Software Tutorial

Software Tutorial Computer Software

Computer Software How to make a summary declaration for the personal income tax withholding and payment system - How to make a summary declaration for the personal income tax withholding and payment system

How to make a summary declaration for the personal income tax withholding and payment system - How to make a summary declaration for the personal income tax withholding and payment systemphp Editor Apple has brought detailed methods on how to summarize and declare the personal income tax withholding and payment system. The system's summary declaration refers to the process of integrating and submitting relevant information about personal income tax withholding and payment. Through this article, readers will learn how to conduct system summary declaration, including operating steps, precautions, etc., to help everyone better manage and declare the personal income tax withholding and payment system.

Enter the declaration: In the personal income tax module, click "Personal income tax withholding and payment summary declaration", as shown in the figure below:

When filling in the report, the system will display the "Personal Income Tax Withholding and Payment Summary Return Form", which should be filled in according to the rules (the rules are the same as those for paper reports).

[Instructions for filling in the form]:

1. Remittance declaration: When reporting for remittance, select directly;

2. Income item: drop-down selection. When reporting remittance, the default is "wage and salary income"

3. Obtained project sub-item: drop-down selection;

4. Starting from the period it belongs to: the system automatically displays it and can be modified;

5. The period to which it belongs: the system automatically displays it and can be modified;

6. Nationality region: drop-down selection; the default is "People's Republic of China"

7. Total number of people: filled in by the taxpayer;

8. Taxable income (summary): filled in by the taxpayer.

9. Tax rate: displayed after tax calculation, automatically calculated by the system, and cannot be modified.

10. Quick calculation of deductions (summary): displayed after tax calculation and cannot be modified;

11. Tax payable (summary): displayed after tax calculation and cannot be modified.

12. Declared tax payable (summary): displayed after tax calculation and cannot be modified;

13. Approved tax reduction or exemption amount (summary): displayed after tax calculation and cannot be modified;

14. The amount of tax that can be deducted (summary): displayed after tax calculation and cannot be modified;

15. The amount of tax that should be withheld (refunded): displayed after tax calculation;

16. Total amount paid: displayed after tax.

[Note]: Withholding agents who have opened online declarations must obtain the consent of the tax authorities before they can make a summary declaration of personal income tax to complete the tax declaration, and then use the "Personal Income Tax Withholding and Payment Supplementary Record Details" in the online filing system. Submit detailed personal income tax return information.

Tax Calculation: After filling in the data and confirming it is correct, click "Calculate Tax" button, the system will automatically calculate the tax, and the page after tax calculation is as follows. If you find that there is an error in filling in the data, you can click the "Clear" button to refill the report or click the "Abandon" button to exit the declaration.

[Note]: If you select "Remittance Declaration", the income column system defaults to "Wages and Salaries" and cannot be selected.

Submit declaration: After verifying that the data is correct, click the "Submit" button to submit the declaration data. The system prompts as shown in the figure below. If errors in calculated data are found, You can click the "Previous" button to modify the declaration data or click the "Give Up" button to exit the declaration.

Withhold taxes

Print report

Supplementary entry details: After the declaration is successful, detailed information must be supplemented through the "Personal Income Tax Withholding and Payment Supplementary Entry Details" within the time specified by the tax bureau.

The above is the detailed content of How to make a summary declaration for the personal income tax withholding and payment system - How to make a summary declaration for the personal income tax withholding and payment system. For more information, please follow other related articles on the PHP Chinese website!

《个人所得税》税率表2024年最新Mar 05, 2024 pm 07:20 PM

《个人所得税》税率表2024年最新Mar 05, 2024 pm 07:20 PM随着时代的不断发展,个人所得税税率也在不断调整。2024年最新的个人所得税税率表已经出炉,对于每个纳税人来说都是一个重要的参考。下面就让我们一起来了解一下2024年最新的个人所得税税率表吧!个人所得税税率表2024年最新一、税率表1、综合所得税率表2、工资、薪资税率表3、过渡期工资薪金税率表4、居民个人劳务报酬所得预扣预缴税率表二、年度个人所得税计算公式1、应纳个人所得税税额=应纳税所得额×适用税率-速算扣除数2、应纳税所得额=年度收入额-准予扣除额3、准予扣除额=基本扣除费用60000元+专项

个人所得税税率计算器Mar 05, 2024 pm 11:40 PM

个人所得税税率计算器Mar 05, 2024 pm 11:40 PM个人所得税想要计算是十分复杂的,多数的玩家不知道个人所得税如何的计算,点击https://www.gerensuodeshui.cn/链接即可进入到税率计算器,接下来就是小编为用户带来的个人所得税税率计算器在线计算入口,感兴趣的用户快来一起看看吧!个人所得税App使用教程个人所得税税率计算器税率计算器入口:https://www.gerensuodeshui.cn/一、个税计算公式1、应缴纳所得额=税前工资收入金额-五险一金(个人缴纳部分)-费用减除额2、应纳税额=应纳所得额×税率-速算扣除数二

个人所得税app怎么申报 个人所得税app申报方法Mar 12, 2024 pm 07:40 PM

个人所得税app怎么申报 个人所得税app申报方法Mar 12, 2024 pm 07:40 PM个人所得税app怎么申报?个人所得税是一款实用性非常强大的手机软件,用户可以在这个软件上面进行申报一些业务,还可以在这个软件上面进行退税等。只要用户有将这个软件下载下来,就可以不用去线下排队等办理了,非常方便。很多用户到现在都还不清楚怎么用个人所得税软件进行申报,下面小编整理了个人所得税软件的申报方法,供大家参考。个人所得税app申报方法 1、首先,打开软件,在首页找到并点击“我要办税”按键; 2、然后,在这里的税费申报中找到并点击“综合所得年度汇算&rdquo

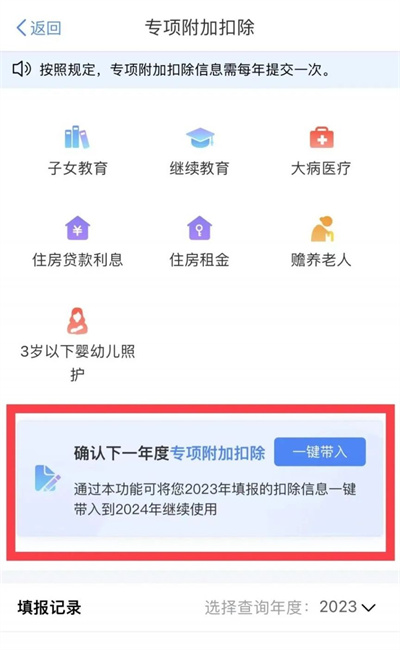

个人所得税专项附加扣除申报怎么填2024Apr 01, 2024 pm 04:01 PM

个人所得税专项附加扣除申报怎么填2024Apr 01, 2024 pm 04:01 PM个人所得税的申报过程中,专项附加扣除是一项重要的政策措施,为纳税人提供了更多减免的机会,所以本文小编就准备了个人所得税专项附加扣除申报步骤流程,一起学习下吧。个人所得税专项附加扣除申报步骤流程1、打开个税APP,在首页选择【常见业务】,然后选择【专项附加扣除填写】2、专项扣除项目范围:子女教育、继续教育、大病医疗、住房贷款利息、住房租金及赡养老人、婴幼儿照护。根据国家税务部门相关政策规定,个人所得税法确定了以下专项扣除项目范围:子女教3、在页面的下方可以选择【一键带入】,这样可以一键填写去年的申

个人所得税app退税申报怎么撤销 个人所得税app退税申报撤销流程Mar 12, 2024 am 11:50 AM

个人所得税app退税申报怎么撤销 个人所得税app退税申报撤销流程Mar 12, 2024 am 11:50 AM个人所得税app退税申报怎么撤销?个人所得税是一款非常受用户欢迎的手机软件,这个软件上面的功能都非常的强大,用户可以在这个软件里面进行很多操作,比如可以在这个软件上面进行申报,然后也可以在这个软件上面进行退税或者是其他一系列的一些操作,很多用户想知道要怎么在这个软件上面撤销申报,下面小编整理了撤销申报的方法供大家参考。个人所得税app退税申报撤销流程 1、进入个人所得税手机APP,点击申报所得年度汇算。 2、页面弹出申报提示,点击申报详情。 3、之后点击已完成。 4、点击已经提交的退

个人所得税退税怎么退2024_个人所得退税操作流程完整介绍Mar 20, 2024 pm 07:26 PM

个人所得税退税怎么退2024_个人所得退税操作流程完整介绍Mar 20, 2024 pm 07:26 PM大家有去申报个人所得税吗?3月1日就可以预约了,提早预约提早申报,如果看到要补税,那悬着的心终于死了。那么个人所得税退税怎么退呢?有需要的小伙伴一起来下文看看吧。个人所得税退税怎么退2024安装并注册个人所得税APP后,可点击首页的“收入纳税明细查询”查看上一年度的收入和已申报税额。选择“综合所得年度汇算”,系统将自动填写相关数据,用户需核对信息是否准确。如需修改,可点击“标准申报”进行调整。3、核对个人基础信息、汇缴地、已缴税额等信息,确认无误之后可以提交申报。4、然后需要选择对应的卡,保证可

个人所得税app如何更正申报记录Mar 14, 2024 pm 03:04 PM

个人所得税app如何更正申报记录Mar 14, 2024 pm 03:04 PM个人所得税app是一款能够方便用户们进行税务查询,缴纳,登记甚至是办理业务的一款官方app,在我们的生活中这款app能够实时帮助我们了解税务情况,那么在个人所得税app如果我们发现申报记录有误,究竟该如何进行更正呢,这篇教程攻略就将为大家带来详细的步骤攻略介绍。首先我们先进入到个人所得税app中,点击办&查选项然后在办&查选项中,即可看到申报记录的查询在记录中找到哦啊我们想要进行更正的记录点击进去将页面拉到最下方即可看到更正按钮,点击更正即可进行更正

个人所得税怎么申请退税Mar 25, 2024 pm 02:45 PM

个人所得税怎么申请退税Mar 25, 2024 pm 02:45 PM1、打开个人所得税app,在首页的【2023综合所得年度汇算】处,点击【开始申报】。2、阅读简易申报须知,点击【我已阅读知晓】,进入简易申报界面。3、确保个人基础信息、汇算地、已缴税额信息无误后,点击【下一步】。4、在弹出的窗口里勾选【我已阅读并同意】,点击【确认】,选择【申请退税】。5、在弹出的窗口里点击【继续退税】,添加银行卡信息或直接选择银行卡。6、点击【提交】,在弹出的

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Zend Studio 13.0.1

Powerful PHP integrated development environment

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

Dreamweaver Mac version

Visual web development tools

Atom editor mac version download

The most popular open source editor

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),