Technology peripherals

Technology peripherals It Industry

It Industry Investors advise Musk: Instead of cutting prices and promoting sales, Tesla should spend money on advertising

Investors advise Musk: Instead of cutting prices and promoting sales, Tesla should spend money on advertisingNews on October 16 that Tesla rarely spends money on advertising, but as sales growth slows and it adopts a price-cutting strategy to boost car sales, many investors are uneasy. Price cuts in particular could cost Tesla billions of dollars in revenue this year. And GM, Ford and other automakers spend more than $20 billion a year on advertising in big media.

The following is the translation:

In many ways, Gary Black can be called He is a Tesla fan. Since launching the fund in 2021, the Chicago fund manager has made Tesla his largest holding and has frequently expressed his support for Tesla on social media. But Black has been thinking about a question recently: Is Tesla wasting money by cutting prices in order to maintain high growth rates?

With sales of Tesla cars and SUVs lagging and the electric Cybertruck on the way, Black insists Tesla, or Elon Musk,should Abandon longstanding opposition to spending money on advertising in big media.

Blake’s assertion has drawn support from allies on social media. An online survey conducted by @TroyTeslike, another active Tesla social media fan, found that half of the more than 8,000 respondents believed Tesla should start advertising in lieu of further price cuts and higher-end models. Growth strategies include adding new technologies to Model S and Model X. Last May, at Tesla’s annual shareholder meeting, when a shareholder questioned Musk on this issue, the latter seemed surprised and even a little amused, but most of the special people present But Silla fans are cheering. “Even if each Tesla spent $525 on advertising this year, it would still be half of Netflix’s advertising budget, and spending $1,000 would only be equivalent to Netflix’s entire advertising budget, and I see no ads for the latter No. Musk, why don’t you spread the word here about what you’re telling us?” said Kevin Paffrath, who runs The Meet Kevin Pricing Power ETF in Southern California. He specifically pointed out that safety features such as airbag deployment technology are Tesla's strengths and may attract more consumers through advertising. In fact,Musk is open to the idea of advertising. He once said: "Tesla has a lot of amazing features and capabilities that people just don't know about. Although there are obviously a lot of people following the Tesla account, you know, to some extent, my personal account has Preaching to the choir, and the choir was convinced." Then Musk made a promise. He said: "I think what you said does have some truth, and I believe it is necessary to adopt these suggestions. We will try to do some advertising and see how it works." Shareholders burst into cheers, and Musk responded: "I I didn’t expect them to be so enthusiastic about advertising.”

However, if shareholders expect Tesla to advertise heavily, they may be disappointed. Wedbush Securities analyst Dan Ives said Tesla spent very little on online and social advertising in the months since. Meanwhile, steep price cuts continue, Musk's main strategy to get more people interested in Tesla. Musk has always been a staunch supporter of cost reduction. As he said at this year's annual shareholder meeting, one of Tesla's goals is to bring electric transportation to mass-market consumers. In the U.S. market, many Model 3s are already priced below the average price of a new passenger car. Price cuts impact Tesla gross profitIn fact, according to data from Cox Automotive, since August 2022, the average price of most Tesla models has dropped by approximately 20%. These figures do not include the $7,500 federal tax credit restored under the 2022 Inflation Reduction Act. But Black said the latest round of price cuts announced last month is costing Tesla $2 billion a year. Overall, Ives estimated, price cuts over the past year had a greater impact on Tesla's revenue. In fact, Black came up with the above estimate because he believes Musk should reconsider the extent to which Tesla relies on price reduction strategies instead of spending money on advertising to promote electric vehicles. Lower vehicle costs and safety features such as over-the-air software updates. That's especially pressing given that Tesla's stock price, while up about 140% this year, is still a third below its 2021 peak and has consistently lagged the S&P 500's gains last year. Black said: "I don't think you can get that much elasticity of demand by reducing the price of Model Y from $55,000 to $48,000. Instead of reducing the price by $2,000, you might as well reduce the price by $1,800 and increase advertising. Delivery.”Black also believes that Tesla’s price cuts are actually a strategy to increase marketing expenses. He said Tesla's market share decline in electric vehicles this year shows that price cuts alone won't work.

In fact, despite Tesla lowering prices, its share of the U.S. electric vehicle market has been declining. Tesla delivered 435,059 vehicles in the third quarter, well up from 343,830 vehicles a year earlier but down from 466,140 vehicles in the second quarter and about 423,000 vehicles in the first quarter. Tesla blamed “planned shutdowns for factory upgrades” for third-quarter results that fell short of analysts’ expectations.

Ives said the negative impact of the price reduction strategy was also reflected in Tesla's gross profit, which fell as a percentage of sales in the second quarter from 25% in the second quarter of 2022. to 18%. That means Tesla's potential gross profit will be reduced by $1.5 billion, unless some of that can be made up through increased sales.

How does Tesla advertise?

We can guess how effective Tesla’s advertising campaign might be, said Allen Weiss, CEO of MarketingProfs, a market research and training company. He pointed out that consumers are concerned about many aspects besides safety features.

He said: "I would first determine what benefits the customer wants to get. Some of them may be more concerned about the performance improvement of Tesla cars. Some people prefer to see it as a luxury product or a status symbol. Some people think that they in helping save the planet. After that, I would find out what these benefits represent, target a subset of these buyers, and come up with good ideas around these benefits. This way, you can both get interesting ideas and engage with buyers about their The challenge for Tesla, Weiss believes, is that as the company grows, it will compete more directly with experienced marketing firms. Ford is already heavily promoting its F-150 Lightning pickup truck, and General Motors has been running SuperBowl ads for the past three years.

Swedish electric carmaker Polestar is also advertising, spending an estimated $20 million this year. Polestar and BMW also both promote electric vehicles during the Super Bowl telecast, even though it is the most expensive telecast in the United States. Industry data firm iSpot estimates that about a quarter of automotive ad spending in 2022 will be targeted at electric vehicles, a trend Ives calls a "wave" that he expects to continue.

Weiss said: "Other automakers are used to paying more attention to customer interests, but Tesla is not. Open Ford's website, click on the 'Electric Vehicles' page, and you will immediately see something exciting. Stunning design, impressive performance and exciting words. Go to BMW's electric car page and you'll see descriptions like 'cutting-edge performance and luxury'. On Tesla's website, you'll just see Price."

Even Musk himself admitted at the annual meeting that people often tell him that Tesla's electric cars are too expensive. He said: "I have talked to a lot of people and they still think Tesla is super expensive. But I don't feel that is the case. The average selling price of Tesla is lower than the average selling price of a new car in the United States."

爱Voss said Tesla doesn't need to spend as much money on advertising as Ford or General Motors, and he believes a targeted advertising campaign could focus on the specific benefits of Tesla or other electric vehicles.

"There's something different about Tesla that people don't know about," he said. Even as the average cost of a Tesla vehicle drops, advertising can be used to maintain its luxury brand image and "start changing people's perceptions."

Ives also said that when Tesla reaches its maximum scale, the most interesting things are sales volume and operating profit margin. Black thinks people will soon find out whether more advertising helps.

Even Musk has begun to believe in the power of advertising. He once said at the annual meeting of shareholders: "I think it is ironic that X relies heavily on advertising, but I personally 'never use advertising' , and now I own a company that relies heavily on advertising. I think I should say that advertising is great, and everyone should advertise."

Advertising statement: The external jump links contained in the article (including Not limited to hyperlinks, QR codes, passwords, etc.), used to convey more information and save selection time. The results are for reference only. All articles on this site include this statement.

The above is the detailed content of Investors advise Musk: Instead of cutting prices and promoting sales, Tesla should spend money on advertising. For more information, please follow other related articles on the PHP Chinese website!

特斯拉Model 3再添新变化!路测照片曝光蓝色车型Jun 10, 2023 pm 09:21 PM

特斯拉Model 3再添新变化!路测照片曝光蓝色车型Jun 10, 2023 pm 09:21 PM6月10日消息,近日在Reddit社区上,网友Icy_Nectarine_6311爆料了一组关于特斯拉Model3的新照片,这一代号为“ProjectHighland”的车型在之前已经曝光了白色和黑色车身,而这次首次发现了一辆蓝色车型。根据照片显示,蓝色Model3Highland采用了一种类似于19英寸运动轮毂和冬季轮胎套件的轮毂设计,与之前的白色和黑色车型有所不同。不过,这款蓝色车型的轮毂没有带有特斯拉标志的黑色轮毂盖。此外,新款Model3的前大灯与之前曝光的照片一致,采用了更加时尚和动感

深度剖析Tesla自动驾驶技术方案May 17, 2023 am 08:55 AM

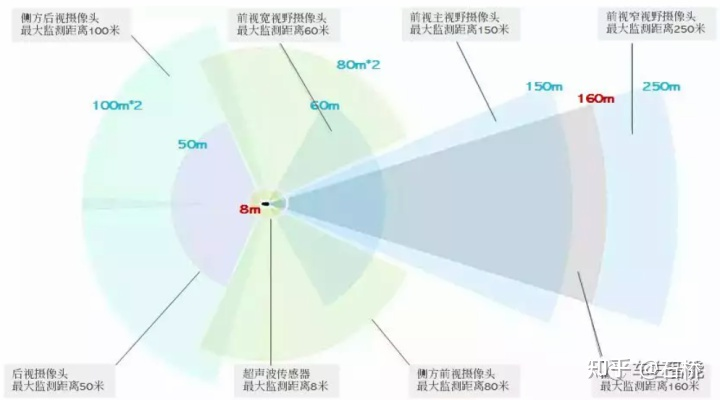

深度剖析Tesla自动驾驶技术方案May 17, 2023 am 08:55 AM01感知:构建实时的4D自动驾驶场景1.特斯拉摄像头布局特斯拉的摄像头视野可以覆盖车身周围360°,在前向有120°鱼眼、长焦镜头用于加强观测,布局如上图。2.特斯拉图像数据预处理特斯拉采用的是36Hz的1280*960-12bit的图像原始数据,这相对于只有8-bit的ISP后处理数据多了4位信息,动态方位扩大了16倍。特斯拉这样处理的原因有2个:1)ISP基于rule-base的算法对原始信号做了自动对焦(AF)、自动曝光(AE)、自动白平衡(AWB)、坏点校正(DNS)、高动态范围成像(H

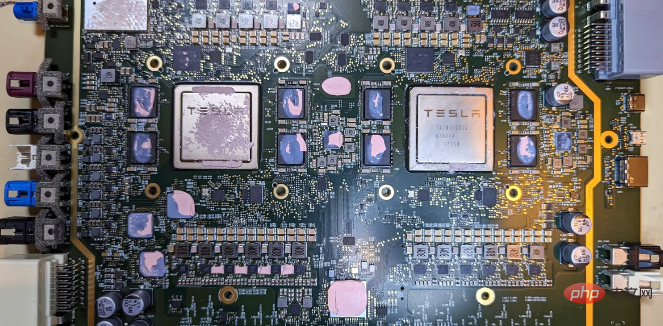

特斯拉自动驾驶硬件 4.0 实物拆解:增加雷达,提供更多摄像头Apr 08, 2023 pm 12:11 PM

特斯拉自动驾驶硬件 4.0 实物拆解:增加雷达,提供更多摄像头Apr 08, 2023 pm 12:11 PM2 月 16 日消息,特斯拉的新自动驾驶计算机,即硬件 4.0(HW4)已经泄露,该公司似乎已经在制造一些带有新系统的汽车。我们已经知道,特斯拉准备升级其自动驾驶硬件已有一段时间了。特斯拉此前向联邦通信委员会申请在其车辆上增加一个新的雷达,并称计划在 1 月份开始销售,新的雷达将意味着特斯拉计划更新其 Autopilot 和 FSD 的传感器套件。硬件变化对特斯拉车主来说是一种压力,因为该汽车制造商一直承诺,其自 2016 年以来制造的所有车辆都具备通过软件更新实现自动驾驶所需的所有硬件。事实证

特斯拉人形机器人集体出街!马斯克:比车便宜,会有100亿台May 31, 2023 pm 08:01 PM

特斯拉人形机器人集体出街!马斯克:比车便宜,会有100亿台May 31, 2023 pm 08:01 PM特斯拉Optimus进化了,价格“比车更低”。来源|量子位ID:QbitAI作者|金磊西风转载已获授权马斯克的人形机器人——特斯拉Optimus进化了,价格还“比车更低”。现在,成群结队的Optimus学会了像人一样缓慢前行:视频中它们还路过Cybertruck的生产间,满满的赛博朋克味道。而且Optimus们可不是简单的在走路而已,而是边走边发现并记忆周遭的环境:接下来,是更为细节的能力展示。例如特斯拉展示了Optimus电机转矩控制的能力,是能做到控制力道不打碎鸡蛋的那种:手活儿也是过关的,

特斯拉GIGA实验室亮相成都,创造45秒造车奇迹Jun 10, 2023 pm 06:47 PM

特斯拉GIGA实验室亮相成都,创造45秒造车奇迹Jun 10, 2023 pm 06:47 PM6月10日消息,全国首家特斯拉GIGA实验室在成都隆重亮相,为成都市民带来了全新的特斯拉体验。这座被誉为特斯拉"成都最美门店"的实验室位于四川省成都市金牛区天府艺术公园,具体地址是天府1113号楼1层104号,即特斯拉天府111体验店。据小编了解,在这里,顾客们不仅可以与朋友相约畅聊小憩,还能沉浸式地体验特斯拉的制造奇迹,仅需45秒即可见证一辆汽车的诞生。特斯拉的超级工厂被冠名为"GIGA",这个词源于计量单位,代表着"数十亿"的含义。

特斯拉Cyberquad:马斯克推出的“宠娃车”灵感源自CybertruckJul 15, 2023 am 11:10 AM

特斯拉Cyberquad:马斯克推出的“宠娃车”灵感源自CybertruckJul 15, 2023 am 11:10 AM7月14日消息,特斯拉今日宣布推出一款新车型——特斯拉Cyberquad。这款面向儿童的玩具车将在特斯拉国内官网以及天猫/京东特斯拉官方旗舰店上架,标价11990元。虽然这个价格对于一款玩具车来说并不便宜,但这并没有阻止国内特斯拉粉丝们对它的热情。在上架时,由于人数过多,特斯拉官网甚至出现了卡顿现象,导致消费者无法成功加购。然而,截至目前,特斯拉官网仍然无法成功购买该商品。据小编了解,特斯拉Cyberquad的设计灵感源自特斯拉最酷炫的Cybertruck电动皮卡,车身采用特斯拉标志性的LED大

特斯拉Dojo超算架构细节首次公开!为自动驾驶「操碎了芯」Apr 11, 2023 pm 09:46 PM

特斯拉Dojo超算架构细节首次公开!为自动驾驶「操碎了芯」Apr 11, 2023 pm 09:46 PM为了满足对人工智能和机器学习模型越来越大的需求, 特斯拉创建了自己的人工智能技术,来教特斯拉的汽车自动驾驶。最近,特斯拉在Hot Chips 34会议上,披露了大量关于Dojo(道场)超级计算架构的细节。本质上,Dojo是一个巨大的可组合的超级计算机,它由一个完全定制的架构构建,涵盖了计算、网络、输入/输出(I/O)芯片到指令集架构(ISA)、电源传输、包装和冷却。所有这些都是为了大规模地运行定制的、特定的机器学习训练算法。Ganesh Venkataramanan是Tesla自动驾驶硬件高级总

特斯拉北美地区Model 3和Model Y标准色调整为"冷光银"Jul 11, 2023 pm 04:01 PM

特斯拉北美地区Model 3和Model Y标准色调整为"冷光银"Jul 11, 2023 pm 04:01 PM7月4日消息,特斯拉近日宣布在北美地区对Model3和ModelY的标准色进行了调整。据悉,特斯拉将北美地区Model3和ModelY的标准色改为了"冷光银",而除了银色之外的所有颜色都需要额外付费,包括黑色和白色。特斯拉旗下的ModelY作为例子,目前提供了五种车漆选择。除了标准的冷光银外,还有珍珠白(多涂层)、深海蓝、纯黑和红色(多涂层)。然而,除了冷光银之外的其他四种颜色都需要额外支付费用。其中,深海蓝和珍珠白车漆需额外支付1000美元(约7250元人民币),纯黑车漆需

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

WebStorm Mac version

Useful JavaScript development tools

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software