Uniswap protocol fee allocation proposal detonates the market, what impact will it have on the future of DeFi?

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-02-29 15:31:05476browse

The Uniswap protocol fee allocation proposal detonated the market and had a huge impact on the future of DeFi. The proposal will adjust the fee distribution mechanism, which has triggered heated discussions in the market and community. PHP editor Strawberry will provide an in-depth analysis of the reasons, impacts and prospects behind the Uniswap proposal, and will help you understand the challenges and opportunities this important event brings to the DeFi ecosystem.

Wu said author|defioasis

Editor of this issue|Colin Wu

On the evening of February 23, Uniswap Foundation Governance Leader (Gov Lead) Erin Koen reported to Uniswap The Governance Forum launched a proposal proposing a fee mechanism to reward UNI token holders who have delegated and staked their tokens. In the years since Uniswap announced its token airdrop in mid-to-late September 2020, there has been discussion about whether UNI should capture protocol fees to increase the utility of the token, but almost all has come to nothing. This proposal put forward by the head of the Uniswap Foundation formally places the utility of UNI tokens for discussion at the governance level, which has aroused the excitement of many holders and led to the emergence of UNI and other DeFi protocol representatives. The currency rises.

First of all, it should be clear that this proposal was proposed by a representative of the Uniswap Foundation, and the Uniswap Foundation is not equal to Uniswap Labs. Uniswap Labs is responsible for developing and maintaining, updating and upgrading the Uniswap protocol, playing a core role in technology development and innovation. At its core, Uniswap Labs is a commercial company. The Uniswap Foundation mainly focuses on the governance and community development of the Uniswap protocol and is a non-profit organization. Uniswap Labs will focus more on considering issues at the protocol/company level, and the Uniswap Foundation represents community interests to a certain extent. It is not difficult to find that the Uniswap Labs official tweet did not mention or forward this matter, and even Hayden, the founder of the Uniswap protocol, did not participate in much discussion.

Secondly, you need to clarify what the agreement fee is. Currently, it can be divided into two types of fees, front-end fees and LP fees. The front-end fee refers to the 0.15% fee for executing transactions through the Uniswap Labs front-end starting in mid-October 2023, that is, the fee collected from the Uniswap official front-end and paid to Uniswap Labs; Hayden said that the purpose of charging this fee is to Funding Uniswap Labs’ sustainable operations. The LP fee is the fee of the Uniswap pool, which is paid by traders to LP. For example, the fee charged by WBTC/ETH, the pool with the highest TVL in Uniswap V3, is 0.3%. In the proposal, it is clearly stated that the protocol fee is expressed as a fraction of the LP fee, which can be 0, 1/4, 1/5, 1/6, 1/7, 1/8, 1/9 or 1/10 (currently set is 0), the specific score can be adjusted through governance.

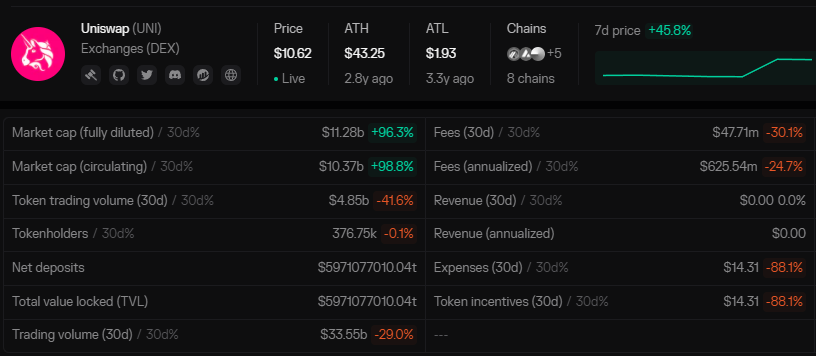

(数据来源:https://tokenterminal.com/terminal/projects/uniswap)

According to data from Token Terminal on February 25, Uniswap’s annualized LP fees were approximately US$626 million. Assuming that the proposal is passed and 1/10-1/4 of the LP fee is allocated to UNI holders as protocol fees, UNI holders can receive annualized dividends of approximately $62.62 million-$156.5 million. The current market capitalization of UNI is approximately US$8 billion, and the ratio of market capitalization to annualized dividends is approximately between 51.1 and 127.8. Of course, this is just a simple calculation reference and not any investment basis.

Finally, this proposal is still in the proposal and community discussion stage. Whether it will be passed depends on the final voting results of the community and UNI delegates representing multiple forces. The Uniswap Foundation believes that if there are no major obstacles, it expects to release Snapshot voting on March 1 and on-chain voting on March 8. As an early investor in Uniswap, a16z may play a key role in future votes on the proposal. According to Arkham data, the address marked a16z (and suspected a16z) may control approximately 60 million UNIs.

While nothing is set in stone and the proposal’s passage remains uncertain, it marks an attempt at a shift toward utility tokens. Even if this proposal is not passed, I believe that other institutions or individuals will work hard to transform UNI into a utility token in the future. If the proposal is passed, giving back to token holders by cannibalizing part of LP's income may cause certain losses to LP. As the protocol develops, how to better balance the interests of UNI holders and LP will become a new governance issue.

After several years of development, Uniswap has become a Beta that can represent the entire Crypto industry after BTC and ETH. Now that the foundation has officially proposed to empower UNI, this may benefit from the victory of Grayscale and Ripple, the smooth passage of the spot BTC ETF, and active trading. The US regulatory policy has become relatively milder. At the same time, this may also set an example for other protocol developers or teams, especially those in the United States. For example, Blur and Blast founder Pacman recognized the proposal put forward by the Uniswap Foundation and hoped that Blur could learn from its experience. (Note: The NFT trading market Blur token BLUR is similar to UNI, both are governance tokens without empowerment.)

Whether it is UNI or BLUR, the protocols they represent are the best in their fields. Uniswap occupies about 60% of the market share in the DEX field. It not only has excellent technological innovation and market influence, but also has made an indelible contribution to promoting the development of the Crypto industry. These are the core of our continued focus. For Uniswap, empowering UNI may be just the icing on the cake, and the upcoming v4 hook may be even more exciting.

The above is the detailed content of Uniswap protocol fee allocation proposal detonates the market, what impact will it have on the future of DeFi?. For more information, please follow other related articles on the PHP Chinese website!