Technology peripherals

Technology peripherals It Industry

It Industry Investors talk about SpaceX's near-monopoly: it's not conducive to industry development

Investors talk about SpaceX's near-monopoly: it's not conducive to industry developmentNews on September 13, an investment banker from the international investment bank Lazard issued a warning about SpaceX’s dominance in the rocket launch market, saying that the entire industry needs more competitors to try Shoot More Rockets

Vikram Nidamaluri is general manager of Lazard's Telecommunications, Media and Entertainment division. He told a panel discussion at World Satellite Business Week that the problem was huge

Nidamaruri added: “Overall, the existence of a completely dominant launch services provider may have a significant impact on The business outlook for the entire industry is unfavorable." "No one wants a monopoly to kill any part of the value chain. There are obviously other companies working hard to increase production capacity, but I don't think their plans are moving fast enough."

NIDA Maruri's comments also reflect concerns expressed by other aerospace industry insiders this year about SpaceX's monopoly on the rocket launch market. Rocket launches are a key link and potential bottleneck in putting valuable satellites, spacecraft and astronauts into orbit. While several other U.S. companies are working to develop products to compete with SpaceX's main Falcon rocket, program delays mean rivals face huge challenges in launching a new generation of operational rockets.

A few days ago, SpaceX just completed its 63rd rocket launch mission in 2023. The company has broken the record of 61 launch missions completed last year, and is still making great strides at an average of one launch every four days. . Looking at the global rocket launch market, SpaceX leads the way in the number of launches and the number of spacecraft carried every quarter.

SpaceX Vice President Tom Ochinero echoed Nidamaruri’s concerns during a separate panel discussion on Monday about whether the company would exist with Starlink satellite internet service The competition to send satellites into space was explained.

"We've proven that, yes, we're going to do it," Ochinero said. “We are a launch company first, and we provide launch services.”

Although Starlink is SpaceX’s “large internal customer,” Ochinero also said, “Sometimes we will use our own launch services based on demand. Satellite launches were moved aside to provide launch services to competitors and customers." Recently, SpaceX signed an agreement with Canadian operator Telesat to launch 14 satellites for its Lightspeed Internet satellite into orbit. Occhinello said that SpaceX has previously launched satellites for other Starlink competitors such as OneWeb, Viasat and EchoStar. "I am not particularly worried about this. We are here to launch rockets." Occhinero said Nairo said

Tory Bruno, CEO of United Launch Alliance (ULA), pushed back during a panel discussion on the notion that SpaceX has complete control of the launch market. As the second-largest rocket launch company in the U.S. market, ULA is a competitor of SpaceX. ULA has only completed two rocket launches this year and is working hard to prepare for the first launch of its new generation Vulcan rocket in the next few months

Bruno said: "I appreciate that SpaceX will be a "mercy company" "The perspective of a monopoly, but I don't think you are a monopoly, and I don't think our plan is to make you a monopoly."

Advertising Statement: External jump links contained in the article (Including but not limited to hyperlinks, QR codes, passwords, etc.), used to convey more information and save selection time. The results are for reference only. All articles on this site include this statement.

The above is the detailed content of Investors talk about SpaceX's near-monopoly: it's not conducive to industry development. For more information, please follow other related articles on the PHP Chinese website!

Starlink Mini priced at $599 as SpaceX makes weight specs official and offers Mini Roam plan for $30/monthJun 21, 2024 am 06:35 AM

Starlink Mini priced at $599 as SpaceX makes weight specs official and offers Mini Roam plan for $30/monthJun 21, 2024 am 06:35 AMSpaceX is starting a limited trial of its new and compact Starlink Mini dish for select satellite Internet subscribers in the US. The Starlink Mini kit price, however, is now higher than the Standard Kit. SpaceX is running a promo on the Starlink Sta

$299 Starlink Mini dish with built-in router and MediaTek Wi-Fi 6 chip will fit in a backpackJun 19, 2024 am 06:44 AM

$299 Starlink Mini dish with built-in router and MediaTek Wi-Fi 6 chip will fit in a backpackJun 19, 2024 am 06:44 AMAfter pictures of a new and mysterious Starlink Mini dish with integrated router emerged, Elon Musk confirmed its existence and said that it will cost just "about half the price of the standard dish to buy." Elon even bragged that he is cur

SpaceX prices Starlink Mini dish at $599 as it makes weight specs official and offers Mini Roam plan for $30/monthJun 20, 2024 pm 09:40 PM

SpaceX prices Starlink Mini dish at $599 as it makes weight specs official and offers Mini Roam plan for $30/monthJun 20, 2024 pm 09:40 PMSpaceX is starting a limited trial of its new and compact Starlink Mini dish for select satellite Internet subscribers in the US. The Starlink Mini kit price, however, is now higher than the Standard Kit. SpaceX is running a promo on the Starlink Sta

Walmart starts selling Starlink dishes at 17% discount on top of $200 regional credit offer for new usersJun 22, 2024 am 09:30 AM

Walmart starts selling Starlink dishes at 17% discount on top of $200 regional credit offer for new usersJun 22, 2024 am 09:30 AMAfter Home Depot, Target, Costco, and Best Buy, it is now the turn of Walmart to start selling the Starlink Standard Kit. SpaceX is trying to expand Starlink's customer base, and the appearance of its dish at the stores of the retail juggernaut will

SpaceX 星舰基地再添新塔,距马斯克圆梦火星更近一步Aug 23, 2024 am 07:33 AM

SpaceX 星舰基地再添新塔,距马斯克圆梦火星更近一步Aug 23, 2024 am 07:33 AM本站8月22日消息,SpaceX官方宣布,其星际基地(Starbase,即南得克萨斯发射场)第二座星舰发射塔现已完成封顶(完成塔身的全部堆叠)工作,这一过程仅用了41天。fenyeSpaceX还表示,他们正准备在未来一个月内相继发射的两艘载人龙飞船,分别执行SpaceX的第14和第15次载人任务,也就是“北极星黎明”商业航天任务和NASA的Crew-9任务。其中,“北极星黎明”任务将完成人类首次商业太空行走,并打破近地轨道载人任务的最高轨道高度记录,详情可见本站此前报道。此外,如果波音无法通过自

Elon Musk pegs the first human flight to Mars for 2028 with a colony to follow in 20 yearsSep 08, 2024 pm 09:30 PM

Elon Musk pegs the first human flight to Mars for 2028 with a colony to follow in 20 yearsSep 08, 2024 pm 09:30 PMWhile talking about thefirst reusable spaceship achievement, and the fact that its tonnage costs for a trip to Mars need to be much lower, Elon Musk casually mentioned that he envisions the first manned Starship flight to Mars will happen in 2028. Fi

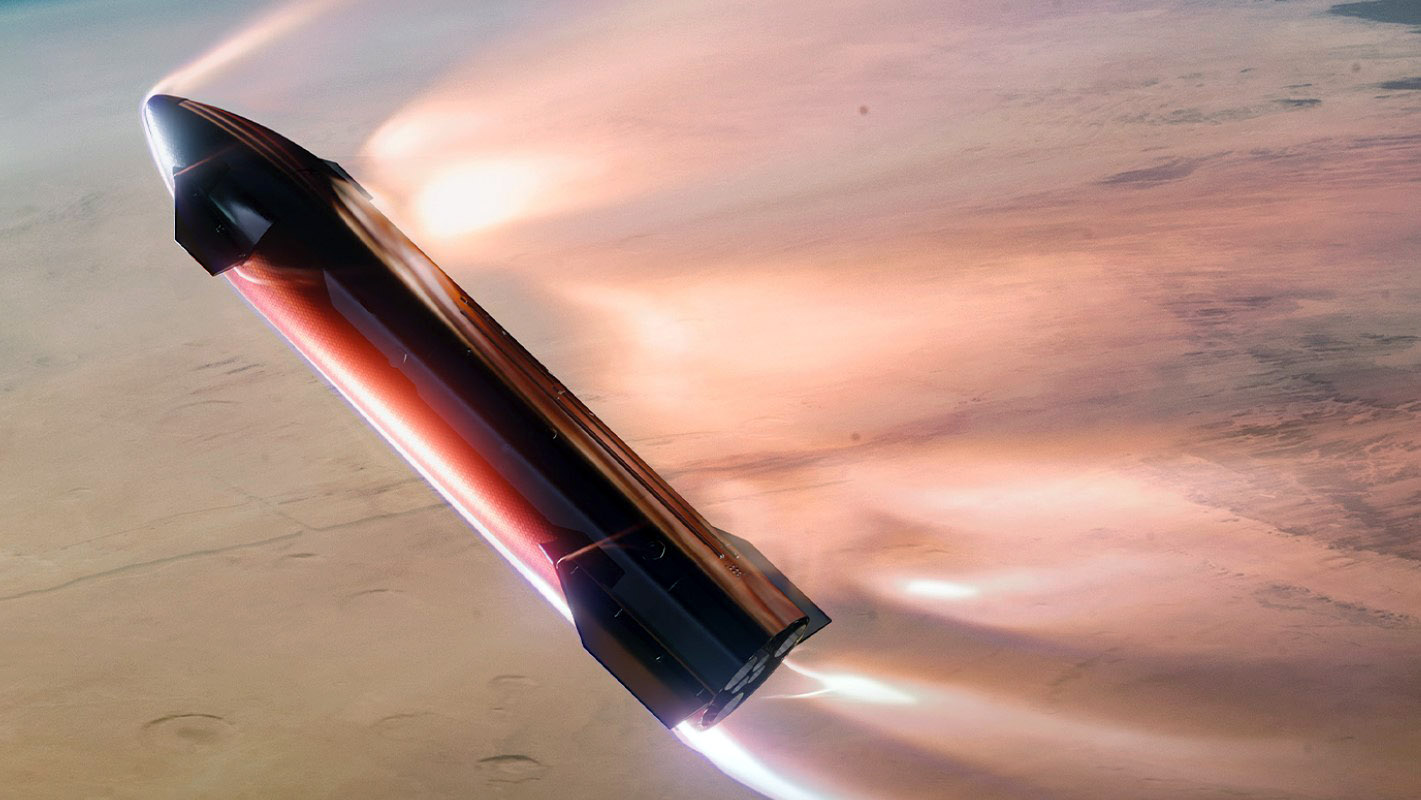

四试告捷,SpaceX 星舰史上首次完成试飞任务Jun 11, 2024 pm 01:15 PM

四试告捷,SpaceX 星舰史上首次完成试飞任务Jun 11, 2024 pm 01:15 PM本站6月6日消息,虽然信号中断、机身严重受损,但SpaceX官方确认星舰已经成功在印度洋完美软着陆,解锁新的里程碑。北京时间6月6日晚20:50左右,SpaceX星舰成功,开启第四次试飞任务,随后按计划与超重型助推器完成分离。发射约9分钟后,星舰成功进入预定轨道。随后,B11超重型助推器已经成功溅落在墨西哥湾海域中。发射约47分钟后,星舰开始重新进入大气层,相比于在这一阶段表现并不完美的第三次试飞,本次星舰选择了相对平缓的弹道,利用更多的时间使得速度缓缓下降,以减少进入高密度空气时所受到的剧烈冲

美国联邦航空管理局最快下个月批准 SpaceX 星舰发射Sep 18, 2023 pm 04:17 PM

美国联邦航空管理局最快下个月批准 SpaceX 星舰发射Sep 18, 2023 pm 04:17 PM本站9月14日消息,美国联邦航空管理局(FAA)代理局长表示,该机构最早将于下个月批准SpaceXStarship的发射许可证。“我们正在与他们进行良好的合作和讨论。我们的团队正在共同努力,我们乐观地认为下个月的某个时候可以做到,”FAA代理FAA署长波莉-特罗滕伯格在接受记者采访时说道。SpaceX还需要获得美国鱼类和野生动物管理局(USFWS)的环境批准,这是除了其他要求之外的一项必要条件本站此前报道,FAA上周对SpaceX4月的Starship火箭测试发射进行了技术调查,并表示该公司需纠

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

WebStorm Mac version

Useful JavaScript development tools

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

Atom editor mac version download

The most popular open source editor