What is the next LSD with a market value of 100 billion US dollars?

After the Ethereum Shanghai upgrade, 565,000 ETH flowed into the Liquid Staking agreement. As of May 24, 2023, the total value locked in liquid staking agreements such as Lido Finance and Coinbase exceeded US$18.3 billion.

According to DefiLlama data, Liquid Staking’s TVL has surpassed DeFi borrowing and firmly occupied the second place since the beginning of March with the release of the Ethereum Shanghai upgrade time. It has now surpassed DEX and become the first.

Correspondingly, Liquid Staking Derivatives (liquidity derivatives quality staking track) has become a DeFi field The latest development trend is even considered to be the most anticipated narrative in the encryption industry this year.

So, what exactly are Liquid Staking and Liquid Staking Derivatives (hereinafter referred to as LSD)? What are the pros and cons? What are the future prospects? Let's take a look together.

01

What is Liquidity Staking and LSD?

Starting from the launch of the Ethereum beacon chain in 2020, ETH holders can become a node validator on the beacon chain by pledging 32 ETH and receive additional ETH rewards. After that, ETH staking begins. Already, The upcoming Ethereum Shanghai upgrade will allow users to unlock their previously pledged ETH, gain liquidity and earn income.

Pledge, also known as Staking, means that users lock their assets within a specific period. ETH holders can become a node verification on the beacon chain by pledging 32 ETH. People are part of the staking process, but this model means they miss out on opportunities to trade ETH for profit.

This is similar to a traditional bank deposit. Unless you withdraw the money, the money deposited cannot be used for other purposes at the same time.

However, The development of Liquid Staking allows ETH holders to receive staking rewards while using their ETH as they wish. This ensures that stakers receive staking rewards and the opportunity to use ETH in external transactions, further helping them maximize returns and generate multiple revenue streams.

According to the previous article, due to the locked nature of ETH, Liquid Staking was invented to allow users to earn multiple benefits through liquid staking. However, receiving ETH for pledging ETH requires providing the pledger with a receipt Token. The receipt Token is called Liquid Staked Derivative (LSD).

LSD is a liquidity token, which is equivalent to the substitute of the pledged Token, but its functions are similar to the pledged Token, such as selling, providing liquidity, lending, using as collateral, etc. To earn additional income on top of the staking income you earn.

02

What are the advantages and disadvantages of LSD?

"Mortgage" Tokens generally means storing them on the chain for a period of time to help improve the security of the blockchain network, but the disadvantage is that these Tokens cannot be used when needed, and LSD The emergence of staking tokens allows us to use these pledged tokens in other places in DeFi while still receiving rewards through staking.

It can not only enhance the security and stability of the blockchain network, but also maintain the flexibility of holders to manage their Token assets to encourage more people to pledge their Tokens and participate in DeFi. The world, ultimately benefiting everyone involved, is the greatest advantage of LSD.

But there are advantages and disadvantages, and LSD also has some disadvantages.

A major issue is the possibility of "slashing" , where if a staker's misconduct is detected, even if it is not intentional, they may lose a portion of the staked tokens. Therefore, investors need to consider the risks before deciding to participate in a liquidity staking protocol.

Another issue is the risk of smart contracts. If the smart contracts that handle these derivatives have loopholes or errors and are unfortunately hacked, then all the assets pledged on these contracts and the derivatives may will be permanently lost.

03

The future development of LSD

With the completion of the Shanghai upgrade and the continuous innovation and development of the LSD track, the competitive landscape of LSD will change. As staking capabilities increase, Token holders have more choices and features when choosing a blockchain, such as permissionless verification, slash protection, and tax efficiency, which means higher benefits for stakers Security and flexibility.

This shift also brings new opportunities to the broader DeFi ecosystem. The development of LSD enables more and more users to participate in staking, and liquidity will flow to LSD, thus creating greater liquidity in DeFi protocols that utilize LSD, forming a Matthew effect.

Overall, the future of LSD is bright, with the potential for increased competition and enhanced functionality. As more users participate in staking, the broader DeFi ecosystem will benefit, providing new opportunities for investors and potentially increasing efficiency and innovation in the space.

04

Summary

In general, Liquid Staking is a new generation system that enables users to Earn passive income from their assets. This goes beyond the traditional problem of locking up their funds without being able to use them, and instead provides users with a liquid version of their assets for use on other platforms.

The above is the detailed content of What is the next LSD with a market value of 100 billion US dollars?. For more information, please follow other related articles on the PHP Chinese website!

Tether CEO Paolo Ardoino Completes Visit to the United States, Meeting with Lawmakers in Washington, D.C. to Discuss Stablecoin RegulationApr 15, 2025 am 11:24 AM

Tether CEO Paolo Ardoino Completes Visit to the United States, Meeting with Lawmakers in Washington, D.C. to Discuss Stablecoin RegulationApr 15, 2025 am 11:24 AMHis visit comes as the U.S. Congress moves closer to introducing legislation regulating stablecoins, which Ardoino believes is necessary for financial inclusion and preserving U.S. dollar dominance.

Why XRP Price May Not 'Go Parabolic' Post-SEC SettlementApr 15, 2025 am 11:22 AM

Why XRP Price May Not 'Go Parabolic' Post-SEC SettlementApr 15, 2025 am 11:22 AMThe XRP price holds still in the $2.10-2.20 range for the past few days, but this is not stopping Ripple's community from continuing to post various content about XRP

Metaplanet Expands Its Bitcoin Treasury Holdings by Another 319 BTCApr 15, 2025 am 11:20 AM

Metaplanet Expands Its Bitcoin Treasury Holdings by Another 319 BTCApr 15, 2025 am 11:20 AMIn an announcement made earlier today, Japanese firm Metaplanet revealed it has acquired another 319 Bitcoin (BTC), pushing its total corporate holdings beyond 4,500 BTC.

Metaplanet Scoops Another 319 Bitcoin, Pushing Its Total Corporate Holdings Beyond 4500Apr 15, 2025 am 11:18 AM

Metaplanet Scoops Another 319 Bitcoin, Pushing Its Total Corporate Holdings Beyond 4500Apr 15, 2025 am 11:18 AMIn an announcement made earlier today, Japanese firm Metaplanet revealed it has acquired another 319 Bitcoin (BTC), pushing its total corporate holdings beyond 4,500 BTC.

Ripple (XRP) price rallied through a weekend riseApr 15, 2025 am 11:16 AM

Ripple (XRP) price rallied through a weekend riseApr 15, 2025 am 11:16 AMRipple (XRP) price rallied through a weekend rise from its $2.00 critical support mark to reach $2.23.

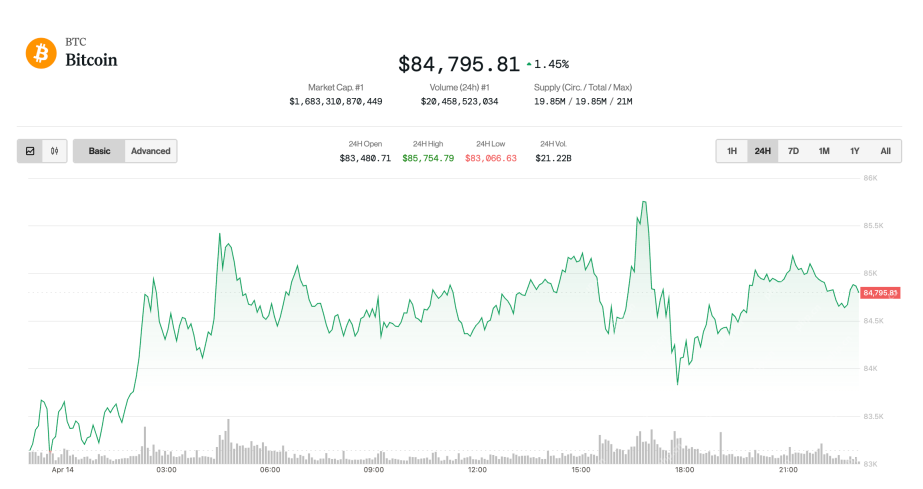

Bitcoin (BTC) drifts upwards as the broader market adjusts favorably to trade-related newsApr 15, 2025 am 11:14 AM

Bitcoin (BTC) drifts upwards as the broader market adjusts favorably to trade-related newsApr 15, 2025 am 11:14 AMThe largest cryptocurrency was up 1.6% in the last 24 hours and is now trading just shy of $85,000. Ether (ETH), meanwhile, rose 2.7%

Is ADA the Sleeper Pick for the Next Bull Run? Hoskinson's $250K BTC Forecast Says YesApr 15, 2025 am 11:12 AM

Is ADA the Sleeper Pick for the Next Bull Run? Hoskinson's $250K BTC Forecast Says YesApr 15, 2025 am 11:12 AMADA has risen by 1.5% in the past 24 hours, with its move to $0.644 coming as the crypto market suffers a 2% loss today.

Solana Leads Market Recovery After Brief Dip Below $100Apr 15, 2025 am 11:10 AM

Solana Leads Market Recovery After Brief Dip Below $100Apr 15, 2025 am 11:10 AMJimmy has nearly 10 years of experience as a journalist and writer in the blockchain industry. He has worked with well-known publications such as Bitcoin Magazine, CCN, and Blockonomi, covering news...

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Zend Studio 13.0.1

Powerful PHP integrated development environment

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.