Home >Technology peripherals >It Industry >HP's fourth-quarter net revenue was $13.8 billion, turning a profit year-on-year

HP's fourth-quarter net revenue was $13.8 billion, turning a profit year-on-year

- 王林forward

- 2023-11-22 13:01:281055browse

In the morning news on November 22, Beijing time, HP today released the company’s fourth quarter and full-year financial report for fiscal year 2023.

The report shows that HP’s net revenue in the fourth fiscal quarter was US$13.8 billion, a decrease of 6.5% compared with US$14.8 billion in the same period last year; net profit was US$1 billion, compared with a net loss of US$2,300 in the same period last year. million, turning a profit year-on-year; adjusted net profit not in accordance with GAAP was US$900 million, an increase of 8% compared with US$800 million in the same period last year.

HP’s fiscal fourth-quarter revenue and adjusted earnings per share both exceeded Wall Street analysts’ expectations, but its outlook for adjusted earnings per share in the first quarter of fiscal 2024 fell short of expectations. HP's shares fell more than 3% in after-hours trading after the earnings report was released.

Fourth quarter fiscal year 2023 results summary:

In the quarter ended October 31, 2023, HP's net profit was US$1 billion, compared with a net loss of US$23 million in the same period last year, turning a profit year-on-year. HP's fourth-quarter diluted net income per share was $0.97, compared with a diluted net loss per share of $0.02 in the same period last year.

Excluding one-time items (not in accordance with U.S. GAAP), HP’s adjusted net income in the fourth fiscal quarter was US$900 million, an increase of 8% compared with US$800 million in the same period last year; adjusted Net earnings per share were US$0.90, an increase of 10% compared with US$0.82 in the same period last year. This performance exceeded analysts' expectations. According to data provided by Yahoo Finance Channel, 13 analysts had expected HP to earn $0.82 per share in the fourth quarter.

HP’s fourth-quarter net income and earnings per share (not in accordance with U.S. GAAP) exclude after-tax adjustments of $14 million and $0.02 per share, respectively, which are related to restructuring and other expenses. , acquisition and divestiture expenses, intangible asset amortization expenses, debt extinguishment proceeds, non-operating retirement-related credits, and tax adjustments.

HP’s net revenue in the fourth fiscal quarter was US$13.8 billion, a decrease of 6.5% compared with US$14.8 billion in the same period last year; excluding the impact of exchange rate changes, HP’s net revenue in the fourth fiscal quarter was US$13.8 billion compared with US$14.8 billion in the same period last year. It fell 5% over the same period, but the performance still exceeded analysts' expectations. According to data provided by Yahoo Finance Channel, 11 analysts had expected HP's fourth-quarter net revenue to reach $12.69 billion on average.

Based on U.S. GAAP, HP's fourth-quarter operating margin was 7.3%, an increase of 2.3 percentage points from 5.0% in the same period last year. Excluding one-time items (non-GAAP), HP's adjusted operating margin in the fiscal fourth quarter was 9.0%, up 1.4 percentage points from 7.6% in the same period last year.

Performance of each department in the fourth fiscal quarter:

Divided by business segment, HP Personal Systems Group's revenue in the fourth fiscal quarter was US$9.4 billion, down from US$10.2 billion in the same period last year. 8%, excluding the impact of exchange rate changes, a year-on-year decrease of 7%; the operating profit margin of the Personal Systems Group in the fourth fiscal quarter was 6.7%. Among them, the commercial PS department's net revenue decreased by 11% year-on-year, and the personal consumer PS department's net revenue decreased by 1% year-on-year; the total shipment volume remained unchanged year-on-year, of which the shipment volume of personal consumer PS equipment increased by 9% year-on-year, and the commercial PS department's net revenue increased by 9% year-on-year. Equipment shipments fell 6% year over year.

Within the Personal Systems Group, by product, HP’s net revenue from the commercial PS division in the fourth fiscal quarter was US$6.213 billion, a decrease of 11% compared with US$7.016 billion in the same period last year; Net revenue of the Consumer PS segment was US$3.185 billion, down 1% from US$3.224 billion in the same period last year.

HP Printing Group’s fourth quarter revenue was US$4.4 billion, a decrease of 3% compared with US$4.5 billion in the same period last year. Excluding the impact of exchange rate changes, it was a year-on-year decrease of 2%; operating profit margin was 18.9%. Among them, the net revenue of the personal printer business fell by 21% year-on-year in the fourth quarter, and the revenue of the commercial printer business fell by 4% year-on-year. Total hardware shipments fell 19% year over year in the fiscal fourth quarter, with business hardware shipments down 24% year over year and personal hardware shipments down 18% year over year.

Within the printing group, HP’s revenue from commercial products in the fourth fiscal quarter was US$1.064 billion, a decrease of 4% compared with US$1.108 billion in the same period last year; revenue from consumer products was US$1.064 billion, a decrease of 4% from US$1.108 billion in the same period last year; US$533 million, a decrease of 21% compared with US$677 million in the same period last year.

HP's corporate investments in the fiscal fourth quarter were $2 million, compared with $1 million in the same period last year.

HP’s materials revenue in the fourth quarter was US$2.821 billion, an increase of 3% compared with US$2.748 billion in the same period last year. Excluding the impact of currency changes, it was a year-on-year increase of 4%.

Full Year Fiscal Year 2023 Results Summary:

For the full fiscal year 2023, HP’s net revenue was $53.7 billion, compared with $62.9 billion in fiscal 2022 Compared with a decrease of 14.6%, excluding the impact of exchange rate changes, the year-on-year decrease was 12%. HP's net income for fiscal 2023 was $3.3 billion, up 4% from $3.1 billion in fiscal 2022. HP's diluted net income per share for fiscal 2023 will be $3.26, up 9% from $2.98 in fiscal 2022.

Excluding one-time items (not in accordance with U.S. GAAP), HP's adjusted net income in fiscal 2023 was $3.3 billion, a decrease of 22% from $4.2 billion in fiscal 2022; adjusted net income per share Earnings were $3.28, down 18% from $3.98 in the same period last year, but the performance still exceeded analysts' expectations. On average, 16 analysts had expected HP to post adjusted earnings of $3.02 per share in fiscal 2023, according to data provided by Yahoo Finance.

HP's operating margin for fiscal 2023 was 6.4%, down 0.8 percentage points from 7.2% in fiscal 2022. Excluding one-time items (non-GAAP), HP's adjusted operating margin for fiscal 2023 was 8.5%, which was flat from 8.5% for fiscal 2022.

Other financial information:

HP's total costs and expenses for the fiscal fourth quarter were $12.803 billion, compared with $14.033 billion in the same period last year. Among them, the cost of revenue was US$10.832 billion, compared with US$12.083 billion in the same period last year; R&D expenses were US$411 million, compared with US$382 million in the same period last year; sales, general and administrative expenses were US$1.327 billion, compared with US$1.189 billion in the same period last year. U.S. dollars; restructuring and divestiture expenses were $111 million, compared with $70 million in the same period last year; M&A related expenses were $34 million, compared with $235 million in the same period last year; amortization of intangible assets was $88 million, compared with $74 million in the same period last year Ten thousand U.S. dollars.

HP's net cash provided by operating activities in the fourth quarter was $2 billion. At the end of the fiscal fourth quarter, HP's total receivables were $4.2 billion; its receivables outstanding days were 28 days, a decrease of 2 days compared with the previous quarter. At the end of the fiscal fourth quarter, HP's inventory totaled $6.9 billion and had 57 days of inventory, a decrease of 5 days compared with the previous quarter. At the end of the fiscal fourth quarter, HP's accounts payable totaled $14 billion and its accounts payable outstanding days were 117 days, a decrease of 6 days compared with the previous quarter.

HP’s fiscal fourth-quarter free cash flow was $1.9 billion. Free cash flow includes $2.0 billion of net cash provided by operating activities and is adjusted for $28 million of net investments in leases and $134 million of net investments in property, plant and equipment.

HP paid a cash dividend of $0.2625 per share in the fiscal fourth quarter, using $300 million in cash for the dividend. As a result, HP returned 14% of free cash flow to company shareholders in its fiscal fourth quarter. HP had $3.2 billion in cash at the end of its fiscal fourth quarter, which includes cash and cash equivalents, restricted cash and short-term investments. Cash, cash equivalents and restricted cash includes $125 million of restricted cash related to amounts collected and held on behalf of third parties for trade receivables from previous sales.

HP's full-year fiscal 2023 net cash provided by operating activities was $3.6 billion and free cash flow was $3.1 billion. Free cash flow includes $3.6 billion of net cash provided by operating activities and is adjusted for $110 million of net investments in leases and $593 million of net investments in property, plant and equipment.

HP used approximately $100 million of cash to repurchase approximately 3.6 million shares of common stock in the open market throughout fiscal 2023. Combined with the $1 billion in cash dividends HP paid in fiscal 2023, the company returned 37% of free cash flow to shareholders for the full year.

HP’s Board of Directors has declared a quarterly cash dividend of $0.2756 per share to common shareholders, an increase of 5% from the last time a dividend was paid. This dividend will be paid on January 4, 2024.

Performance Outlook:

Performance Outlook for the first quarter of fiscal year 2024:

HP expects that, in accordance with U.S. GAAP, the first fiscal quarter of fiscal year 2024 will Diluted earnings per share in the first fiscal quarter will be between US$0.60 and US$0.70; non-GAAP adjusted diluted earnings per share in the first fiscal quarter are expected to be between US$0.76 and US$0.86. This performance outlook The average was $0.81, missing analysts' expectations. HP's non-GAAP estimates of diluted earnings per share from continuing operations in the first quarter of fiscal 2024 do not include after-tax expenses of $0.16 per share, which are mainly related to restructuring and other expenses. expenses, acquisition and divestiture expenses, intangible asset amortization expenses, non-operating retirement-related credits, tax adjustments and the related tax effects of these items.

According to data provided by financial market data information and infrastructure provider LSEG (formerly known as Refinitiv), analysts on average had expected HP to report adjusted earnings per share of $0.86 in the first fiscal quarter.

Fiscal Year 2024 Performance Outlook:

HP expects that in accordance with U.S. GAAP, quarterly diluted earnings per share in fiscal 2024 will be between $2.68 and $3.08; not in accordance with U.S. GAAP Under generally accepted accounting principles, adjusted diluted earnings per share in fiscal 2024 are expected to be between $3.25 and $3.65. The average of this performance outlook is $3.45, exceeding analyst expectations. HP's non-GAAP estimates of fiscal 2024 diluted earnings per share from continuing operations do not include after-tax expenses of $0.57 per share, which are primarily related to restructuring and other expenses, mergers and acquisitions and related to divestiture expenses, intangible asset amortization expenses, non-operating retirement-related credits, tax adjustments and the related tax effects of these items.

According to data provided by Yahoo Finance Channel, 15 analysts had previously expected HP’s adjusted earnings per share in fiscal 2024 to reach $3.16.

HP also expects free cash flow in fiscal 2024 to be between $3.1 billion and $3.6 billion.

Stock price changes:

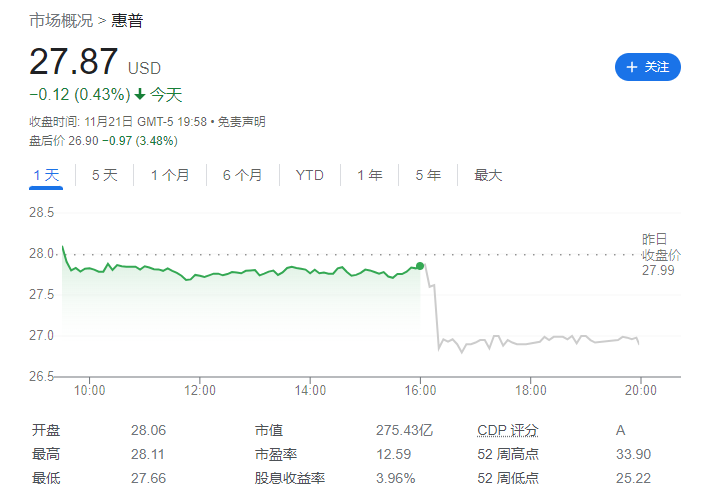

On the same day, HP’s stock price fell $0.12 in regular trading on the New York Stock Exchange to close at $27.87, a decrease of 0.43%. In subsequent after-hours trading as of 5:21 pm Eastern Time on the 21st (6:21 am Beijing time on the 22nd), HP's stock price fell again by $0.87 to $27.00, a decrease of 3.12%. Over the past 52 weeks, HP's highest price was $33.90 and its lowest price was $25.22.

Advertising statement: The external jump links contained in the article (including but not limited to hyperlinks, QR codes, passwords, etc.) are used for Convey more information and save selection time. The results are for reference only. All articles on this site contain this statement.

The above is the detailed content of HP's fourth-quarter net revenue was $13.8 billion, turning a profit year-on-year. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Where is the HP laptop sound card driver?

- How to update HP laptop sound card driver

- The editor teaches you how to change HP win10 to win7

- Tongcheng Travel Q2 financial report: revenue reached 2.87 billion yuan, soaring 117.4% year-on-year

- Tesla announces Cybertruck electric pickup truck delivery plan and financial report highlights