Technology peripherals

Technology peripherals AI

AI Increased penetration rate + domestic substitution drive, the time is right for the rise of domestic industrial robot leaders

Increased penetration rate + domestic substitution drive, the time is right for the rise of domestic industrial robot leadersAccording to data from the Advanced Robot Industry Research Institute (GGII), by 2022, my country's industrial robot sales will account for more than half of the world's sales, ranking first in the world for ten consecutive years. Recently, GGII data shows that by the first half of 2023, the sales volume of industrial robots in the Chinese market will reach 151,900 units, a year-on-year increase of 10.98%. GGII predicts that by 2023, the annual sales volume of industrial robots in the Chinese market will reach 326,000 units, with a year-on-year growth rate of 7.59%

Wang Hong, deputy director of the Equipment Industry Department of the Ministry of Industry and Information Technology, recently said at the press conference of the 2023 World Robot Conference that in the first half of this year, my country’s robot industry has maintained a stable growth trend, with the output of industrial robots reaching 222,000 sets. A year-on-year increase of 5.4%, service robot production reached 3.53 million units, a year-on-year increase of 9.6%. In the first three quarters of 2023, my country's industrial robot sales were basically flat year-on-year, and sales in the third quarter increased quarter-on-quarter.

According to data from the National Bureau of Statistics, my country's industrial robot production increased slightly in the first three quarters of 2023. From January to September, my country's industrial robot production was 320,500 units, a year-on-year increase of 0.4%; service robot production was 6.6477 million units, a year-on-year increase. 39.3%. The overall sales volume of industrial robots in the first three quarters was 207,000 units, a year-on-year increase of 1%. The market is expected to continue to improve quarter-on-quarter in the fourth quarter. It is expected that the full-year sales in 2023 will exceed 280,000 units, a slight increase of 0.1% year-on-year.

In terms of industry and machine models, in the first three quarters of 2023, the sales of small six-axis robots, large six-axis robots, and SCARA robots accounted for relatively high proportions, accounting for 33%, 32%, and 22.21% respectively. In terms of industries, electronic manufacturing, auto parts, metal products, lithium batteries, and photovoltaics are the five industries with the highest sales volume in the downstream field, accounting for 19.1%, 14.6%, 12.3%, 10.6%, and 9.4% respectively. Among them, the growth rate of industrial robots in the photovoltaic industry far exceeds that of other industries, followed by the automotive electronics, semiconductor, and medical supplies industries.

Looking at the slowdown in overall market demand growth, price wars and involution have become inevitable trends in the industry. Domestic substitution is accelerating, and the market share of domestic brands has further increased. In the first three quarters of 2023, domestic industrial robot manufacturers have withstood the pressure, and some listed companies have achieved year-on-year growth in revenue and net profit, which is much higher than the overall market growth rate. Leading companies such as Eston, Inovance Technology, and Newstar have relied on years of technology accumulation and scale advantages to achieve increased revenue and further increase market share.

On October 31, A-share listed company Eston released its performance report for the first three quarters of 2023. In the first three quarters, operating income was 3.226 billion yuan, a year-on-year increase of 26.88%. The net profit attributable to shareholders of listed companies was 140 million yuan, a year-on-year increase of 16.64%. The net profit attributable to shareholders of listed companies after deducting non-recurring gains and losses was 87.6459 million yuan, a year-on-year increase of 31.95%. The rapid growth in revenue is mainly due to the strengthening of the competitiveness of the company's robot business, the further increase in share, and the solid position of domestic robot head companies.

On October 27, New Star, one of the leading companies in China’s robotics and motion control industry, released its report for the first three quarters of 2023. The report shows that operating income reached 2.582 billion yuan, a year-on-year increase of 7.41%. The net profit attributable to shareholders of the listed company was 79.17 million yuan, a year-on-year increase of 282.58%, successfully turning losses into profits. Newstar Company has always focused on the field of intelligent manufacturing, mainly providing industrial robot products with its own servo motors, frequency converters and other core technologies, and is committed to becoming a supplier of intelligent production line solutions

Industrial automation leader Inovance Technology released its third quarterly report on the evening of October 26, which showed that the company achieved operating income of 20.121 billion yuan in the first three quarters, a year-on-year increase of 23.89%; the company achieved a net profit attributable to shareholders of listed companies of 3.319 billion yuan, a year-on-year increase of 3.319 billion yuan. An increase of 7.60%. Among them, Inovance Technology's operating income in the third quarter remained high, reaching 7.670 billion yuan, a year-on-year increase of 31.24%, and the absolute value set a new single-quarter high. At the same time, in the third quarter, net profit attributable to the parent company was 1.242 billion yuan, a year-on-year increase of 11.94%.

Under the environment of stable growth expectations and improving domestic demand, industrial robots are expected to rebound slightly in the fourth quarter, and full-year sales are expected to be basically the same as in 2022. In addition, China's industrial robots have increased penetration and are driven by domestic substitution, and the industry has broad prospects.

The domestic industrial robot industry chain is relatively complete, and product quality, independent capabilities in key core technologies, and brand awareness are also constantly improving. It is expected that the market share will further expand in the future, and it is time for domestic leading companies to rise

The above is the detailed content of Increased penetration rate + domestic substitution drive, the time is right for the rise of domestic industrial robot leaders. For more information, please follow other related articles on the PHP Chinese website!

What is Graph of Thought in Prompt EngineeringApr 13, 2025 am 11:53 AM

What is Graph of Thought in Prompt EngineeringApr 13, 2025 am 11:53 AMIntroduction In prompt engineering, “Graph of Thought” refers to a novel approach that uses graph theory to structure and guide AI’s reasoning process. Unlike traditional methods, which often involve linear s

Optimize Your Organisation's Email Marketing with GenAI AgentsApr 13, 2025 am 11:44 AM

Optimize Your Organisation's Email Marketing with GenAI AgentsApr 13, 2025 am 11:44 AMIntroduction Congratulations! You run a successful business. Through your web pages, social media campaigns, webinars, conferences, free resources, and other sources, you collect 5000 email IDs daily. The next obvious step is

Real-Time App Performance Monitoring with Apache PinotApr 13, 2025 am 11:40 AM

Real-Time App Performance Monitoring with Apache PinotApr 13, 2025 am 11:40 AMIntroduction In today’s fast-paced software development environment, ensuring optimal application performance is crucial. Monitoring real-time metrics such as response times, error rates, and resource utilization can help main

ChatGPT Hits 1 Billion Users? 'Doubled In Just Weeks' Says OpenAI CEOApr 13, 2025 am 11:23 AM

ChatGPT Hits 1 Billion Users? 'Doubled In Just Weeks' Says OpenAI CEOApr 13, 2025 am 11:23 AM“How many users do you have?” he prodded. “I think the last time we said was 500 million weekly actives, and it is growing very rapidly,” replied Altman. “You told me that it like doubled in just a few weeks,” Anderson continued. “I said that priv

Pixtral-12B: Mistral AI's First Multimodal Model - Analytics VidhyaApr 13, 2025 am 11:20 AM

Pixtral-12B: Mistral AI's First Multimodal Model - Analytics VidhyaApr 13, 2025 am 11:20 AMIntroduction Mistral has released its very first multimodal model, namely the Pixtral-12B-2409. This model is built upon Mistral’s 12 Billion parameter, Nemo 12B. What sets this model apart? It can now take both images and tex

Agentic Frameworks for Generative AI Applications - Analytics VidhyaApr 13, 2025 am 11:13 AM

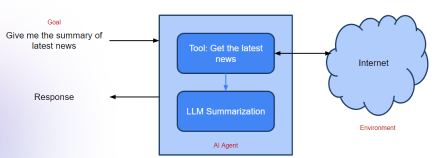

Agentic Frameworks for Generative AI Applications - Analytics VidhyaApr 13, 2025 am 11:13 AMImagine having an AI-powered assistant that not only responds to your queries but also autonomously gathers information, executes tasks, and even handles multiple types of data—text, images, and code. Sounds futuristic? In this a

Applications of Generative AI in the Financial SectorApr 13, 2025 am 11:12 AM

Applications of Generative AI in the Financial SectorApr 13, 2025 am 11:12 AMIntroduction The finance industry is the cornerstone of any country’s development, as it drives economic growth by facilitating efficient transactions and credit availability. The ease with which transactions occur and credit

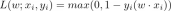

Guide to Online Learning and Passive-Aggressive AlgorithmsApr 13, 2025 am 11:09 AM

Guide to Online Learning and Passive-Aggressive AlgorithmsApr 13, 2025 am 11:09 AMIntroduction Data is being generated at an unprecedented rate from sources such as social media, financial transactions, and e-commerce platforms. Handling this continuous stream of information is a challenge, but it offers an

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 Chinese version

Chinese version, very easy to use

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

Dreamweaver Mac version

Visual web development tools

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.