Technology peripherals

Technology peripherals AI

AI Gartner: Four steps to ensure financial AI applications are implemented correctly

Gartner: Four steps to ensure financial AI applications are implemented correctly

- Artificial intelligence (AI) is increasingly important to finance, but CFOs are still learning when and how to successfully deploy them.

- Investing in artificial intelligence and other digital initiatives can blunt the negative effects of economic stress in the short term and build competitive advantage in the long term.

- In finance, successful AI implementation requires the right leadership, talent, software investment and experimentation.

The use of artificial intelligence remains an emerging priority for CFOs as they move their finance functions further into a digital future. Of those using AI, 75% said they started using it within the past two years.

"The use of artificial intelligence in finance is still in its infancy, and most early adopters have little awareness of the expected returns on such projects," said Alexander Bant, research director at Gartner. “Defining financial use cases is key – for digital initiatives in general and AI projects in particular. Ultimately, the goal is to improve your competitive position and prepare for an autonomous future, especially in today’s economy.”

Gartner research shows that leading AI deployers engage in four common behaviors that enable them to quickly meet or exceed the expected impact of their AI projects and deliver key financial and business results.

“On average, finance departments that took these four actions found twice as many AI use cases as departments that didn’t take these actions,” Bant said. "This translates into more important business results, such as new product lines, and financial department results, such as greater accuracy and shorter process times."

四Key actions to ensure the success of financial artificial intelligence:

1. Hire external AI professionals

There are three options to ensure talent with AI skills and expertise: hire new talent, upgrade existing talent skills or borrow talent from the IT department. Organizations that focus their talent strategies on recruiting external employees with AI skills are more likely to become leading AI finance organizations.

AI specific talent brings valuable experience in handling the nuances of AI. This enables organizations to overcome inertia in using AI

applications and shorten the technology learning curve. While upskilling finance staff may be less expensive, doing so may slow progress and introduce a greater potential for error. New AI professionals change traditional processes and ways of thinking by bringing new ideas to support AI deployments.

2. Invest in software with embedded AI capabilities for quick success

Buy software with embedded AI capabilities to experiment with AI and apply it to financing use cases to quickly build solutions for unique business problems of pilot. Building in-house AI solutions for all financial processes creates more work and less bandwidth to explore new pilots or use cases.

3. Experiment early and widely

Top financial AI organizations take a “quick trial and error” experimental approach to AI deployment rather than making a few big bets. Early leaders will use AI more and deploy it faster.

The three most common AI use cases are accounting processes, back-office processing, and cash flow forecasting. Customer payment forecasting is a use case explored by half of leading organizations, but rarely among less successful organizations.

4. Choose an analytical AI implementation leader

Enterprises must choose the right people to lead AI deployments to realize benefits. This might mean the head of financial planning and analysis (FP&A) or the head of financial analytics leading the AI implementation, rather than the controller.

The FP&A and Financial Analytics leader has successfully led AI with his strong analytics and data background. They rely less on understanding traditional financial processes and more on understanding the complexities of AI in a business environment.

The above is the detailed content of Gartner: Four steps to ensure financial AI applications are implemented correctly. For more information, please follow other related articles on the PHP Chinese website!

ai合并图层的快捷键是什么Jan 07, 2021 am 10:59 AM

ai合并图层的快捷键是什么Jan 07, 2021 am 10:59 AMai合并图层的快捷键是“Ctrl+Shift+E”,它的作用是把目前所有处在显示状态的图层合并,在隐藏状态的图层则不作变动。也可以选中要合并的图层,在菜单栏中依次点击“窗口”-“路径查找器”,点击“合并”按钮。

ai橡皮擦擦不掉东西怎么办Jan 13, 2021 am 10:23 AM

ai橡皮擦擦不掉东西怎么办Jan 13, 2021 am 10:23 AMai橡皮擦擦不掉东西是因为AI是矢量图软件,用橡皮擦不能擦位图的,其解决办法就是用蒙板工具以及钢笔勾好路径再建立蒙板即可实现擦掉东西。

谷歌超强AI超算碾压英伟达A100!TPU v4性能提升10倍,细节首次公开Apr 07, 2023 pm 02:54 PM

谷歌超强AI超算碾压英伟达A100!TPU v4性能提升10倍,细节首次公开Apr 07, 2023 pm 02:54 PM虽然谷歌早在2020年,就在自家的数据中心上部署了当时最强的AI芯片——TPU v4。但直到今年的4月4日,谷歌才首次公布了这台AI超算的技术细节。论文地址:https://arxiv.org/abs/2304.01433相比于TPU v3,TPU v4的性能要高出2.1倍,而在整合4096个芯片之后,超算的性能更是提升了10倍。另外,谷歌还声称,自家芯片要比英伟达A100更快、更节能。与A100对打,速度快1.7倍论文中,谷歌表示,对于规模相当的系统,TPU v4可以提供比英伟达A100强1.

ai可以转成psd格式吗Feb 22, 2023 pm 05:56 PM

ai可以转成psd格式吗Feb 22, 2023 pm 05:56 PMai可以转成psd格式。转换方法:1、打开Adobe Illustrator软件,依次点击顶部菜单栏的“文件”-“打开”,选择所需的ai文件;2、点击右侧功能面板中的“图层”,点击三杠图标,在弹出的选项中选择“释放到图层(顺序)”;3、依次点击顶部菜单栏的“文件”-“导出”-“导出为”;4、在弹出的“导出”对话框中,将“保存类型”设置为“PSD格式”,点击“导出”即可;

ai顶部属性栏不见了怎么办Feb 22, 2023 pm 05:27 PM

ai顶部属性栏不见了怎么办Feb 22, 2023 pm 05:27 PMai顶部属性栏不见了的解决办法:1、开启Ai新建画布,进入绘图页面;2、在Ai顶部菜单栏中点击“窗口”;3、在系统弹出的窗口菜单页面中点击“控制”,然后开启“控制”窗口即可显示出属性栏。

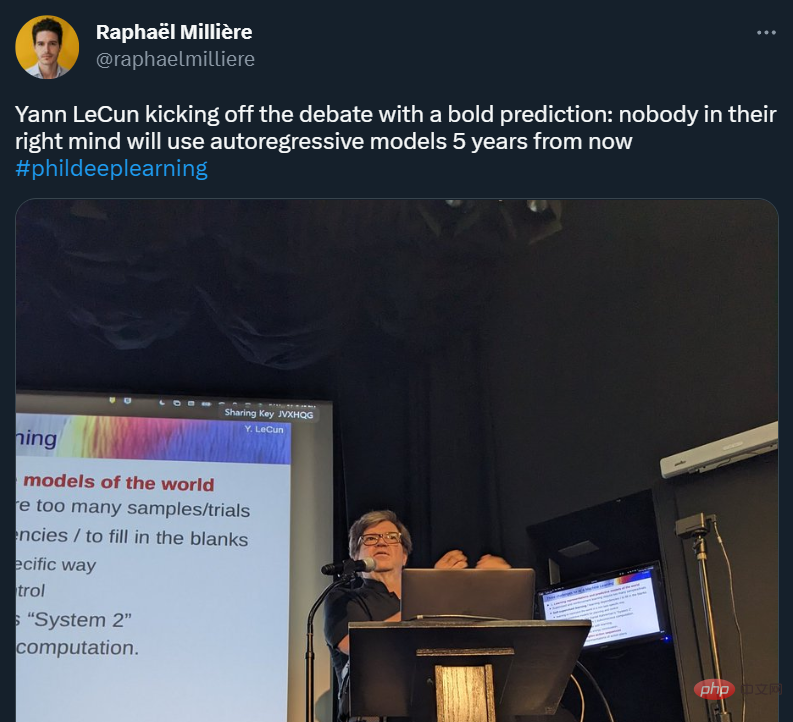

GPT-4的研究路径没有前途?Yann LeCun给自回归判了死刑Apr 04, 2023 am 11:55 AM

GPT-4的研究路径没有前途?Yann LeCun给自回归判了死刑Apr 04, 2023 am 11:55 AMYann LeCun 这个观点的确有些大胆。 「从现在起 5 年内,没有哪个头脑正常的人会使用自回归模型。」最近,图灵奖得主 Yann LeCun 给一场辩论做了个特别的开场。而他口中的自回归,正是当前爆红的 GPT 家族模型所依赖的学习范式。当然,被 Yann LeCun 指出问题的不只是自回归模型。在他看来,当前整个的机器学习领域都面临巨大挑战。这场辩论的主题为「Do large language models need sensory grounding for meaning and u

强化学习再登Nature封面,自动驾驶安全验证新范式大幅减少测试里程Mar 31, 2023 pm 10:38 PM

强化学习再登Nature封面,自动驾驶安全验证新范式大幅减少测试里程Mar 31, 2023 pm 10:38 PM引入密集强化学习,用 AI 验证 AI。 自动驾驶汽车 (AV) 技术的快速发展,使得我们正处于交通革命的风口浪尖,其规模是自一个世纪前汽车问世以来从未见过的。自动驾驶技术具有显着提高交通安全性、机动性和可持续性的潜力,因此引起了工业界、政府机构、专业组织和学术机构的共同关注。过去 20 年里,自动驾驶汽车的发展取得了长足的进步,尤其是随着深度学习的出现更是如此。到 2015 年,开始有公司宣布他们将在 2020 之前量产 AV。不过到目前为止,并且没有 level 4 级别的 AV 可以在市场

ai移动不了东西了怎么办Mar 07, 2023 am 10:03 AM

ai移动不了东西了怎么办Mar 07, 2023 am 10:03 AMai移动不了东西的解决办法:1、打开ai软件,打开空白文档;2、选择矩形工具,在文档中绘制矩形;3、点击选择工具,移动文档中的矩形;4、点击图层按钮,弹出图层面板对话框,解锁图层;5、点击选择工具,移动矩形即可。

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

SublimeText3 Linux new version

SublimeText3 Linux latest version

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool