100% of voters support Uniswap fee reward proposal

Summary:

•The Uniswap community is supporting a proposal to reallocate protocol fees to UNI token holders.

• Blockchain analysis company Token Terminal noted that UNI holders could earn more than $50 million.

• UNI has been trending upward since the proposal was made, and observers believe there is room for further gains.

Uniswap is an Ethereum-based decentralized exchange (DEX) on the verge of change in the decentralized finance (DeFi) space.

Designed to redistribute protocol fees to UNI token holders, this marks a major step forward in democratizing the network.

Uniswap community supports new proposal

Snapshot voting shows overwhelming community support for the fee reward proposal, which is expected to end on March 7.

The proposal includes upgrading the UniswapV3 Factory contract and giving the ability to seamlessly and programmatically collect protocol fee revenue. This strategic move aims to strengthen the governance framework and give UNI token holders greater influence in the decision-making process.

Erin Koen, head of governance at the Uniswap Foundation, outlined, “Overall, we are proposing to upgrade the protocol so that its fee mechanism rewards holders who have delegated and staked their UNI tokens.”

In essence, Uniswap’s reformed governance structure is designed to incentivize active participation from UNI token holders, thereby enhancing the sustainability of the protocol and promoting its expansion.

Uniswap protocol fee estimate|Source: Token

Terminal

Due to the unanimous support of voters, more than 10 million UNI tokens have now been pledged for the upgrade.

Blockchain analytics firm Token Terminal highlighted the huge benefits that UNI holders will receive from the proposal. Analysis shows that if the fee switch is activated, UNI holders have accumulated a cumulative income of up to US$58 million in the past year by facilitating US$437.7 billion in transaction volume and generating US$588.3 million in transaction fees.

Token Terminal explains, “Assuming a 10% protocol fee is implemented, Uniswap will become the ninth largest revenue-generating protocol in crypto, ranking between Optimism mainnet and Avalanche.”

However, with the fee switch dormant, Uniswap has yet to realize revenue generation from these fees, leaving huge potential for future development.

UNI Price Forecast: Further upside potential

The price of UNI has risen sharply in recent weeks, gaining significant momentum following the introduction of new governance proposals. Data shows that Uniswap’s market capitalization has surged 100% in the past month.

It peaked at over $13, up from less than $5 previously, and is currently trading at $12.43, reflecting a slight correction.

UNI Price Chart | Source: TradingView

Market analysts attribute this significant growth to widespread optimism surrounding fee award proposals. Notably, one analyst highlighted the key role the proposed development protocol could play in shaping the coin’s trajectory.

Analyst DaanCrypto said, "The weekly chart is quite clear. We hold the cost price around $9.8, and I will look for opportunities to break through $13 at some point in the future. This will likely depend on the progress surrounding the fee agreement proposal."

The above is the detailed content of 100% of voters support Uniswap fee reward proposal. For more information, please follow other related articles on the PHP Chinese website!

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PM

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PMThis sharp drop happened as investor interest faded and a major scandal hit the highly speculative market.

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PM

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PMDespite being pretty much the iconic example of “random” – well, that and dice rolls – we can't help but feel like there's some element of skill involved. Especially when we lose.

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AM

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AMBitwise, a leading digital asset manager, has announced the listing of four of its crypto Exchange-Traded Products (ETPs) on the London Stock Exchange (LSE).

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AM

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AMBitcoin may be poised for a massive rally—but only if gold continues its upward climb, according to Joe Consorti, Head of Growth at Theya.

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AM

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AMThe Shiba Inu price continues to attract the attention of analysts, who are watching for its next potential move. By Samuele Piar. Updated April 14, 2025.

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AM

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AMThe joint motion of Ripple and U.S. Securities and Exchange Commission (SEC) to hold the appeal in abeyance has been granted by the Circuit Judge Jose A. Cabranes.

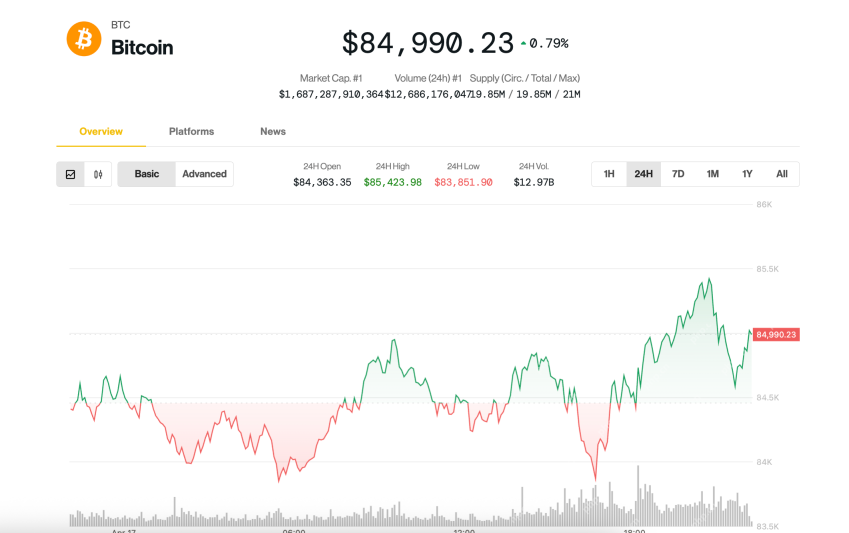

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AM

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AMBitcoin (BTC) was treading water just below $85,000 late Thursday as tensions between U.S. President Donald Trump and Federal Reserve Chair Jerome Powell added another layer of uncertainty for investors.

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AM

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AMToday, AB DAO officially announced the launch of a dual reward campaign in collaboration with Bitget (bitget.com), the world's second-largest digital asset trading platform.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

Dreamweaver CS6

Visual web development tools

WebStorm Mac version

Useful JavaScript development tools

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

Notepad++7.3.1

Easy-to-use and free code editor