Technology peripherals

Technology peripherals AI

AI Ten billion quantitative private equity: Quantitative investment enters the era of 'intensive farming' and AI brings new changes to the industry

Ten billion quantitative private equity: Quantitative investment enters the era of 'intensive farming' and AI brings new changes to the industry

Economic Observer Network reporter Chen Shan From July 6th to 8th, the 2023 World Artificial Intelligence Conference (WAIC) was held in Shanghai. At the Data Intelligence Forum held on July 7, the founders of two tens of billions of quantitative private equity companies, Black Wing Asset and Kuande Investment, respectively delivered speeches on topics such as "Application of AI in the field of quantitative investment" and "Focus of future artificial intelligence development". views, and all believe that with the continuous development of artificial intelligence and the deepening of the integration of AI and investment, the field of quantitative investment will usher in new changes and opportunities.

Domestic quantitative investment has entered the era of "intensive farming", announced by Zou Yitian, founder of Black Wing Assets, at the forum, after more than ten years of development. Judging from the development history of the domestic quantitative investment industry, from 2012 to 2017, most quantitative managers still mainly used models such as OAS (value and momentum strategies); starting from 2017, a large number of quantitative managers began to use traditional machines Learning model; after 2020, many managers will turn to deep learning models.

According to reports, Black Wing Asset was established in 2014 and is a well-known quantitative veteran in China. The company’s investment categories cover stocks, commodities, and convertible bonds. It is a multi-asset and multi-strategy private equity fund. The company's investment process mainly relies on data and models, and it is a purely technology-driven company.

Zou Yitian said that at present, the company’s quantitative investment process mainly includes four links: data collection, factor mining, income prediction, and portfolio optimization, and AI technology is used in each link. The entire quantitative investment can obtain huge empowerment from the three elements of data, algorithm and computing power in the field of AI. In the past two years, the substantial increase in data volume has provided a steady stream of high-quality food for AI algorithms. At the same time, the substantial increase in excellent computing power has laid a foundation for companies to analyze massive data and use complex models.

In Zou Yitian’s view, after several generations of development, artificial intelligence has basically achieved initial perception capabilities, but its reasoning, interpretability, and cognitive abilities still need to be improved. He believes that the future development of artificial intelligence will focus on four aspects: large language models, reinforcement learning, knowledge graphs and explainable AI. He firmly believes that as artificial intelligence technology continues to advance, the productivity of various industries will rapidly increase, bringing a new revolution to the quantitative investment industry.

Talking about the application of AI in the field of quantitative investment, Feng Xin, co-founder of Kuande Investment, introduced at the above forum that the company mainly uses a combination of statistical learning and machine learning. He believes that there are many AI fields that will continue to be studied in depth in the quantitative field in the future, such as text processing, social network analysis, graph databases, knowledge graphs, etc.

Feng Xin also believes that with the improvement of quantitative management talents, quantitative investment companies have the potential to become an important force in the technology field. Private equity's high-tech investment is determined by the quantification of its own technological attributes and the iterative demand for technological updates. On the other hand, the cash flow structure of quantitative investment companies is different from that of technology research companies, and they can engage in research and layout with longer-term goals. In addition, quantitative investment companies have abundant talent resources and strong talent recruitment capabilities, so as to better serve technological exploration.

Feng Xin said that regarding the prospects of quantitative investment, we should not overexaggerate its role, nor should we overestimate its value. Rewritten sentence: We should focus on long-term development and establish long-term trust relationships with investors, while communicating effectively with regulatory agencies. In addition, quantitative investment should not be based on scale. The scale of management is indeed a very important number, but for the asset management industry, the assessment of capabilities is the most critical.

The above is the detailed content of Ten billion quantitative private equity: Quantitative investment enters the era of 'intensive farming' and AI brings new changes to the industry. For more information, please follow other related articles on the PHP Chinese website!

Let's Dance: Structured Movement To Fine-Tune Our Human Neural NetsApr 27, 2025 am 11:09 AM

Let's Dance: Structured Movement To Fine-Tune Our Human Neural NetsApr 27, 2025 am 11:09 AMScientists have extensively studied human and simpler neural networks (like those in C. elegans) to understand their functionality. However, a crucial question arises: how do we adapt our own neural networks to work effectively alongside novel AI s

New Google Leak Reveals Subscription Changes For Gemini AIApr 27, 2025 am 11:08 AM

New Google Leak Reveals Subscription Changes For Gemini AIApr 27, 2025 am 11:08 AMGoogle's Gemini Advanced: New Subscription Tiers on the Horizon Currently, accessing Gemini Advanced requires a $19.99/month Google One AI Premium plan. However, an Android Authority report hints at upcoming changes. Code within the latest Google P

How Data Analytics Acceleration Is Solving AI's Hidden BottleneckApr 27, 2025 am 11:07 AM

How Data Analytics Acceleration Is Solving AI's Hidden BottleneckApr 27, 2025 am 11:07 AMDespite the hype surrounding advanced AI capabilities, a significant challenge lurks within enterprise AI deployments: data processing bottlenecks. While CEOs celebrate AI advancements, engineers grapple with slow query times, overloaded pipelines, a

MarkItDown MCP Can Convert Any Document into Markdowns!Apr 27, 2025 am 09:47 AM

MarkItDown MCP Can Convert Any Document into Markdowns!Apr 27, 2025 am 09:47 AMHandling documents is no longer just about opening files in your AI projects, it’s about transforming chaos into clarity. Docs such as PDFs, PowerPoints, and Word flood our workflows in every shape and size. Retrieving structured

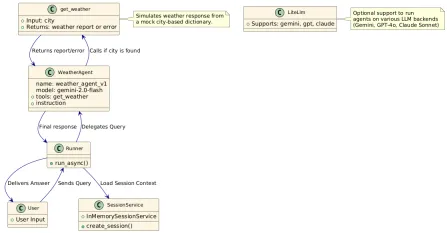

How to Use Google ADK for Building Agents? - Analytics VidhyaApr 27, 2025 am 09:42 AM

How to Use Google ADK for Building Agents? - Analytics VidhyaApr 27, 2025 am 09:42 AMHarness the power of Google's Agent Development Kit (ADK) to create intelligent agents with real-world capabilities! This tutorial guides you through building conversational agents using ADK, supporting various language models like Gemini and GPT. W

Use of SLM over LLM for Effective Problem Solving - Analytics VidhyaApr 27, 2025 am 09:27 AM

Use of SLM over LLM for Effective Problem Solving - Analytics VidhyaApr 27, 2025 am 09:27 AMsummary: Small Language Model (SLM) is designed for efficiency. They are better than the Large Language Model (LLM) in resource-deficient, real-time and privacy-sensitive environments. Best for focus-based tasks, especially where domain specificity, controllability, and interpretability are more important than general knowledge or creativity. SLMs are not a replacement for LLMs, but they are ideal when precision, speed and cost-effectiveness are critical. Technology helps us achieve more with fewer resources. It has always been a promoter, not a driver. From the steam engine era to the Internet bubble era, the power of technology lies in the extent to which it helps us solve problems. Artificial intelligence (AI) and more recently generative AI are no exception

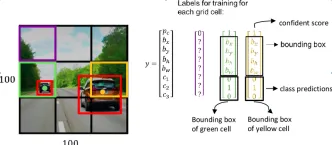

How to Use Google Gemini Models for Computer Vision Tasks? - Analytics VidhyaApr 27, 2025 am 09:26 AM

How to Use Google Gemini Models for Computer Vision Tasks? - Analytics VidhyaApr 27, 2025 am 09:26 AMHarness the Power of Google Gemini for Computer Vision: A Comprehensive Guide Google Gemini, a leading AI chatbot, extends its capabilities beyond conversation to encompass powerful computer vision functionalities. This guide details how to utilize

Gemini 2.0 Flash vs o4-mini: Can Google Do Better Than OpenAI?Apr 27, 2025 am 09:20 AM

Gemini 2.0 Flash vs o4-mini: Can Google Do Better Than OpenAI?Apr 27, 2025 am 09:20 AMThe AI landscape of 2025 is electrifying with the arrival of Google's Gemini 2.0 Flash and OpenAI's o4-mini. These cutting-edge models, launched weeks apart, boast comparable advanced features and impressive benchmark scores. This in-depth compariso

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Atom editor mac version download

The most popular open source editor

Dreamweaver CS6

Visual web development tools

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

Dreamweaver Mac version

Visual web development tools

SublimeText3 English version

Recommended: Win version, supports code prompts!