Bitcoin market sentiment is extremely greedy, with contract positions increasing by 10.71% within 24 hours confirmed

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-01-19 14:09:16801browse

According to the latest data, Bitcoin market sentiment has entered an extremely greedy state. Meanwhile, contract open interest surged 10.71% in the past 24 hours. This growth shows that the market's confidence in Bitcoin is growing, and investors may increase their investment in the space. However, this may also lead to the risk of market bubbles and excessive speculation. Therefore, investors involved in Bitcoin trading need to remain cautious and pay close attention to market dynamics.

According to the latest data, the number of Bitcoin contracts held by the Chicago Mercantile Exchange (CME) is 132,900, with a market value of approximately US$6.23 billion, ranking first. The cryptocurrency exchange Binance ranks second with 97,200 Bitcoin contract positions and a market value of approximately US$4.59 billion.

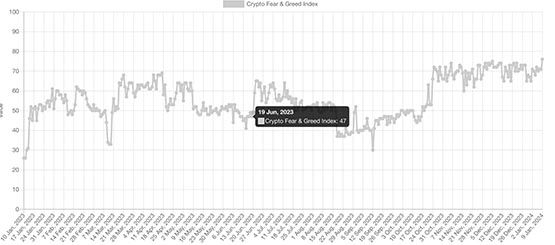

Market sentiment has entered "extreme greed"

Interestingly, according to data, Bitcoin's market sentiment score is currently 76 points (out of 100 points), entering "extreme greed" field. This is the highest score since Bitcoin reached $69,000 in mid-November 2021.

Fear and Greed Index

It is understood that the Cryptocurrency Fear and Greed Index is evaluated based on six key market performance indicators. These indicators include volatility, market momentum and volume, social media, surveys, Bitcoin dominance and trends. Each indicator has a different weight in the evaluation process, with volatility and market momentum and volume each accounting for 25%, social media and surveys each accounting for 15%, and Bitcoin dominance and trends accounting for 10%. Weights. Through the evaluation of these indicators, we can understand changes in market sentiment.

Half a year ago, when BlackRock Group applied for a Bitcoin spot ETF, the market sentiment score was 41, which fell into the "panic" zone.

Over the next six days, however, several other asset managers followed BlackRock's lead, with the market sentiment score soaring to 59, entering a "greedy" mood.

The data highlights the impact of the Bitcoin Spot ETF on market sentiment, with investors responding positively to major financial institutions’ participation in the cryptocurrency market.

BlackRock led the team to apply for spot ETFs on the first day when the market was still in a state of fear

The above is the detailed content of Bitcoin market sentiment is extremely greedy, with contract positions increasing by 10.71% within 24 hours confirmed. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Getting Started with Python: Detailed Introduction to Blockchain (Picture)

- Analyze the blockchain in detail through Python functions

- How does blockchain store data?

- Blockchain and smart contract technology in PHP

- Cryptocurrency craze subsides, mining companies turn to provide high-performance computing services for AI