Technology peripherals

Technology peripherals AI

AI There are sufficient orders for the power Internet of Things, and the growth trend of the PLC communication market is gratifying-IOTE Internet of Things Exhibition

There are sufficient orders for the power Internet of Things, and the growth trend of the PLC communication market is gratifying-IOTE Internet of Things ExhibitionThe power grid is the most extensive network in the world, and the area where electricity flows is much wider than the area where people set foot. Power lines extend in all directions, and their value is not only for transmitting electrical energy, but also for transmitting communication data. Therefore, the collection and remote control of IoT device data through the power grid will bring about the true Internet of Everything.

In recent years, with the rapid development of distributed energy resources (especially distributed photovoltaics), higher requirements have been put forward for the digital construction of distribution networks. After large-scale distributed generation is connected to the system, it will significantly affect the power flow distribution, power quality, and short-circuit current of the distribution network, which will further affect the fault location and power supply restoration functions of traditional protection components. This requires strengthening the monitoring and control of distribution networks.

Currently, under the background of China's vigorous promotion of the construction of new power systems, the scale of digital construction of China's distribution network is also expanding year by year - During the "14th Five-Year Plan" period of the State Grid, the investment in distribution network construction exceeded 1.2 trillion yuan, accounting for more than 60%; China Southern Power Grid proposed to fully build a digital platform by the end of the "14th Five-Year Plan" period, with 100% coverage of smart meters and low-voltage centralized reading, and an increase in automatic meter reading rate to more than 99%. The power distribution automation coverage rate reaches more than 90%, and the communication network covers 100%. China Southern Power Grid has invested 320 billion yuan in digitalization and distribution network construction during the “14th Five-Year Plan”, accounting for nearly half of the total investment.

At the same time, as the key infrastructure supporting the digital development of the power industry, the power Internet of Things will usher in rapid development. According to data from the State Grid, more than 500 million terminal devices were connected to the State Grid system at the end of 2018. The State Grid’s plan predicts that the number of connected terminal devices will exceed 1 billion by 2025, and the number of connected terminal devices in 2030 will be Reaching 2 billion, it has become the largest IoT ecosystem for access devices, bringing huge market opportunities to many fields.

Since the power Internet of Things is a huge and complex ecosystem, it is difficult for the author to describe it in one article. This time, I will start from the construction of the communication base of the power Internet of Things, and analyze it based on the current development status of the hot PLC communication market and the financial reports of related companies. .

Introduction to PLC communication

Currently, there are four main categories of common communication methods between things:

Among the above four types of communication methods, the first two are wired communication technologies, and the latter two are wireless communication technologies. Wired communication is greatly affected by line characteristics, while wireless communication is greatly affected by environmental factors. Among them, the outstanding feature of power line communication technology is that the network is connected to the power supply. For those devices powered by power lines, they can access the network without deploying additional special communication lines.

PLC technology can be divided into narrowband, medium-band and broadband technologies according to frequency bands.

Narrowband power communication technology is the earliest PLC technology used in power distribution networks. It has a series of international standards, such as G3-PLC, PRIME, IEEE 1901.2, etc. The carrier frequency band is mainly distributed between 3 and 500 kHz. , mainly used for remote meter reading.

Mid-frequency band PLC technology originated in China. The medium-frequency band technology based on the HPLC specification of the State Grid Corporation of China is widely used in the field of domestic power information collection. It was standardized in IEEE in 2018 and released the IEEE 1901.1 International Standard.

Broadband PLC technology enhances the advantage of large bandwidth and is suitable for short-range applications. It is common in home broadband access and can also use relays for long-distance transmission.

PLC technology plays an important role in power system automation. The following are some applications of PLC technology in power system automation:

Power distribution automation,PLC technology can realize the monitoring and control of power distribution automation, including fault location, isolation and recovery functions. Through PLC technology, the status of the power distribution system can be monitored in real time, faults can be discovered and dealt with in a timely manner, and the reliability and safety of the power distribution system can be improved.

Power quality monitoring, PLC technology can realize real-time monitoring and analysis of power quality, including measurement and analysis of voltage, current, frequency, harmonics and other parameters. Through PLC technology, power quality problems can be discovered in time, and corresponding measures can be taken to improve them to ensure the stable operation of the power system.

Power demand side management, PLC technology can realize the management and control of the power demand side, including functions such as monitoring, analysis and control of power loads. Through PLC technology, changes in electricity load can be monitored in real time, dispatched and controlled according to actual needs, and the operating efficiency and economy of the power system can be improved.

Remote monitoring and control, PLC technology can realize remote monitoring and control of power systems, including remote data collection, transmission and processing functions. Through PLC technology, the operating status of the power system can be monitored in real time, problems can be discovered and dealt with in a timely manner, and the reliability and safety of the power system can be improved. PLC technology plays an important role in power system automation and can improve the reliability, safety and economy of the power system. With the continuous development of technology, the application prospects of PLC technology in power system automation will be broader.

In addition, PLC technology can also be used in smart homes, smart buildings, smart transportation and other fields to realize intelligent control and data transmission of various equipment.

Although PLC technology has been questioned due to factors such as complex power grid environment, severe noise interference, and large time variability, from a business perspective, PLC uses the ubiquitous power line network as a communication medium, which greatly reduces the cost of expensive network Construction costs and subsequent operation and maintenance management costs.

In recent years, with the development of modulation/demodulation and error correction technology, and the improvement of semiconductor integration technology, the anti-interference ability of PLC communication integrated circuits has been greatly improved. Domestic manufacturers’ innovation and research and development levels are also constantly making breakthroughs. PLC plays an important role in power communications. The position of the market is irreplaceable.

PLC market status

According to statistics and forecasts from QYR (Hengzhou Bozhi), the global power line communications (PLC) system market sales will reach US$7.2 billion in 2021, and are expected to reach US$14.7 billion in 2028, with a compound annual growth rate (CAGR) is 10.6% (2022-2028). At the regional level, Europe is currently the world's largest power line communications (PLC) system market, accounting for nearly 30% of the market share, followed by China and North America, which together account for 43% of the global market. With the advancement of my country's new power grid construction and the emergence of many Internet of Things applications under the background of "Superman of Things", China's PLC market will continue to grow rapidly.

Looking at the domestic market, although PLC technology originated in Europe and the United States, with the rise of domestic manufacturers, it has gradually achieved localization. In the field of narrow-band low-speed power line carrier communications, manufacturers such as ST and Echelon have been basically replaced by domestic companies; in the field of high-speed power line communications, foreign manufacturers have gradually withdrawn from the domestic market due to the wave of high-speed power line carriers that started in 2018.

Currently, the main companies deploying PLC communication business areHuawei HiSilicon, Neusoft Carrier, Lihewei, Dingxin Carrier, Shenzhen Intelligent Microelectronics, etc.

Regarding the competition pattern of the PLC market, the market changes are actually affected by the fit between the manufacturer's technology and the technical needs of major customers in the two major industries of State Grid and South Grid. After the State Grid HPLC interconnection technical specifications (chip level) in 2017, the "Dual-mode Communication Interconnection Technical Specifications" was released in 2020. In 2022, the demand will be adjusted to switch from HPLC to high-speed dual-mode. These changes in demand require relevant manufacturers to continue to seize the trend through technological innovation.

Related company business

Yesterday, Lihewei released a performance forecast for the first three quarters. It is expected to achieve operating income of 448.3081 million yuan in the first three quarters of 2023, an increase of 98.7558 million yuan compared with the same period last year, a year-on-year increase of 28.25%. At the same time, it is expected that the net profit attributable to the owners of the parent company will be 80 million yuan to 83 million yuan in the first three quarters of 2023, a year-on-year increase of 55.65% to 61.48%.

Regarding the reasons for performance growth, Lihewei attributed it to the continued growth of the power Internet of Things market performance, sufficient orders, effective guarantee of chip production capacity, and its active promotion of new chip products in smart photovoltaic, smart home and other fields.

The author reviewed Lihewei’s 2023 semi-annual report and summarized the following information:

In the first half of 2023, Lihewei achieved operating income of 252.7066 million yuan, an increase of 13.39% over the same period last year; achieved a net profit of 50.6034 million yuan, an increase of 59.42% over the same period last year; among which, The smart grid business achieved operating income of 238.3873 million yuan, accounting for 94.43% of the total operating income, an increase of 12.84% over the same period last year.

The report mentioned an important opportunity for Lihewei's performance growth, that is, starting from the fourth quarter of 2022, the State Grid's demand for communication unit products will switch from HPLC to high-speed dual-mode. Lihewei is a State Grid's first batch of high-speed dual-mode module suppliers that passed the full performance test of high-speed dual-mode module-level products have effectively seized the market opportunity.

In addition to maintaining continued sales growth in existing PLC communication chip products, in the first half of 2023, Lihewei also launched a number of new products - high-speed power line communications (PLC) for smart homes The SOC chip has been successfully taped out, and the photovoltaic module rapid shutdown module based on the independently developed PLC photovoltaic chip has been certified by the international CSA testing and certification agency. It is oriented to the Internet of Things market such as smart home, smart home appliances, smart lighting, etc. Based on the smart home high-speed power line communication (PLC) SOC chip, a series of gateway PLC modules, smart home, smart lighting PLC modules and other products have been developed.

Currently, Lihewei has formed a product ecology with power line communication chips as the core, covering chips, modules, terminals, systems, etc., and continues to deepen the market with continuous innovation efforts:

Lihewei’s ongoing research projects in 2023

At the same time, the author also referred to Neusoft Carrier’s 2023 semi-annual report:

In the first half of 2023, Neusoft Carrier achieved a total operating income of 410.1994 million yuan, a year-on-year increase of 4.15%; a net profit of 46.5491 million yuan, with a gross profit margin of 44.2%, a year-on-year decrease of 5.55%. Among them, the PLC product business achieved operating income of 308.2967 million yuan, a year-on-year increase of 51.55%, and the gross profit margin reached 46.47%. Compared with other businesses, PLC products have achieved higher profit returns.

Among them, Carrier Technology, as the main body of a listed company, focuses on smart power distribution, smart power consumption, smart microgrids and comprehensive energy application needs, providing a full range of supporting solutions from meters to main station systems, including narrowband and low-speed , dual-mode communication solutions that combine narrowband high-speed, broadband high-speed and micro-power wireless and various other power line carrier communication solutions, including HPLC HRF high-speed dual-mode communication systems, intelligent convergence terminals, intelligent terminal sensing terminals, microgrid controllers, energy Key equipment such as routers and smart sensors promote extensive interconnection and in-depth perception of various energy facilities and power grids on the customer side.

Generally speaking, PLC communication business manufacturers have received good business support based on market opportunities, with product profit margins maintained at more than 40%, and they are all expanding their businesses in multiple dimensions based on deep cultivation in the power grid field. The author also summarized the main business directions:

- Smart Energy

In the field of photovoltaic power generation, China occupies more than 70% of the global market share, and it is expected that the total global photovoltaic installed capacity will exceed 400GW by 2025. According to CPIA forecasts, domestic newly installed photovoltaic capacity is expected to reach 70-90GW/year during the "14th Five-Year Plan" period. Each GW is equipped with about 2 million photovoltaic panels, and the number of new photovoltaic panels every year will reach 140 million to 180 million. In the context of dual carbon, photovoltaic power plants pay more attention to the efficiency, operation and maintenance, and management of photovoltaic power generation, and the photovoltaic energy system is fully digitalized. According to statistics from the National Energy Administration, newly installed photovoltaic capacity in the first half of 2023 was 78.42GW, a year-on-year increase of 154%, which is close to the newly installed capacity in the whole of 2022. This has brought huge demand for communication technology, data processing technology and chips.

- Whole house intelligence

PLC network-wide intelligent system has the features of simple installation, plug-and-play, stable without disconnection, controllable with power, low latency, fast response, multiplexed power lines, and can save 30%-50% of wiring costs, etc. Many advantages. In 2022, Huawei's whole-house intelligence and AO.SMITH AI-LINK will both adopt PLC technology-based communication technology for whole-house intelligent device interconnection. Other enterprise ecosystems are also accelerating the introduction of PLC, using PLC communication technology for home whole-house intelligence. The major connectivity technology landscape is taking shape.

- Charging infrastructure

Currently, with the development of my country's new energy vehicle economy, policy support for charging infrastructure construction has been further increased. As of the end of June 2023, my country has built a total of 6.652 million charging piles of various types, a year-on-year increase of 69.8%; in the first half of this year, 1.442 million new charging piles were built nationwide, and the sales volume of new energy vehicles was 3.74 million units, with an incremental vehicle-to-pile ratio of 2.6 :1, there is still room for improvement compared to the ideal vehicle-to-pile ratio of 1:1. According to the "New Energy Vehicle Industry Development Plan (2021-2035)" released by the Ministry of Industry and Information Technology, the number of new energy vehicles in my country is expected to reach 64.2 million by 2030. Currently, many charging piles on the market are installed in basements with weak wireless signals. Other communication methods have high costs and unstable signals. PLC communication technology uses power line transmission, which has the advantages of no wiring costs and stable and reliable communication.

Reference:

1. Puhua Youce. Development overview of the power Internet of Things industry and market segment analysis, development opportunities and challenges, and market size

2. Jiweiwang. The power Internet of Things market has sufficient orders, and Lihewei’s net profit in the first three quarters is expected to increase by more than 55.65%

3.Huawei.PLC-IOT Industry White Paper

4.2023 Lihe Micro Semi-Annual Report, 2023 Neusoft Carrier Semi-Annual Report

The above is the detailed content of There are sufficient orders for the power Internet of Things, and the growth trend of the PLC communication market is gratifying-IOTE Internet of Things Exhibition. For more information, please follow other related articles on the PHP Chinese website!

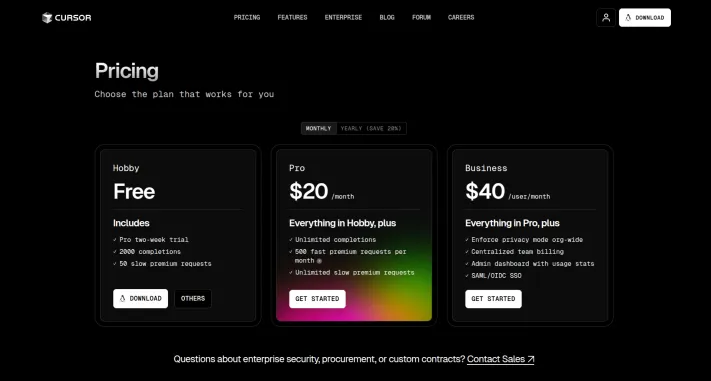

I Tried Vibe Coding with Cursor AI and It's Amazing!Mar 20, 2025 pm 03:34 PM

I Tried Vibe Coding with Cursor AI and It's Amazing!Mar 20, 2025 pm 03:34 PMVibe coding is reshaping the world of software development by letting us create applications using natural language instead of endless lines of code. Inspired by visionaries like Andrej Karpathy, this innovative approach lets dev

How to Use DALL-E 3: Tips, Examples, and FeaturesMar 09, 2025 pm 01:00 PM

How to Use DALL-E 3: Tips, Examples, and FeaturesMar 09, 2025 pm 01:00 PMDALL-E 3: A Generative AI Image Creation Tool Generative AI is revolutionizing content creation, and DALL-E 3, OpenAI's latest image generation model, is at the forefront. Released in October 2023, it builds upon its predecessors, DALL-E and DALL-E 2

Top 5 GenAI Launches of February 2025: GPT-4.5, Grok-3 & More!Mar 22, 2025 am 10:58 AM

Top 5 GenAI Launches of February 2025: GPT-4.5, Grok-3 & More!Mar 22, 2025 am 10:58 AMFebruary 2025 has been yet another game-changing month for generative AI, bringing us some of the most anticipated model upgrades and groundbreaking new features. From xAI’s Grok 3 and Anthropic’s Claude 3.7 Sonnet, to OpenAI’s G

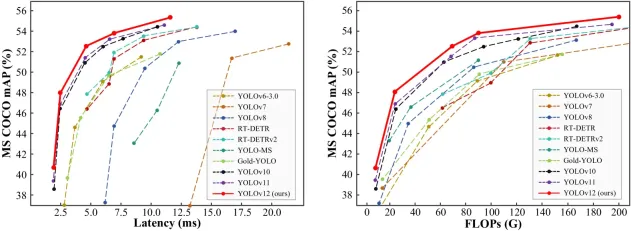

How to Use YOLO v12 for Object Detection?Mar 22, 2025 am 11:07 AM

How to Use YOLO v12 for Object Detection?Mar 22, 2025 am 11:07 AMYOLO (You Only Look Once) has been a leading real-time object detection framework, with each iteration improving upon the previous versions. The latest version YOLO v12 introduces advancements that significantly enhance accuracy

Elon Musk & Sam Altman Clash over $500 Billion Stargate ProjectMar 08, 2025 am 11:15 AM

Elon Musk & Sam Altman Clash over $500 Billion Stargate ProjectMar 08, 2025 am 11:15 AMThe $500 billion Stargate AI project, backed by tech giants like OpenAI, SoftBank, Oracle, and Nvidia, and supported by the U.S. government, aims to solidify American AI leadership. This ambitious undertaking promises a future shaped by AI advanceme

Sora vs Veo 2: Which One Creates More Realistic Videos?Mar 10, 2025 pm 12:22 PM

Sora vs Veo 2: Which One Creates More Realistic Videos?Mar 10, 2025 pm 12:22 PMGoogle's Veo 2 and OpenAI's Sora: Which AI video generator reigns supreme? Both platforms generate impressive AI videos, but their strengths lie in different areas. This comparison, using various prompts, reveals which tool best suits your needs. T

Google's GenCast: Weather Forecasting With GenCast Mini DemoMar 16, 2025 pm 01:46 PM

Google's GenCast: Weather Forecasting With GenCast Mini DemoMar 16, 2025 pm 01:46 PMGoogle DeepMind's GenCast: A Revolutionary AI for Weather Forecasting Weather forecasting has undergone a dramatic transformation, moving from rudimentary observations to sophisticated AI-powered predictions. Google DeepMind's GenCast, a groundbreak

Which AI is better than ChatGPT?Mar 18, 2025 pm 06:05 PM

Which AI is better than ChatGPT?Mar 18, 2025 pm 06:05 PMThe article discusses AI models surpassing ChatGPT, like LaMDA, LLaMA, and Grok, highlighting their advantages in accuracy, understanding, and industry impact.(159 characters)

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

SublimeText3 English version

Recommended: Win version, supports code prompts!

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment