Is there any liquidity risk on Matcha Exchange?

php Editor Strawberry: Does Matcha Exchange have liquidity risks? As a global digital currency trading platform, Matcha Exchange’s liquidity has always been its focus. Matcha Exchange has a complete liquidity management mechanism, including but not limited to: 1. Multi-currency support: Matcha Exchange supports transactions in multiple mainstream digital currencies, providing users with a wealth of trading options and increasing market liquidity. 2. Deep order book: Matcha Exchange has a deep order book to ensure that orders from buyers and sellers can be quickly matched, improve transaction efficiency, and reduce liquidity risks. 3. Market maker system: Matcha Exchange introduces a market maker system to attract professional market makers to provide liquidity, increase market depth, and improve transaction efficiency. 4. Risk control: Matcha Exchange has established a strict risk control system, including but not limited to anti-money laundering, anti-fraud, anti-market manipulation and other measures to ensure transaction security and reduce liquidity risks. Therefore, the liquidity risk of Matcha Exchange is low, and users can use Matcha Exchange for digital currency transactions with confidence.

MXC International Station is a platform focused on the exchange and exchange of blockchain assets co-founded by Wall Street, Japan and Europe’s senior quantitative trading teams and senior blockchain practitioners. Through decentralized self-organization, MXC is committed to providing users with safer, more convenient and intelligent blockchain asset circulation services. The platform will gather global high-quality blockchain assets and integrate the world's top security technologies, aiming to build the world's top international station for blockchain assets.

MXC Exchange is currently ranked 14th in the world, and the platform provides transactions for 178 projects such as BTC, ETH, and ESV. The 24-hour transaction volume reached 16.51 billion. In terms of marketing, the exchange has adopted models such as forced listing, free listing, and platform currency destruction and repurchase. At first, these models were not recognized by the market, but later investors gradually accepted them. At present, Matcha Exchange can be regarded as a third-tier exchange.

Matcha developed well last year, with strong strength and operations. Although its trading depth is not as deep as Huobi and Binance, it is still a safe and reliable exchange with promising prospects.

The above is the detailed content of Is there any liquidity risk on Matcha Exchange?. For more information, please follow other related articles on the PHP Chinese website!

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PM

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PMThis sharp drop happened as investor interest faded and a major scandal hit the highly speculative market.

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PM

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PMDespite being pretty much the iconic example of “random” – well, that and dice rolls – we can't help but feel like there's some element of skill involved. Especially when we lose.

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AM

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AMBitwise, a leading digital asset manager, has announced the listing of four of its crypto Exchange-Traded Products (ETPs) on the London Stock Exchange (LSE).

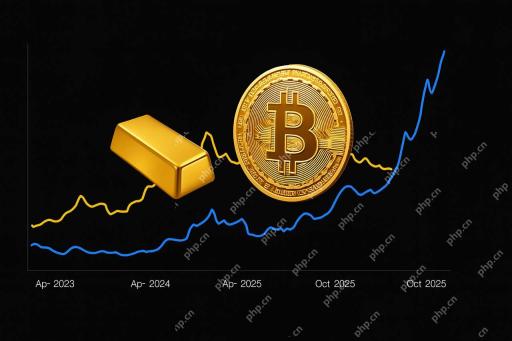

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AM

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AMBitcoin may be poised for a massive rally—but only if gold continues its upward climb, according to Joe Consorti, Head of Growth at Theya.

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AM

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AMThe Shiba Inu price continues to attract the attention of analysts, who are watching for its next potential move. By Samuele Piar. Updated April 14, 2025.

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AM

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AMThe joint motion of Ripple and U.S. Securities and Exchange Commission (SEC) to hold the appeal in abeyance has been granted by the Circuit Judge Jose A. Cabranes.

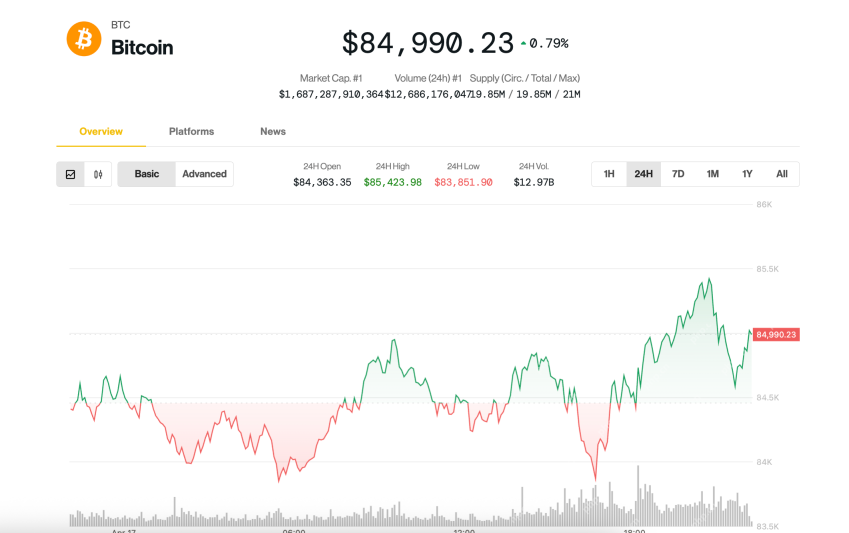

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AM

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AMBitcoin (BTC) was treading water just below $85,000 late Thursday as tensions between U.S. President Donald Trump and Federal Reserve Chair Jerome Powell added another layer of uncertainty for investors.

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AM

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AMToday, AB DAO officially announced the launch of a dual reward campaign in collaboration with Bitget (bitget.com), the world's second-largest digital asset trading platform.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

SublimeText3 Chinese version

Chinese version, very easy to use