CoinShares: Digital asset investment products continue to have net inflows! Bitcoin still dominates the market

- 王林forward

- 2024-02-21 08:00:351084browse

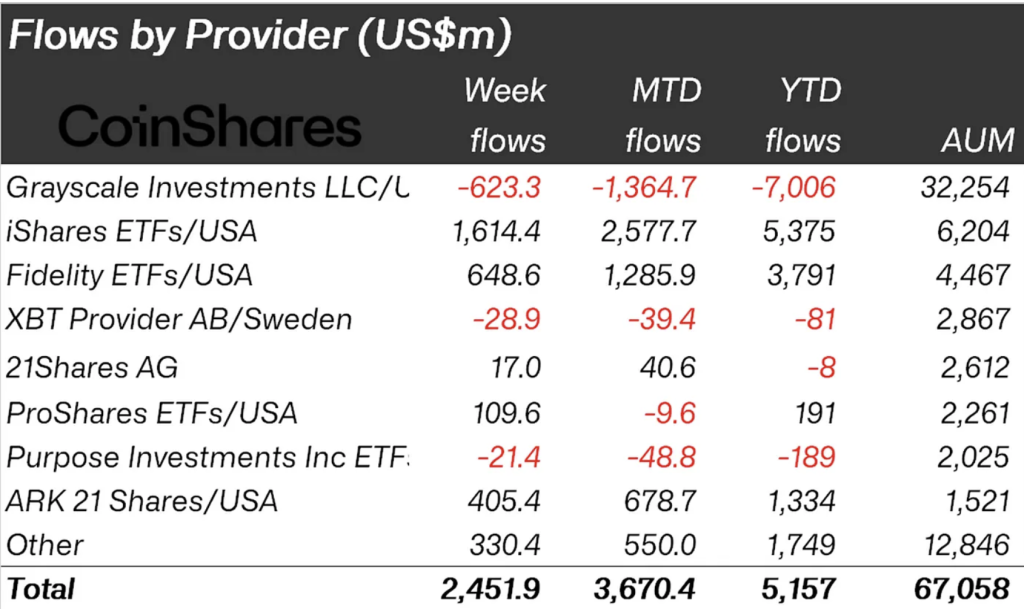

Digital asset investment products attracted a record $2.45 billion in inflows last week, bringing total inflows to $5.2 billion so far this year, according to data from crypto asset management company CoinShares. Under management has returned to December 2021 levels.

Digital asset investment products continue to have net inflows

The inflow of digital asset investment products hit a record high last week, reaching $2.45 billion, and the total so far this year has reached $5.2 billion. These inflows combined with the recent rise in digital currency prices have pushed total assets under management (AUM) to $67.1 billion, the highest level since December 2021.

Although Grayscale Trust has had outflows of US$7 billion this year, its asset size still ranks first, reaching US$32.3 billion. BlackRock's assets reached $6.2 billion, followed by Fidelity with $4.5 billion.

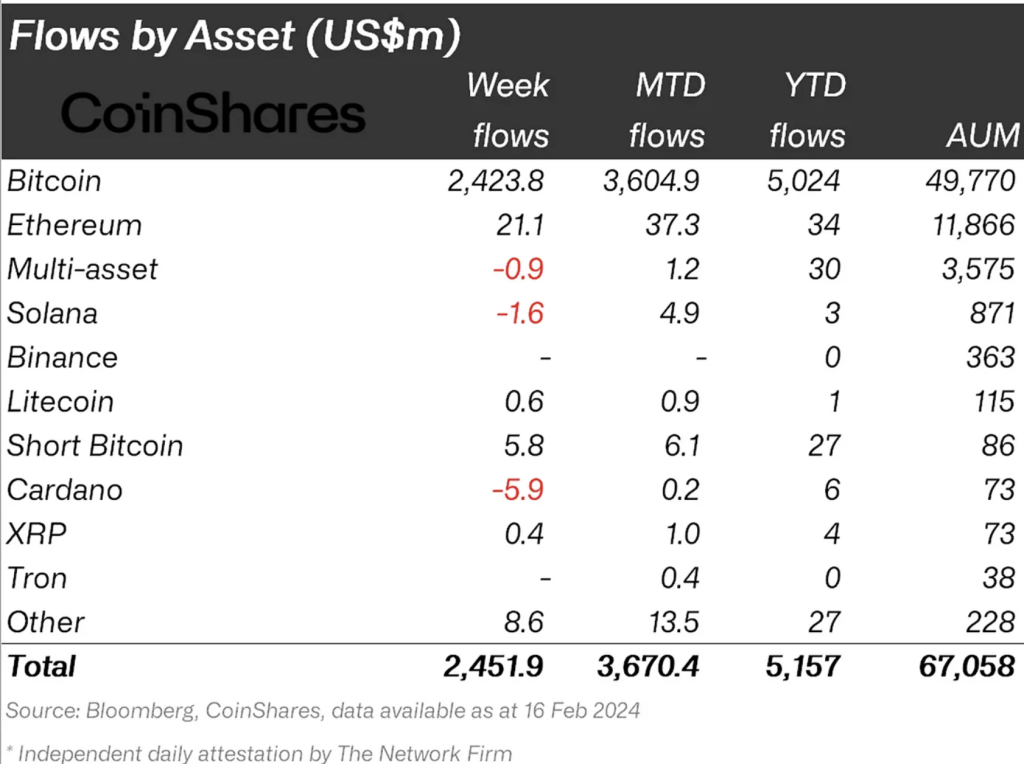

Bitcoin still dominates the market

In terms of asset classes, Bitcoin accounted for $2.42 billion, while Ethereum accounted for only $21.1 million. Solana’s recent outage affected market sentiment, leading to a $1.6 million outflow. Avalanche, Chainlink and Polygon have inflows of US$1 million, US$900,000 and US$900,000 respectively, with continuous inflows every week this year.

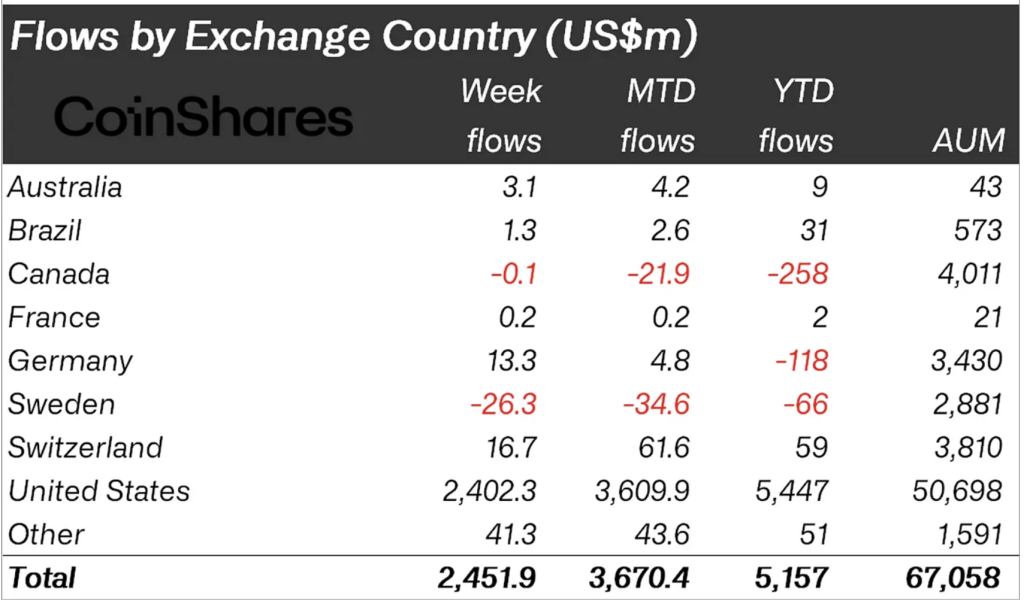

Significant inflow of funds into the United States

Broken down by region, the United States accounted for 99% of the total inflow, totaling US$2.4 billion. This represents growing interest in spot ETFs. At the same time, outflows from existing players decreased significantly. Other regions such as Germany and Switzerland saw inflows of $13.3 million and $16.7 million respectively, while outflows from Sweden totaled $26.3 million.

The above is the detailed content of CoinShares: Digital asset investment products continue to have net inflows! Bitcoin still dominates the market. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- How does Java implement a dynamic balancing strategy based on digital currency?

- Summary of fees for various Bitcoin spot ETFs: Grayscale fees are up to 1.5%, and Ark and Bitwise are free in the initial stage.

- In 2024, Spartan focuses on the prospects of key areas such as 3A Web3 games, Bitcoin development and RWA

- 2023 Global Cryptocurrency Exchange Rankings Ranking of the Top Five Domestic Digital Currency APPs

- Justin Sun announced that TRON will enter Bitcoin Layer 2! Community: Sun Ge is coming, run away quickly