Bitcoin market share is close to 50%, consolidating its dominant position! Price returns to $42,000

- 王林forward

- 2024-01-29 08:03:21756browse

According to data, Bitcoin spot ETF funds once again experienced net inflows on Friday after four consecutive days of net outflows. It is worth noting that the single-day outflow amount of Grayscale GBTC funds also declined, to $255 million. After reaching a peak of $640 million on the 22nd, it has fallen for four consecutive days. This trend suggests that the GBTC sell-off may be starting to slow down.

Against this background, Bitcoin (BTC) has started its upward momentum again since Friday, breaking through the important $40,000 mark and continuing to rise. After reaching a high of $42,842 this morning, it is now quoted at $42,398, up 1.5% in the last 24 hours and more than 5% in the past three days.

Ethereum (ETH) has seen a significant resurgence over the past few days. Since the low of US$2,170 on the 26th, its price has continued to rise, and was reported at US$2,285 as of press time, up 0.93% in the past 24 hours. Ethereum has gained over 5% in the past 3 days.

The top ten currencies are rising

According to data from CoinMarketCap, the top ten currencies showed an overall upward trend today. Among them, AVAX led the gains with an increase of 10.58%, BNB increased by 1.14%, SOL increased by 4.55%, XRP increased by 0.27%, ADA increased by 2.72%, and DOGE increased by 1.31%.

The total liquidation amount of the entire network in the past 24 hours was less than 100 million U.S. dollars

According to Coinglass data, in the past 24 hours, the total amount of cryptocurrency liquidation across the entire network reached 75.36 million U.S. dollars, resulting in 32,127 Investors suffered liquidation. Although the liquidation amount was relatively low, it still caused certain losses to investors. Among the currencies that suffered liquidation, BTC ranked first with an amount of $24.6 million, ETH ranked second with an amount of $88.33 million, and SOL ranked third with an amount of $5.26 million. This data shows the volatility and riskiness of the entire cryptocurrency market.

Bitcoin’s market share has climbed to nearly 50%

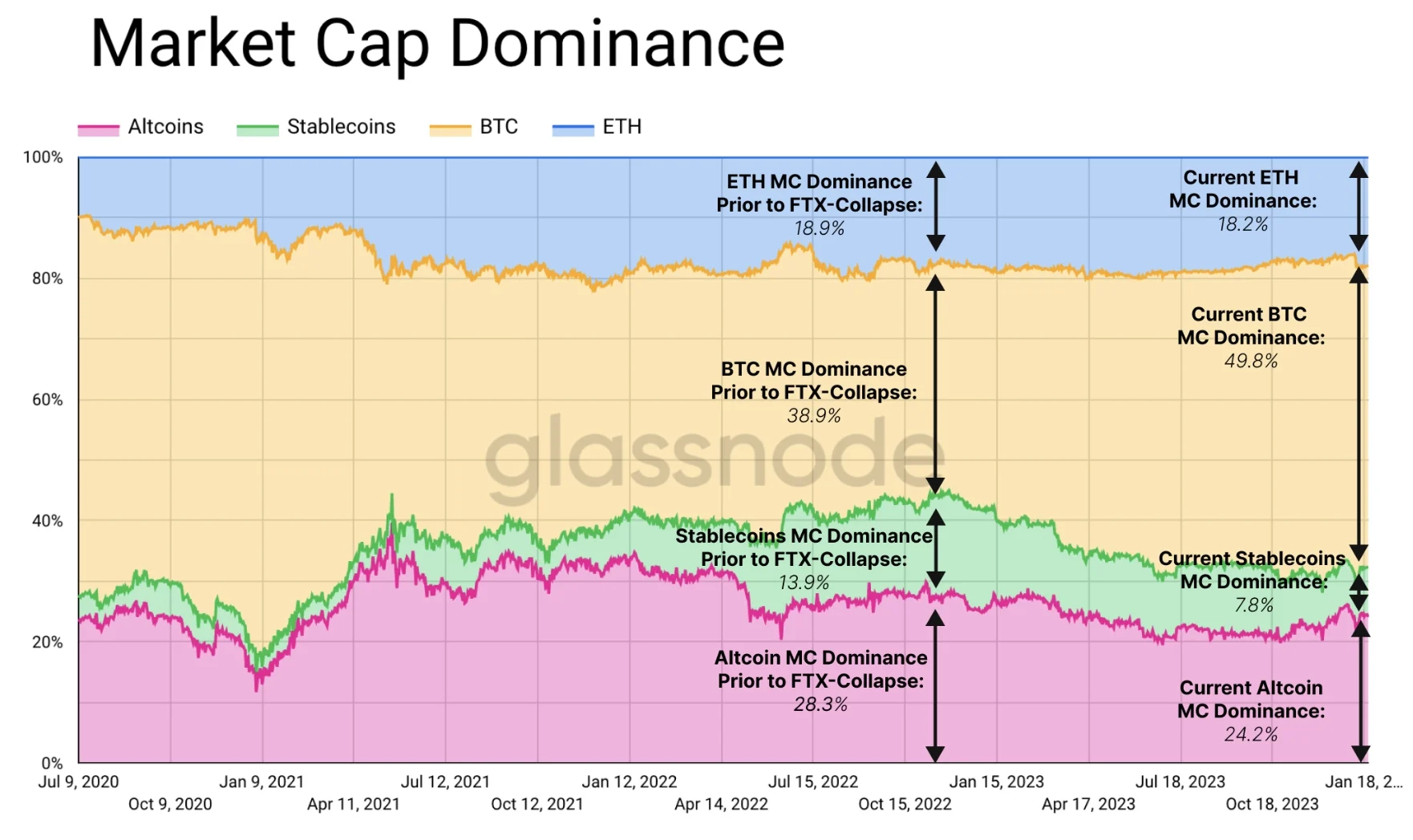

It is worth noting that Glassnode data shows that driven by Bitcoin spot ETFs, Bitcoin has become increasingly dominant in 2022 Since the FTX thunderstorm in November, Bitcoin’s market share in the overall currency market has increased from 38.9% to 49.8%.

On the other hand, ETH also maintains its dominant position. When FTX exploded in November 2022, ETH's market share was 18.9%. It is currently 18.2%, which is basically the same. Its market share in the cryptocurrency market The ones that lost the most were altcoins, whose market share dropped from 28.3% to 24.2%, and the market share of stablecoins also dropped from 13.9% to 7.8%.

Changes in Cryptocurrency Market Share

The above is the detailed content of Bitcoin market share is close to 50%, consolidating its dominant position! Price returns to $42,000. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- What are the classifications of various stablecoins?

- Tether issues $1 billion USDT stablecoin on Tron and expands to DeFi protocol

- Tether obtains 4 trademark registrations in Russia! USDT secures its leadership in stablecoins, with market value exceeding US$95 billion

- PayPal stablecoin PYUSD plans to enter the Aave lending protocol in the DeFi field

- Figure Submits Application, Plans to Launch Interest-Bearing Stablecoin and Bid to SEC for FTX