CryptoQuant Report: Passage of Bitcoin Spot ETF Causes Profit-taking by Investors and Miners

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-01-19 20:06:051262browse

The U.S. Securities and Exchange Commission (SEC) is reviewing Bitcoin spot ETF applications submitted by 13 issuers including BlackRock and Grayscale. The market generally believes that the first Bitcoin spot ETF may be launched in January 2024, which is expected to bring more capital inflows to Bitcoin.

CryptoQuant: The passage of ETF may lead to the emergence of selling pressure

However, a research report released by blockchain data analysis company CryptoQuant warned that if the Bitcoin spot ETF is passed, it may trigger a large amount of selling. pressure, causing the price of Bitcoin to fall sharply.

According to CryptoQuant analysts, as Bitcoin breaks through the $40,000 mark, unrealized profits in investor accounts have reached quite high levels. Especially investors who hold Bitcoin for a short period of time have unrealized profits as high as 30%.

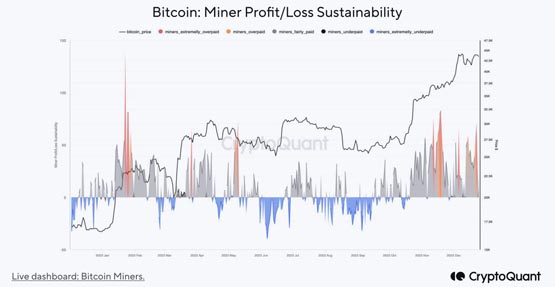

At the same time, Bitcoin miners are also facing huge unrealized profits. The Bitcoins they hold need to be sold at high prices, thus increasing the selling pressure on Bitcoin. Over the past few weeks, the price of Bitcoin has remained above $40,000, and we can see that miners have been selling their Bitcoins.

Finally, analysts predict that the price of Bitcoin may fall back to $32,000, stimulated by the "shipping news" of ETF clearance.

CryptoQuant: This round of bull market BTC is looking at $160,000

CryptoQuant’s downward prediction is a short-term performance, but the company also pointed out in a report released on the 20th of this month that Bitcoin In a bull market cycle. Taking into account the expectations of ETF clearance, the Bitcoin halving event and the macroeconomic outlook, the company believes that Bitcoin may even rise to $160,000 at the peak of the bull market. Additionally, they predict that 2024 will be a positive year for Bitcoin and cryptocurrency markets, influenced by: market valuation cycles, network activity, Bitcoin halving, macroeconomic outlook, spot ETF clearance, and growing Stablecoin liquidity.

The above is the detailed content of CryptoQuant Report: Passage of Bitcoin Spot ETF Causes Profit-taking by Investors and Miners. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Blockchain industry, how can an ordinary person make money in it?

- Google's 72-bit quantum computer, is Bitcoin still safe?

- Machine Learning for Blockchain: The Most Important Advances and What You Need to Know

- 4 possible threats to Bitcoin

- The role of Bitcoin mining pools and a list of common mining pools