web3.0

web3.0 Germany's first compliant blockchain carbon rights exchange! Optimistic about RWA driving renewable energy market

Germany's first compliant blockchain carbon rights exchange! Optimistic about RWA driving renewable energy marketGermany's first compliant blockchain carbon rights exchange! Optimistic about RWA driving renewable energy market

This site (120BTc.coM) stated that Neutral has cooperated with DLT Finance, a trading and brokerage company licensed by the German Federal Financial Supervisory Authority (BaFin), to jointly launch the first regulated A tokenized environmental asset trading platform. The platform is dedicated to building tokenized infrastructure for environmental assets such as carbon rights, renewable energy and other environmental commodities. These include carbon credits and renewable energy credits.

The first compliant blockchain carbon exchange

mentioned in the article that by 2023, the on-chain value of tokenized real-world assets has grown by $1.05 billion, mainly concentrated in Treasury and real estate. It is expected that by 2030, this market size will reach 10 trillion US dollars. The tokenization of environmental assets is a product of this trend.

According to Neutral CEO Farouq Ghandour, users will be able to choose to use standardized trading tools to redeem or deposit the specific assets they want, and buy and sell orders can be executed immediately, funds transferred to or Take out their account. He also noted that institutional clients and market participants are increasingly interested in tokenizing traditional assets, but regulators and infrastructure still lag. Through this collaboration, Neutral combines innovative technology with a strong regulatory foundation to provide compliance, value discovery and liquidity for the on-chain environmental asset ecosystem.

Julien Hawle, Head of Regulatory Business Development at DLT Finance, also added: “We plan to work with Neutral to change the way environmental assets such as carbon credits are traded and managed. We will leverage the full potential of blockchain technology, And combine Neutral’s expertise in environmental assets with DLT Finance’s regulatory license. Through collaborations like this, we will make environmental assets more widely accessible, transparent, and have greater impact.”

Neutral What is DLT Finance?

Neutral is an environmental asset trading platform where users can buy and sell tokenized carbon credits and renewable energy credits, as well as trade forward contracts.

DLT Finance is an investment company and crypto asset custodian regulated by the German Federal Financial Supervisory Authority (BaFin). The company's key features are regulatory compliance and comprehensive trade execution and security infrastructure.

The above is the detailed content of Germany's first compliant blockchain carbon rights exchange! Optimistic about RWA driving renewable energy market. For more information, please follow other related articles on the PHP Chinese website!

Tether CEO Paolo Ardoino Completes Visit to the United States, Meeting with Lawmakers in Washington, D.C. to Discuss Stablecoin RegulationApr 15, 2025 am 11:24 AM

Tether CEO Paolo Ardoino Completes Visit to the United States, Meeting with Lawmakers in Washington, D.C. to Discuss Stablecoin RegulationApr 15, 2025 am 11:24 AMHis visit comes as the U.S. Congress moves closer to introducing legislation regulating stablecoins, which Ardoino believes is necessary for financial inclusion and preserving U.S. dollar dominance.

Why XRP Price May Not 'Go Parabolic' Post-SEC SettlementApr 15, 2025 am 11:22 AM

Why XRP Price May Not 'Go Parabolic' Post-SEC SettlementApr 15, 2025 am 11:22 AMThe XRP price holds still in the $2.10-2.20 range for the past few days, but this is not stopping Ripple's community from continuing to post various content about XRP

Metaplanet Expands Its Bitcoin Treasury Holdings by Another 319 BTCApr 15, 2025 am 11:20 AM

Metaplanet Expands Its Bitcoin Treasury Holdings by Another 319 BTCApr 15, 2025 am 11:20 AMIn an announcement made earlier today, Japanese firm Metaplanet revealed it has acquired another 319 Bitcoin (BTC), pushing its total corporate holdings beyond 4,500 BTC.

Metaplanet Scoops Another 319 Bitcoin, Pushing Its Total Corporate Holdings Beyond 4500Apr 15, 2025 am 11:18 AM

Metaplanet Scoops Another 319 Bitcoin, Pushing Its Total Corporate Holdings Beyond 4500Apr 15, 2025 am 11:18 AMIn an announcement made earlier today, Japanese firm Metaplanet revealed it has acquired another 319 Bitcoin (BTC), pushing its total corporate holdings beyond 4,500 BTC.

Ripple (XRP) price rallied through a weekend riseApr 15, 2025 am 11:16 AM

Ripple (XRP) price rallied through a weekend riseApr 15, 2025 am 11:16 AMRipple (XRP) price rallied through a weekend rise from its $2.00 critical support mark to reach $2.23.

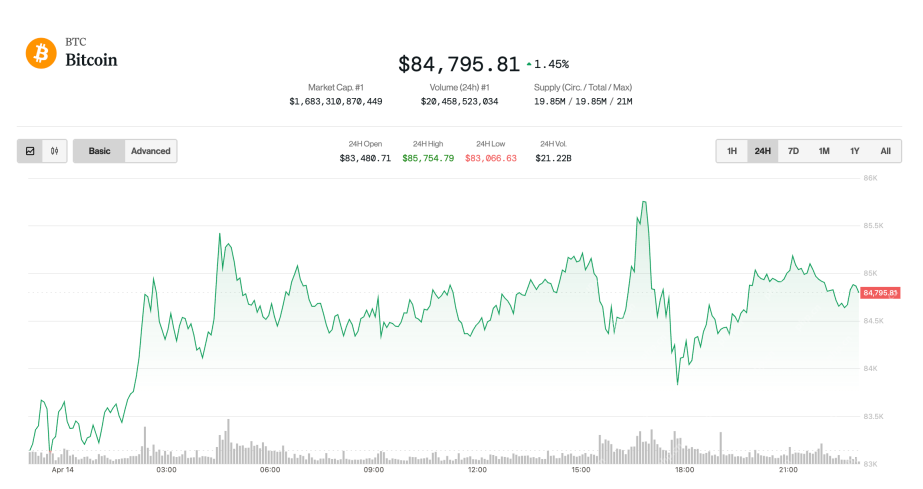

Bitcoin (BTC) drifts upwards as the broader market adjusts favorably to trade-related newsApr 15, 2025 am 11:14 AM

Bitcoin (BTC) drifts upwards as the broader market adjusts favorably to trade-related newsApr 15, 2025 am 11:14 AMThe largest cryptocurrency was up 1.6% in the last 24 hours and is now trading just shy of $85,000. Ether (ETH), meanwhile, rose 2.7%

Is ADA the Sleeper Pick for the Next Bull Run? Hoskinson's $250K BTC Forecast Says YesApr 15, 2025 am 11:12 AM

Is ADA the Sleeper Pick for the Next Bull Run? Hoskinson's $250K BTC Forecast Says YesApr 15, 2025 am 11:12 AMADA has risen by 1.5% in the past 24 hours, with its move to $0.644 coming as the crypto market suffers a 2% loss today.

Solana Leads Market Recovery After Brief Dip Below $100Apr 15, 2025 am 11:10 AM

Solana Leads Market Recovery After Brief Dip Below $100Apr 15, 2025 am 11:10 AMJimmy has nearly 10 years of experience as a journalist and writer in the blockchain industry. He has worked with well-known publications such as Bitcoin Magazine, CCN, and Blockonomi, covering news...

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 Chinese version

Chinese version, very easy to use

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

WebStorm Mac version

Useful JavaScript development tools

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment