Technology peripherals

Technology peripherals AI

AI Opportunities and challenges of artificial intelligence applications in financial technology

Opportunities and challenges of artificial intelligence applications in financial technologyOpportunities and challenges of artificial intelligence applications in financial technology

Artificial intelligence has now been widely used in data analysis and management in the financial field. AI plays a key role in making lending decisions, providing customer support, preventing fraud, predicting credit, assessing risk, and more. Many modern fintech companies are aware of the advantages of AI and are keen to leverage AI technology to improve their efficiency.

In the financial services sector, the level of process automation and digital transformation activities is increasing. Artificial intelligence technology is developing rapidly in the global financial industry. According to industry data, experts predict that the global market size of artificial intelligence in financial technology will reach US$26.67 billion.

The following introduces the opportunities and challenges of artificial intelligence technology in the financial technology industry.

Types of Artificial Intelligence in the Financial Industry

Artificial intelligence technology is much more efficient at identifying patterns in data than humans. This is why financial companies prefer applications powered by artificial intelligence technology. There are two types of artificial intelligence that are popular in the financial industry:

(1) Weak artificial intelligence

Weak artificial intelligence, also known as narrow artificial intelligence system, is specially designed to complete specific tasks. task or solve a specific problem. Artificial intelligence technology is governed by a set of rules and it delivers the best possible job without going beyond the rules. Apple’s Siri assistant is the best example of weak artificial intelligence.

(2)Strong artificial intelligence

Strong artificial intelligence is also called a complete artificial intelligence system. As the name suggests, it is designed to have greater promise than weak artificial intelligence. Applications powered by full artificial intelligence have immense power and functionality. It also has understanding and awareness. Therefore, many people generally believe that the entire artificial intelligence system mimics the human brain.

Application of Artificial Intelligence in Financial Services

Algorithms based on artificial intelligence are being implemented in financial services in almost all financial industries. Here are several key application scenarios of artificial intelligence in financial services:

(1) Personal Finance

Modern consumers prefer financial independence and seek to improve their financial independence by adopting artificial intelligence technology. The ability to manage your own financial health. This is why financial companies are being forced to implement artificial intelligence in personal finance. Businesses prefer to support customers around the clock through AI chatbots and provide consumers with personalized wealth management solutions.

Eno, a subsidiary of U.S.-based Capital One Bank, launched an SMS-based assistant to customers back in 2017. This SMS-based ancillary service offers 12 proactive services, including notifying customers of suspected fraud or price increases.

(2) Financial consumption

In business cases, preventing fraud and cyber attacks is the most important capability of artificial intelligence technology. Consumers are always looking for banks that offer high security for their accounts. According to data released by research institutions, approximately US$48 billion in online fraud is expected to occur in 2023. Banks prefer AI that has the ability to analyze and find irregular patterns in financial services.

JPMorgan Chase & Co. has successfully implemented a key fraud detection artificial intelligence application for all of its account holders. Every time a customer makes a credit card transaction, AI-powered proprietary algorithms detect patterns of fraud.

(3) Corporate Financing

Artificial intelligence technology is the first choice for enterprises to predict and obtain loan risks. In addition to reducing financial risk, AI technology also reduces financial crime by introducing advanced fraud detection operations.

To avoid anti-money laundering and identify bad customers, Bank of America uses artificial intelligence technology in its middle and back-end operations. AI-driven applications will unlock and analyze customer-related data through deep learning.

Real use cases of artificial intelligence in the financial industry

In the financial field, some companies use a large number of artificial intelligence applications in practical ways to solve their problems and save time and money. Here are some real-life examples of companies using artificial intelligence applications to operate effectively.

- Apps with artificial intelligence technology such as virtual financial advisors and chatbots will automate customer support services. Consumers are now interacting with chatbots to seek the answers they want.

- AI-powered applications such as “Contract Analyzer” detect fraud through anomalies. If a customer applies for multiple identical loans within minutes of each other, the AI application will detect it and flag it as suspicious.

- Data analysis is performed by AI-driven applications such as "churn prediction". It eliminates much of the tedious work for analysts, allowing them to focus on the important issues. Meanwhile, it continues working in the background to identify similar and smaller issues. In addition, the application of artificial intelligence technology helps enterprises analyze large amounts of data efficiently in real time.

- Artificial intelligence technology is widely used by the financial sector to identify someone’s creditworthiness. The app with artificial intelligence technology will help avoid overcharging or undercharging when disbursing loans by checking the credit scores of at-risk customers in real time.

Analysis of challenges and solutions facing the fintech industry in 2022

(1) Data breach

The top priority for financial services companies is to protect their sensitive data from Attacked by cybercrime. Compared with other industries, the financial industry is subject to 300 times more cyber attacks.

Solutions: Implementing innovative solutions, such as applications powered by artificial intelligence technology, will ensure financial services stay ahead of cybercriminals.

(2) Comply with the rules

The regulations and terms set by government departments for financial services continue to increase. Financial service providers are forced to spend significant amounts of money to ensure that their operations comply with all these regulations. Additionally, they need to frequently change their systems to keep up with evolving regulations and standards.

Solution: Adapting AI technology will help financial services providers avoid significant costs when complying with changing regulations. AI technology provides the necessary flexibility for businesses to define their own set of rules.

(3)Consumer expectations

Modern consumers have increasing expectations for financial service providers such as personalized financial services.

Solution: Introducing chatbots powered by artificial intelligence will help businesses understand the needs of consumers and provide the exact services they are looking for.

Benefits of Adopting Artificial Intelligence in the Financial Industry

In addition to enabling financial companies to automate tasks, detect fraud, and provide personalized financial services to valuable consumers, artificial intelligence technology also Offers a wide range of benefits to the financial industry.

The perfect implementation of artificial intelligence technology in the front and middle offices of the financial sector will have a significant positive impact on its operations. Let’s take a look at a few of the key benefits financial companies can gain from AI-driven applications.

- Eliminate time wastage on duplicate work.

- Significantly reduce human error through automation.

- High quality, frictionless, 24/7 customer interaction.

- Compliance and fraud detection.

- Help prevent fraud.

- Saving costs, etc.

Furthermore, artificial intelligence technology provides the fintech industry with unique solutions to solve all modern problems. The ability to identify patterns and suspicious behavior helps financial companies effectively deliver sensitive financial services.

The future of fintech is artificial intelligence

The financial sector has experienced substantial growth over the past few years. To solve modern problems and provide smarter services to customers, financial companies need to take full advantage of innovative technologies powered by artificial intelligence. By offering a wide range of benefits, AI technology offers financial companies the potential to conduct innovative financial transactions without changing traditional banking intermediaries.

The above is the detailed content of Opportunities and challenges of artificial intelligence applications in financial technology. For more information, please follow other related articles on the PHP Chinese website!

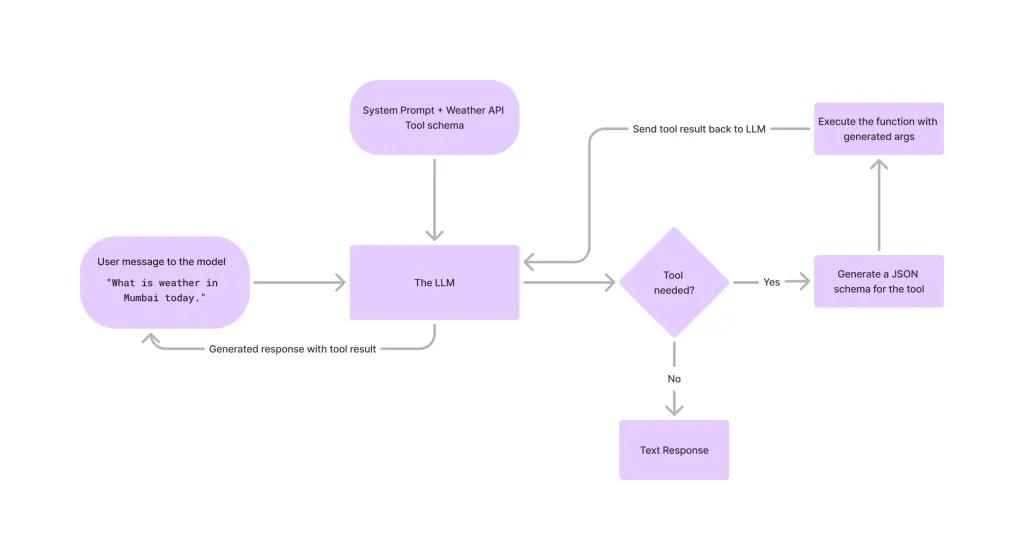

Tool Calling in LLMsApr 14, 2025 am 11:28 AM

Tool Calling in LLMsApr 14, 2025 am 11:28 AMLarge language models (LLMs) have surged in popularity, with the tool-calling feature dramatically expanding their capabilities beyond simple text generation. Now, LLMs can handle complex automation tasks such as dynamic UI creation and autonomous a

How ADHD Games, Health Tools & AI Chatbots Are Transforming Global HealthApr 14, 2025 am 11:27 AM

How ADHD Games, Health Tools & AI Chatbots Are Transforming Global HealthApr 14, 2025 am 11:27 AMCan a video game ease anxiety, build focus, or support a child with ADHD? As healthcare challenges surge globally — especially among youth — innovators are turning to an unlikely tool: video games. Now one of the world’s largest entertainment indus

UN Input On AI: Winners, Losers, And OpportunitiesApr 14, 2025 am 11:25 AM

UN Input On AI: Winners, Losers, And OpportunitiesApr 14, 2025 am 11:25 AM“History has shown that while technological progress drives economic growth, it does not on its own ensure equitable income distribution or promote inclusive human development,” writes Rebeca Grynspan, Secretary-General of UNCTAD, in the preamble.

Learning Negotiation Skills Via Generative AIApr 14, 2025 am 11:23 AM

Learning Negotiation Skills Via Generative AIApr 14, 2025 am 11:23 AMEasy-peasy, use generative AI as your negotiation tutor and sparring partner. Let’s talk about it. This analysis of an innovative AI breakthrough is part of my ongoing Forbes column coverage on the latest in AI, including identifying and explaining

TED Reveals From OpenAI, Google, Meta Heads To Court, Selfie With MyselfApr 14, 2025 am 11:22 AM

TED Reveals From OpenAI, Google, Meta Heads To Court, Selfie With MyselfApr 14, 2025 am 11:22 AMThe TED2025 Conference, held in Vancouver, wrapped its 36th edition yesterday, April 11. It featured 80 speakers from more than 60 countries, including Sam Altman, Eric Schmidt, and Palmer Luckey. TED’s theme, “humanity reimagined,” was tailor made

Joseph Stiglitz Warns Of The Looming Inequality Amid AI Monopoly PowerApr 14, 2025 am 11:21 AM

Joseph Stiglitz Warns Of The Looming Inequality Amid AI Monopoly PowerApr 14, 2025 am 11:21 AMJoseph Stiglitz is renowned economist and recipient of the Nobel Prize in Economics in 2001. Stiglitz posits that AI can worsen existing inequalities and consolidated power in the hands of a few dominant corporations, ultimately undermining economic

What is Graph Database?Apr 14, 2025 am 11:19 AM

What is Graph Database?Apr 14, 2025 am 11:19 AMGraph Databases: Revolutionizing Data Management Through Relationships As data expands and its characteristics evolve across various fields, graph databases are emerging as transformative solutions for managing interconnected data. Unlike traditional

LLM Routing: Strategies, Techniques, and Python ImplementationApr 14, 2025 am 11:14 AM

LLM Routing: Strategies, Techniques, and Python ImplementationApr 14, 2025 am 11:14 AMLarge Language Model (LLM) Routing: Optimizing Performance Through Intelligent Task Distribution The rapidly evolving landscape of LLMs presents a diverse range of models, each with unique strengths and weaknesses. Some excel at creative content gen

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment