Technology peripherals

Technology peripherals AI

AI UBTECH enters the Hong Kong Stock Exchange and is expected to become the first humanoid robot stock

UBTECH enters the Hong Kong Stock Exchange and is expected to become the first humanoid robot stockUBTECH enters the Hong Kong Stock Exchange and is expected to become the first humanoid robot stock

The rewritten content is as follows: Produced by Sihai, Node Business Group

Making a robot is a challenging and great thing, but making a humanoid robot is even more so. Humanoid robots are called the ultimate form of artificial intelligence. In 2008, Zhou Jian, as an automation student, saw a humanoid robot in Japan and was deeply impressed by it. After returning to China, he decided to found UBTECH and began working on the development of China's humanoid robots in 2012

Recently, UBTECH has updated its Hong Kong IPO prospectus, and the China Securities Regulatory Commission has confirmed UBTECH’s overseas issuance and listing filing information. This means that UBTECH has met the prerequisites for the Hong Kong stock listing hearing and is expected to become the first listed company in the field of humanoid robots in China. According to the Frost & Sullivan Report, UBTECH is a leading company in the country in many aspects. Once successfully listed, UBTECH will usher in a new stage of development

01 Humanoid robot market, ice and fire coexist

According to incomplete statistics, UBTECH has completed at least 9 rounds of financing since its establishment, including the participation of well-known institutions such as Tencent Investment, SoftBank Vision, Qiming Venture Partners, CDH Investment and Zhengxuan Investment. In terms of valuation, as early as May 2018, when it completed a US$820 million Series C financing, the company's valuation had already reached US$5 billion

Recently, a talented young man, Zhihui Jun, launched a humanoid robot called "Expedition A1". This product is mainly aimed at factory scenes, but it is also hoped to enter home kitchens in the future. Prior to this, Tesla and Xiaomi also entered the humanoid robot industry, launching products named "Optimus Prime" and "Iron Egg" respectively

Compared with the enthusiasm in the market, the current situation of the industry is cold, and almost no companies can achieve profitability.

According to the data in the prospectus, UBTECH’s revenue in the first nine months of fiscal year 2020 to fiscal year 2022 was 740 million yuan, 820 million yuan, and 530 million yuan respectively, and its net losses were 710 million yuan and 530 million yuan, respectively. 920 million yuan and 780 million yuan (the above amounts are all in RMB). The scale of losses not only exceeds the scale of revenue, but also expands for several consecutive years

Node Finance noted that this is mainly due to maintaining high-intensity R&D investment for a long time. UBTECH's R&D expenditures during the same period were 430 million yuan, 520 million yuan, and 320 million yuan respectively. In other words, for every dollar earned, UBTECH will invest half of it in research and development. This reflects the cruel side of the humanoid robot industry, that is, the entry threshold for the industry is high, and once you get on board, it is difficult to avoid spending money on research and development and investment.

Commercialization: diversified development, opening up more possibilities

In terms of commercialization, UBTECH has experienced a transformation from being oriented to the consumer market to focusing on both the consumer market and the enterprise market. The company's original intention is to bring robots into thousands of households to provide services to families, but because the industry is still immature, this wish is difficult to realize. Therefore, UBTECH has opened up the enterprise-level market based on humanoid robot technology.

It is worth noting that education is an important application field for UBTECH humanoid robots, whether it is the consumer market or the enterprise market.

Use scenarios in the enterprise market include commercial, health care and education. In the commercial field, mainly for customers with public service attributes, the company has developed products such as food delivery robots, guide robots, disinfection robots and patrol robots. The health care market focuses on customers with special needs such as hospitals and nursing homes. Its products include mobility robots, auxiliary walking robots, etc.

In the field of education, our customers are mainly universities. Currently we have launched specialized education solutions

In the education direction of the consumer market, UBTECH focuses on family companion products, such as "Wukong" and Jimu robots. The former can help students complete their studies through voice interaction.

In addition, UBTECH has also released dictionary pens, AI calligraphy pens and sweeping and mopping integrated robots

After sorting it out, can be seen that UBTECH’s current commercialization strategy is to pay equal attention to the enterprise market and the consumer market, and is also laying out the home market. It should be noted that the company has deployed sweeping robot products, which shows that the company's future layout in the consumer market is not just education. Home cleaning may become the company's future focus. Currently, enterprise-level robotic solutions are the company’s main source of revenue. According to different application scenarios, it mainly includes education and logistics. Among them, the education field accounts for a relatively high proportion of revenue, reaching 67.7% in the first nine months of fiscal year 2022. As of September 30, 2022, UBTECH’s robot sales have reached 500,000 units, and it has nearly 1,000 corporate customers The key for the company to open up the market is to adopt a market strategy that pays equal attention to the consumer market and the enterprise market. At the same time, controlling costs is also crucial Like VR and other advanced technologies with a "future" color, products in the robotics industry are inseparable from manufacturing, so cost is a key factor that determines the competitiveness of enterprises. According to Frost & Sullivan, the company is the first company in the world to reduce the cost of a bipedal life-size robot to less than $100,000. Taking the official flagship store of UBTECH Taobao as an example, the maximum price of commercial robot products is 50,000 yuan, and the maximum price of household robot products is 2,499 yuan How competitive is it? The most well-known humanoid robot is Atlas, a subsidiary of Boston Dynamics. Boston Dynamics has released several Atlas parkour videos, which attracted high attention every time. This also raises a problem that You must choose to face, that is, industry competition. According to data from multiple institutions, the robot market shows broad prospects, but no real leading company has yet emerged According to the China Electronics Society, the global robot market is expected to exceed US$65 billion in 2024. A Goldman Sachs research report pointed out that within 10-15 years, humanoid robots can achieve a market size of at least US$6 billion, accounting for 4% of the U.S. manufacturing labor shortage gap by 2030, and accounting for 1% of the global elderly population by 2035. 2% of nursing needs. It is expected that by 2035, under the blue ocean market scenario, the market can reach 154 billion U.S. dollars (approximately 1,108.8 billion yuan at the current exchange rate), which is close to one-third of the global electric vehicle market and the global smartphone market as of 2021. one. Such a great prospect has attracted many players to participate. Currently, participants in the industry are mainly divided into two categories. One type is start-ups like Boston Dynamics, UBTECH and Engineered Arts, and the other type is new businesses launched by large companies, such as Tesla’s “Optimus Prime” If we only look at the domestic market, UBTECH is at the forefront of the industry in multiple dimensions. According to Frost & Sullivan, UBTECH Walker Robot is the first commercial bipedal life-size humanoid robot in China; UBTECH Technology is also the first company in China to launch a commercial bipedal life-size humanoid robot; it is the first company in China to launch a commercial bipedal life-size humanoid robot. A company that realizes large-scale commercialization of small humanoid robots; it is the first company in the world to reduce the cost of bipedal life-size robots to less than US$100,000. Node Finance exclusively contacted the early investor of Youbixuan, Helen Shen, the founding partner of Sirius Capital, who had bet on Youbixuan three times. "Zhou Jian originally started a business and was quite successful. Later, because of his persistence in robots, he invested all the money he earned into new projects. He has faith and practical ability." Helen Shen said. Talking about the profitability problem in the robot industry, Helen Shen believes that this is mainly due to high investment in research and development. “To seize the time window, companies have to maintain high-intensity R&D investment in the early stage of development.” Another reason why it is currently difficult for UBTECH to make a profit is that, in Zhou Jian’s view, only humanoid robots like Walker (a large humanoid robot developed by UBTECH) are the ultimate. “One of the goals of UBTECH’s listing is to accumulate enough ammunition to attack the ultimate form,” Helen Shen told Node Finance. There is an old saying in China, misfortune lies on the back of good fortune, and good fortune lies on the back of misfortune. High-intensity investment in R&D makes it difficult for companies to make profits, but it also allows the company to accumulate technological advantages. Helen Shen said that there are two types of companies that are expected to emerge in the industry in the future. One type is some start-up companies that have accumulated certain advantages and seized the time window. The advantages they have accumulated cannot be caught up in a short time; the other type is those with the participation of large companies, including large companies doing their own work and Major manufacturers are deeply involved in both models. Node Finance Statement: This article is for reference only. The information and opinions stated in the article do not constitute any investment advice. Node Finance is not responsible for any actions taken based on this article

The above is the detailed content of UBTECH enters the Hong Kong Stock Exchange and is expected to become the first humanoid robot stock. For more information, please follow other related articles on the PHP Chinese website!

How to Run LLM Locally Using LM Studio? - Analytics VidhyaApr 19, 2025 am 11:38 AM

How to Run LLM Locally Using LM Studio? - Analytics VidhyaApr 19, 2025 am 11:38 AMRunning large language models at home with ease: LM Studio User Guide In recent years, advances in software and hardware have made it possible to run large language models (LLMs) on personal computers. LM Studio is an excellent tool to make this process easy and convenient. This article will dive into how to run LLM locally using LM Studio, covering key steps, potential challenges, and the benefits of having LLM locally. Whether you are a tech enthusiast or are curious about the latest AI technologies, this guide will provide valuable insights and practical tips. Let's get started! Overview Understand the basic requirements for running LLM locally. Set up LM Studi on your computer

Guy Peri Helps Flavor McCormick's Future Through Data TransformationApr 19, 2025 am 11:35 AM

Guy Peri Helps Flavor McCormick's Future Through Data TransformationApr 19, 2025 am 11:35 AMGuy Peri is McCormick’s Chief Information and Digital Officer. Though only seven months into his role, Peri is rapidly advancing a comprehensive transformation of the company’s digital capabilities. His career-long focus on data and analytics informs

What is the Chain of Emotion in Prompt Engineering? - Analytics VidhyaApr 19, 2025 am 11:33 AM

What is the Chain of Emotion in Prompt Engineering? - Analytics VidhyaApr 19, 2025 am 11:33 AMIntroduction Artificial intelligence (AI) is evolving to understand not just words, but also emotions, responding with a human touch. This sophisticated interaction is crucial in the rapidly advancing field of AI and natural language processing. Th

12 Best AI Tools for Data Science Workflow - Analytics VidhyaApr 19, 2025 am 11:31 AM

12 Best AI Tools for Data Science Workflow - Analytics VidhyaApr 19, 2025 am 11:31 AMIntroduction In today's data-centric world, leveraging advanced AI technologies is crucial for businesses seeking a competitive edge and enhanced efficiency. A range of powerful tools empowers data scientists, analysts, and developers to build, depl

AV Byte: OpenAI's GPT-4o Mini and Other AI InnovationsApr 19, 2025 am 11:30 AM

AV Byte: OpenAI's GPT-4o Mini and Other AI InnovationsApr 19, 2025 am 11:30 AMThis week's AI landscape exploded with groundbreaking releases from industry giants like OpenAI, Mistral AI, NVIDIA, DeepSeek, and Hugging Face. These new models promise increased power, affordability, and accessibility, fueled by advancements in tr

Perplexity's Android App Is Infested With Security Flaws, Report FindsApr 19, 2025 am 11:24 AM

Perplexity's Android App Is Infested With Security Flaws, Report FindsApr 19, 2025 am 11:24 AMBut the company’s Android app, which offers not only search capabilities but also acts as an AI assistant, is riddled with a host of security issues that could expose its users to data theft, account takeovers and impersonation attacks from malicious

Everyone's Getting Better At Using AI: Thoughts On Vibe CodingApr 19, 2025 am 11:17 AM

Everyone's Getting Better At Using AI: Thoughts On Vibe CodingApr 19, 2025 am 11:17 AMYou can look at what’s happening in conferences and at trade shows. You can ask engineers what they’re doing, or consult with a CEO. Everywhere you look, things are changing at breakneck speed. Engineers, and Non-Engineers What’s the difference be

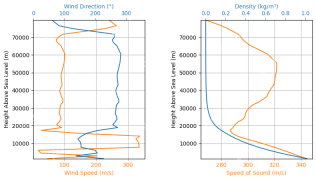

Rocket Launch Simulation and Analysis using RocketPy - Analytics VidhyaApr 19, 2025 am 11:12 AM

Rocket Launch Simulation and Analysis using RocketPy - Analytics VidhyaApr 19, 2025 am 11:12 AMSimulate Rocket Launches with RocketPy: A Comprehensive Guide This article guides you through simulating high-power rocket launches using RocketPy, a powerful Python library. We'll cover everything from defining rocket components to analyzing simula

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Atom editor mac version download

The most popular open source editor

SublimeText3 Linux new version

SublimeText3 Linux latest version

SublimeText3 Mac version

God-level code editing software (SublimeText3)

SublimeText3 English version

Recommended: Win version, supports code prompts!

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.