Technology peripherals

Technology peripherals It Industry

It Industry Tesla's performance is in adversity: annual profit decreases for the first time, price reduction policy brings positive and negative effects

Tesla's performance is in adversity: annual profit decreases for the first time, price reduction policy brings positive and negative effectsAccording to news on January 25, Tesla, as a leader in the electric vehicle market, seems to have encountered some performance challenges recently. Although Tesla has long been promoting the development of the electric vehicle industry and has always occupied a leading position in the market, the latest financial report data shows that this star company is going through a difficult period.

According to Tesla’s fourth quarter and full-year financial report for 2023, the company’s profits fell for the first time last year. Especially in the fourth quarter, profits fell sharply year-on-year. down 40%. Revenue and earnings per share also failed to meet market expectations, causing the company's stock price to fall 5% in after-hours trading. Specifically, Tesla's earnings per share in 2023 will be $3.12, a 23% decrease from $4.07 in 2022. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) was $16.6 billion, down 13% from $19.2 billion in 2022. This downward trend has occurred for Tesla for the first time since 2017, causing market concern and concern. Analysts believe that this is mainly due to factors such as global chip shortages, supply chain issues, and rising raw material costs. Tesla also acknowledged these challenges in the report and said it would take steps to address and mitigate these issues. Despite the difficulties, Tesla has maintained strong sales and market share. The report shows that Tesla delivered about 1 million electric vehicles in 2023, setting a record high in the company's history. In addition, Tesla continues to promote its global expansion plan, including the construction of new production bases and super charging stations to meet daily needs.

According to the editor’s understanding, Tesla Revenue in the fourth quarter report was $25.17 billion, a year-on-year increase of 3%. However, earnings per share were only $0.71, down 40% year over year. This is mainly due to Tesla's repeated reductions in car product prices. Due to the impact of the price reduction strategy, gross profit margin in the fourth quarter fell to 17.6%, the lowest level since 2019 and a decrease of more than 600 basis points from the same period last year.

Despite the pressure of weak profits, Tesla still achieved a historic breakthrough in revenue in 2023, reaching US$96.8 billion, a year-on-year increase of 19%. In the past year, Tesla delivered a total of 1.8 million vehicles, including 484,500 vehicles in the fourth quarter, setting a new delivery record. This data shows that although Tesla's price reduction strategy successfully increased sales, it did not bring corresponding profit growth.

The above is the detailed content of Tesla's performance is in adversity: annual profit decreases for the first time, price reduction policy brings positive and negative effects. For more information, please follow other related articles on the PHP Chinese website!

特斯拉Model 3再添新变化!路测照片曝光蓝色车型Jun 10, 2023 pm 09:21 PM

特斯拉Model 3再添新变化!路测照片曝光蓝色车型Jun 10, 2023 pm 09:21 PM6月10日消息,近日在Reddit社区上,网友Icy_Nectarine_6311爆料了一组关于特斯拉Model3的新照片,这一代号为“ProjectHighland”的车型在之前已经曝光了白色和黑色车身,而这次首次发现了一辆蓝色车型。根据照片显示,蓝色Model3Highland采用了一种类似于19英寸运动轮毂和冬季轮胎套件的轮毂设计,与之前的白色和黑色车型有所不同。不过,这款蓝色车型的轮毂没有带有特斯拉标志的黑色轮毂盖。此外,新款Model3的前大灯与之前曝光的照片一致,采用了更加时尚和动感

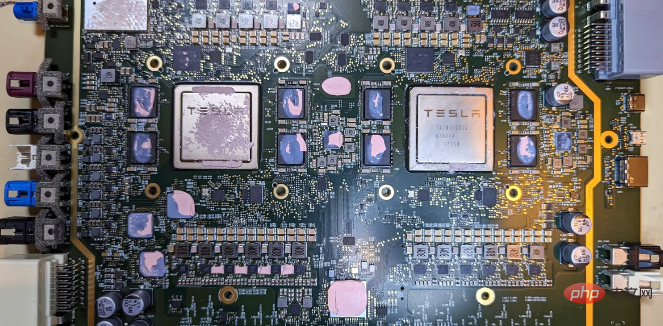

特斯拉自动驾驶硬件 4.0 实物拆解:增加雷达,提供更多摄像头Apr 08, 2023 pm 12:11 PM

特斯拉自动驾驶硬件 4.0 实物拆解:增加雷达,提供更多摄像头Apr 08, 2023 pm 12:11 PM2 月 16 日消息,特斯拉的新自动驾驶计算机,即硬件 4.0(HW4)已经泄露,该公司似乎已经在制造一些带有新系统的汽车。我们已经知道,特斯拉准备升级其自动驾驶硬件已有一段时间了。特斯拉此前向联邦通信委员会申请在其车辆上增加一个新的雷达,并称计划在 1 月份开始销售,新的雷达将意味着特斯拉计划更新其 Autopilot 和 FSD 的传感器套件。硬件变化对特斯拉车主来说是一种压力,因为该汽车制造商一直承诺,其自 2016 年以来制造的所有车辆都具备通过软件更新实现自动驾驶所需的所有硬件。事实证

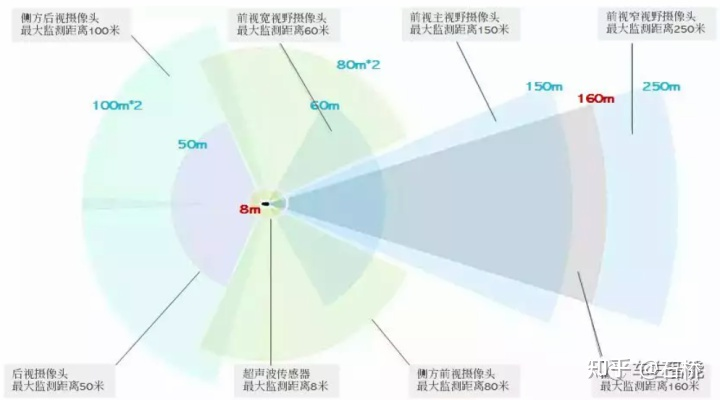

深度剖析Tesla自动驾驶技术方案May 17, 2023 am 08:55 AM

深度剖析Tesla自动驾驶技术方案May 17, 2023 am 08:55 AM01感知:构建实时的4D自动驾驶场景1.特斯拉摄像头布局特斯拉的摄像头视野可以覆盖车身周围360°,在前向有120°鱼眼、长焦镜头用于加强观测,布局如上图。2.特斯拉图像数据预处理特斯拉采用的是36Hz的1280*960-12bit的图像原始数据,这相对于只有8-bit的ISP后处理数据多了4位信息,动态方位扩大了16倍。特斯拉这样处理的原因有2个:1)ISP基于rule-base的算法对原始信号做了自动对焦(AF)、自动曝光(AE)、自动白平衡(AWB)、坏点校正(DNS)、高动态范围成像(H

特斯拉人形机器人集体出街!马斯克:比车便宜,会有100亿台May 31, 2023 pm 08:01 PM

特斯拉人形机器人集体出街!马斯克:比车便宜,会有100亿台May 31, 2023 pm 08:01 PM特斯拉Optimus进化了,价格“比车更低”。来源|量子位ID:QbitAI作者|金磊西风转载已获授权马斯克的人形机器人——特斯拉Optimus进化了,价格还“比车更低”。现在,成群结队的Optimus学会了像人一样缓慢前行:视频中它们还路过Cybertruck的生产间,满满的赛博朋克味道。而且Optimus们可不是简单的在走路而已,而是边走边发现并记忆周遭的环境:接下来,是更为细节的能力展示。例如特斯拉展示了Optimus电机转矩控制的能力,是能做到控制力道不打碎鸡蛋的那种:手活儿也是过关的,

特斯拉GIGA实验室亮相成都,创造45秒造车奇迹Jun 10, 2023 pm 06:47 PM

特斯拉GIGA实验室亮相成都,创造45秒造车奇迹Jun 10, 2023 pm 06:47 PM6月10日消息,全国首家特斯拉GIGA实验室在成都隆重亮相,为成都市民带来了全新的特斯拉体验。这座被誉为特斯拉"成都最美门店"的实验室位于四川省成都市金牛区天府艺术公园,具体地址是天府1113号楼1层104号,即特斯拉天府111体验店。据小编了解,在这里,顾客们不仅可以与朋友相约畅聊小憩,还能沉浸式地体验特斯拉的制造奇迹,仅需45秒即可见证一辆汽车的诞生。特斯拉的超级工厂被冠名为"GIGA",这个词源于计量单位,代表着"数十亿"的含义。

特斯拉Cyberquad:马斯克推出的“宠娃车”灵感源自CybertruckJul 15, 2023 am 11:10 AM

特斯拉Cyberquad:马斯克推出的“宠娃车”灵感源自CybertruckJul 15, 2023 am 11:10 AM7月14日消息,特斯拉今日宣布推出一款新车型——特斯拉Cyberquad。这款面向儿童的玩具车将在特斯拉国内官网以及天猫/京东特斯拉官方旗舰店上架,标价11990元。虽然这个价格对于一款玩具车来说并不便宜,但这并没有阻止国内特斯拉粉丝们对它的热情。在上架时,由于人数过多,特斯拉官网甚至出现了卡顿现象,导致消费者无法成功加购。然而,截至目前,特斯拉官网仍然无法成功购买该商品。据小编了解,特斯拉Cyberquad的设计灵感源自特斯拉最酷炫的Cybertruck电动皮卡,车身采用特斯拉标志性的LED大

特斯拉Dojo超算架构细节首次公开!为自动驾驶「操碎了芯」Apr 11, 2023 pm 09:46 PM

特斯拉Dojo超算架构细节首次公开!为自动驾驶「操碎了芯」Apr 11, 2023 pm 09:46 PM为了满足对人工智能和机器学习模型越来越大的需求, 特斯拉创建了自己的人工智能技术,来教特斯拉的汽车自动驾驶。最近,特斯拉在Hot Chips 34会议上,披露了大量关于Dojo(道场)超级计算架构的细节。本质上,Dojo是一个巨大的可组合的超级计算机,它由一个完全定制的架构构建,涵盖了计算、网络、输入/输出(I/O)芯片到指令集架构(ISA)、电源传输、包装和冷却。所有这些都是为了大规模地运行定制的、特定的机器学习训练算法。Ganesh Venkataramanan是Tesla自动驾驶硬件高级总

特斯拉北美地区Model 3和Model Y标准色调整为"冷光银"Jul 11, 2023 pm 04:01 PM

特斯拉北美地区Model 3和Model Y标准色调整为"冷光银"Jul 11, 2023 pm 04:01 PM7月4日消息,特斯拉近日宣布在北美地区对Model3和ModelY的标准色进行了调整。据悉,特斯拉将北美地区Model3和ModelY的标准色改为了"冷光银",而除了银色之外的所有颜色都需要额外付费,包括黑色和白色。特斯拉旗下的ModelY作为例子,目前提供了五种车漆选择。除了标准的冷光银外,还有珍珠白(多涂层)、深海蓝、纯黑和红色(多涂层)。然而,除了冷光银之外的其他四种颜色都需要额外支付费用。其中,深海蓝和珍珠白车漆需额外支付1000美元(约7250元人民币),纯黑车漆需

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

WebStorm Mac version

Useful JavaScript development tools

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.