Backend Development

Backend Development Python Tutorial

Python Tutorial Python quantitative trading practice: obtaining stock data and analyzing it

Python quantitative trading practice: obtaining stock data and analyzing itPython quantitative trading practice: obtaining stock data and analyzing it

Quantitative trading (also known as automated trading) is an investment method that applies mathematical models to help investors make judgments and conduct transactions based on instructions sent by a computer program. It greatly reduces the impact of investor sentiment fluctuations. The main advantages of quantitative trading are as follows:

- Quick detection

- Objective and rational

- Automation

The core of quantitative trading is the screening strategy , strategies also rely on mathematical or physical models to create, turning mathematical language into computer language. The process of quantitative trading is from data acquisition to data analysis and processing.

Data acquisition

The first step in data analysis is to obtain data, which is data collection. There are many ways to obtain data. Generally speaking, data sources are mainly divided into two categories: external sources (external purchases, web crawling, free open source data, etc.) and internal sources (own company sales data, financial data, etc.).

Because we do not produce data, we can only obtain data from the outside. The access method is the third-party open source library tushare.

Use tushare to obtain historical stock data

tushare is a free, open source Python financial data interface package. It mainly implements the process of data collection, cleaning, processing and data storage of financial data such as stocks, and can provide financial analysts with fast, clean and diverse data that is easy to analyze, so as to reduce their workload in data acquisition.

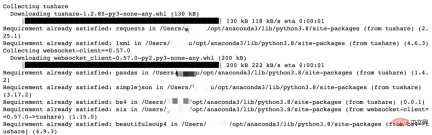

Install the tushare library, enter the following command under Jupter Notebook:

%pip install tushare

Restart the kernel, and then enter the following command.

import tushare

print("tushare版本号{}".format(tushare.__version__))tushare版本号1.2.85

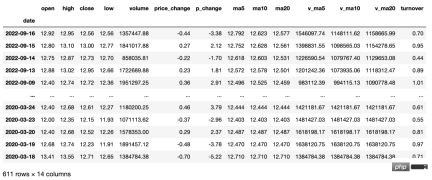

Obtain historical transaction data of individual stocks (including moving average data). Users can obtain daily K-line, weekly K-line, monthly K-line, as well as 5-minute, 15-minute, 30-minute and 60-minute K-line through parameter settings. data. This interface can only obtain daily data for the past three years, and is suitable for stock selection and analysis in conjunction with moving average data. The Python code is as follows:

importtushareasts

ts.get_hist_data('000001') #一次性获取全部日k线数据

'''

参数说明:

code:股票代码,即6位数字代码,或者指数代码(sh=上证指数 sz=深圳成指 hs300=沪深300指数 sz50=上证50 zxb=中小板 cyb=创业板)

start:开始日期,格式YYYY-MM-DD

end:结束日期,格式YYYY-MM-DD

ktype:数据类型,D=日k线 W=周 M=月 5=5分钟 15=15分钟 30=30分钟 60=60分钟,默认为D

retry_count:当网络异常后重试次数,默认为3

pause:重试时停顿秒数,默认为0

例如:

ts.get_hist_data('000001', ktype='W') #获取周k线数据

ts.get_hist_data('000001', ktype='M') #获取月k线数据

ts.get_hist_data('000001', ktype='5') #获取5分钟k线数据

ts.get_hist_data('000001', ktype='15') #获取15分钟k线数据

ts.get_hist_data('000001', ktype='30') #获取30分钟k线数据

ts.get_hist_data('000001', ktype='60') #获取60分钟k线数据

ts.get_hist_data('sh')#获取上证指数k线数据

ts.get_hist_data('sz')#获取深圳成指k线数据

ts.get_hist_data('hs300')#获取沪深300指数k线数据

ts.get_hist_data('000001',start='2021-01-01',end='2021-03-20') #获取”000001”从2021-01-01到2021-03-20的k线数据

'''

The return value is explained as follows.

- date: date;

- open: opening price;

- high: highest price;

- close: closing price;

- low: lowest price;

- volume: trading volume;

- price_ change: price change;

- pchange: increase or decrease;

- mas: 5-day average price;

- ma10: 10-day average price;

- ma20: 20-day average price;

- v_mas: 5-day average volume;

- v_ma10: 10-day average volume;

- v_ma20: 20-day average volume;

turnover: turnover rate (note: the index does not have this item).

Use tushare to obtain real-time data of all stocks

Historical transaction data of individual stocks is delayed data. Faced with real-time changing price data, we can use the more convenient real-time market conditions of the day to quickly grasp the market conditions through Python quantification and select outstanding stocks that meet the current conditions.

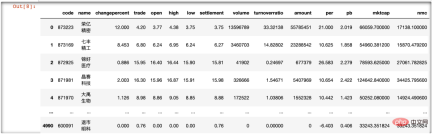

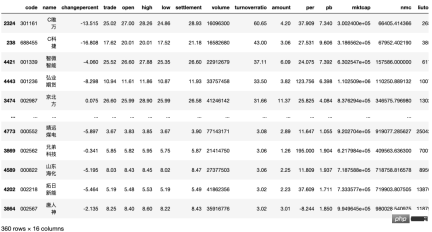

The following uses get_today_all() in the third-party library tushare to obtain the real-time data of all stocks (if it is a holiday, it is the previous trading day). The code is as follows:

importtushareasts ts.get_today_all()

The acquisition of data is the foundation of data research. A fast, accurate and stable API will greatly shorten the time for individuals to obtain data, allowing researchers to devote more energy to data processing and modeling. The tushare library is also one of the main ways for the author to obtain data. It provides a stable and powerful data source for quantitative work, so that data collection can be achieved simply with one line of code.

Data preprocessing

Whether it is a quantitative strategy or a simple machine learning project, data preprocessing is a very important part. From the perspective of quantitative learning, data preprocessing mainly includes data cleaning, sorting, missing value or outlier processing, statistical analysis, correlation analysis and principal component analysis (PCA), etc.

Because the previous book collected all regular stock data, the data preprocessing to be introduced in this chapter is to eliminate the stock data that does not meet the conditions in advance, and then optimize and screen the remaining stocks. This chapter mainly uses the Pandas library, and readers should focus on understanding the filtering ideas.

Clear ST stocks

ST stocks usually indicate that stocks of listed companies with abnormal financial or other conditions require special treatment (Special Treatment). . Due to the "special treatment", ST is prefixed to the abbreviation, so these stocks are called ST stocks.

Adding ST before the name of a stock is a warning to the market. The stock has investment risks and serves as a warning. However, this kind of stock has high risks and high returns. If *ST is added, it will It means that the stock has a risk of delisting and should be vigilant. Specifically, around April 2021, if the company's financial statements submitted to the China Securities Regulatory Commission have suffered losses for consecutive years, there will be a risk of delisting. The trading rules for stocks are also limited to 5% increase and 5% decrease on the quotation day.

We want to avoid this kind of "landmine stocks" (ST stocks), so we can use the following code to clean out ST stocks.

import tushareasts

csv_data=ts.get_today_all()

csv_data[~csv_data.name.str.contains('ST')]我们对 csv_data 的 name 列进行操作,筛选出包含 ST 字母的行,并对整个 DataFrame 取反,进而筛选出不含 ST 股票的行。经过观察,我们发现在运行结果中没有 ST 股票,实现了数据的初步清洗。

清洗掉没成交量的股票

首先要明确定义,什么是没有成交量的股票。没有成交量不是成交量为零,而是一支股票单位时间的成交量不活跃。成交量是反映股市上人气聚散的一面镜子。人气旺盛、 买卖踊跃,成交量自然放大:相反人气低迷、买卖不活跃,成交量必定萎缩。成交量是观察庄家大户动态的有效途径。

下面开始清洗没成交量的股票,在原来的基础上增加代码如下:

import tushareasts

csv_data=ts.get_today_all()

csv_data=csv_data[~csv_data.name.str.contains('ST')]

csv_data[csv_data["volume"]>15000000]#15万手在以上代码中,我们对 csv_data 的 volume 列进行操作。15 万手是过滤掉不活跃、没成交量的股票,主要以小盘股居多。

其运行结果为:

Index 出现了调行现象,即为去掉成交量小手 15 万手的股票。

清洗掉成交额过小的股票

成交额是成交价格与成交数量的乘积,它是指当天已成交股票的金额总数。成交最的至少取决于市场的投资热情。我们每天看大盘,一个重要的指标就是大 A 股成交量是否超过一万亿元,超过即为成交活跃。

筛选成交额超过 1 亿元的股票,代码如下:

import tushareasts

csv_data=ts.get_today_all()

csv_data=csv_data[~csv_data.name.str.contains('ST')]

csv_data=csv_data[csv_data["volume"]>15000000]#15万手

csv_data["amount"]=round(csv_data["amount"]/100000000,2)#一亿,保留2位

csv_data[(csv_data["amount"]>1)]筛选股票的数量没有锐减,这是因为成交额-成交价格×成交量。有些股票价格低,成交量巨大,乘积刚刚超过 1亿元;有些股票价格高,成交量相对小一些,乘积仍然超过1亿元。同成交额,2元股票相对于 20 元与 200 元股票,其成交量相差10 倍到 100 倍之多。同成交量,有些股票成交额为 100 亿元,相对于成交额仅有 1亿元的股票,也有百倍之多。

用户可以对 1亿元这个参数进行调参,不过笔者不是特别支持。因为将成交额变大即是对大盘股产生偏重,而前面成交量的筛选也己经对大盘股的成交量进行了偏重筛选,这样双重筛选下来,就会全部变成大盘股,数据偏置严重,没有合理性。预处理的思想也是先将数据进行简单的筛选。笔者认为后期的策略相对于这里的调参更为重要,策略是日后交易的核心。

清洗掉换手率低的股票

换手率=某一段时期内的成交量/流通总股数×100% 。一般情况下,大多数股票每日换手率在1%~2.5%之间(不包括初上市的股票)。70%股票的换手率基本在 3%以下,3%就成为一种分界。

当一支股票的换手率在 3%~7%之间时,该股进入相对活跃状态。当换手率在 7%~10%之间时,则为强势股的出现,股价处于高度活跃中。

筛选换手率超过3的股票,代码如下:

importtushareasts

csv_data=ts.get_today_all()

csv_data=csv_data[~csv_data.name.str.contains('ST')]

csv_data=csv_data[csv_data["volume"]>15000000]#15万手

csv_data["amount"]=round(csv_data["amount"]/100000000,2)#一亿,保留2位

csv_data=csv_data[(csv_data["amount"]>1)]

csv_data["liutongliang"]=csv_data["nmc"]/csv_data["trade"]#增加流通盘的列

csv_data["turnoverratio"]=round(csv_data["turnoverratio"],2)#换手率保留2位

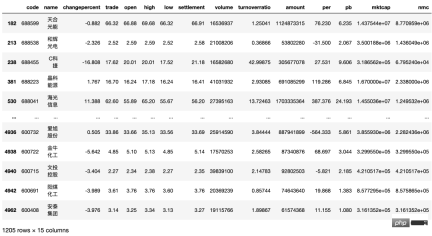

csv_data[csv_data["turnoverratio"]>3]筛选股票的数量减半。换手率低于 3%当然也有不错的股票,但是根据正态分布,我们不选取小概率事件。选择换手率较好的股票,意味着该文股票的交投越活跃,人们购买该支股票的意愿越高,该股票属于热门股。

换手率商一般意味股票流通性好,进出市场比较容易,不会出现想买买不到、想卖卖不出的现象,具有我较强的变现能力。然而值得注意的是,换手率较高的股票,往往也是短线资金追逐的对象,投机性较强,股价起伏较大,风险也相对较大。

将换手率降序排列并保存数据

换手率是最重要的一个指标,所以将筛选出来的股票换手率进行降序排列并保存,以备日后取证与研究。

将序排列用 sort_values() 两数,保存用 to_csv() 函数。这两个函数都很常用,也比较简单。代码如下:

import tushare as ts

def today_data():

csv_data=ts.get_today_all()

csv_data=csv_data[~csv_data.name.str.contains('ST')]

csv_data=csv_data[csv_data["volume"]>15000000]#15万手

csv_data["amount"]=round(csv_data["amount"]/100000000,2)#一亿,保留2位

csv_data=csv_data[(csv_data["amount"]>1)]

csv_data["liutongliang"]=csv_data["nmc"]/csv_data["trade"]#增加流通盘的列

csv_data["turnoverratio"]=round(csv_data["turnoverratio"],2)#换手率保留2位

csv_data=csv_data[csv_data["turnoverratio"]>3]

csv_data=csv_data.sort_values(by="turnoverratio", ascending=False)

return csv_data经过一系列的数据清洗与筛选,选择出符合要求的股票数据并保存到 Jupter Notebook 中。我们将上述代码进行函数化处理,并命名为 get_data.py。

以后,只要运行如下代码,就会将得到的 csv_data 显示出来:

import get_data get_data.today_data()

模块化后,将去掉大量重复代码,重加专注一个功能,也会增强代码的可读性。

本文摘编自《Python量化交易实战》,经出版方授权发布。(ISBN:9787522602820)

The above is the detailed content of Python quantitative trading practice: obtaining stock data and analyzing it. For more information, please follow other related articles on the PHP Chinese website!

Merging Lists in Python: Choosing the Right MethodMay 14, 2025 am 12:11 AM

Merging Lists in Python: Choosing the Right MethodMay 14, 2025 am 12:11 AMTomergelistsinPython,youcanusethe operator,extendmethod,listcomprehension,oritertools.chain,eachwithspecificadvantages:1)The operatorissimplebutlessefficientforlargelists;2)extendismemory-efficientbutmodifiestheoriginallist;3)listcomprehensionoffersf

How to concatenate two lists in python 3?May 14, 2025 am 12:09 AM

How to concatenate two lists in python 3?May 14, 2025 am 12:09 AMIn Python 3, two lists can be connected through a variety of methods: 1) Use operator, which is suitable for small lists, but is inefficient for large lists; 2) Use extend method, which is suitable for large lists, with high memory efficiency, but will modify the original list; 3) Use * operator, which is suitable for merging multiple lists, without modifying the original list; 4) Use itertools.chain, which is suitable for large data sets, with high memory efficiency.

Python concatenate list stringsMay 14, 2025 am 12:08 AM

Python concatenate list stringsMay 14, 2025 am 12:08 AMUsing the join() method is the most efficient way to connect strings from lists in Python. 1) Use the join() method to be efficient and easy to read. 2) The cycle uses operators inefficiently for large lists. 3) The combination of list comprehension and join() is suitable for scenarios that require conversion. 4) The reduce() method is suitable for other types of reductions, but is inefficient for string concatenation. The complete sentence ends.

Python execution, what is that?May 14, 2025 am 12:06 AM

Python execution, what is that?May 14, 2025 am 12:06 AMPythonexecutionistheprocessoftransformingPythoncodeintoexecutableinstructions.1)Theinterpreterreadsthecode,convertingitintobytecode,whichthePythonVirtualMachine(PVM)executes.2)TheGlobalInterpreterLock(GIL)managesthreadexecution,potentiallylimitingmul

Python: what are the key featuresMay 14, 2025 am 12:02 AM

Python: what are the key featuresMay 14, 2025 am 12:02 AMKey features of Python include: 1. The syntax is concise and easy to understand, suitable for beginners; 2. Dynamic type system, improving development speed; 3. Rich standard library, supporting multiple tasks; 4. Strong community and ecosystem, providing extensive support; 5. Interpretation, suitable for scripting and rapid prototyping; 6. Multi-paradigm support, suitable for various programming styles.

Python: compiler or Interpreter?May 13, 2025 am 12:10 AM

Python: compiler or Interpreter?May 13, 2025 am 12:10 AMPython is an interpreted language, but it also includes the compilation process. 1) Python code is first compiled into bytecode. 2) Bytecode is interpreted and executed by Python virtual machine. 3) This hybrid mechanism makes Python both flexible and efficient, but not as fast as a fully compiled language.

Python For Loop vs While Loop: When to Use Which?May 13, 2025 am 12:07 AM

Python For Loop vs While Loop: When to Use Which?May 13, 2025 am 12:07 AMUseaforloopwheniteratingoverasequenceorforaspecificnumberoftimes;useawhileloopwhencontinuinguntilaconditionismet.Forloopsareidealforknownsequences,whilewhileloopssuitsituationswithundeterminediterations.

Python loops: The most common errorsMay 13, 2025 am 12:07 AM

Python loops: The most common errorsMay 13, 2025 am 12:07 AMPythonloopscanleadtoerrorslikeinfiniteloops,modifyinglistsduringiteration,off-by-oneerrors,zero-indexingissues,andnestedloopinefficiencies.Toavoidthese:1)Use'i

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

Dreamweaver Mac version

Visual web development tools

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function