Technology peripherals

Technology peripherals AI

AI The application of AI technology in Ant Group's insurance business: innovating insurance services and bringing new experiences

The application of AI technology in Ant Group's insurance business: innovating insurance services and bringing new experiencesThe application of AI technology in Ant Group's insurance business: innovating insurance services and bringing new experiences

The importance of the insurance industry to social people’s livelihood and the national economy is self-evident. As a risk management tool, insurance provides protection and welfare for the people and promotes economic stability and sustainable development. In the context of the new era, the insurance industry is facing new opportunities and challenges, and needs continuous innovation and transformation to adapt to changes in social needs and adjustments to the economic structure

In recent years, China's insurance technology has developed vigorously. Through innovative business models and advanced technological means, we actively promote the digital and intelligent transformation of the insurance industry. The goal of insurtech is to improve the convenience, personalization and intelligence of insurance services and change the face of the traditional insurance industry at an unprecedented speed. This development trend has injected new vitality into the insurance industry and made insurance products closer to the actual needs of the people. Through the application of new technologies such as the Internet, cloud computing, and artificial intelligence, insurance technology has achieved remarkable results in sales, services, risk control, underwriting, claims, etc., bringing new development opportunities and experience innovation to the insurance industry

At the 2023 China International Fair for Trade in Services, Sun Zhenxing, chief technology officer of Ant Group’s insurance business group, attended and delivered a speech titled “AI New Technology Reshapes Insurance Services and Brings New Experience to the Industry.” He introduced in detail how the Ant Insurance platform uses artificial intelligence technology to reshape insurance services and bring a new experience to the industry in four aspects: product selection, customer service, risk control and claims

Sun Zhenxing introduced that around Product selection, service, risk control, and claims settlement, AI technology is playing a key role in the entire insurance service chain. Especially since 2022, generative AI technology has made many breakthroughs, and Ant Insurance has also fully explored the field of insurance technology. Practice and explore the application paradigm of generative large models in vertical fields. Sun Zhenxing believes that "Generative large models are good at cognition, understanding, reasoning, and control of language, and have extensive general knowledge, but in How to achieve safety, controllability and accuracy in the vertical professional field is extremely challenging, and this is exactly what the insurance industry must solve."

"In the user purchase stage, how can Provide a new experience of clearly understanding insurance products." - Insurance products usually have multiple clauses, with a total of dozens of pages, and they also contain a lot of medical professional terms. For ordinary people, it is difficult to fully understand these clauses. Quite difficult. At the same time, there are a large number of highly homogeneous insurance products on the market, making users face huge challenges in the selection process.

To this end, Ant Group has launched the Jinxuan AIMM model, which aims to be user-centered and help screen high-quality insurance products across the industry so that users can choose to purchase with confidence. This involves two most critical links: First, how to automatically and intelligently conduct structured analysis of the terms of tens of thousands of insurance products across the market. In the past, traditional natural language processing methods faced huge challenges, but today, the era of large models makes this possible. Sun Zhenxing said, "After more than half a year of exploration, our analysis and extraction capabilities have covered 98 standard responsibilities, 189 responsibility attributes, and 851 factors, with an accuracy of more than 95%. Based on this, we have built the industry's most advanced A complete product information database.”

Second, how to conduct automatic quantitative evaluation. Based on the product information database, Ant Insurance combined the input of actuaries and industry experts to define a multi-factor quantitative model covering five dimensions such as insurance threshold, coverage coverage, cost performance, insurance company operation, and claims experience, to achieve comprehensive analysis of the entire product database. Automatic evaluation and quantification. At present, the AIMM Golden Selection model has covered the five major tracks and 55 subdivided tracks in the insurance industry, providing users with a full range of help in purchasing insurance products and reducing purchase costs.

# "In terms of consulting services, how to bring a new experience that is available to everyone, online in real time, and for thousands of people." —— Traditional manual services This method has the problem of limited coverage and inability to be online in real time. At the same time, the traditional technical solutions used in the past have also reached their bottlenecks. However, new AIGC generative technologies offer opportunities for breakthroughs. Despite this, it is not realistic to directly use this technology in the insurance industry, and it will face many challenges such as authenticity and rigor. In the process of practical exploration, the key to current application is to deconstruct the tasks in the vertical field.

"The three most critical things: The first is to achieve accurate user insights, which can be achieved through multi-modal methods, combining static portraits and dynamic behaviors to improve the understanding of user personality;The second is intelligent dialogue, which is deconstructed into multiple tasks such as intention understanding, entity extraction, answer production, reasoning and expression, etc., giving full play to the advantages of AIGC in language processing tasks; The third is knowledge expertise With power, the answers to insurance professional questions must be accurate, compliant, and controllable," Sun Zhenxing pointed out, "Our approach is to use the two-wheel drive of domain knowledge graph and AIGC to build a full product channel for the industry. The knowledge map currently covers 1,000 products on the platform, covering 40,000 diseases, and the total knowledge reaches 500 million levels. Based on this, the professional capabilities of insurance intelligent consultants have basically reached expert-level service levels, and each user is equipped with An expert intelligent insurance consultant becomes possible." "How to make risk control both universal and beneficial, helping financial institutions continue to expand service boundaries and allow more users to enjoy a higher-quality service experience." — — Risk control is the core competency in the financial industry, but today some users with sub-healthy or sick conditions cannot enjoy the services of professional institutions. They may be rudely rejected when applying for insurance, and some users have insufficient insurance coverage. question. On the premise of ensuring that data does not leave the domain and is compliant and secure, Ant Insurance is based on Ant Group's privacy computing technology and big data layered risk control capabilities to maximize the value of data, helping insurance companies better provide services to users and achieve inclusive benefits. experience.

Sun Zhenxing introduced, “Ant Insurance has built a hierarchical risk control model and an adverse selection model to provide differentiated intelligent health warning solutions for people who were originally violently intercepted, helping as many users as possible to buy the best products. Matching insurance products. With the support of this set of solutions,

helps cooperative insurance companies reduce the risk control interception rate by 50% on the premise of reducing risks by 10%, which means that people who were originally unable to enjoy insurance services are experiencing differentiated health risks. With the help of advertisements, half of them can buy suitable insurance products.”Pet insurance is an emerging industry, and risk control capabilities are also a necessary prerequisite for scale. To achieve scale, the problem of pet identification must first be solved. After continuous exploration, Ant Bao successfully developed pet identification technology. This is not an easy task, and there are two main challenges: first, how to obtain high-quality photos of pet nose prints; second, how to achieve high-accuracy identification. In order to meet these challenges, a pet camera with an integrated end-side intelligent engine has been launched, which can detect and capture photos in real time on the end-side, greatly reducing the cost of photography for pet owners. In terms of recognition, a biometric model based on metric learning and DAM feature weighting is used, and the current accuracy of cats and dogs has reached 99.9%. This technology makes it possible to scale pet insurance.

“How to be user-centered and provide a full-cycle, companion service experience.”——

“How to be user-centered and provide a full-cycle, companion service experience.”——

Claims settlement service is an important post-warranty service. In the past, claims settlement was difficult, faced with long cycles and various uncertainties. When users really need to make a claim, they often don’t know how to make a claim, who to contact, and what materials to submit. It is also difficult to understand in a timely manner what problems may occur during the long waiting process after submission. In order to solve these problems, Ant Insurance and industry partners have jointly created a safe compensation service. Help users quickly upload claim materials online and give clear instructions. At the same time, Ant Insurance has built an intelligent claim verification auxiliary system on the insurance company's side to help insurance companies quickly review, reduce costs and increase efficiency. Sun Zhenxing said, "

2-day fast compensation is not the end. As technology continues to evolve, we believe we should strive for greater excellence and continue to make breakthroughs in experience and efficiency.We have developed a multi-modal generation method in the field of claims Extraction model has made new breakthroughs in the extraction of claim settlement materials. For the extraction of difficult materials such as complex materials, long texts, occlusions/blurs, etc., the case-level accuracy rate has exceeded 95%. This provides a comprehensive automation for future claims settlement. Based on the foundation, we believe that the timeliness experience of claims settlement will also be further improved." At the same time, at the 2023 China International Trade in Services Fair, the

intelligent claims assistance system applied by Ant Insurance Agency Co., Ltd. won the " Typical cases of artificial intelligence integrated development and safety application in 2023."It is reported that. Ant Insurance was established in September 2016 and is managed and operated by Ant Insurance Agency Co., Ltd. Since its launch, it has reached cooperation with 90 insurance companies and has served more than 600 million users. The platform's products cover health insurance, accident insurance, pension and education funds, property insurance, pet insurance and other categories, and provide "Ant Insurance Premium Selection", "Insurance Payment Xiaobao", "Ant Insurance Savings Care Package", and "Ant Security Care Insurance Compensation" and other high-quality insurance services. Users can search for “Ant Insurance” on the Alipay APP to view related insurance products and services. Ant Insurance Platform is committed to becoming the most trusted and favorite insurance service platform for users and institutions through the power of technology and openness. It hopes to continue to use AI technology to bring high-quality services and experiences to users and institutions.

The above is the detailed content of The application of AI technology in Ant Group's insurance business: innovating insurance services and bringing new experiences. For more information, please follow other related articles on the PHP Chinese website!

How to Run LLM Locally Using LM Studio? - Analytics VidhyaApr 19, 2025 am 11:38 AM

How to Run LLM Locally Using LM Studio? - Analytics VidhyaApr 19, 2025 am 11:38 AMRunning large language models at home with ease: LM Studio User Guide In recent years, advances in software and hardware have made it possible to run large language models (LLMs) on personal computers. LM Studio is an excellent tool to make this process easy and convenient. This article will dive into how to run LLM locally using LM Studio, covering key steps, potential challenges, and the benefits of having LLM locally. Whether you are a tech enthusiast or are curious about the latest AI technologies, this guide will provide valuable insights and practical tips. Let's get started! Overview Understand the basic requirements for running LLM locally. Set up LM Studi on your computer

Guy Peri Helps Flavor McCormick's Future Through Data TransformationApr 19, 2025 am 11:35 AM

Guy Peri Helps Flavor McCormick's Future Through Data TransformationApr 19, 2025 am 11:35 AMGuy Peri is McCormick’s Chief Information and Digital Officer. Though only seven months into his role, Peri is rapidly advancing a comprehensive transformation of the company’s digital capabilities. His career-long focus on data and analytics informs

What is the Chain of Emotion in Prompt Engineering? - Analytics VidhyaApr 19, 2025 am 11:33 AM

What is the Chain of Emotion in Prompt Engineering? - Analytics VidhyaApr 19, 2025 am 11:33 AMIntroduction Artificial intelligence (AI) is evolving to understand not just words, but also emotions, responding with a human touch. This sophisticated interaction is crucial in the rapidly advancing field of AI and natural language processing. Th

12 Best AI Tools for Data Science Workflow - Analytics VidhyaApr 19, 2025 am 11:31 AM

12 Best AI Tools for Data Science Workflow - Analytics VidhyaApr 19, 2025 am 11:31 AMIntroduction In today's data-centric world, leveraging advanced AI technologies is crucial for businesses seeking a competitive edge and enhanced efficiency. A range of powerful tools empowers data scientists, analysts, and developers to build, depl

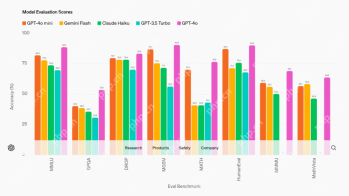

AV Byte: OpenAI's GPT-4o Mini and Other AI InnovationsApr 19, 2025 am 11:30 AM

AV Byte: OpenAI's GPT-4o Mini and Other AI InnovationsApr 19, 2025 am 11:30 AMThis week's AI landscape exploded with groundbreaking releases from industry giants like OpenAI, Mistral AI, NVIDIA, DeepSeek, and Hugging Face. These new models promise increased power, affordability, and accessibility, fueled by advancements in tr

Perplexity's Android App Is Infested With Security Flaws, Report FindsApr 19, 2025 am 11:24 AM

Perplexity's Android App Is Infested With Security Flaws, Report FindsApr 19, 2025 am 11:24 AMBut the company’s Android app, which offers not only search capabilities but also acts as an AI assistant, is riddled with a host of security issues that could expose its users to data theft, account takeovers and impersonation attacks from malicious

Everyone's Getting Better At Using AI: Thoughts On Vibe CodingApr 19, 2025 am 11:17 AM

Everyone's Getting Better At Using AI: Thoughts On Vibe CodingApr 19, 2025 am 11:17 AMYou can look at what’s happening in conferences and at trade shows. You can ask engineers what they’re doing, or consult with a CEO. Everywhere you look, things are changing at breakneck speed. Engineers, and Non-Engineers What’s the difference be

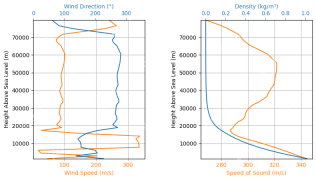

Rocket Launch Simulation and Analysis using RocketPy - Analytics VidhyaApr 19, 2025 am 11:12 AM

Rocket Launch Simulation and Analysis using RocketPy - Analytics VidhyaApr 19, 2025 am 11:12 AMSimulate Rocket Launches with RocketPy: A Comprehensive Guide This article guides you through simulating high-power rocket launches using RocketPy, a powerful Python library. We'll cover everything from defining rocket components to analyzing simula

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SublimeText3 Linux new version

SublimeText3 Linux latest version

Dreamweaver Mac version

Visual web development tools

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

SublimeText3 Mac version

God-level code editing software (SublimeText3)