Technology peripherals

Technology peripherals AI

AI OpenAI CEO offers emergency funding to help startups cope with fallout from Silicon Valley bank collapse

OpenAI CEO offers emergency funding to help startups cope with fallout from Silicon Valley bank collapseOpenAI CEO offers emergency funding to help startups cope with fallout from Silicon Valley bank collapse

According to news on March 13, after Silicon Valley Bank, the 16th largest bank in the United States, announced its collapse, Sam Altman, CEO of OpenAI, the developer of the popular chatbot ChatGPT Emergency funding is being provided to several startups to help them pay their employees and ensure they can continue to operate.

The bank that focused on technology startups collapsed suddenly on Friday, making it the largest bank failure since the 2008 financial crisis. The collapse of Silicon Valley Bank has disrupted global markets, with many technology company founders worried about not being able to withdraw money to pay employees. To avoid what Jiaxing Chen, CEO of startup accelerator Y Combinator, calls “a potential extinction-level event for the tech industry,” industry executives have moved quickly to do whatever they can to help save small businesses.

Altmann runs one of Silicon Valley’s hottest companies, OpenAI, and has spent his own money to help save startups. "I had no choice, so I emailed him," confirmed Doktor Gurson, CEO of Rad AI, a radiology startup based in Berkeley, Calif. Altman said after receiving the request We quickly responded and agreed to provide emergency funds of at least US$100,000 (The company relied heavily on Silicon Valley Bank, Goulson said, and its sudden closure meant he had no money to pay his roughly 65 employees. "A lot of people are living paycheck to paycheck, they have mortgages to pay and bills to pay," Goulson said. Previously, Goulson's entrepreneurial partner was on the Federal Deposit Insurance Corporation's hotline. Waited for 8 hours but got no results. Multiple attempts to transfer funds from Silicon Valley Bank failed. Altman’s brother, Jack Altman, wrote on Twitter on Saturday: “Sam has been sending money to struggling startups today with no strings attached. Just say: 'Pay me back when you can!'" When asked about this, Altman said: "I remember when I was running a startup and investors offered me help. I was really impressed. The help is needed, and I always try to give back." Altman is just one of several technology executives who have provided aid to startups affected by the collapse of Silicon Valley banks. Silicon Valley Bank was placed under regulatory control on Friday after falling stock prices and a series of headwinds triggered a run, marking the second major U.S. bank failure since the 2008 financial crisis. Fintech startup Brex announced on Friday that it will provide emergency loans to startups. The company's co-CEO Henrique Dubugras said they received more than $1.5 billion in loan applications from nearly 1,000 companies this weekend. "We are working hard to sign up with lenders by the end of tomorrow and everyone is working hard on that," he said. In a tweet on Friday as Silicon Valley Bank collapsed, Altman encouraged Investors provide emergency funding to the startups they back, with no strings attached. He said: "Even if Silicon Valley banks can't find a buyer over the weekend and can't find a loan, startup deposits should be allowed to be withdrawn. But in the meantime, people are facing a real liquidity crunch and it's not their fault." Altman did not confirm the amount of money he provided to Rad AI or any other startup, but Gulson said he speculated that Altman had provided funding to Rad AI and other companies have provided at least US$1 million (IT House note: currently about 6.95 million yuan) in funding. Several startup founders confirmed they have no way to pay employees while they wait for further information from the Federal Deposit Insurance Corporation on what to do with their deposits. The Federal Deposit Insurance Corporation took over Silicon Valley Bank's assets on Friday. As of Saturday evening, more than 3,500 company CEOs and founders, representing about 220,000 employees, had signed a petition launched by Y Combinator directly calling on U.S. Treasury Secretary Janet Yellen. Yellen and others are supporting savers, many of whom are small business owners who may not be able to pay their employees for the next 30 days. The petition advocates “increased supervision and capital requirements for regional banks” and an investigation into any “misconduct or mismanagement” by Silicon Valley Bank executives. The petition warns that more than 100,000 jobs could be at risk.Venture investors advise startups to look for alternatives to obtain short-term liquidity. Some, including LowerCarbon Capital, provide loans to companies with money trapped in Silicon Valley bank accounts. LowerCarbon will provide payroll support over the next two weeks and will begin disbursing funds on Monday, its partner Clay Dumas said.

Khosla Ventures also said: “Given the rapidly changing situation, we are in talks with over 100 investment firms to assess their critical needs and plan to build bridges where we are a lead or lead investor .”

The above is the detailed content of OpenAI CEO offers emergency funding to help startups cope with fallout from Silicon Valley bank collapse. For more information, please follow other related articles on the PHP Chinese website!

What is Graph of Thought in Prompt EngineeringApr 13, 2025 am 11:53 AM

What is Graph of Thought in Prompt EngineeringApr 13, 2025 am 11:53 AMIntroduction In prompt engineering, “Graph of Thought” refers to a novel approach that uses graph theory to structure and guide AI’s reasoning process. Unlike traditional methods, which often involve linear s

Optimize Your Organisation's Email Marketing with GenAI AgentsApr 13, 2025 am 11:44 AM

Optimize Your Organisation's Email Marketing with GenAI AgentsApr 13, 2025 am 11:44 AMIntroduction Congratulations! You run a successful business. Through your web pages, social media campaigns, webinars, conferences, free resources, and other sources, you collect 5000 email IDs daily. The next obvious step is

Real-Time App Performance Monitoring with Apache PinotApr 13, 2025 am 11:40 AM

Real-Time App Performance Monitoring with Apache PinotApr 13, 2025 am 11:40 AMIntroduction In today’s fast-paced software development environment, ensuring optimal application performance is crucial. Monitoring real-time metrics such as response times, error rates, and resource utilization can help main

ChatGPT Hits 1 Billion Users? 'Doubled In Just Weeks' Says OpenAI CEOApr 13, 2025 am 11:23 AM

ChatGPT Hits 1 Billion Users? 'Doubled In Just Weeks' Says OpenAI CEOApr 13, 2025 am 11:23 AM“How many users do you have?” he prodded. “I think the last time we said was 500 million weekly actives, and it is growing very rapidly,” replied Altman. “You told me that it like doubled in just a few weeks,” Anderson continued. “I said that priv

Pixtral-12B: Mistral AI's First Multimodal Model - Analytics VidhyaApr 13, 2025 am 11:20 AM

Pixtral-12B: Mistral AI's First Multimodal Model - Analytics VidhyaApr 13, 2025 am 11:20 AMIntroduction Mistral has released its very first multimodal model, namely the Pixtral-12B-2409. This model is built upon Mistral’s 12 Billion parameter, Nemo 12B. What sets this model apart? It can now take both images and tex

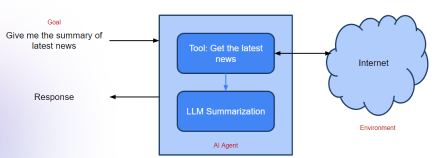

Agentic Frameworks for Generative AI Applications - Analytics VidhyaApr 13, 2025 am 11:13 AM

Agentic Frameworks for Generative AI Applications - Analytics VidhyaApr 13, 2025 am 11:13 AMImagine having an AI-powered assistant that not only responds to your queries but also autonomously gathers information, executes tasks, and even handles multiple types of data—text, images, and code. Sounds futuristic? In this a

Applications of Generative AI in the Financial SectorApr 13, 2025 am 11:12 AM

Applications of Generative AI in the Financial SectorApr 13, 2025 am 11:12 AMIntroduction The finance industry is the cornerstone of any country’s development, as it drives economic growth by facilitating efficient transactions and credit availability. The ease with which transactions occur and credit

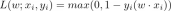

Guide to Online Learning and Passive-Aggressive AlgorithmsApr 13, 2025 am 11:09 AM

Guide to Online Learning and Passive-Aggressive AlgorithmsApr 13, 2025 am 11:09 AMIntroduction Data is being generated at an unprecedented rate from sources such as social media, financial transactions, and e-commerce platforms. Handling this continuous stream of information is a challenge, but it offers an

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

WebStorm Mac version

Useful JavaScript development tools