Learn about the Real Robotics Industry Index 100 ETF (ticker: 159530)

Recently, the robot industry has ushered in the dual benefits of technological breakthroughs and policy support. On the one hand, Tesla released a new demonstration video of the humanoid robot "Optimus Gen 2", which has made significant progress in aspects such as perception and movement, making people feel that "the future is here." On the other hand, the Ministry of Industry and Information Technology issued the "Guiding Opinions on the Innovation and Development of Humanoid Robots", proposing to achieve breakthroughs in key technologies such as the "brain, cerebellum, and limbs" of humanoid robots by 2025, ensuring the safe and effective supply of core components and other active industries. The goal has further boosted people's expectations for the accelerated development of the robot industry

So, how should investors seize the trend opportunities in the robotics industry? The National Securities Robot Industry Index focuses on my country's robot industry chain and has achieved better access to the breadth and depth of the industrial chain. It can be said to be a true robot index. E Fund National Securities Robot Industry ETF (subscription code: 159530) closely tracks the National Securities Robot Industry Index and will be publicly sold from December 18 to 29, 2023. It can be used as a high-quality investment opportunity for investors to lay out the rapid growth window of the robot industry. tool.

Strengthen the position of core enterprises in the industry and demonstrate the breadth and depth of the industrial chain

The National Securities Robot Industry Index is a scarce index that brings together leading enterprises in the upper, middle and lower reaches of my country's robot industry chain. According to the composition of the index, the first three industries are mechanical equipment, computers and electrical equipment, representing core areas such as robot body parts, AI algorithm control modules and battery power modules

The National Securities Robot Industry Index focuses on leading companies in the field of robots, including equipment suppliers in the upstream of the robot industry (such as double-ring transmission, Greenland Harmonic), and ontology manufacturers and integrators in the midstream (such as Robot, Topstar), and downstream brands (such as Stone Technology, Ecovacs). The index not only covers the current industry leaders (such as Inovance Technology, iFlytek), but also absorbs emerging forces in the early stages of growth, demonstrating the breadth and depth of the industry chain

This index is called the "real robot index" because it adopts an innovative weight stratification setting mechanism during the compilation process, which makes the leading stocks related to the robotics field account for a higher proportion in the index. Therefore, the index more accurately represents the status of the robotics industry. The specific preparation plan shows that the upper limit of the weight of component stocks is divided into two levels. The free circulation market value adjustment coefficient in the robotics field is 1 and the upper limit of the weight is 10%; the free circulation market value adjustment coefficient in other fields is 0.5 and the upper limit of the weight is 3%. This weight distribution mechanism allows leading stocks whose main business is in the field of robotics to account for a higher proportion in the index

Small and medium-cap stocks have obvious characteristics, and their profit quality and growth are excellent

From the perspective of style characteristics, the weight of the National Securities Robot Industry Index is mainly concentrated in small and medium-sized companies, and the weight of component stocks with a market value of less than 50 billion accounts for more than 70%. At present, the robot industry is in a stage of vigorous development and rapid product launch, and there is very broad room for market value increase

The robotics industry has shown strong quality and growth potential in terms of profitability. According to predictions, in the next two years, the compound growth rate of net profit of the robot industry is expected to be 35.3%, which is much higher than the mainstream broad-based index and growth sector index. According to the third quarter report of 2023, the net interest rate on total assets of the National Securities Robot Industry Index is 3.95%, and shows a continued upward trend

High returns, high flexibility, and sufficient growth momentum

The historical performance of the National Securities Robot Industry Index is very good, fully demonstrating the characteristics of high returns and high flexibility. Since 2015, the index’s cumulative return rate has reached 86.09%, with an annualized return rate of 7.40%, far exceeding the mainstream broad-based index and similar indexes. At the same time, the annualized volatility rate since the base period has been 30.19%, and the annualized Sharpe ratio is 30.19%. 0.36, the trading attributes and risk-return characteristics are also more ideal than similar indexes

Driven by the dual benefits of continued breakthroughs in research and development and the implementation of industrial policies, the certainty of the upward trend of the robot industry has gradually been consolidated. E Fund National Securities Robot Industry ETF (Subscription Code: 159530) packages the leading enterprises in my country's robot industry chain with one click to help layout the industry growth stage, and will be publicly sold from December 18 to 29, 2023!

Please note that the source interface of this information is Lianyun. The content and data are for reference only and do not constitute investment advice. AI technology strategy provided by Youlianyun

The above is the detailed content of Learn about the Real Robotics Industry Index 100 ETF (ticker: 159530). For more information, please follow other related articles on the PHP Chinese website!

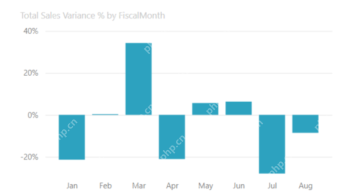

Most Used 10 Power BI Charts - Analytics VidhyaApr 16, 2025 pm 12:05 PM

Most Used 10 Power BI Charts - Analytics VidhyaApr 16, 2025 pm 12:05 PMHarnessing the Power of Data Visualization with Microsoft Power BI Charts In today's data-driven world, effectively communicating complex information to non-technical audiences is crucial. Data visualization bridges this gap, transforming raw data i

Expert Systems in AIApr 16, 2025 pm 12:00 PM

Expert Systems in AIApr 16, 2025 pm 12:00 PMExpert Systems: A Deep Dive into AI's Decision-Making Power Imagine having access to expert advice on anything, from medical diagnoses to financial planning. That's the power of expert systems in artificial intelligence. These systems mimic the pro

Three Of The Best Vibe Coders Break Down This AI Revolution In CodeApr 16, 2025 am 11:58 AM

Three Of The Best Vibe Coders Break Down This AI Revolution In CodeApr 16, 2025 am 11:58 AMFirst of all, it’s apparent that this is happening quickly. Various companies are talking about the proportions of their code that are currently written by AI, and these are increasing at a rapid clip. There’s a lot of job displacement already around

Runway AI's Gen-4: How Can AI Montage Go Beyond AbsurdityApr 16, 2025 am 11:45 AM

Runway AI's Gen-4: How Can AI Montage Go Beyond AbsurdityApr 16, 2025 am 11:45 AMThe film industry, alongside all creative sectors, from digital marketing to social media, stands at a technological crossroad. As artificial intelligence begins to reshape every aspect of visual storytelling and change the landscape of entertainment

How to Enroll for 5 Days ISRO AI Free Courses? - Analytics VidhyaApr 16, 2025 am 11:43 AM

How to Enroll for 5 Days ISRO AI Free Courses? - Analytics VidhyaApr 16, 2025 am 11:43 AMISRO's Free AI/ML Online Course: A Gateway to Geospatial Technology Innovation The Indian Space Research Organisation (ISRO), through its Indian Institute of Remote Sensing (IIRS), is offering a fantastic opportunity for students and professionals to

Local Search Algorithms in AIApr 16, 2025 am 11:40 AM

Local Search Algorithms in AIApr 16, 2025 am 11:40 AMLocal Search Algorithms: A Comprehensive Guide Planning a large-scale event requires efficient workload distribution. When traditional approaches fail, local search algorithms offer a powerful solution. This article explores hill climbing and simul

OpenAI Shifts Focus With GPT-4.1, Prioritizes Coding And Cost EfficiencyApr 16, 2025 am 11:37 AM

OpenAI Shifts Focus With GPT-4.1, Prioritizes Coding And Cost EfficiencyApr 16, 2025 am 11:37 AMThe release includes three distinct models, GPT-4.1, GPT-4.1 mini and GPT-4.1 nano, signaling a move toward task-specific optimizations within the large language model landscape. These models are not immediately replacing user-facing interfaces like

The Prompt: ChatGPT Generates Fake PassportsApr 16, 2025 am 11:35 AM

The Prompt: ChatGPT Generates Fake PassportsApr 16, 2025 am 11:35 AMChip giant Nvidia said on Monday it will start manufacturing AI supercomputers— machines that can process copious amounts of data and run complex algorithms— entirely within the U.S. for the first time. The announcement comes after President Trump si

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Atom editor mac version download

The most popular open source editor

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

Dreamweaver Mac version

Visual web development tools

Notepad++7.3.1

Easy-to-use and free code editor