Technology peripherals

Technology peripherals It Industry

It Industry EA's revenue in the third fiscal quarter was US$1.945 billion, with net profit of US$290 million, a year-on-year increase of 42%

EA's revenue in the third fiscal quarter was US$1.945 billion, with net profit of US$290 million, a year-on-year increase of 42%In the morning news on January 31st, Beijing time, Electronic Arts (EA) today announced the company’s third quarter financial report for fiscal year 2024.

The report shows that Electronic Arts’ total net revenue in the third fiscal quarter was US$1.945 billion, compared with US$1.881 billion in the same period last year, a year-on-year increase; not in accordance with U.S. GAAP, Electronic Arts’ third fiscal quarter net bookings were US$2.366 billion, compared with US$2.342 billion in the same period last year, a year-on-year increase of 1%, excluding the impact of exchange rate changes, a year-on-year increase of 2%; net profit was US$290 million, a year-on-year increase of 1%. An increase of 42% compared to US$204 million in the same period.

Both Electronic Arts’ third-quarter net bookings and earnings per share failed to meet Wall Street analysts’ previous expectations, and its performance outlook for the first quarter and full-year fiscal 2024 also fell short of expectations, leading to Shares fell nearly 2% after hours.

Main results:

In the fiscal quarter ended December 31, Electronic Arts Net profit was US$290 million, an increase of 42% compared with US$204 million in the same period last year; diluted earnings per share was US$1.07, an increase compared with US$0.73 in the same period last year, but this performance still failed to reach analysts expected. According to data provided by Yahoo Finance, 20 analysts had expected Electronic Arts to earn $2.93 per share in the third quarter.

Electronic Arts’ total net revenue in the third fiscal quarter was $1.945 billion, compared with $1.881 billion in the same period last year, a year-on-year increase. Among them, EA’s net revenue from the full game business in the third fiscal quarter was US$618 million, compared with US$622 million in the same period last year; net revenue from streaming services and other businesses was US$1.327 billion. US dollars, compared with US$1.259 billion in the same period last year.

By platform, Electronic Arts’ net revenue from game console platforms in the third fiscal quarter was US$1.229 billion, an increase of 7% compared with US$1.152 billion in the same period last year; from PC and other platforms Net revenue was US$420 million, a decrease of 3% compared with US$435 million in the same period last year; net revenue from the mobile platform was US$296 million, an increase of 1% compared with US$294 million in the same period last year.

Not in accordance with U.S. GAAP, EA's net bookings (net bookings) in the third fiscal quarter were US$2.366 billion, compared with US$2.342 billion in the same period last year, a year-on-year increase of 1%, excluding exchange rates The impact of the change was a year-on-year increase of 2%, a performance that failed to meet analyst expectations. According to data provided by Yahoo Finance, 16 analysts had expected EA's net bookings to reach $2.39 billion in the third fiscal quarter.

Electronic Arts’ cost of revenue in the third fiscal quarter was US$529 million, compared with US$568 million in the same period last year, a year-on-year decrease. Electronic Arts' third-quarter gross profit was $1.416 billion, up from $1.313 billion a year earlier.

Electronic Arts’ total operating expenses for the fiscal third quarter were $1.051 billion, up from $1.024 billion a year earlier. Among them, R&D expenses were US$584 million, compared with US$556 million in the same period last year; marketing and sales expenses were US$276 million, compared with US$256 million in the same period last year; general and administrative expenses were US$170 million, compared with US$170 million in the same period last year. Amortization expense of intangible assets was US$21 million, compared with US$50 million in the same period last year.

Electronic Arts’ fiscal third-quarter operating profit was $365 million, an increase from $289 million in the same period a year earlier.

Electronic Arts’ net cash from operating activities in the third fiscal quarter was $1.264 billion, an increase of 13% compared with the same period last year. Over the last 12 months, EA had $2.352 billion in net cash from operating activities.

In the third fiscal quarter, Electronic Arts repurchased 2.5 million shares, and the total amount of funds used to repurchase shares was $325 million; in the past 12 months, Electronic Arts repurchased a total of 10.4 million shares were purchased, and the total amount of funds used to repurchase shares was US$1.300 billion.

Electronic Arts announced that the company will pay a cash dividend of $0.19 per share to common shareholders. The dividend will be paid on March 20, 2024 to all shareholders of record as of the close of business on February 28, 2024. Disbursed to shareholders.

Performance Outlook:

Performance Outlook for the Fourth Quarter of Fiscal Year 2024:

Electronic Arts expects net revenue for the fourth fiscal quarter of Fiscal Year 2024 Will reach between US$1.625 billion and US$1.925 billion; net profit is expected to be between US$54 million and US$183 million; diluted earnings per share is expected to be between US$0.20 and US$0.68, lower than analyst expectations; net bookings It is expected to reach between US$1.625 billion and US$1.925 billion, with an average of US$1.775 billion, which is lower than analysts' expectations; revenue costs are expected to reach between US$360 million and US$410 million; operating expenses are expected to reach US$1.125 billion. to US$1.205 billion; pretax profit before income tax provisions is expected to be between US$158 million and US$325 million.

According to data provided by Yahoo Finance Channel, 17 analysts had previously expected on average that Electronic Arts’ net bookings in the fourth fiscal quarter would reach US$1.82 billion, and 20 analysts had previously expected on average that Electronic Arts’ fourth fiscal quarter net bookings would reach US$1.82 billion. Earnings per share will be $1.56.

Full-year performance outlook for fiscal year 2024:

Electronic Arts estimates that net revenue in fiscal year 2024 is expected to reach between US$7.408 billion and US$7.708 billion; net profit is expected to reach US$1.145 billion to US$1.274 billion Between US$1.95 billion and US$2.10 billion; diluted earnings per share are expected to be between US$4.21 and US$4.68, lower than analysts' expectations; operating cash flow is expected to be between US$1.950 billion and US$2.100 billion; net bookings are expected to reach US$7.389 billion to US$7.689 billion, with an average of US$7.539 billion, lower than analyst expectations; revenue costs are expected to be between US$1.713 billion and US$1.763 billion; operating expenses are expected to be between US$4.274 billion and US$4.351 billion ; Pre-tax profit excluding income tax provisions is expected to be between US$1.487 billion and US$1.654 billion.

According to data provided by Yahoo Finance Channel, 22 analysts had previously expected on average that Electronic Arts’ net bookings in fiscal year 2024 would reach US$7.64 billion, and 23 analysts had previously expected on average that Electronic Arts’ net bookings per share in fiscal year 2024 would be The gain will be $7.14.

Stock price changes:

On that day, Electronic Arts’ stock price fell $1.03 in regular trading, closing at $137.55, a decrease of 0.74%. In subsequent after-hours trading as of 5:50 pm ET on Tuesday (6:50 am on Wednesday, Beijing time), EA shares fell another $2.58, or 1.88%, to $134.97. Over the past 52 weeks, Electronic Arts' high price was $143.47 and its low price was $108.53.

The above is the detailed content of EA's revenue in the third fiscal quarter was US$1.945 billion, with net profit of US$290 million, a year-on-year increase of 42%. For more information, please follow other related articles on the PHP Chinese website!

阿里巴巴2024财年半年度财报显示:收入达4589.46亿元,同比增长11%,归母净利润同比增长2748%Jan 04, 2024 pm 06:44 PM

阿里巴巴2024财年半年度财报显示:收入达4589.46亿元,同比增长11%,归母净利润同比增长2748%Jan 04, 2024 pm 06:44 PM本站12月23日消息,阿里巴巴公布2024财年中期报告(截至2023年9月30日止六个月),实现收入4589.46亿元,同比增长11%;经营利润760.74亿元,同比增长52%;归母净利润620.38亿元,同比增长2748%;摊薄每股收益3.01元,同比增长2849%。本站注意到,淘天集团的收入同比增长了8%。阿里国际数字商业集团的出海业务表现强劲,收入增长了47%。菜鸟集团的收入增长了29%。本地生活集团的收入增长了22%。大文娱集团的收入增长了21%截至2023年9月30日的六个月期间,菜鸟

Galaxy Digital 在2023年报告2.96亿美元净利润,此前一年亏损10亿美元Apr 01, 2024 pm 06:55 PM

Galaxy Digital 在2023年报告2.96亿美元净利润,此前一年亏损10亿美元Apr 01, 2024 pm 06:55 PM截至今年2月底,GalaxyDigital的管理资产(AUM)激增至101亿美元。MikeNovogratz旗下的数字资产金融服务公司GalaxyDigital最近发布的财务报表显示,今年全年实现净利润2960万美元。这是继2022年亏损10亿美元之后的重大转变。公司表示,2023年第四季度对公司来说是特别具有转折性的。在其官方声明中,GalaxyDigital表示,2023年最后一个季度的运势发生了积极变化,将其净利润推高至3.02亿美元。这与加密市场经历的急需的反弹相吻合,市场从长期的加密寒

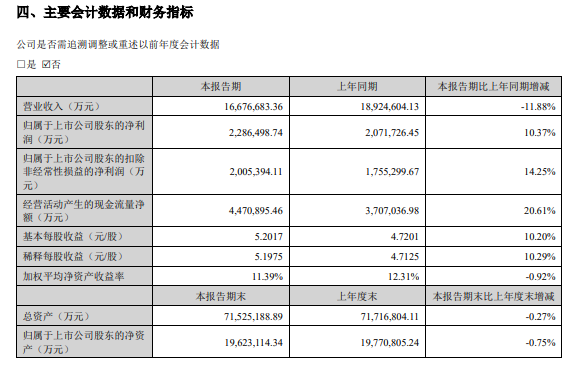

宁德时代 2024 年上半年净利润 228.65 亿元同比增长 10.37%Jul 27, 2024 am 11:41 AM

宁德时代 2024 年上半年净利润 228.65 亿元同比增长 10.37%Jul 27, 2024 am 11:41 AM本站7月26日消息,宁德时代发布2024年半年报:今年上半年营收1667.7亿元,同比降低11.88%;上半年归母净利润228.65亿元,同比增长10.37%。1.市场占有率:宁德时代2024年1-5月动力电池使用量全球市占率为37.5%,较去年同期提升2.3个百分点,继续蝉联全球第一。储能领域:宁德时代连续3年储能电池出货量排名全球第一。研发投入:宁德时代今年上半年研发投入达85.92亿元,同比降低12.77%。产品或服务方面,宁德时代动力电池系统上半年毛利率达26.90%,较上年同期增长6.

育碧上半年净预订额 8.224 亿欧元同比增长 17.6%,《彩虹六号:围攻》最出色Oct 27, 2023 pm 06:49 PM

育碧上半年净预订额 8.224 亿欧元同比增长 17.6%,《彩虹六号:围攻》最出色Oct 27, 2023 pm 06:49 PM本站10月27日消息,育碧公布2023-2024财年上半年业绩(3月-9月),营业收入1610万欧元(本站备注:当前约1.24亿元人民币),去年上半年为2.15亿欧元;累计收入达8.36亿欧元,同比增长14%;上半年净预订额达到8.224亿欧元,较上年大幅增长17.6%。二季度净预订额为5.548亿欧元(当前约42.83亿元人民币),增长36.6%,远高于约3.5亿欧元的目标。育碧的收入增长部分归功于9月份推出的赛车模拟游戏《飙酷车神:轰鸣盛典》以及10月初推出的《刺客信条幻影》的预发货。《彩虹

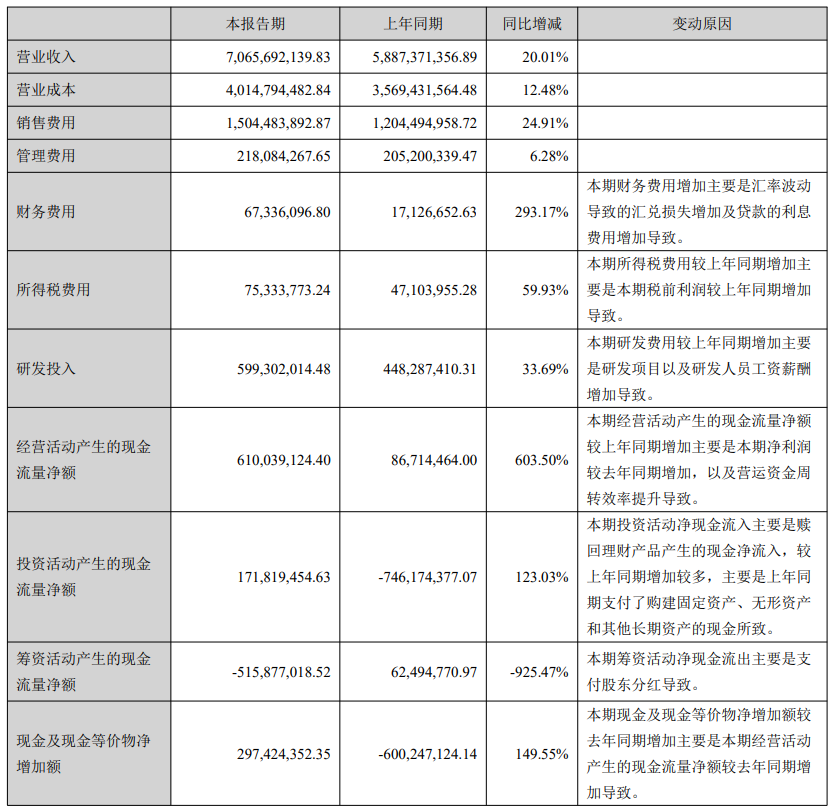

安克创新:上半年营收 70.66 亿元同比增长 20.01%,净利润同比增长 42.3%Sep 12, 2023 pm 01:45 PM

安克创新:上半年营收 70.66 亿元同比增长 20.01%,净利润同比增长 42.3%Sep 12, 2023 pm 01:45 PM本站9月5日消息,安克创新近日公布2023半年度报告,上半年实现营业总收入70.66亿元,同比增长20.01%;实现归属于上市公司股东的净利润8.20亿元,同比增长42.33%。产品类别方面,充电类实现收入34.83亿元,营收同比增长18.29%,占总营收的49.30%;智能创新类实现收入19.46亿元,营收同比增长16.66%,占总营收的27.54%;无线音频类实现收入15.63亿元,营收同比增长29.11%,占总营收的22.12%。本站从报告中获悉,安克研发投入达5.99亿元,同比增长33.

英伟达预计 Q2 财报将公布,同比增幅预计超过 50%,日期为 8 月 23-24 日Aug 23, 2023 pm 02:21 PM

英伟达预计 Q2 财报将公布,同比增幅预计超过 50%,日期为 8 月 23-24 日Aug 23, 2023 pm 02:21 PM本站8月20日消息,据台媒经济日报今日凌晨报道,英伟达将于美国时间8月23日(北京时间8月23日-8月24日之间)公布其2024会计年度Q2财报。报道称,外界期待该公司财报揭晓能够"进一步验证AI带来的实质利益",并从中得知明确的长期展望作为参考,英伟达在2024会计年度Q1总营收为71.9亿美元(本站备注:当前约524.87亿元人民币),同比减少13%,但跟上一季度相比增长了19%。其数据中心有关的业绩则是同比、环比均出现双位数的增幅。英伟达预估2024会计年度Q2业绩将超

同程旅行 Q2 财报:收入达 28.7 亿元,同比飙升 117.4%Aug 23, 2023 pm 05:05 PM

同程旅行 Q2 财报:收入达 28.7 亿元,同比飙升 117.4%Aug 23, 2023 pm 05:05 PM本站8月22日消息,同程旅行发布2023年第二季度及上半年业绩报告。财报显示,2023年二季度,同程旅行收入达28.7亿元,同比增长117.4%;经调EBITDA(税息折旧及摊销前利润)8.1亿元,同比增长175.8%;经调净利润5.9亿元,同比增长428.9%;经调整净利润率由2022年同期的8.5%增加至20.7%。本站从报告中得知,同程旅行二季度平均月活跃用户达2.8亿,较2019年同期增长53.5%;平均月付费用户4220万,较2019年同期增长52.3%;平均月付费用户4220万,同比

空客 1-9 月综合收入 426 亿欧元同比增长 12%,共交付 488 架民用飞机Nov 10, 2023 pm 09:33 PM

空客 1-9 月综合收入 426 亿欧元同比增长 12%,共交付 488 架民用飞机Nov 10, 2023 pm 09:33 PM本站11月10日消息,空中客车公司发布截至2023年9月30日公司前九个月的综合财务业绩,综合收入同比增长12%,达426亿欧元(本站备注:当前约3318.54亿元人民币);综合调整后息税前利润为36.31亿欧元,与空中客车民用飞机业务相关的调整后息税前利润增至32.16亿欧元;直升机调整后息税前利润增至4.17亿欧元。空中客车民用飞机共获得1280架新订单(去年同期856架),其中净订单1241架(去年同期647架);共交付488架民用飞机,包括41架A220飞机、391架A320系列飞机、2

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

Atom editor mac version download

The most popular open source editor

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

Dreamweaver CS6

Visual web development tools