web3.0

web3.0 Binance faces off against SEC for first time at hearing! Binance wants court to dismiss lawsuit

Binance faces off against SEC for first time at hearing! Binance wants court to dismiss lawsuitBinance faces off against SEC for first time at hearing! Binance wants court to dismiss lawsuit

Although Binance reached a settlement with the U.S. Department of Justice, the Commodity Futures Trading Commission (CFTC), the Office of Foreign Assets Control (OFAC), and the Financial Crimes Enforcement Network (FinCEN) in November last year , pleaded guilty and agreed to pay a $4.3 billion fine, but litigation with the U.S. Securities and Exchange Commission (SEC) is still ongoing.

During this period, Binance has repeatedly asked the court to dismiss the lawsuit. At 10 a.m. Eastern Time on January 22 (11 a.m. tonight in Beijing), Binance and the SEC will hold their first hearing in court, and Binance will fight for the judge to dismiss the SEC’s charges.

In June last year, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Binance parent company Binance Holdings, Changpeng Zhao, and Binance US (Binance US), accusing them of engaging in unregistered exchange business and illegally 13 charges including offering and selling securities to U.S. investors while also accusing them of misconduct in handling client funds.

Although judges typically do not rule quickly on hearings, if the SEC presents undisclosed evidence in court to fight Binance, it could cause significant volatility in the currency market. Therefore, investors should remain cautious.

Binance’s net capital inflow is still better than its competitors

After Binance reached a plea bargain with U.S. regulators in November last year, there was a capital outflow, with more than $1 billion being stolen in 24 hours. Withdraw. However, the market subsequently returned to stability and fears of capital outflows quickly abated.

According to Defilllama data, Binance’s net inflows have reached $4.6 billion, surpassing other exchange competitors, including OKX’s $2.6 billion and Bybit’s $1.1 billion.

Comparison of capital inflows from Binance and other exchanges

The SEC and the exchange Coinbase also held a hearing last week

In fact, Last week, another exchange, Coinbase, also held a hearing in the U.S. District Court for the Southern District of New York seeking to dismiss the SEC lawsuit.

After listening to the court’s five-hour hearing, Elliott Stein, a senior litigation analyst at Bloomberg, wrote that he believed Coinbase had a high chance of winning the case and predicted that there was a 70% chance of a full dismissal of the SEC’s charges.

"Going into the SEC lawsuit Coinbase hearing, I thought Coinbase would probably win dismissal of its main claim (regarding the trading) on this motion, but probably not on the staking and brokerage charges. Success. But after the hearing, I think Coinbase may win the entire case.”

Although the backgrounds of the two exchanges are different, they may serve as a reference for the possible outcome of the lawsuit between Binance and the SEC.

The above is the detailed content of Binance faces off against SEC for first time at hearing! Binance wants court to dismiss lawsuit. For more information, please follow other related articles on the PHP Chinese website!

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AM

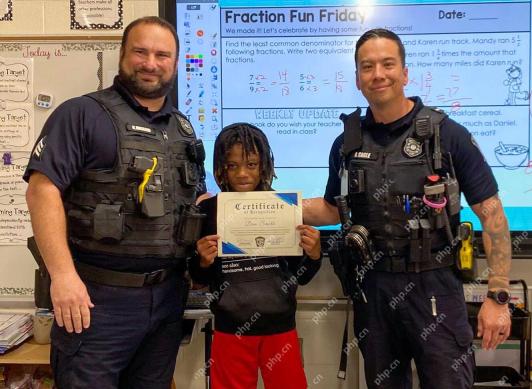

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AMFayetteville Police Department officers Kevin Ingram and David Cagle present Spring Hill Elementary fifth grader Dan Smith with a certificate of recognition for his heroic actions. By FPD

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AM

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AMArtificial Intelligence (AI) has begun to penetrate all aspects of human life, and governance is next. On April 14, the government of the United Arab Emirates (UAE) approved the implementation of what the media is calling the first AI-powered legisla

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AM

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AMOn-chain data reveals that large Shiba Inu investors, referred to as whales, sold their tokens as the coin's value declined.

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AM

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AMSmart crypto investors are looking for an asset with real-world utility and early potential gains in 2025. XRP and Chainlink (LINK) remain the bedrock of solid portfolios but new opportunities

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AM

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AMAs Bitcoin flirts with the $100,000 milestone and Ethereum climbs closer to the $2,000 mark, the eyes of crypto enthusiasts and investors alike are beginning to focus

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AM

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AMU.S. President Donald Trump’s media company, called Trump Media & Technology Group, is exploring yet another crypto-related venture, the company said in a letter to shareholders on Tuesday.

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AM

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AMTop 10 digital currency trading apps: 1. OKX, 2. Binance, 3. Coinbase, 4. Kraken, 5. Huobi, 6. KuCoin, 7. Bitfinex, 8. Gemini, 9. Bitstamp, 10. Poloniex, these platforms are all known for their security, user experience and diverse features, suitable for users with different needs to conduct digital currency transactions.

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AM

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AMA video by DA CONTENT TV on YouTube dives deep into a bold new prediction for Pi Network (PI). According to the discussion, there is growing optimism that the Pi price could surge dramatically, potentially hitting $5 much sooner than many expected.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

SublimeText3 English version

Recommended: Win version, supports code prompts!

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function