortgage down payments: These ETFs open up a financial world full of awareness, opportunity and functionality to 99% of mainstream investors, and you really can’t underestimate how important this is to the entire network sex.

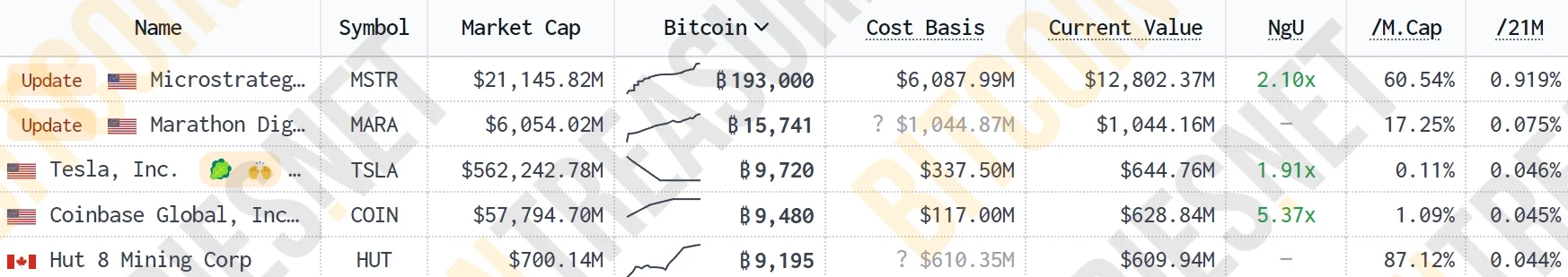

Bitcoin floating profit has reached 6.7 billion US dollars

MicroStrategy has invested a total of 6.08 billion US dollars in buying Bitcoin. The latest action is to spend 155 million US dollars to increase the position of 3,000 Bitcoins in February. Regarding Bitcoin, MicroStrategy currently holds a total of approximately 193,000 Bitcoins worth US$12.8 billion, and its Bitcoin floating profit has soared to approximately US$6.7 billion.

Bitcoin positions of listed companies

Although BTC is close to historical high prices, MicroStrategy announced that it will continue to buy Bitcoin, Michael Saylor announced on Tuesday, It will issue senior convertible corporate bonds worth US$600 million (adjusted to US$700 million yesterday) to qualified institutional investors through private placement, and the proceeds will be used to "purchase Bitcoin" and other general corporate purposes.

The above is the detailed content of Michael Saylor: Bitcoin spot ETF is competing with the S&P 500! The future is beyond gold. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- What are the formal Bitcoin trading platforms?

- Which software can buy Bitcoin in China? Bitcoin decentralized platform!

- The latest official Bitcoin trading platform app ranks among the top ten largest Bitcoin trading platforms in China

- Reasons for Bitcoin's plunge

- Coinbase crashes! Bitcoin plummets and cannot be traded, CEO apologizes: traffic exceeds expectations