B2B buyers are increasingly looking for more financial control and self-service alternatives.

Artificial intelligence (AI) is increasingly being invested in traditional banks, lenders and financial institutions, which are also keen to integrate it into their technology infrastructure.

Artificial intelligence in payments technology can help fintech startups, banks and social media payment systems improve their ability to detect fraud and help people pay online.

Peer-to-peer lending (P2P) and new players entering the B2C market have well demonstrated the revolutionary shift in digital payments that is now well underway!

Earlier this year , the well-known analysis platform CBInsight predicts that the B2B payment industry will grow to US$20 trillion.

PayPal and many other fintech companies are just a few payment service providers that have tried to make B2B payments less stressful and cumbersome. Why B2B payments took so long to enter the digital age is the key to this case.

Customers of all ages know that prioritizing digital-first B2B interactions mirrors the B2C purchases they are accustomed to today. B2B buyers are increasingly looking for more financial control and self-service alternatives.

As a result, B2B companies are now, in turn, accelerating AI-driven B2B payments processes—by leveraging Robotic Process Automation (RPA) to reduce costs, reduce errors, and more. B2B payments still have a lot of catching up to do, due to the varying complexity of authorizations and the numerous payment terms involved.

RPA is a software technology that helps people do their jobs better by automating part of their work. Today's accountants use tools and processes that are computer-dependent and involve numerous manual steps and keystrokes. RPA can change the way accounting works by integrating different tasks into a single, smooth, automated process.

B2B Payments and Artificial Intelligence Development

Businesses are under a lot of pressure due to lengthy, labor-intensive manual methods and outdated technology that, until recently, were the standard for payments. . On the other hand, artificial intelligence has recently become an integral part of the financial system.

Artificial Intelligence (AI) investments are becoming increasingly active among traditional banks, lenders and financial institutions, which are also keen to integrate AI into their technology infrastructure. If the current development rate is followed, the global financial technology market’s investment in artificial intelligence will reach US$22.26 billion by 2025, with a compound annual growth rate of 23.37%!

By utilizing information management, artificial intelligence-driven RPA Can improve accounting efficiency.

Sending purchase orders, tracking invoices, and negotiating payment and pricing terms are standard procedures in B2B transactions that have traditionally been labor-intensive and largely repetitive. From a communication perspective, the various internal finance departments also need to coordinate seamlessly. All of this is a complex process, with time frames stretched even further due to outdated, siled and monolithic systems.

How can artificial intelligence simplify B2B payments?

Businesses must improve their B2B payment processes to better serve their customers in an increasingly digital world. To reduce time and get rid of human errors, artificial intelligence in B2B payments can help automate payment operations. They are expediting the process to ensure the satisfaction of all relevant stakeholders.

Here are some of the top ways AI is being used to help businesses streamline B2B payments:

Improving access to credit

AI credit scoring makes it cheaper to evaluate a business than other methods Much more! Additionally, when traditional financial information is missing, AI systems can eliminate bias and use current and historical data to make credit choices.

Identify and prevent fraud

Artificial intelligence has been widely used in fraud prevention technology to encrypt or protect customer and supplier data. Machine learning (ML) is now being used in more advanced systems to help uncover suspicious behavior or vulnerabilities that people might overlook, as well as discover and assess potential risk factors.

Automated Payment Process

The time and money required to handle and process payments is greatly reduced as automation eliminates various nonsensical components.

The Changing B2B Payments Environment

While B2C payments technology has grown rapidly over the past few years, B2B payments innovation has slowed significantly. The number of parties involved, the volume of transactions and long payment cycles have led to the gradual disruption of the B2B payment process.

This number is gradually declining due to the widespread use of digital alternatives such as Automated Clearing House (ACH) and Exchange Traded Fund (EFT) transfers.

Fintech companies are also looking for new ways to use artificial intelligence technology as a standard to improve the efficiency of B2B transactions.

Conclusion

Artificial intelligence has huge potential to transform the B2B payments landscape and bring it into the digital age, from instantly assessing a company’s creditworthiness to ensuring fraud prevention. Therefore, by eliminating the extensive manual payment processes that limit business growth, SMBs can free up time and resources for more critical tasks.

Financial institutions and B2B fintech companies are increasing collaboration to develop cutting-edge products that comply with regulatory requirements. ?

The above is the detailed content of The role of artificial intelligence in B2B transactions. For more information, please follow other related articles on the PHP Chinese website!

2023年机器学习的十大概念和技术Apr 04, 2023 pm 12:30 PM

2023年机器学习的十大概念和技术Apr 04, 2023 pm 12:30 PM机器学习是一个不断发展的学科,一直在创造新的想法和技术。本文罗列了2023年机器学习的十大概念和技术。 本文罗列了2023年机器学习的十大概念和技术。2023年机器学习的十大概念和技术是一个教计算机从数据中学习的过程,无需明确的编程。机器学习是一个不断发展的学科,一直在创造新的想法和技术。为了保持领先,数据科学家应该关注其中一些网站,以跟上最新的发展。这将有助于了解机器学习中的技术如何在实践中使用,并为自己的业务或工作领域中的可能应用提供想法。2023年机器学习的十大概念和技术:1. 深度神经网

人工智能自动获取知识和技能,实现自我完善的过程是什么Aug 24, 2022 am 11:57 AM

人工智能自动获取知识和技能,实现自我完善的过程是什么Aug 24, 2022 am 11:57 AM实现自我完善的过程是“机器学习”。机器学习是人工智能核心,是使计算机具有智能的根本途径;它使计算机能模拟人的学习行为,自动地通过学习来获取知识和技能,不断改善性能,实现自我完善。机器学习主要研究三方面问题:1、学习机理,人类获取知识、技能和抽象概念的天赋能力;2、学习方法,对生物学习机理进行简化的基础上,用计算的方法进行再现;3、学习系统,能够在一定程度上实现机器学习的系统。

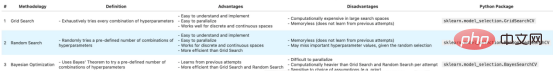

超参数优化比较之网格搜索、随机搜索和贝叶斯优化Apr 04, 2023 pm 12:05 PM

超参数优化比较之网格搜索、随机搜索和贝叶斯优化Apr 04, 2023 pm 12:05 PM本文将详细介绍用来提高机器学习效果的最常见的超参数优化方法。 译者 | 朱先忠审校 | 孙淑娟简介通常,在尝试改进机器学习模型时,人们首先想到的解决方案是添加更多的训练数据。额外的数据通常是有帮助(在某些情况下除外)的,但生成高质量的数据可能非常昂贵。通过使用现有数据获得最佳模型性能,超参数优化可以节省我们的时间和资源。顾名思义,超参数优化是为机器学习模型确定最佳超参数组合以满足优化函数(即,给定研究中的数据集,最大化模型的性能)的过程。换句话说,每个模型都会提供多个有关选项的调整“按钮

得益于OpenAI技术,微软必应的搜索流量超过谷歌Mar 31, 2023 pm 10:38 PM

得益于OpenAI技术,微软必应的搜索流量超过谷歌Mar 31, 2023 pm 10:38 PM截至3月20日的数据显示,自微软2月7日推出其人工智能版本以来,必应搜索引擎的页面访问量增加了15.8%,而Alphabet旗下的谷歌搜索引擎则下降了近1%。 3月23日消息,外媒报道称,分析公司Similarweb的数据显示,在整合了OpenAI的技术后,微软旗下的必应在页面访问量方面实现了更多的增长。截至3月20日的数据显示,自微软2月7日推出其人工智能版本以来,必应搜索引擎的页面访问量增加了15.8%,而Alphabet旗下的谷歌搜索引擎则下降了近1%。这些数据是微软在与谷歌争夺生

荣耀的人工智能助手叫什么名字Sep 06, 2022 pm 03:31 PM

荣耀的人工智能助手叫什么名字Sep 06, 2022 pm 03:31 PM荣耀的人工智能助手叫“YOYO”,也即悠悠;YOYO除了能够实现语音操控等基本功能之外,还拥有智慧视觉、智慧识屏、情景智能、智慧搜索等功能,可以在系统设置页面中的智慧助手里进行相关的设置。

人工智能在教育领域的应用主要有哪些Dec 14, 2020 pm 05:08 PM

人工智能在教育领域的应用主要有哪些Dec 14, 2020 pm 05:08 PM人工智能在教育领域的应用主要有个性化学习、虚拟导师、教育机器人和场景式教育。人工智能在教育领域的应用目前还处于早期探索阶段,但是潜力却是巨大的。

30行Python代码就可以调用ChatGPT API总结论文的主要内容Apr 04, 2023 pm 12:05 PM

30行Python代码就可以调用ChatGPT API总结论文的主要内容Apr 04, 2023 pm 12:05 PM阅读论文可以说是我们的日常工作之一,论文的数量太多,我们如何快速阅读归纳呢?自从ChatGPT出现以后,有很多阅读论文的服务可以使用。其实使用ChatGPT API非常简单,我们只用30行python代码就可以在本地搭建一个自己的应用。 阅读论文可以说是我们的日常工作之一,论文的数量太多,我们如何快速阅读归纳呢?自从ChatGPT出现以后,有很多阅读论文的服务可以使用。其实使用ChatGPT API非常简单,我们只用30行python代码就可以在本地搭建一个自己的应用。使用 Python 和 C

人工智能在生活中的应用有哪些Jul 20, 2022 pm 04:47 PM

人工智能在生活中的应用有哪些Jul 20, 2022 pm 04:47 PM人工智能在生活中的应用有:1、虚拟个人助理,使用者可通过声控、文字输入的方式,来完成一些日常生活的小事;2、语音评测,利用云计算技术,将自动口语评测服务放在云端,并开放API接口供客户远程使用;3、无人汽车,主要依靠车内的以计算机系统为主的智能驾驶仪来实现无人驾驶的目标;4、天气预测,通过手机GPRS系统,定位到用户所处的位置,在利用算法,对覆盖全国的雷达图进行数据分析并预测。

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Linux new version

SublimeText3 Linux latest version