One article to learn about the seven major sectors of virtual currency worth paying attention to in 2024

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-02-20 09:13:161495browse

The seven major sections of virtual currency are as follows:

BTC: digital gold.

ETH: Smart Contracts and Electronic Cash.

BCH: Bitcoin clone.

XRP: Enterprise transfer network.

LTC: A faster version of Bitcoin.

DASH: A more private Bitcoin clone.

NEO: Ethereum.

If you want to maximize your profits in this bull market, you must choose the right narrative.

Last cycle we witnessed the explosive growth of tokens in the L1, DeFi and Metaverse categories, and in this cycle, institutions are pouring money into these narratives.

We have the opportunity to enter the market early. In this article, I will introduce the segmented narrative of each industry in the bull market and why these vertical tracks are worthy of attention. Of course I am interested in other areas as well, but this article will focus on the main trends that stand out in particular.

The reason I chose these narratives is that I believe they are still in the early stages of the hype cycle. After all, recognizing when a narrative is in its early stages is an important skill to have in the cryptocurrency space.

1.DePIN

DePIN stands for "Decentralized Physical Infrastructure". This is a blockchain protocol that encourages decentralized communities to build and maintain physical hardware, investing resources to make contributions to the network. Contributing users will receive corresponding token rewards.

DePIN is vast and covers multiple multi-billion dollar hardware areas:

Cloud Storage

Computing Power

Wireless Sensor Networks, etc.

Messari predicts that by 2028, the total market value of these DePIN industries will reach $3.2 trillion.

Existing products such as RNDR, FIL, AKT are representative projects of current solutions, and there are many interesting upcoming solutions such as AethirCloud.

2. Artificial Intelligence

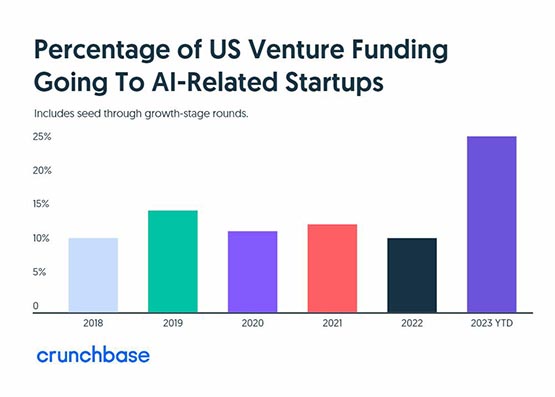

2023 was a breakout year for the artificial intelligence (AI) industry, with more than $50 billion in new investment flowing into the industry.

AI-related venture capital investment in 2023 is as high as $50 billion, and even that only scratches the surface of AI’s potential.

With artificial intelligence growing exponentially, it’s scary to imagine where it will be in the next 2-3 years (let alone 10 years) And exciting.

Cryptocurrency and AI have yet to fully take hold, with many current solutions simply using AI as a buzzword and treating it as an AI agent (around major events/hype trades) rather than long-term fundamental investments.

However, AI and cryptocurrency may intersect in many interesting ways in the future:

• Cryptocurrency-powered reputation system for GPU leasing;

• AI robots for trading and prediction;

• Blockchain-based AI training incentives;

• Digital media certification;

KyleSamani also wrote a great article Great article detailing the potential intersection of AI and cryptography, expanding on more potential use cases. (Fun fact: he wrote much of the article using AI).

I strongly believe that some of the best performers in this cycle will be AI tokens. My current strategy is to trade AI tokens as proxies around major events such as conferences/press releases/announcements, but I allocate a fair portion of stablecoins to new AI projects.

3.RWAs

Real World Assets (RWAs) have gained a lot of momentum recently, especially after the recognition of BlackRock CEO Larry Fink. After all, when the world’s largest asset management company ’s CEO has repeatedly advocated for asset tokenization, it’s hard not to be optimistic about RWAs.

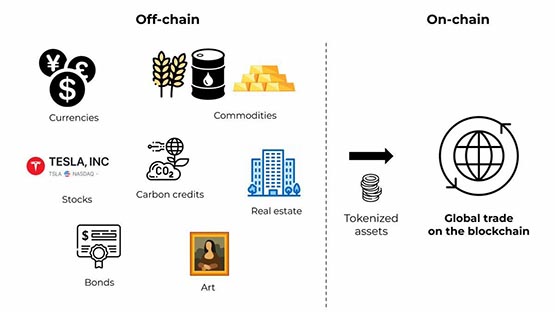

RWAs refer to the tokenization of real-world assets (such as real estate, treasuries, bonds, gold, etc.) on the blockchain.

This increases:

Efficiency (lower costs without a broker);

Accessibility (fragmentation and more liquidity);

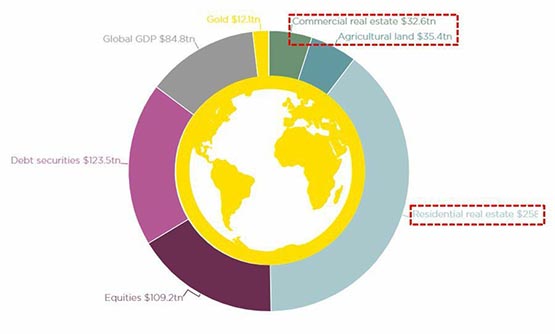

RWAs have access to huge markets such as real estate ($326 trillion), global bonds ($124 trillion) and gold ($12 trillion).

Over the next few weeks I will be publishing a complete in-depth topic on RWAs (and my favorite altcoins).

4. Gaming

When I think of industries that can truly attract millions of new retail users, the first thing that comes to mind is gaming.

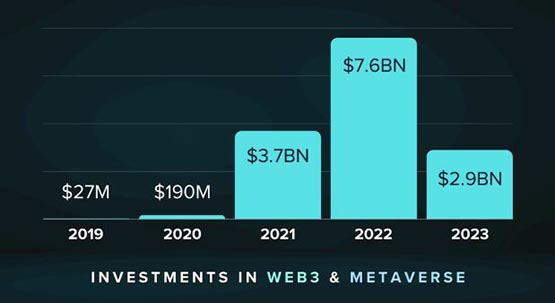

It is also one of the most well-funded crypto industries, with more than $14.4 billion in total funding since 2019, with the majority of investment inflows into the cryptocurrency game coming in 2021/2022.

Games take years to make, so we're just now starting to hit a development inflection point.

Between 2024 and 2026, we'll likely realize the true size of this funding with a slew of new quality games. , and cryptocurrency games add two very important vertical areas to traditional games:

The ability to have real, verifiable ownership of game assets;

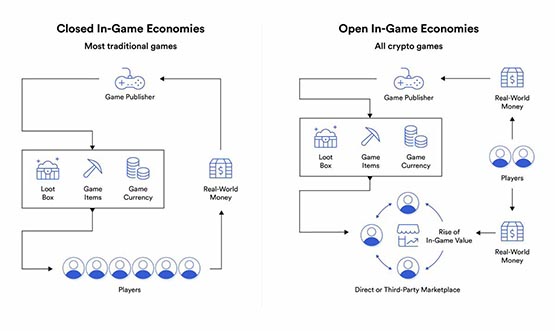

The ability to financially reward/enable game users Benefit rather than purely sucking away liquidity in a closed in-game economy;

When investing in the gaming industry, I like to take a layered approach, in order of weight:

Game infrastructure: L1 and L2, SDK, etc.;

Game studio: Provide multiple game experiences at the same time;

Individual games: highest benefits, highest risks;

5.BRC-20

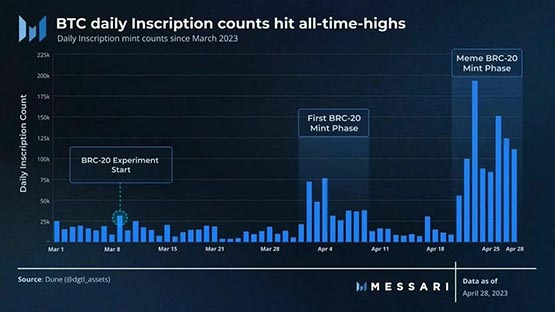

Since its launch, the BRC-20 token has continued to rapidly gain traction, creating demand for block space and bringing interest to the Bitcoin blockchain New use cases.

First of all, what is a BRC-20 token?

Inscription is to append data to satoshi (the smallest unit of Bitcoin), and "BRC-20" refers to the experimental standard for appending JSON code to sats based on inscription.

Despite being in an experimental stage, the BRC-20 token has a market capitalization of over $2.5 billion. As the Bitcoin story heats up with ETFs and the upcoming halving, BRC-20 tokens are poised to benefit.

The BRC-20 ecosystem is still relatively nascent and lacks quality infrastructure, I have made a small bet in this space and am always keeping an eye on new projects. With many upcoming products coming out, there are also many airdrop opportunities.

6.Restaking

I view Restaking as the new version of this cycle of the DeFi Ponzi scheme of the previous cycle.

During the 2021 bull market we witnessed an insatiable pursuit of yield due to bullish market sentiment, and if we enter a broader bull market (as I expect) demand for yield is expected to return.

We are already seeing early signs of this happening, with the EigenLayer airdrop also being a major catalyst for the industry.

So, what is Restaking?

In short, it allows you to reuse your already staked ETH in multiple other protocols. This allows you to stack your earnings on top of your main ETH earnings and gain access to protocol airdrops.

EigenLayer is the middleware that pioneered the concept of re-staking, but interestingly, most of the re-staking is actually the corresponding points system.

EigenLayer will be one of the largest airdrops in 2024, which is why more than $1.4 billion is locked in the platform (Foresight News notes that it is more than $3 billion at the time of publishing).

7.ZK

ZK technology is one of the biggest crypto innovations of the decade.

It is a type of cryptography that can prove the validity of a message without revealing any identifying details.

ZK helps:

Reduce network congestion (helps with scalability);

Add privacy protection elements and support new types of applications;

Enhance network security;

Many projects are now utilizing ZK technology, including Linea, zkSync, Manta, Polygon, etc.

While scalability has always been one of the more prominent use cases, ZK proves to have applications in many verticals.

An interesting example is Chainlink’s “DECO” project, which uses ZK proofs to ensure tamper-proof content transmission across Internet protocols.

Decentralized identity oracles like zkMe are another important use case, especially for KYC and AML compliance.

Due to the introduction of ZK technology, many new use cases are unlocked.

The above is the detailed content of One article to learn about the seven major sectors of virtual currency worth paying attention to in 2024. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Looking at the initial chain from the development process of blockchain

- What is blockchain technology and what are its characteristics

- Ethereum market circulation increased by 1 billion USDT! Are there signs of recovery in the Defi industry?

- Teach you how to convert BTC cryptocurrency in TP wallet

- Is DOME Coin a cryptocurrency made in China? Does DOME coin have potential?