Technology peripherals

Technology peripherals AI

AI AI robots may serve as fund managers, aiming for perfection: starting from today, AI will be directly applied to all funds under management

AI robots may serve as fund managers, aiming for perfection: starting from today, AI will be directly applied to all funds under managementAI robots may serve as fund managers, aiming for perfection: starting from today, AI will be directly applied to all funds under management

Red Star Capital Bureau news, on June 1, Beijing Zhiyu Zhishan Investment Management Co., Ltd. (hereinafter referred to as "Zhiyu Zhishan Investment") announced that it will deploy the artificial intelligence-based robot Cybertron (tentative name) ) manages a private equity fund product alone.

Among them, the private equity fund products managed by Cybertron alone end at Zhishan No. 1, supervised by its general manager He Li.

Zhizhishan Investment said that the independent management of funds by AI robots will be its first attempt to integrate subjectivity with AI and invest in the global market in a quantitative way, laying a solid foundation for the AI era.

At the same time, Zhiyu Zhishan also announced that it will arrange for four other researchers to independently manage four private equity fund products. "Starting in the second half of 2023, we will start the appointment of new fund managers and conduct association registration."

Screenshot from the public account "Zhizhizhishan Investment"

Red Star Capital Bureau found through the official website of the China Asset Management Association that Zhiyu Zhishan Investment was established in March 2016, with registered capital and paid-in capital of 10 million yuan, and its management scale ranges from 0 to 500 million. Yuan, what is the reason for the actual controller?

Among them, the Zhiyu Zhishan No. 1 private equity fund was established in April 2018 (fund number SCQ070). The management type is trustee management. The custodian is China International Finance Securities (600109.SH) and is in operation.

Based on a special notice from the Asset Management Association, based on the latest submitted information (updated in the first quarter), the fund’s existing scale does not exceed 5 million yuan.

Screenshot from the official website of China Securities Investment Fund Industry Association

According to the Private Equity Ranking Network, there are 14 funds under Zhishan. As of May 2023, the company's cumulative return is 15.47%, and the annualized return is 10.69%.

Screenshot Self-funded Ranking Network

On the morning of June 2, Zhiyu Zhishan Investment released the "Announcement on Directly Applying Cybertron (AI) to All Funds Under Management" on its official account. The announcement stated that after discussion and reflection by the team, Saibotan The real significance and value of Botan (AI) lies in the reshaping and integration of its value investment system, rather than being mainly used for trading.

Zhizhi Shan announced in the announcement, "So we will use Cybertron (AI) directly for all funds we manage starting from today to better embrace the era of artificial intelligence."

However, Zhizhi Shan did not specify whether it will let Cybertron manage Zhixian No. 1 alone in the second half of the year.

On June 2, Red Star Capital Bureau called Zhiyu Zhishan at the phone number published on the official website, but no one answered as of press time.

Red Star News reporter Yang Peiwen

Editor Xiao Ziqi

The above is the detailed content of AI robots may serve as fund managers, aiming for perfection: starting from today, AI will be directly applied to all funds under management. For more information, please follow other related articles on the PHP Chinese website!

From Friction To Flow: How AI Is Reshaping Legal WorkMay 09, 2025 am 11:29 AM

From Friction To Flow: How AI Is Reshaping Legal WorkMay 09, 2025 am 11:29 AMThe legal tech revolution is gaining momentum, pushing legal professionals to actively embrace AI solutions. Passive resistance is no longer a viable option for those aiming to stay competitive. Why is Technology Adoption Crucial? Legal professional

This Is What AI Thinks Of You And Knows About YouMay 09, 2025 am 11:24 AM

This Is What AI Thinks Of You And Knows About YouMay 09, 2025 am 11:24 AMMany assume interactions with AI are anonymous, a stark contrast to human communication. However, AI actively profiles users during every chat. Every prompt, every word, is analyzed and categorized. Let's explore this critical aspect of the AI revo

7 Steps To Building A Thriving, AI-Ready Corporate CultureMay 09, 2025 am 11:23 AM

7 Steps To Building A Thriving, AI-Ready Corporate CultureMay 09, 2025 am 11:23 AMA successful artificial intelligence strategy cannot be separated from strong corporate culture support. As Peter Drucker said, business operations depend on people, and so does the success of artificial intelligence. For organizations that actively embrace artificial intelligence, building a corporate culture that adapts to AI is crucial, and it even determines the success or failure of AI strategies. West Monroe recently released a practical guide to building a thriving AI-friendly corporate culture, and here are some key points: 1. Clarify the success model of AI: First of all, we must have a clear vision of how AI can empower business. An ideal AI operation culture can achieve a natural integration of work processes between humans and AI systems. AI is good at certain tasks, while humans are good at creativity and judgment

Netflix New Scroll, Meta AI's Game Changers, Neuralink Valued At $8.5 BillionMay 09, 2025 am 11:22 AM

Netflix New Scroll, Meta AI's Game Changers, Neuralink Valued At $8.5 BillionMay 09, 2025 am 11:22 AMMeta upgrades AI assistant application, and the era of wearable AI is coming! The app, designed to compete with ChatGPT, offers standard AI features such as text, voice interaction, image generation and web search, but has now added geolocation capabilities for the first time. This means that Meta AI knows where you are and what you are viewing when answering your question. It uses your interests, location, profile and activity information to provide the latest situational information that was not possible before. The app also supports real-time translation, which completely changed the AI experience on Ray-Ban glasses and greatly improved its usefulness. The imposition of tariffs on foreign films is a naked exercise of power over the media and culture. If implemented, this will accelerate toward AI and virtual production

Take These Steps Today To Protect Yourself Against AI CybercrimeMay 09, 2025 am 11:19 AM

Take These Steps Today To Protect Yourself Against AI CybercrimeMay 09, 2025 am 11:19 AMArtificial intelligence is revolutionizing the field of cybercrime, which forces us to learn new defensive skills. Cyber criminals are increasingly using powerful artificial intelligence technologies such as deep forgery and intelligent cyberattacks to fraud and destruction at an unprecedented scale. It is reported that 87% of global businesses have been targeted for AI cybercrime over the past year. So, how can we avoid becoming victims of this wave of smart crimes? Let’s explore how to identify risks and take protective measures at the individual and organizational level. How cybercriminals use artificial intelligence As technology advances, criminals are constantly looking for new ways to attack individuals, businesses and governments. The widespread use of artificial intelligence may be the latest aspect, but its potential harm is unprecedented. In particular, artificial intelligence

A Symbiotic Dance: Navigating Loops Of Artificial And Natural PerceptionMay 09, 2025 am 11:13 AM

A Symbiotic Dance: Navigating Loops Of Artificial And Natural PerceptionMay 09, 2025 am 11:13 AMThe intricate relationship between artificial intelligence (AI) and human intelligence (NI) is best understood as a feedback loop. Humans create AI, training it on data generated by human activity to enhance or replicate human capabilities. This AI

AI's Biggest Secret — Creators Don't Understand It, Experts SplitMay 09, 2025 am 11:09 AM

AI's Biggest Secret — Creators Don't Understand It, Experts SplitMay 09, 2025 am 11:09 AMAnthropic's recent statement, highlighting the lack of understanding surrounding cutting-edge AI models, has sparked a heated debate among experts. Is this opacity a genuine technological crisis, or simply a temporary hurdle on the path to more soph

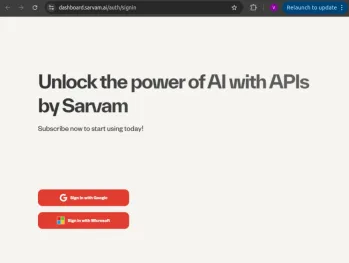

Bulbul-V2 by Sarvam AI: India's Best TTS ModelMay 09, 2025 am 10:52 AM

Bulbul-V2 by Sarvam AI: India's Best TTS ModelMay 09, 2025 am 10:52 AMIndia is a diverse country with a rich tapestry of languages, making seamless communication across regions a persistent challenge. However, Sarvam’s Bulbul-V2 is helping to bridge this gap with its advanced text-to-speech (TTS) t

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

Zend Studio 13.0.1

Powerful PHP integrated development environment

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software