Technology peripherals

Technology peripherals AI

AI How AI-driven conversational intelligence can deliver superior customer experiences for financial services firms

How AI-driven conversational intelligence can deliver superior customer experiences for financial services firmsHow AI-driven conversational intelligence can deliver superior customer experiences for financial services firms

This article explains three ways AI-driven conversational intelligence can improve customer experience.

(1) Use an empathetic approach to improve customer satisfaction

Conversational intelligence provides scenarios around the “why” and “how” to improve customer satisfaction (CSAT) and Net Promoter Score (NPS) and other key indicators. It provides a deeper understanding of the end-to-end customer journey, giving financial services companies the opportunity to proactively address real customer needs and deliver a more personalized customer experience.

Although it sounds counterintuitive, artificial intelligence can actually promote greater empathy and more human agent and customer interactions. It allows human agents to use tone-based sentiment analysis to focus on how customers are feeling and dig deeper into what makes an experience positive or negative. It also enables business executives to verify whether their teams are using effective empathic ways to contact customers and discover why certain contacts are being escalated so they can better train team members to change strategies.

(2) Improve conversion and retention rates

On average, financial services companies can only handle 0.05% of contact center calls using traditional manual methods. However, artificial intelligence enables them to automatically transcribe and analyze 100% of customer interactions and instantly act on a range of insights to improve customer conversion and retention.

Using this conversational intelligence, financial services companies can better understand where exactly customers drop off, which types of conversations create the most positive experiences, and what specific factors impact the effectiveness of human agents. For example, AI can identify opportunities for human agents to quickly identify negative customer sentiment and provide recommendations for correction. This fast and specific feedback also provides human agents with personalized coaching opportunities, motivating them to improve their performance.

(3) Give customers what they need

Last but not least, conversational intelligence enables businesses to make smarter data-driven decisions, including but not limited to better Support and Service.

Insights gleaned from customer interactions can help marketing teams deliver more targeted and relevant campaigns based on customer response and feedback on new products. It also reveals the main pain points and unmet needs that the product team is thinking about and solving. It further provides sales teams with the insights they need to close more business. In short, every customer interaction delights customers and keeps them coming back, while also uncovering business improvement insights that impact every function of the enterprise.

Using Artificial Intelligence to Empower Employees

Financial services companies can improve by proactively resolving customer support issues, improving customer satisfaction and customer retention, and creating products and services that continue to set the benchmark. its competitive advantage. AI-powered conversational intelligence enables financial services companies to augment the work of human agents to create memorable, compassionate and impactful customer experiences.

The above is the detailed content of How AI-driven conversational intelligence can deliver superior customer experiences for financial services firms. For more information, please follow other related articles on the PHP Chinese website!

What is Graph of Thought in Prompt EngineeringApr 13, 2025 am 11:53 AM

What is Graph of Thought in Prompt EngineeringApr 13, 2025 am 11:53 AMIntroduction In prompt engineering, “Graph of Thought” refers to a novel approach that uses graph theory to structure and guide AI’s reasoning process. Unlike traditional methods, which often involve linear s

Optimize Your Organisation's Email Marketing with GenAI AgentsApr 13, 2025 am 11:44 AM

Optimize Your Organisation's Email Marketing with GenAI AgentsApr 13, 2025 am 11:44 AMIntroduction Congratulations! You run a successful business. Through your web pages, social media campaigns, webinars, conferences, free resources, and other sources, you collect 5000 email IDs daily. The next obvious step is

Real-Time App Performance Monitoring with Apache PinotApr 13, 2025 am 11:40 AM

Real-Time App Performance Monitoring with Apache PinotApr 13, 2025 am 11:40 AMIntroduction In today’s fast-paced software development environment, ensuring optimal application performance is crucial. Monitoring real-time metrics such as response times, error rates, and resource utilization can help main

ChatGPT Hits 1 Billion Users? 'Doubled In Just Weeks' Says OpenAI CEOApr 13, 2025 am 11:23 AM

ChatGPT Hits 1 Billion Users? 'Doubled In Just Weeks' Says OpenAI CEOApr 13, 2025 am 11:23 AM“How many users do you have?” he prodded. “I think the last time we said was 500 million weekly actives, and it is growing very rapidly,” replied Altman. “You told me that it like doubled in just a few weeks,” Anderson continued. “I said that priv

Pixtral-12B: Mistral AI's First Multimodal Model - Analytics VidhyaApr 13, 2025 am 11:20 AM

Pixtral-12B: Mistral AI's First Multimodal Model - Analytics VidhyaApr 13, 2025 am 11:20 AMIntroduction Mistral has released its very first multimodal model, namely the Pixtral-12B-2409. This model is built upon Mistral’s 12 Billion parameter, Nemo 12B. What sets this model apart? It can now take both images and tex

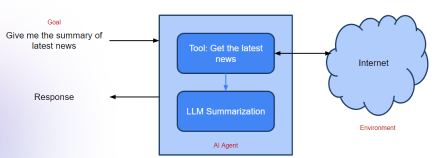

Agentic Frameworks for Generative AI Applications - Analytics VidhyaApr 13, 2025 am 11:13 AM

Agentic Frameworks for Generative AI Applications - Analytics VidhyaApr 13, 2025 am 11:13 AMImagine having an AI-powered assistant that not only responds to your queries but also autonomously gathers information, executes tasks, and even handles multiple types of data—text, images, and code. Sounds futuristic? In this a

Applications of Generative AI in the Financial SectorApr 13, 2025 am 11:12 AM

Applications of Generative AI in the Financial SectorApr 13, 2025 am 11:12 AMIntroduction The finance industry is the cornerstone of any country’s development, as it drives economic growth by facilitating efficient transactions and credit availability. The ease with which transactions occur and credit

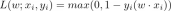

Guide to Online Learning and Passive-Aggressive AlgorithmsApr 13, 2025 am 11:09 AM

Guide to Online Learning and Passive-Aggressive AlgorithmsApr 13, 2025 am 11:09 AMIntroduction Data is being generated at an unprecedented rate from sources such as social media, financial transactions, and e-commerce platforms. Handling this continuous stream of information is a challenge, but it offers an

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

SublimeText3 English version

Recommended: Win version, supports code prompts!

SublimeText3 Mac version

God-level code editing software (SublimeText3)