web3.0

web3.0 2023 DeFi platform revenue ranking: Maker, Lido, PancakeSwap, GMX, and Convex are shortlisted

2023 DeFi platform revenue ranking: Maker, Lido, PancakeSwap, GMX, and Convex are shortlisted2023 DeFi platform revenue ranking: Maker, Lido, PancakeSwap, GMX, and Convex are shortlisted

Foreign media Blockworks lists the top five DeFi protocols with the highest revenue in 2023 based on DeFiLlama data. As the total value locked (TVL) is increasingly criticized, perhaps revenue is the measure. A key indicator of whether a protocol is feasible?

1. Maker: US$95.91 million

Maker will gradually involve U.S. government bonds and RWA assets starting in 2022, trying to earn more additional income as the U.S. continues to raise interest rates.

This decision seems to be quite correct based on the benefits alone, but it also brings related risks.

2. Lido: US$55.79 million

Lido is among the top protocols in terms of TVL and revenue. The market value of Lido Staked Ether (StETH) exceeds US$20 billion, ranking No. 1 on CoinGecKo Nine major cryptocurrencies.

Tree nature also attracts wind. Lido has always suffered from concerns such as excessive staking market share, centralization, and even cooperation with regulatory sanctions.

Lido staking market share

3. PancakeSwap: 52.31 million US dollars

In terms of transaction volume, PancakeSwap is second only to Uniswap The second largest decentralized exchange (DEX).

PancakeSwap not only launched the v3 version this year (forked from Uniswap v3 after the license expired), but also modified its governance model and launched a game market.

4. Convex Finance: $42.23 million

Curve is the second largest DEX on Ethereum after Uniswap, and Convex is closely involved in the ecology of Curve, allowing users to trade on Convex Lock in CRV and earn revenue.

5. GMX: US$37.52 million

The perpetual contract agreement GMX emerged in the bear market and performed brilliantly. It is the agreement with the highest TVL on Arbitrum and has been able to generate actual income since its launch. Arthur Hayes, the founder of BitMEX, once said: As we all know, the trading volume of derivatives should be several orders of magnitude higher than that of spot. No matter which DEX monopoly will obtain a large amount of fee income, this is a future bull market case in a single field. GMX is by far the best I've seen.

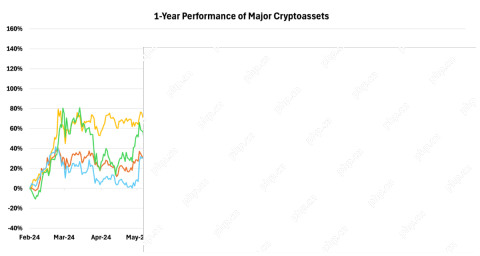

Protocol income = currency price increase?

According to CoinMarketCap, the first and second place MKR and LDO have the same annual growth rate as the protocol revenue ranking, while GMX, CVX, and CAKE perform poorly, especially CAKE, whose token economic model The shift has yet to bring immediate benefits to prices.

Protocol currency price

The above is the detailed content of 2023 DeFi platform revenue ranking: Maker, Lido, PancakeSwap, GMX, and Convex are shortlisted. For more information, please follow other related articles on the PHP Chinese website!

Virtuals Protocol (VIRTUAL) Soars Past $1.50 as Binance.US Opens TradingApr 30, 2025 am 10:02 AM

Virtuals Protocol (VIRTUAL) Soars Past $1.50 as Binance.US Opens TradingApr 30, 2025 am 10:02 AMVirtuals Protocol (VIRTUAL), a popular AI agent project, soared past $1.50 early Tuesday after Binance.US opened trading for the altcoin.

BNB is not just another token - it is the fuel, the bony, the world's largest crypto exchange, and BNB ChainApr 30, 2025 am 10:00 AM

BNB is not just another token - it is the fuel, the bony, the world's largest crypto exchange, and BNB ChainApr 30, 2025 am 10:00 AMOriginally started as an ERC 20 token on Ethereum in 2017, BNB has now been migrated to its own blockchain and has developed into a hybrid Exchange

Bitcoin (BTC) Is at a Critical Juncture. Market Watchers and Analysts Are Turning Their Attention to the Closing of This Week's CandleApr 30, 2025 am 09:58 AM

Bitcoin (BTC) Is at a Critical Juncture. Market Watchers and Analysts Are Turning Their Attention to the Closing of This Week's CandleApr 30, 2025 am 09:58 AMThis could either confirm the resilience of the current recovery or signal the start of a deeper corrective phase.

Will XRP (CRYPTO: XRP) Ever Overtake Bitcoin (CRYPTO: BTC) as the World's Most Valuable Cryptocurrency?Apr 30, 2025 am 09:56 AM

Will XRP (CRYPTO: XRP) Ever Overtake Bitcoin (CRYPTO: BTC) as the World's Most Valuable Cryptocurrency?Apr 30, 2025 am 09:56 AMEver since it launched in 2009, Bitcoin (CRYPTO: BTC) has stood alone as the world's most valuable cryptocurrency.

Tether Announces XAUT Gold Stablecoin, Pegged to One Ounce of Physical Gold Bullion, Has a Market Cap of $770 MillionApr 30, 2025 am 09:54 AM

Tether Announces XAUT Gold Stablecoin, Pegged to One Ounce of Physical Gold Bullion, Has a Market Cap of $770 MillionApr 30, 2025 am 09:54 AMTether announced that it holds $770 million in physical gold bullion, backing up its Tether Gold stablecoin (XAUT).

The SEC's Recent Announcement to Postpone Decisions on the Dogecoin and XRP ETFs May Reshape the Altcoin LandscapeApr 30, 2025 am 09:52 AM

The SEC's Recent Announcement to Postpone Decisions on the Dogecoin and XRP ETFs May Reshape the Altcoin LandscapeApr 30, 2025 am 09:52 AMAs crypto asset managers turn their focus to altcoin ETFs following last year's Bitcoin ETF approvals, the potential for increased investment options is significant.

Bitcoin Is the Only Asset the U.S. Would Refuse to Sell, Strategy's Michael Saylor ClaimsApr 30, 2025 am 09:50 AM

Bitcoin Is the Only Asset the U.S. Would Refuse to Sell, Strategy's Michael Saylor ClaimsApr 30, 2025 am 09:50 AMIn a recent interview, Strategy's Michael Saylor characterized the present moment as a pivotal entry point for bitcoin, contending that many of the earlier risks

Tether's Gold-Backed Crypto XAUT Hits Record High Amid Investor SurgeApr 29, 2025 am 11:26 AM

Tether's Gold-Backed Crypto XAUT Hits Record High Amid Investor SurgeApr 29, 2025 am 11:26 AMTether's gold-backed token, XAUT, has released its first official attestation, confirming it is backed by over 246500 ounces of gold

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Dreamweaver CS6

Visual web development tools

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

Atom editor mac version download

The most popular open source editor

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.