Technology peripherals

Technology peripherals AI

AI Zhu Min: It is normal for ordinary people to be unable to trade in stocks and robots. AI can already understand market sentiments.

Zhu Min: It is normal for ordinary people to be unable to trade in stocks and robots. AI can already understand market sentiments.Ifeng.com Financial News (Reporter Lu Jinghan) From June 27th to 29th, the 2023 New Leaders Annual Meeting (Tianjin Summer Davos Forum) with the theme of "Entrepreneurship: The Driving Force of the World Economy" It was held grandly at Tianjin Meijiang Convention and Exhibition Center, and Phoenix Finance reported the entire event.

In the on-site question and answer session of the roundtable discussion with the theme of "Digital China's New Blueprint", Zhu Min, Vice Chairman of the China Center for International Economic Exchanges and former Vice President of the IMF (International Monetary Fund), answered questions from ifeng.com Finance .

Talking about the impact of artificial intelligence on the financial industry, Zhu Min said that it is normal for ordinary people to be unable to trade in stocks and robots. Now AIGC (generative artificial intelligence) can not only analyze existing corporate data and financial data in the market, but also understand the emotions of market fluctuations.

In addition, Zhu Min said that AIGC's management of customer marketing is very detailed and comprehensive. It can include customer demand management, market prediction, etc. in its products, manufacturing and marketing processes. , greatly improving efficiency. AIGC's impact on the financial sector has gone beyond the transformation of Fintech.

Regarding the impact of artificial intelligence on future employment, Zhu Min believes that the future is a competition between people and technology. The strengths of technology lie in knowledge, decision-making, and data. Human strengths lie in humanity, wisdom, and the development of the entire human concept. In the future, what we should learn is knowledge from both ends, one is mathematics, physics, and engineering, and the other is philosophy, sociology, psychology, and history. Things at both ends will be machineized.

The following is the full text of the on-site Q&A:

Ifeng.com Finance: Thank you, Mr. Wang. I am Lu Jinghan from Ifeng.com Finance. I would like to ask this question to President Zhu because you just talked about the impact of AIGC on the manufacturing industry. I would like to ask you to talk about AIGC (generative formula). Artificial Intelligence)'s impact on the financial industry, and ask a question for ordinary people, is it impossible for robots to trade stocks in the future? Which jobs in the financial industry will remain popular in the future? thank you.

Zhu Min: It is normal that robots cannot be traded in stocks. The most powerful thing about AIGC is that in addition to analyzing corporate data and financial data (what we traditionally call market data) of its existing businesses, it also connects market fluctuations and the entire industry. The market has emotions, and AIGC connects them. It connects market fluctuations based on existing financial data. The combination of these three dimensions includes its understanding of the market, which is a big thing.

Second, AIGC has changed Fintech. It enables cross-selling. Cross-selling is the core area of finance.

Third, AIGC's management of customer marketing is very detailed and comprehensive. It can include customer demand management, market prediction, etc. in its products, manufacturing and marketing processes, which is extremely high Improved efficiency. Therefore, AIGC’s impact on the financial field has gone beyond the transformation of Fintech.

Wang Boming: The most important question she just asked was how to keep up with the trend when choosing a career in the future?

Zhu Min: What is more important than keeping up with the trend when choosing a career? The future is a competition between people and technology. It is not a competition between industries, but a competition between people and technology. What are the strengths of technology? In knowledge, in decision-making, in data. What are people’s strengths? In human nature, in wisdom, in the occurrence of the entire human concept. So what we need to think about is how people return to the concept of human beings.

Wang Boming: What I asked is a very practical question, how will the company develop in the future? What to study in the future?

Zhu Min: What we should study is two ends, one is mathematics, physics, and engineering, and the other is philosophy, sociology, psychology, and history. Things at both ends will be machineized.

The above is the detailed content of Zhu Min: It is normal for ordinary people to be unable to trade in stocks and robots. AI can already understand market sentiments.. For more information, please follow other related articles on the PHP Chinese website!

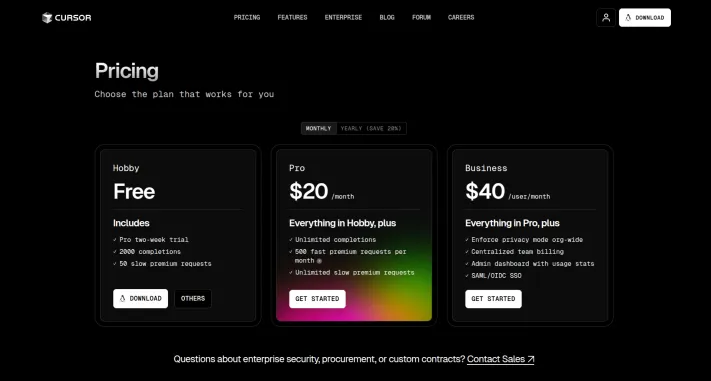

I Tried Vibe Coding with Cursor AI and It's Amazing!Mar 20, 2025 pm 03:34 PM

I Tried Vibe Coding with Cursor AI and It's Amazing!Mar 20, 2025 pm 03:34 PMVibe coding is reshaping the world of software development by letting us create applications using natural language instead of endless lines of code. Inspired by visionaries like Andrej Karpathy, this innovative approach lets dev

Replit Agent: A Guide With Practical ExamplesMar 04, 2025 am 10:52 AM

Replit Agent: A Guide With Practical ExamplesMar 04, 2025 am 10:52 AMRevolutionizing App Development: A Deep Dive into Replit Agent Tired of wrestling with complex development environments and obscure configuration files? Replit Agent aims to simplify the process of transforming ideas into functional apps. This AI-p

Top 5 GenAI Launches of February 2025: GPT-4.5, Grok-3 & More!Mar 22, 2025 am 10:58 AM

Top 5 GenAI Launches of February 2025: GPT-4.5, Grok-3 & More!Mar 22, 2025 am 10:58 AMFebruary 2025 has been yet another game-changing month for generative AI, bringing us some of the most anticipated model upgrades and groundbreaking new features. From xAI’s Grok 3 and Anthropic’s Claude 3.7 Sonnet, to OpenAI’s G

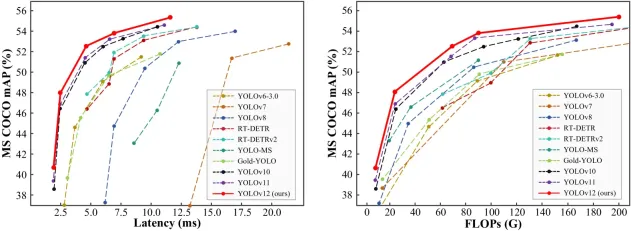

How to Use YOLO v12 for Object Detection?Mar 22, 2025 am 11:07 AM

How to Use YOLO v12 for Object Detection?Mar 22, 2025 am 11:07 AMYOLO (You Only Look Once) has been a leading real-time object detection framework, with each iteration improving upon the previous versions. The latest version YOLO v12 introduces advancements that significantly enhance accuracy

How to Use DALL-E 3: Tips, Examples, and FeaturesMar 09, 2025 pm 01:00 PM

How to Use DALL-E 3: Tips, Examples, and FeaturesMar 09, 2025 pm 01:00 PMDALL-E 3: A Generative AI Image Creation Tool Generative AI is revolutionizing content creation, and DALL-E 3, OpenAI's latest image generation model, is at the forefront. Released in October 2023, it builds upon its predecessors, DALL-E and DALL-E 2

Elon Musk & Sam Altman Clash over $500 Billion Stargate ProjectMar 08, 2025 am 11:15 AM

Elon Musk & Sam Altman Clash over $500 Billion Stargate ProjectMar 08, 2025 am 11:15 AMThe $500 billion Stargate AI project, backed by tech giants like OpenAI, SoftBank, Oracle, and Nvidia, and supported by the U.S. government, aims to solidify American AI leadership. This ambitious undertaking promises a future shaped by AI advanceme

5 Grok 3 Prompts that Can Make Your Work EasyMar 04, 2025 am 10:54 AM

5 Grok 3 Prompts that Can Make Your Work EasyMar 04, 2025 am 10:54 AMGrok 3 – Elon Musk and xAi’s latest AI model is the talk of the town these days. From Andrej Karpathy to tech influencers, everyone is talking about the capabilities of this new model. Initially, access was limited to

Google's GenCast: Weather Forecasting With GenCast Mini DemoMar 16, 2025 pm 01:46 PM

Google's GenCast: Weather Forecasting With GenCast Mini DemoMar 16, 2025 pm 01:46 PMGoogle DeepMind's GenCast: A Revolutionary AI for Weather Forecasting Weather forecasting has undergone a dramatic transformation, moving from rudimentary observations to sophisticated AI-powered predictions. Google DeepMind's GenCast, a groundbreak

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Atom editor mac version download

The most popular open source editor

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

Dreamweaver Mac version

Visual web development tools

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.