Bitcoin liquidity is lower than FTX period, SOL and BONK tokens surge!

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-01-19 17:24:11881browse

The latest report from research institute Kaiko mentioned the skyrocketing rise of tokens such as SOL and BONK, and also pointed out that the depth and liquidity of Bitcoin have not increased due to the recent rise. In fact, Bitcoin always falls from the high of that year on 12/31 of every year. The good news, however, is that the Federal Reserve is expected to end its most aggressive rate-raising cycle in recent years, which could bring new capital inflows to the crypto market.

BONK surges

Bonk (BONK), based on Solana, has gained a foothold in the field of crypto-meme coins as a dark horse. It soared 40% in a single week after being listed on Coinbase. This year, it has increased by nearly 3,000%. Its market value Already ranked 54th.

Kaiko believes that in addition to Meme attributes, the integration and adoption of BONK with many Solana projects also allows BONK to gain more exposure, such as the cooperation with the Solana blockchain mobile phone "Saga":

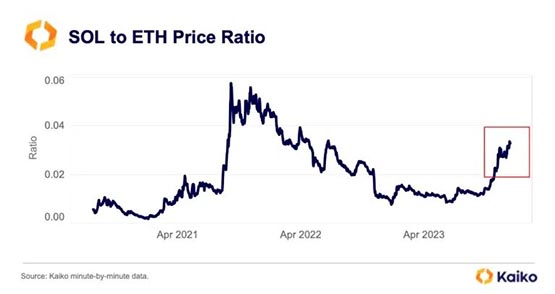

SOL/ETH price reversal

Since the third quarter, SOL has far exceeded ETH in price performance, and the SOL/ETH exchange rate has reversed for the first time since 2021.

The increase in SOL has also made FTX’s debt trading market more popular.

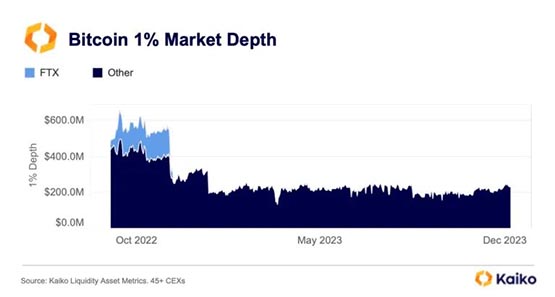

Bitcoin depth and liquidity have not increased due to the rise

Kaiko data shows that the recent rise in Bitcoin has not increased its liquidity. Since the FTX collapse, asset trading volume and order depth have plummeted across all exchanges, to less than half of what they were last October.

But if the Bitcoin spot ETF passes in January as expected, Kaiko believes that liquidity will be expected to recover by then.

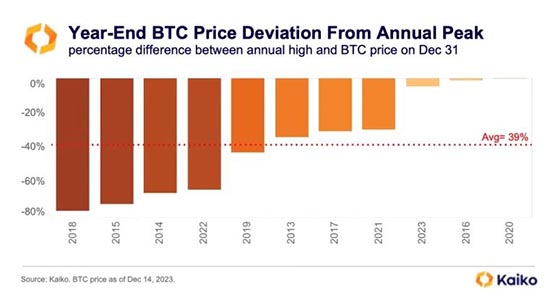

Bitcoin always falls at the end of the year

From 2013 to 2023, the price of Bitcoin on 12/31 of each year is compared to the high point of the year The average decline is -39%.

However, this situation seems to have improved in recent years. The declines in 2016 and 2020 were relatively low. This year, BTC only fell by -4.8% compared to the high point on December 9.

Will the Fed’s monetary policy turn?

In the past two years, the Federal Reserve has been the most hawkish central bank among developed countries. The data on interest rate increases in various countries since the beginning of 2022 are as follows:

United States: 5.25%

UK : 5.00%

Canada: 4.75%

Europe: 4.50%

In the interest rate decision announced by the Federal Reserve a few days ago, it is the third consecutive time that the interest rate has been maintained at 5.25 ~5.5% remains unchanged, which is likely to lay the foundation for multiple interest rate cuts in 2024 and beyond.

Kaiko also cited CME Group FedWatch data and pointed out that the possibility of a rate cut in March has increased significantly and is currently hovering around 67%, up from 35% a month ago.

This signals that the most aggressive rate-raising cycle in years may be coming to an end and could help extend cryptocurrency gains, attracting new capital into altcoins.

The above is the detailed content of Bitcoin liquidity is lower than FTX period, SOL and BONK tokens surge!. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- What are the main characteristics of blockchain technology?

- What are the four core technologies of blockchain

- Can PHP write blockchain?

- Analysis of the application prospects of blockchain technology in the field of network security

- Honduras District Próspera plans to use Bitcoin as unit of account and pay taxes in BTC