Technology peripherals

Technology peripherals AI

AI The next disruptive product, why is the robotics industry so important? --Robotics industry ETF listed

The next disruptive product, why is the robotics industry so important? --Robotics industry ETF listedThe next disruptive product, why is the robotics industry so important? --Robotics industry ETF listed

On November 2, the Ministry of Industry and Information Technology issued the "Guiding Opinions on the Innovation and Development of Humanoid Robots". The robot industry ushered in a major policy plan, and the market enthusiasm increased accordingly. It is mentioned that humanoid robots integrate advanced technologies such as artificial intelligence, high-end manufacturing, and new materials. is expected to become a disruptive product after computers, smartphones, and new energy vehicles. It will profoundly change human production and lifestyle and reshape the world. Industrial development pattern.

Especially in terms of long-term planning, the "Guiding Opinions" formulated strategic deployments and clarified the development goals of humanoid robots in accordance with the timetable of the three-year plan and five-year outlook. By 2025, mass production of complete machines will be achieved, and a safe and reliable industrial chain and supply chain system will be established in 2027

Under this circumstance, the Robot Industry ETF (159551) was successfully listed on November 16!

Why does the robot industry receive so much attention?

First of all, with the aging of the population, machines have become an inevitable choice. Judging from the experience of developed countries, the higher the degree of population aging, the higher the degree to which machines will replace people. According to data from the International Federation of Robotics (IFR), the density of robots in Sweden in 2020 was 289 units/10,000 people, Germany was 371 units/10,000 people, and Japan had 390 units/10,000 people.

Rewritten content: Data source is IFR and Guotai Junan

As the aging of the population accelerates, the penetration rate of robots in China has also increased significantly. The proportion of my country's working-age population aged 15-64 in the total population began to fall after reaching 74.5% in 2010. The density of robots began to rise rapidly, from 10 units/ten thousand people to 322 units/ten thousand people in 2021, ranking among the world's highest robots. Density country ranks. The replacement of manpower by machines will become a long-term development trend in the future.

What needs to be rewritten is: In China’s current robot industry, especially in core links, the proportion of domestic production is still low, which limits the development of the entire industry chain. In recent years, under the guidance of government policies, the proportion of domestic production of industrial robots has continued to increase. However, in the manufacturing areas of three core components, six-axis and SCARA robots, the proportion of domestic production is still less than 50%. At the same time, in the fields of automobiles, warehousing and logistics, the proportion of domestic production of system integration is also low

The penetration rate of domestic robots in traditional industries such as automobile manufacturing and electronics is still low. Generally speaking, there is great room for improvement in the localization rate of the robot industry, and these fields are all high-end development directions.

The localization rate of the robot segmented industrial chain (taking industrial robots as an example), data sources: GGII, MIR, Zhiyan Consulting, Huxiu Think Tank, Huabao Securities

From an investment perspective, robotics is a long-term growth area. According to different application fields, robots can be divided into industrial, service and special robots

There is no need to change the original meaning, the content that needs to be rewritten is: Data source: China Electronics Industry Association, Zhongtai Securities

According to data from the China Electronics Society and IFR, the global market size of industrial robots, service robots, and special robots in 2021 will be US$17.5 billion, US$17.2 billion, and US$8.2 billion respectively. The compound annual growth rate of the market size of industrial robots is expected to be 9% from 2022 to 2024, and the compound annual growth rate of the market size of service robots and special robots is 16% and 18% respectively.

It is expected that from 2022 to 2024, the size of my country's industrial robot market will continue to grow at a compound annual growth rate of 15% per year, and the growth rates of the service robot and special robot markets will reach 25% and 24% respectively. The growth rate of my country's three types of robot markets is higher than the global level

Musk expects Tesla Optimus to begin mass production and be launched in the next 3-5 years, which will become the focus of a new round of growth. Tesla plans to dedicate its production plant to this humanoid robot industry within 24 years

Compared with industrial robots, humanoid robots are more adaptable to various real-life scenarios, allowing robots to increase scale and reduce costs. According to a report released by MarketsandMarkets in July 2023, the humanoid robot market will grow from US$1.8 billion in 2023 to US$13.8 billion in 2028, with a compound annual growth rate of 50%. Humanoid robots are ushering in a 0 to 1 growth trend. During the outbreak stage, all links in the domestic industrial chain are expected to usher in rapid development.

Data from market research companies Markets and Markets and Caitong Securities show that the size of the global humanoid robot market is expected to be in billions of dollars, and the future development trend will be the same

Artificial intelligence large models have been popular since last year and will be combined with robots in the future to accelerate the process of robot intelligence. The tasks that robots can perform are becoming more and more complex, their autonomy continues to increase, the threshold for use will be lowered, their application fields will gradually expand, and production efficiency will gradually increase. Therefore, the pain points of humanoid robot demand will gradually be solved

The robot industry may be gradually ushering in an upward cycle. In the short term, the general machinery industry has cyclical fluctuations of 3-4 years. Metal cutting machine tools, forklifts, industrial robots, etc. are all general mechanical equipment. The last cycle started around the third quarter of 2019 and peaked in the first quarter of 2021. According to the law of historical cycles, it is speculated that with the recovery of downstream manufacturing industry, industrial robots may usher in a new round of upward cycle

As of November 15, 2023, the PE valuation of the CSI Robot Index is 40.95 times, which is at the historical 12.05% percentile. Since 2021, against the background of rising transportation costs, rising raw material prices, and weak downstream demand, the valuation of the robot industry has fallen significantly.

With the recovery of the manufacturing industry, the profitability of the industry will be eased, and small businesses will face greater pressure to clear. Driven by the scale effect, the profit inflection point of leading listed companies is worth looking forward to, and there is also considerable room for repair in the valuation of the index. According to Wind's consensus expectations, the index's earnings forecast growth rates in 2023 and 2024 are 51.95% and 29.96% respectively

The source of this content is Wind

The valuation is at a historical low, and there are also high growth prospects, short-term policy stimulus and economic recovery expectations. Friends who are interested in this can pay attention to the Robot Industry ETF (159551), which will be listed on November 16th

risk warning:

Investors should fully understand the difference between regular fixed-amount investment of funds and savings methods such as lump sum withdrawals. Regular fixed-amount investment is a simple and easy investment method that can guide investors to make long-term investments and average investment costs. However, regular fixed-amount investment cannot completely avoid the inherent risks of fund investment, cannot guarantee investors’ income, and is not an equivalent financial management method that replaces savings

Both stock ETF/LOF funds are securities investment funds with higher expected risks and expected returns. Their expected returns and expected risk levels are higher than hybrid funds, bond funds and money market funds.

Fund assets invested in stocks on the Science and Technology Innovation Board and GEM will face unique risks arising from differences in investment targets, market systems and trading rules. Investors are reminded to pay attention.

The short-term rise and fall of sectors/funds is only used as auxiliary material for the analysis and opinions of the article, for reference only, and does not constitute a guarantee of fund performance.

The short-term performance of individual stocks mentioned in the article is for reference only and does not constitute a stock recommendation, nor does it constitute a prediction or guarantee of fund performance.

The above opinions are for reference only and do not constitute investment advice or commitment. If you need to purchase related fund products, please pay attention to the relevant regulations on investor suitability management, conduct risk assessment in advance, and purchase fund products with a matching risk level based on your own risk tolerance. Funds have risks, please invest with caution

Daily Economic News

The above is the detailed content of The next disruptive product, why is the robotics industry so important? --Robotics industry ETF listed. For more information, please follow other related articles on the PHP Chinese website!

AI Game Development Enters Its Agentic Era With Upheaval's Dreamer PortalMay 02, 2025 am 11:17 AM

AI Game Development Enters Its Agentic Era With Upheaval's Dreamer PortalMay 02, 2025 am 11:17 AMUpheaval Games: Revolutionizing Game Development with AI Agents Upheaval, a game development studio comprised of veterans from industry giants like Blizzard and Obsidian, is poised to revolutionize game creation with its innovative AI-powered platfor

Uber Wants To Be Your Robotaxi Shop, Will Providers Let Them?May 02, 2025 am 11:16 AM

Uber Wants To Be Your Robotaxi Shop, Will Providers Let Them?May 02, 2025 am 11:16 AMUber's RoboTaxi Strategy: A Ride-Hail Ecosystem for Autonomous Vehicles At the recent Curbivore conference, Uber's Richard Willder unveiled their strategy to become the ride-hail platform for robotaxi providers. Leveraging their dominant position in

AI Agents Playing Video Games Will Transform Future RobotsMay 02, 2025 am 11:15 AM

AI Agents Playing Video Games Will Transform Future RobotsMay 02, 2025 am 11:15 AMVideo games are proving to be invaluable testing grounds for cutting-edge AI research, particularly in the development of autonomous agents and real-world robots, even potentially contributing to the quest for Artificial General Intelligence (AGI). A

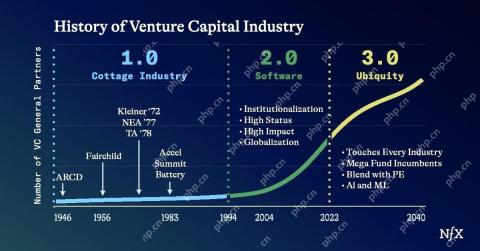

The Startup Industrial Complex, VC 3.0, And James Currier's ManifestoMay 02, 2025 am 11:14 AM

The Startup Industrial Complex, VC 3.0, And James Currier's ManifestoMay 02, 2025 am 11:14 AMThe impact of the evolving venture capital landscape is evident in the media, financial reports, and everyday conversations. However, the specific consequences for investors, startups, and funds are often overlooked. Venture Capital 3.0: A Paradigm

Adobe Updates Creative Cloud And Firefly At Adobe MAX London 2025May 02, 2025 am 11:13 AM

Adobe Updates Creative Cloud And Firefly At Adobe MAX London 2025May 02, 2025 am 11:13 AMAdobe MAX London 2025 delivered significant updates to Creative Cloud and Firefly, reflecting a strategic shift towards accessibility and generative AI. This analysis incorporates insights from pre-event briefings with Adobe leadership. (Note: Adob

Everything Meta Announced At LlamaConMay 02, 2025 am 11:12 AM

Everything Meta Announced At LlamaConMay 02, 2025 am 11:12 AMMeta's LlamaCon announcements showcase a comprehensive AI strategy designed to compete directly with closed AI systems like OpenAI's, while simultaneously creating new revenue streams for its open-source models. This multifaceted approach targets bo

The Brewing Controversy Over The Proposition That AI Is Nothing More Than Just Normal TechnologyMay 02, 2025 am 11:10 AM

The Brewing Controversy Over The Proposition That AI Is Nothing More Than Just Normal TechnologyMay 02, 2025 am 11:10 AMThere are serious differences in the field of artificial intelligence on this conclusion. Some insist that it is time to expose the "emperor's new clothes", while others strongly oppose the idea that artificial intelligence is just ordinary technology. Let's discuss it. An analysis of this innovative AI breakthrough is part of my ongoing Forbes column that covers the latest advancements in the field of AI, including identifying and explaining a variety of influential AI complexities (click here to view the link). Artificial intelligence as a common technology First, some basic knowledge is needed to lay the foundation for this important discussion. There is currently a large amount of research dedicated to further developing artificial intelligence. The overall goal is to achieve artificial general intelligence (AGI) and even possible artificial super intelligence (AS)

Model Citizens, Why AI Value Is The Next Business YardstickMay 02, 2025 am 11:09 AM

Model Citizens, Why AI Value Is The Next Business YardstickMay 02, 2025 am 11:09 AMThe effectiveness of a company's AI model is now a key performance indicator. Since the AI boom, generative AI has been used for everything from composing birthday invitations to writing software code. This has led to a proliferation of language mod

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

WebStorm Mac version

Useful JavaScript development tools

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

Dreamweaver Mac version

Visual web development tools