Technology peripherals

Technology peripherals AI

AI 'The perfect combination of intelligent robots and green energy: creating a shocking 'king-fried' effect”

'The perfect combination of intelligent robots and green energy: creating a shocking 'king-fried' effect”Recently, Japan HD Company’s financial report exchange meeting has brought new development impetus to the humanoid robot industry

One of the highlights at the conference was the potential use of harmonic reducers for robots' dexterous hands. The application of this technology indicates that if the field of humanoid robots continues to develop in this direction, the market potential of reducers will be greater

Jianzhi Research believes that Green Harmonic cannot be viewed with the old eyes of the past. The market space for humanoid robots may exceed 100 billion US dollars by 2035. If Green Harmonic can seize the opportunity of humanoid robots, the impact it will bring The ceiling improvement is far beyond what industrial robots can achieve.

View:

1. How big is the demand for reducers for humanoid robots?

2. The competitive landscape of harmonic reducers has deteriorated. What are the harmonic advantages of Green?

The new technology of robots with human-like appearance has attracted people's attention, especially the green harmonic technology.

Recently, heavy news about humanoid robots has been frequent. Japan HD (Hamonaco) Company stated that the product uses a reduction device. Combined with the company’s official website information, the market believes that it is most likely a micro harmonic reducer used on fingers, which has triggered a market Hot discussion, because the market believes that harmonic reducers are only used for rotating joints of humanoid robots. If they can be used in dexterous hands, the usage of single machines will greatly increase in the future. If this is the case, then the usage of humanoid robot reducers will greatly exceed expectations.

One of the core components of industrial robots is the reducer. In the cost structure of industrial robots, reducers, controllers and servo motors account for about 70% of the total cost. Among them, the proportion of reducer is 35%. It can be seen that the reducer plays an important role in the robot industry

If the control system is the "brain" of the robot, responsible for issuing various instructions to the robot and controlling it, then the reducer is equivalent to the "muscle" of the robot, responsible for executing the instructions of the controller. When the controller generates a command signal , the reducer can accurately adjust the angle of rotation of the machine joint, which is equivalent to the human brain sending a signal to bend the elbow upward, and the arm muscles lift upward along the elbow joint. This upward movement of the rotation angle is equivalent to the reducer.

Reducers can be divided into general transmission reducers and precision reducers. The accuracy of general transmission reducers is lower, while the accuracy of precision reducers is higher. Precision reducers are widely used in high-end manufacturing fields such as robots and CNC machine tools, including harmonic reducers, RV reducers, planetary reducers and other types

From the perspective of market structure, the global reducer market is very concentrated, and the market share is basically occupied by overseas companies. Japanese companies Nabtesco and Hamonoko occupy most of the market for RV and harmonic reducers respectively.

In the global market of harmonic reducers, Harmonica accounts for 82% and Green Harmonic accounts for 7%. It ranks second in the world in market share and first in China. It can be said that the only domestic reducer company that can compete globally is Green Harmonic. Once the humanoid robot drives the reducer to increase its volume, Green Harmonic will have the first-mover advantage.

Due to being dragged down by the industry cycle, Green Harmonic’s performance continued to decline after listing

Reviewing the development trajectory of Green Harmonic, it can be seen that Green Harmonic is a very dedicated company. Since the founding team established the company, it has focused on researching harmonic transmission technology. After the company went public, its business structure remained relatively simple. Between 2020 and 2022, Green Harmonic's main business, the sales of harmonic reducers and related metal parts, accounted for approximately 93-94% of the company's total revenue.

Although it seems that the business is pure and the market position is glorious, in fact, Green Harmonic’s performance after its listing has been criticized by the market. After the company went public in 2020, it saw significant growth in revenue and profits in 2021, but it began to show signs of stagnation in 2022. The revenue scale stopped expanding in 2022, and profits also declined compared with 2021.

The company’s explanation is that due to factors such as macroeconomic and export obstruction, market demand will be sluggish in 2022, mainly in 3C electronic products, semiconductor industries, etc. This has led to a slowdown in fixed asset investment, which has slowed down the demand for industrial robots, the main downstream of harmonic reducers, so the performance of harmonic reducers will decline

Looking at the latest performance, revenue in the first three quarters of 2023 was approximately 254 million yuan, a year-on-year decrease of 26.26%; net profit attributable to the parent company was approximately 72.5 million yuan, a year-on-year decrease of 43.36%. Among them, Q3 revenue was 82.44 million yuan, down 18.42% year-on-year, and net profit attributable to the parent company was 21.85 million yuan, down 39.88% year-on-year, and down 15.9% month-on-month.

In the third quarter of 2023, the gross profit margin was 41.73%, a decrease of 9.44% from the same period last year. The company explained that affected by the downturn in major industries such as 3C, semiconductors, and electronics, the industrial robot industry has also suffered a downturn. In addition, it can be seen from the decline in gross profit margin that the competition in the reducer market is intensifying

(Green Harmonic Q3 Revenue)

(Green Harmonic Q3 net profit)

What needs to be rewritten is: (Green Harmonic Q3 gross profit margin)

Because the main downstream of the company's products is industrial robots, and industrial robots belong to the general machinery industry and are typically cyclical, with a cycle of about 3-4 years. The last high point was around 2021, and the cycle has been in a downward trend in the past three years. , so the company's performance is affected.

(Jianzhi Research Drawing)

In addition to companies developing green harmonic technology, most of the performance of reducer companies such as Zhongdali De, Haozhi Electromechanical, Guomao Co., Ltd., and China National Science and Technology Co., Ltd. also showed a downward trend

Robots become the main source of new growth

At present, the application fields of harmonic reducers are mainly concentrated in various robotic fields, but also include other equipment fields such as CNC machine tools, semiconductors, photovoltaics, and medical care. Among the products of the world's leading reducer manufacturer, Hamonak, the market share in the industrial robot field exceeds 50%, and in the current market of green harmonic reducers, 80% of the market share is occupied by industrial and service robots

According to the performance of Green Harmonic in recent years, it can also be seen that pure industrial robots are too cyclical. If the downstream focus is too focused, the company's performance will inevitably be greatly affected by the industry, and the industrial robot market space is limited.

Currently, the humanoid robot industry is still in its early stages of development, which can be compared to new energy vehicles seven years ago. If the market enters the growth stage after the introduction period, the demand for humanoid robots will explode

The use of harmonic reducers in robot upper body joints, such as fingers, elbows, shoulders and other parts that require higher volume and flexibility, can better play its role

It is expected that each humanoid robot main joint will use 9-14 harmonic reducers. The price of a harmonic reducer is approximately 1,000-5,000 yuan. Assuming that each humanoid robot requires 10 harmonic reducers and the unit price is set at 1,500 yuan, then the total value of the harmonic reducer for each humanoid robot is 15,000 yuan. According to Tesla's humanoid robot goal, there will be 1 million humanoid robots by 2025 and 5 million units by 2030. According to this forecast, the size of the single harmonic reducer market is expected to reach 15 billion to 75 billion

Green Harmonic, as the second largest harmonic reducer leader in the world with the second largest market share in the country, will undoubtedly directly benefit from the outbreak of humanoid robots.

Although Green Harmonic has an outstanding performance in the harmonic reducer market, there is still a certain gap compared with Japan's leading companies in this technology field. This is mainly reflected in two aspects:

- Metal powder proportioning at the raw material end: Japanese companies have patent protection in this regard, and their unique proportioning method gives the product specific performance advantages, which is difficult for other companies such as Green Harmonic Directly copied.

- Structural design aspect: For example, Japan's Hamonoko Company has patent protection in the structural design of harmonic reducers, which gives it a clear first-mover advantage. This means that if other companies want to make progress in this field, they can only rely on independent research and development.

An important reason why Green Harmonic has become a leading company in the market is that it broke the monopoly of Hamonnaco in tooth-shaped technology. This technological breakthrough is one of the key factors in Green Harmonic's market leadership.

With the expiration of Harmonica's patent, more and more harmonic reducer manufacturers have appeared in the Chinese market, which has led to intensified competition in the industry. For Green Harmonic, in addition to being affected by the bottom of the industrial cycle, fierce competition, involution and price wars in the industry are also one of the important reasons for its poor performance.

Despite these challenges, Green Harmonic's market share is still gradually increasing, currently accounting for approximately 26%, showing its significant advantage in the market. Despite these challenges, Green Harmonic's market share is still gradually growing and currently accounts for approximately 26%, demonstrating its clear advantage in the market

In addition, Green Harmonic also has core advantages in production capacity and customers. Currently, among domestic companies that can achieve annual shipments of more than 100,000 units, Green Harmonic is in a leading position, and its annual production capacity is expected to reach 590,000 units. In terms of customers, in addition to existing domestic and foreign customers, Green Harmonic is likely to become part of Tesla's supply chain, which provides more possibilities for its future development.

Summarize:

Green Harmonic’s current performance has not yet fully met market expectations, but its steady growth in the industrial robot business is already a positive signal. The key is that as the humanoid robot market develops, Green Harmonic may be able to capitalize on its leadership in harmonic reducer technology to seize new growth opportunities.

Although current performance may not be ideal, Green Harmonic has potential growth prospects in the humanoid robot market in the future, which is worthy of attention

The above is the detailed content of 'The perfect combination of intelligent robots and green energy: creating a shocking 'king-fried' effect”. For more information, please follow other related articles on the PHP Chinese website!

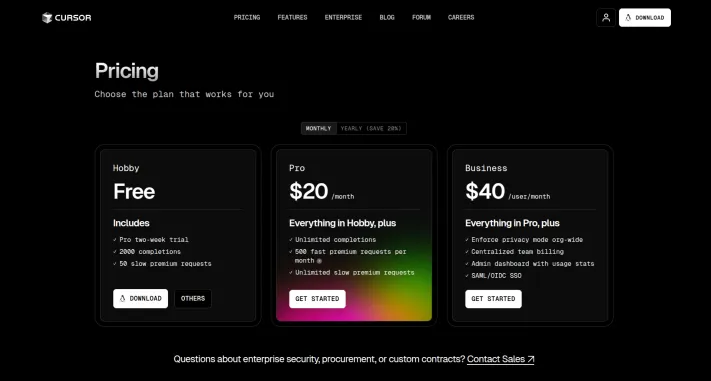

I Tried Vibe Coding with Cursor AI and It's Amazing!Mar 20, 2025 pm 03:34 PM

I Tried Vibe Coding with Cursor AI and It's Amazing!Mar 20, 2025 pm 03:34 PMVibe coding is reshaping the world of software development by letting us create applications using natural language instead of endless lines of code. Inspired by visionaries like Andrej Karpathy, this innovative approach lets dev

Top 5 GenAI Launches of February 2025: GPT-4.5, Grok-3 & More!Mar 22, 2025 am 10:58 AM

Top 5 GenAI Launches of February 2025: GPT-4.5, Grok-3 & More!Mar 22, 2025 am 10:58 AMFebruary 2025 has been yet another game-changing month for generative AI, bringing us some of the most anticipated model upgrades and groundbreaking new features. From xAI’s Grok 3 and Anthropic’s Claude 3.7 Sonnet, to OpenAI’s G

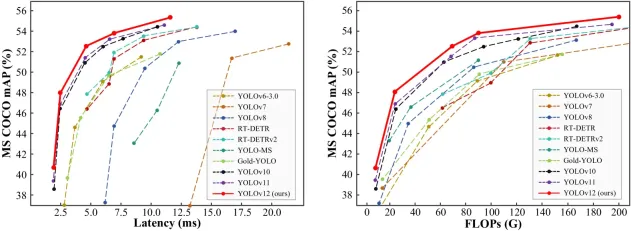

How to Use YOLO v12 for Object Detection?Mar 22, 2025 am 11:07 AM

How to Use YOLO v12 for Object Detection?Mar 22, 2025 am 11:07 AMYOLO (You Only Look Once) has been a leading real-time object detection framework, with each iteration improving upon the previous versions. The latest version YOLO v12 introduces advancements that significantly enhance accuracy

How to Use DALL-E 3: Tips, Examples, and FeaturesMar 09, 2025 pm 01:00 PM

How to Use DALL-E 3: Tips, Examples, and FeaturesMar 09, 2025 pm 01:00 PMDALL-E 3: A Generative AI Image Creation Tool Generative AI is revolutionizing content creation, and DALL-E 3, OpenAI's latest image generation model, is at the forefront. Released in October 2023, it builds upon its predecessors, DALL-E and DALL-E 2

Elon Musk & Sam Altman Clash over $500 Billion Stargate ProjectMar 08, 2025 am 11:15 AM

Elon Musk & Sam Altman Clash over $500 Billion Stargate ProjectMar 08, 2025 am 11:15 AMThe $500 billion Stargate AI project, backed by tech giants like OpenAI, SoftBank, Oracle, and Nvidia, and supported by the U.S. government, aims to solidify American AI leadership. This ambitious undertaking promises a future shaped by AI advanceme

Google's GenCast: Weather Forecasting With GenCast Mini DemoMar 16, 2025 pm 01:46 PM

Google's GenCast: Weather Forecasting With GenCast Mini DemoMar 16, 2025 pm 01:46 PMGoogle DeepMind's GenCast: A Revolutionary AI for Weather Forecasting Weather forecasting has undergone a dramatic transformation, moving from rudimentary observations to sophisticated AI-powered predictions. Google DeepMind's GenCast, a groundbreak

Sora vs Veo 2: Which One Creates More Realistic Videos?Mar 10, 2025 pm 12:22 PM

Sora vs Veo 2: Which One Creates More Realistic Videos?Mar 10, 2025 pm 12:22 PMGoogle's Veo 2 and OpenAI's Sora: Which AI video generator reigns supreme? Both platforms generate impressive AI videos, but their strengths lie in different areas. This comparison, using various prompts, reveals which tool best suits your needs. T

Which AI is better than ChatGPT?Mar 18, 2025 pm 06:05 PM

Which AI is better than ChatGPT?Mar 18, 2025 pm 06:05 PMThe article discusses AI models surpassing ChatGPT, like LaMDA, LLaMA, and Grok, highlighting their advantages in accuracy, understanding, and industry impact.(159 characters)

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Zend Studio 13.0.1

Powerful PHP integrated development environment

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.