Bitcoin spot ETF has achieved net inflows for 14 consecutive days! BlackRock, Bitwise are chasing GBTC

- 王林forward

- 2024-02-17 09:20:25857browse

Bitcoin spot ETFs have continued net inflows. Although GBTC had another net outflow of $174.6 million on February 15, the trading volume and net inflows of exchanges such as Bitwise and BlackRock Still performing well. Based on this, the total assets of Bitcoin spot ETFs have reached US$32.6 billion.

Bitcoin spot ETF has net inflows for 14 consecutive days

The Bitwise Bitcoin ETF ($BITB) attracted $126.5 million in net inflows on February 15, according to Farside data, which was the day Bitwise was established. The second largest capital inflow since. Additionally, Franklin EZBC also received $3 million in net inflows on the same day. Although the data for February 15 is not yet complete, the data shows that investor interest in crypto assets remains strong.

GBTC still had a net outflow of US$174.6 million, and showed a higher net outflow compared to the past few days.

Since January 26, the Bitcoin spot ETF has shown net inflows for 14 consecutive days.

IBIT is in hot pursuit, with assets reaching US$5 billion

BlackRock IBIT had a net inflow of US$224.3 million on February 14, a figure that exceeded Record weekly trading volume. Bloomberg analyst Eric Balchunas believes that trading volume is a good predictor of emerging ETF capital inflows. This data demonstrates growing investor interest and confidence in IBIT.

According to Coinglass, IBIT’s current asset size (market value) has exceeded US$5 billion, second only to GBTC, and the total asset size of Bitcoin spot ETFs has reached US$32.6 billion.

According to Grayscale’s official website, GBTC Bitcoin holdings decreased by approximately 1,492 BTC compared with the previous day.

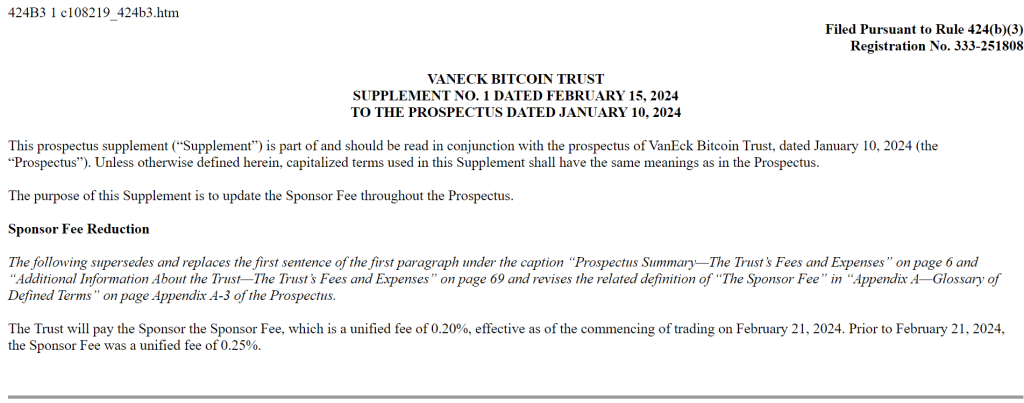

VanEck announces fee reduction

According to SEC documents, ETF issuer VanEck will reduce its VanEck Bitcoin Trust (HODL) fee from 0.25% to 0.20% on February 21. Bitwise (BITB), BlackRock (IBIT), and Ark (ARKB) have more competitive fees.

The above is the detailed content of Bitcoin spot ETF has achieved net inflows for 14 consecutive days! BlackRock, Bitwise are chasing GBTC. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- What should I do if my server is infected with the Bitcoin ransomware virus? Attached is a ransomware solution

- After reading this article, you will understand everything about Bitcoin, blockchain, and decentralization.

- How to implement Bitcoin address in Node.Js

- Rollup SatoshiVM releases testnet to teach you cross-chain participation in Bitcoin EVM compatibility

- What are the platforms for buying and selling Tether? What are the rankings of multiple virtual currency exchanges?