Technology peripherals

Technology peripherals AI

AI New title: China's exoskeleton robot industry: Analysis of the status quo of the industrial chain and market competition pattern in 2023 (with the distribution of enterprises in the coastal areas of East China)

New title: China's exoskeleton robot industry: Analysis of the status quo of the industrial chain and market competition pattern in 2023 (with the distribution of enterprises in the coastal areas of East China)Major listed companies in the industry: (300024), (688580), (836163), etc.

Core data of this article: Industrial chain panorama, regional heat map, merger and reorganization trends

Panoramic review of the industrial chain of the exoskeleton robot industry: extensive upstream and downstream layout

The exoskeleton robot industry is centered on midstream exoskeleton robot manufacturers. The upstream mainly includes core technology systems and hardware, and the downstream is its application field. From an upstream perspective, the sensing system, control system, and drive system are the three key systems, while the mechanical system and power system serve as supporting equipment. The upstream core products include control sensors, surface muscle point signal collectors, control software, servo motors, servo drives, reducers, etc. In the midstream, exoskeleton robots can be divided into military exoskeleton robots, rehabilitation exoskeleton robots, and industrial and commercial exoskeleton robots according to application fields; according to structure, they can be divided into upper limb exoskeleton robots, lower limb exoskeleton robots, etc. The main downstream fields include medical rehabilitation, military field, industrial and commercial field, personal application, etc.

The middle reaches of the exoskeleton robot industry chain are mainly divided into two camps: focusing on the medical field and focusing on the industrial, commercial and military fields. Representative companies in the medical field include Daai Robot, Step Robot, Buffalo Robot, and representative companies in the industrial, commercial and military fields. Including Aosha Intelligence, Maibao, Iron Armor Steel Fist, etc. The upstream sensing systems include Maobu Robot, Fourier Intelligence, etc., the control systems include Xinsong Robot, Aosha Intelligence, Chengtian Technology, etc., and the driving systems include Panasonic, Inovance Technology, etc. The downstream medical field is mainly used for patient rehabilitation training, the industrial and commercial field applications include enhancing load-bearing capacity, reducing labor pressure, and reducing worker strain, etc. The military field is mainly used to enhance the load-bearing level of individual soldiers.

The regional heat map of the exoskeleton robot industry chain shows that most companies are mainly concentrated in the coastal areas of East China

Judging from the regional distribution of enterprises related to China's foreign skeleton robot industry chain, Guangdong Province, Jiangsu Province, Zhejiang Province, Shanghai City, Sichuan Province and other places have gathered a large number of supporting enterprises, and the industrial agglomeration effect is good. Representative exoskeleton robot companies in Guangdong include Step Robot, Chino Power, etc., and corresponding upstream companies include Jingchuang Technology, Shenzhen SEG, Guangzhou CNC Equipment Co., Ltd., etc.; related companies in Jiangsu, Zhejiang, and Shanghai in the Yangtze River Delta region It is also relatively rich, gathering representative companies such as Fourier and Chengtian Technology.

Judging from the regional distribution of listed companies, currently listed companies in China's exoskeleton robot industry are mainly distributed in East China, and most of the selected representative companies are located in Jiangsu and Shanghai.

Product layout of representative exoskeleton robot companies: Products are mainly concentrated in the medical field

The main representative companies of China’s exoskeleton robots are mainly unlisted companies. From the perspective of product types, Chinese companies Daai Robot and Fuli Exoskeleton Robot have a wide range of products. DaAi Robot's business covers products for patients in the early, middle and late stages of recovery, such as Aikang in the early recovery stage, Xiao Aikang in the middle stage of recovery, and AiDong in the late recovery stage. Analyzing from the perspective of qualification certificates obtained, Weiss Medical has obtained more qualification certificates, a total of 87. From the perspective of the number of tenders and tenders, Weisi Medical has a larger number of tenders, reaching 500 pieces

Please note: The data query date is July 25, 2023

Analysis of mergers and reorganizations in the exoskeleton robot industry: mainly horizontal integration

The domestic exoskeleton robot industry is still in its infancy, the commercialization level of each company's products is low, and there has not yet been a large-scale merger or reorganization in the industry. From the perspective of industry development, the key cases of mergers and reorganizations in China's exoskeleton robot industry are analyzed as follows:

Please refer to Qianzhan Industry Research Institute's "" for more research and analysis on this industry

Qianzhan Industry Research Institute also provides other solutions, such as consulting services. If you need to quote the content of this article in public information disclosures such as prospectuses and company annual reports, you must obtain formal authorization from the Qianzhan Industry Research Institute in advance

More in-depth industry analysis is available in [Forward-looking Economist APP], and you can also communicate and interact with 500 economists/senior industry researchers.

The above is the detailed content of New title: China's exoskeleton robot industry: Analysis of the status quo of the industrial chain and market competition pattern in 2023 (with the distribution of enterprises in the coastal areas of East China). For more information, please follow other related articles on the PHP Chinese website!

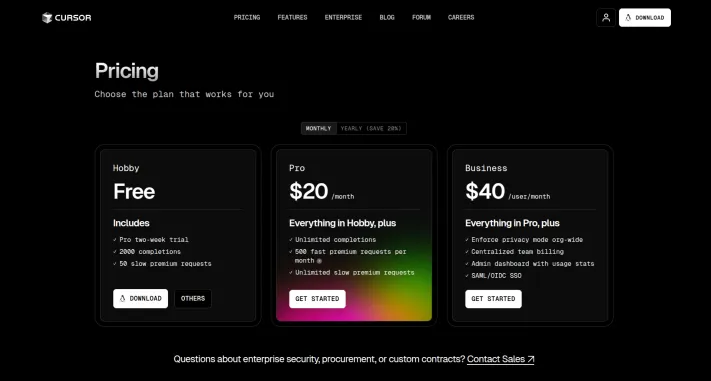

I Tried Vibe Coding with Cursor AI and It's Amazing!Mar 20, 2025 pm 03:34 PM

I Tried Vibe Coding with Cursor AI and It's Amazing!Mar 20, 2025 pm 03:34 PMVibe coding is reshaping the world of software development by letting us create applications using natural language instead of endless lines of code. Inspired by visionaries like Andrej Karpathy, this innovative approach lets dev

Top 5 GenAI Launches of February 2025: GPT-4.5, Grok-3 & More!Mar 22, 2025 am 10:58 AM

Top 5 GenAI Launches of February 2025: GPT-4.5, Grok-3 & More!Mar 22, 2025 am 10:58 AMFebruary 2025 has been yet another game-changing month for generative AI, bringing us some of the most anticipated model upgrades and groundbreaking new features. From xAI’s Grok 3 and Anthropic’s Claude 3.7 Sonnet, to OpenAI’s G

How to Use DALL-E 3: Tips, Examples, and FeaturesMar 09, 2025 pm 01:00 PM

How to Use DALL-E 3: Tips, Examples, and FeaturesMar 09, 2025 pm 01:00 PMDALL-E 3: A Generative AI Image Creation Tool Generative AI is revolutionizing content creation, and DALL-E 3, OpenAI's latest image generation model, is at the forefront. Released in October 2023, it builds upon its predecessors, DALL-E and DALL-E 2

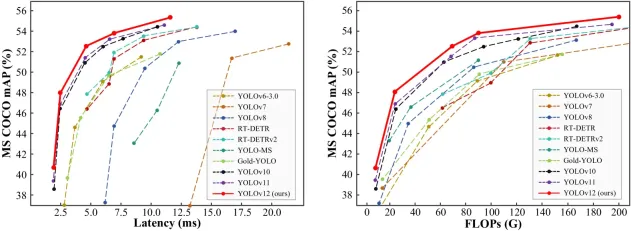

How to Use YOLO v12 for Object Detection?Mar 22, 2025 am 11:07 AM

How to Use YOLO v12 for Object Detection?Mar 22, 2025 am 11:07 AMYOLO (You Only Look Once) has been a leading real-time object detection framework, with each iteration improving upon the previous versions. The latest version YOLO v12 introduces advancements that significantly enhance accuracy

Elon Musk & Sam Altman Clash over $500 Billion Stargate ProjectMar 08, 2025 am 11:15 AM

Elon Musk & Sam Altman Clash over $500 Billion Stargate ProjectMar 08, 2025 am 11:15 AMThe $500 billion Stargate AI project, backed by tech giants like OpenAI, SoftBank, Oracle, and Nvidia, and supported by the U.S. government, aims to solidify American AI leadership. This ambitious undertaking promises a future shaped by AI advanceme

Google's GenCast: Weather Forecasting With GenCast Mini DemoMar 16, 2025 pm 01:46 PM

Google's GenCast: Weather Forecasting With GenCast Mini DemoMar 16, 2025 pm 01:46 PMGoogle DeepMind's GenCast: A Revolutionary AI for Weather Forecasting Weather forecasting has undergone a dramatic transformation, moving from rudimentary observations to sophisticated AI-powered predictions. Google DeepMind's GenCast, a groundbreak

Sora vs Veo 2: Which One Creates More Realistic Videos?Mar 10, 2025 pm 12:22 PM

Sora vs Veo 2: Which One Creates More Realistic Videos?Mar 10, 2025 pm 12:22 PMGoogle's Veo 2 and OpenAI's Sora: Which AI video generator reigns supreme? Both platforms generate impressive AI videos, but their strengths lie in different areas. This comparison, using various prompts, reveals which tool best suits your needs. T

Which AI is better than ChatGPT?Mar 18, 2025 pm 06:05 PM

Which AI is better than ChatGPT?Mar 18, 2025 pm 06:05 PMThe article discusses AI models surpassing ChatGPT, like LaMDA, LLaMA, and Grok, highlighting their advantages in accuracy, understanding, and industry impact.(159 characters)

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

SublimeText3 Linux new version

SublimeText3 Linux latest version