Technology peripherals

Technology peripherals AI

AI Turning on automation, the birth of digital employees at Western Securities

Turning on automation, the birth of digital employees at Western SecuritiesFinancial technology and traditional technology complement each other and have gradually become the core driving force for the development of the securities industry. Whether it is "open banking" or "open brokerage", the financial industry has put forward new strategic requirements for data quality, operational efficiency, and intelligence.

Driven by financial technology, the securities industry has pressed the "fast forward button" on digital transformation and upgrading. New financial technology technologies represented by "ABCD" (artificial intelligence, blockchain, cloud computing, big data), through close integration with asset management, risk management and other businesses, continue to drive financial services to become online, digital, and Intelligent transformation. Among them, Western Securities Co., Ltd., as a Class A securities company in the 2021 securities company classification results of the China Securities Regulatory Commission, is adhering to an attitude of exploration and innovation in this digital transformation of securities companies and actively starting the transformation of the securities industry. explore.

Which department should the digitalization of the securities industry start from? What kind of overall strategy should be formulated? Western Securities’ automation experience is of great reference value. Based on automation technology and taking key application scenarios as a breakthrough, Western Securities is actively realizing the in-depth automation of digital employees and accelerating the digitalization process of enterprises.

Form a "combat" team and find out the business characteristics

In order to smoothly start and expand automation, in December 2021, Western Securities officially established a project-level "AI Process Special Team", aiming to form Dedicated strength in digital workforce promotion and building. Through the construction of this team, various aspects such as pilot selection, deployment promotion, and effect evaluation will be more efficient and smooth, creating favorable conditions for promoting AI-powered business scenarios in depth.

Western Securities summarizes the characteristics of each department. Which businesses are cumbersome? What are the most pressing needs for automation? Western Securities is well aware of this information. For example, in the centralized operation business scenario of the wealth management department, some processes rely heavily on manual operations. Although the Planning and Finance Department has automated various processes in the financial system through the Financial Sharing Center, the extent of this still needs to be explored. In addition, investment banking business lines, custody business departments and other departments also need to be automated step by step.

Western Securities plans to make every effort to improve the efficiency of corporate business processes, reduce manual operation risks, improve customer experience, and achieve "quick win" business results through the deployment and implementation of digital employee projects.

Starting the pilot, the effect is remarkable

The evaluation of the pilot effect is a very critical step. It is not only related to whether the early judgment and investment are correct, but also related to the adjustment of the enterprise's internal automation popularization strategy.

Western Securities has completed the pilot implementation of digital employees through the construction and collaboration of front-end and back-end software robots, and it is expected to achieve significant results.

For example, the daily back-end operations of traditional brokerage businesses of securities firms involve a large number of data operation and configuration processes. Although these processes do not involve core data operations, the data configuration, processing, and verification processes in the process are all completed manually. Moreover, the operation involves multiple systems, numerous parameters, and cumbersome processes, which are very labor-intensive and prone to errors. If this scenario can be used as a pilot for digital employees, operational risks can be reduced, and the accuracy of the original manual processing process can be greatly improved. At the same time, the processing time can be greatly shortened, and the operation can even be completed in advance. It is expected that the average process processing time will be reduced by 80%.

Another example is the financial business processing process at the headquarters of a securities firm. It is necessary to merge the forms submitted regularly by all branches and conduct cross-system verification. This process has a large amount of data and is cumbersome. Manual operations are often difficult to do in a timely manner. Follow-up is also error-prone. If this scenario is replaced by digital employees, the average process processing time is expected to be reduced by 60%.

Based on the effectiveness verification of the pilot, Western Securities can begin to use digital employees on a large scale to automate and accelerate these processes. It is foreseeable that digital employees will also bring great value to other scenarios.

Three steps to deploy digital employees to achieve overall automation

From pilot to operation system construction to platform construction, the digital deployment of Western Securities can be divided into three steps.

Western Securities has rich experience in implementing pilot scenarios. Western Securities divides digital employee users into seed users and core users, and adopts a more comprehensive digital employee operation plan based on user profiles. For businesses with cumbersome and labor-intensive processes, Western Securities quickly built digital employees, implemented digital employee pilot scenarios, and measured efficiency improvements to fully prepare for the company's large-scale deployment.

In establishing a digital employee operation system, Western Securities aims to embed digital employees into various departments to form a digital employee empowerment culture and lay the foundation for subsequent internal promotion and business empowerment. By establishing a multi-dimensional digital employee comprehensive performance system, a digital employee training system and a full life cycle management system, employees can independently design, develop and adopt digital employees. Through sharing methods such as offline salons and online digital employee cloud classrooms, employees have more opportunities to learn digital employee knowledge. When a department needs to apply for digital employees, it can start deployment according to the full-life management system of application, adoption, upgrade, offline, and return to work.

In building a basic platform for digital employees, Western Securities has built a complete basic platform, covering the design platform, management platform and execution platform for digital employees. First, digital employees are designed. Employees use various AI components to quickly create the required digital employees in a low-code form. Secondly, digital employee management. When digital employees reach a certain scale, they can be managed uniformly with the help of a management platform. Finally, how well are digital workers performing? What should I do if the operation is abnormal? Digital employees of specific businesses can be viewed through the execution platform of Western Securities and abnormal alarm resolution can be achieved.

Generally speaking, based on UiPath's cutting-edge automation technology, rich training resources, and mature and complete service system, Western Securities is making digital transformation a reality. At the same time, the UiPath solution can also help Western Securities realize on-demand iteration of digital employees and complete self-research and expansion of automation technology, forming a powerful driving force for Western Securities to continue to expand automation.

Huang Yuyang, head of the Digital Transformation Office of Western Securities, said, “With the in-depth application of digital employees, we will have more business benefits. It is expected that with this form, employees will have more energy to do relevant tasks. value work, and continue to reduce costs and increase efficiency. In addition, we hope to use our own digital transformation experience to set an example for the digital exploration of the securities industry."

The birth experience of Western Securities’ digital employees will be used by more securities industries Customers bring reference value. Facing the future, Western Securities will seize development opportunities, fully release the power of data, and bring efficient and reliable financial services to securities customers. At the same time, UiPath will continue to penetrate into the securities industry, create more digital transformation benchmarks, and help the securities industry "ride the wind and waves"!

The above is the detailed content of Turning on automation, the birth of digital employees at Western Securities. For more information, please follow other related articles on the PHP Chinese website!

Uber部署2000机器人大军,力争2026年在美实现自动送餐Jun 03, 2023 pm 12:09 PM

Uber部署2000机器人大军,力争2026年在美实现自动送餐Jun 03, 2023 pm 12:09 PMDoNews6月2日消息,外送巨头UberEats与ServeRobotics近日正式宣布自2026年起,要在美国各主要城市推出机器人送餐服务。据IT之家援引外媒报道,ServeRobotics表示,这款配备4个轮子的机器人使用AI技术进行路径规划,其续航约为40公里,可运载重达23公斤的商品。此外,该公司的机器人每天可负责数十张订单的配送。Uber表示,消费者通过UberEats下单,会提供由机器人送餐的选项。机器人送餐到指定地点后,顾客需要输入密码才能取餐,以此来保障顾客的食品安全送达。目前

十个值得推荐的自动化和编排工具Apr 14, 2023 pm 02:40 PM

十个值得推荐的自动化和编排工具Apr 14, 2023 pm 02:40 PM自动化和编排网络工具可以比管理人员更快、更准确地执行任务。IT流程自动化本身就是卖点:自动化任务不仅比工作人员执行重复性活动更便宜,而且更高效、更可预测。虽然自动化和编排工具可以与企业员工一起开发自动化工具,但这可能具有挑战性,如果最终需要大规模采用自动化技术的话,可能需要使用商业软件工具。一些任务比其他任务更容易实现自动化,例如管理IT系统、配置物理机和虚拟机、管理服务器配置、识别策略偏差,许多IT系统现在都具有一些功能,这些功能使其更容易在不寻求采用商业平台的情况下实现自动化。此外,在过去的

未来的工作:适应自动化和人工智能Jun 07, 2023 pm 07:42 PM

未来的工作:适应自动化和人工智能Jun 07, 2023 pm 07:42 PM自动化和人工智能(AI)的快速发展正在重塑劳动力队伍,并对未来的工作提出质疑。企业需要具备适当技能的员工来开发、管理和维护自动化设备和数字流程,并完成机器无法完成的工作。再培训可以帮助留守员工找到新的职业。在竞争激烈的就业市场中,员工需要学习新技能,这是至关重要的。本文探讨了自动化和人工智能对就业的影响、不断变化的就业市场所需的技能,以及适应性和终身学习的重要性。自动化的兴起:改变行业和工作角色自动化技术正在彻底改变从制造和物流到客户服务和医疗保健的行业。机器人、机器学习算法和人工智能系统越来越

如何开始使用Python中的NoseApr 11, 2023 pm 09:31 PM

如何开始使用Python中的NoseApr 11, 2023 pm 09:31 PM译者 | 李睿审校 | 孙淑娟在这个Python Nose教程中,将深入研究Nose框架。Nose是一个测试自动化框架,它扩展了unittest,并进一步利用Nose来执行Selenium测试自动化。许多开发人员在Selenium测试自动化中面临的一个挑战是如何选择正确的测试框架,以帮助他们以最少(或不需要)的样板代码完成自动化测试。大多数人都会遇到测试代码,并不得不编写大量代码来执行简单的测试。选择正确的测试自动化框架可以显著地简化开发人员处理测试代码的工作。可以利用框架功能编写测试,以最少

人工取证不堪重负!自动化DFIR(数字取证和事件响应)才是未来Apr 28, 2023 pm 02:49 PM

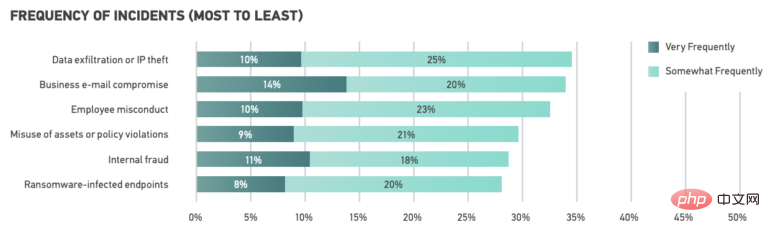

人工取证不堪重负!自动化DFIR(数字取证和事件响应)才是未来Apr 28, 2023 pm 02:49 PM数十年来,数字取证工作在司法侦查的不同分支中不断发展,已成为全球执法活动中非常重要的组成部分。与此同时,由于互联网和全球化的发展,犯罪形式多样化,执法人员也需要通过自动化的数字取证工具,才能获取关键的数字证据,将不法分子送入监狱。日前,Magnetforensics研究团队最新发布了《企业数字取证和事件调查(DFIR)应用现状》研究报告。报告研究认为,数字取证市场目前发生了很大变化,可以用两个词来概括:速度和准确率。如何尽快将违法证据提交给调查人员是将网络犯罪分子绳之以法的关键。然而,这并不容易

人工智能和物联网在供应链管理中的应用Apr 10, 2023 pm 04:31 PM

人工智能和物联网在供应链管理中的应用Apr 10, 2023 pm 04:31 PM在疫情期间,供应链部门遭遇了劳动力短缺、需求增加和过度订购。管理人员自然会寻找技术解决方案,以提高生产率并使分销过程自动化。31.52%的供应链高管采用机器人技术,实现高效配送、快速分拣和人工辅助。疫情后,随着物流业逐步反弹,自动化在小规模工业中激增,每年生产5000 - 6000个机器人,部署在配送过程的各个阶段。因此,从2023年到2028年,印度物流自动化市场预计将以16.2%的复合年增长率增长。供应链管理中的人工智能和物联网驱动的机器人仓库和物流中心充斥着耗时耗力的日常工作和危险任务。尽

低代码自动化将如何改变银行业Apr 09, 2023 am 11:21 AM

低代码自动化将如何改变银行业Apr 09, 2023 am 11:21 AM在基本的经常账户功能方面,银行几乎没有什么区别,因此公司需要为客户提供更多的服务。对于传统商业银行来说,这一点尤其重要,因为它们面临着来自更新颖、更灵活的基于应用程序的挑战者银行和其他金融科技竞争对手的威胁。现任者可能会被遗留系统所困扰,但他们确实拥有关于客户偏好的经验和数据,可以利用这些经验和数据为自己带来好处。公司需要新产品,新方法和新想法来吸引和留住客户。但如果他们想要保持竞争力,他们还需要快速的交付它们,并能够根据不断变化的业务和监管需求来更改它们。这就带来了自动化——31%的金融服务高

人工智能将如何改变软件开发者的世界?May 28, 2023 pm 05:42 PM

人工智能将如何改变软件开发者的世界?May 28, 2023 pm 05:42 PM随着越来越多的企业尝试使用AI基础模型(例如OpenAI的ChatGPT),但与此同时,自动化平台给软件开发人员带来的影响越来越明显。一方面,这些平台可能会彻底改变开发人员的工作方式;另一方面,这些平台也威胁到业内人士的工作,与既定流程形成鲜明对比。也就是说,毫无疑问地,像ChatGPT这样的平台是一股颠覆性的力量,受到了风险资本家的热烈欢迎。根据研究公司Gartner的数据显示,过去三年中生成式AI解决方案获得了超过17亿美金的投资,其中很大一部分投入在AI软件编码上。自动化对软件开发还有其他

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

SublimeText3 Mac version

God-level code editing software (SublimeText3)

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

SublimeText3 English version

Recommended: Win version, supports code prompts!