Technology peripherals

Technology peripherals AI

AI Spend 61 billion US dollars! Chip giant Broadcom acquires VMware to achieve a 'fusion' of software and hardware

Spend 61 billion US dollars! Chip giant Broadcom acquires VMware to achieve a 'fusion' of software and hardwareSpend 61 billion US dollars! Chip giant Broadcom acquires VMware to achieve a 'fusion' of software and hardware

Today, chip industry giant Broadcom officially announced that it will acquire VMware for US$61 billion!

The purchase price values VMware at $142.50 per share, which is similar to the closing price on May 20, the last trading day before news of the acquisition was first reported. A premium of 44%. In addition, Broadcom will assume VMware's $8 billion in net debt.

Upon completion of the transaction, Broadcom Software Group will rebrand and operate as VMware, bringing Broadcom's existing infrastructure and security software solutions as part of the expanded VMware portfolio.

The merger of Broadcom and VMware would be one of the largest acquisitions in the history of the technology industry. Previously, Dell acquired EMC for $67 billion in 2015. Earlier this year, Microsoft acquired gaming giant Activision Blizzard for $68.7 billion.

This time Broadcom’s handwriting is almost the same. As a hardware giant in the semiconductor industry, Broadcom’s current chip business involves almost all aspects of daily computing. The company makes chips that are at the heart of storage and wired networking equipment. Broadcom is also a major player in the wireless industry, making Wi-Fi and Bluetooth chips used in PCs and mobile devices.

In the automotive industry, Broadcom’s chips occupy an important position in infotainment, autonomous driving and battery management systems. It also has a broad portfolio of enterprise hardware and software products, the latter of which is why this deal is critical to Broadcom's future growth.

VMware was founded in 1998 and focuses on virtualization software and cloud computing.

VMware's virtual machine software supports all major desktop operating systems (Windows, Linux, macOS) and also provides enterprise software solutions for server hardware platforms. In 2004, VMware was acquired by storage technology giant EMC. VMware was acquired by Dell in 2015 as part of the Dell-EMC deal. A year ago, Dell spun off VMware and once again operated as an independent company.

Broadcom President and CEO Chen Fuyang said, "VMware is a pioneer in the field of enterprise software, and this acquisition will better integrate our semiconductor and infrastructure software businesses with Combining the enterprise software business. As a leading infrastructure technology company, our goal is to re-invent the products and services we can provide our customers."

"We look forward to VMware's talented team joining Broadcom to further cultivate shared capabilities. "For the past 24 years, VMware has been reshaping the IT landscape and helping customers become digital enterprises." said Raghu Raghuram, CEO of VMware. The combination of assets and talented team with Broadcom’s existing enterprise software portfolio will result in a preeminent enterprise software player.”

Broadcom expects the transaction with VMware to be completed in fiscal 2023.

Chip giant cross-border "buy, buy, buy", can it be a win-win situation?

Currently, Broadcom and VMware have almost no business overlap. Broadcom mainly makes 5G and data center hardware, while VMware mainly develops cloud and virtualization software. Analysts believe that Broadcom is looking to expand its business beyond traditional chips, especially amid the current chip shortage.

The acquisition of VMware can provide opportunities in enterprise software. In addition, this transaction can also help Broadcom compete with cloud computing companies such as Amazon and Microsoft, and provide Broadcom with a better hybrid and multi-cloud operation strategy. "In Broadcom's view, the risk of market fluctuations in the chip field is too great," said Dan Morgan, a trust investment manager at financial services company Synovus. "One of the best ways to solve this problem is to shift to a stable, high-cash flow business." Enterprise The software market is that kind of business.

Broadcom has made several large-scale acquisitions in recent years, including acquiring CA Technologies for US$18.9 billion in 2018 and acquiring security company Symantec for US$10.7 billion in 2019, all in an effort to open up more diversification beyond hardware. business line.

Moreover, Broadcom has been looking for larger transactions. The company attempted to acquire fellow chip giant Qualcomm in 2018, but was blocked by then-President Trump on national security grounds. Broadcom faces significant regulatory hurdles in acquiring Qualcomm because they are both chip companies. Nvidia faced similar challenges before when it acquired Arm, and was eventually forced to give up because it failed to pass regulatory approval.

"Now this deal is completely different. Entering the software field is a major strategic change for Broadcom." Some analysts predict that the merger of the two companies is expected to drive down the prices of cloud computing and 5G. The entry of more and stronger players in this field will promote the growth of the business and will reduce the prices over a period of time.

“This transaction is pro-competitive, not anti-competitive,” said Marty Wolf, managing partner of Martinwolf. In recent years, more and more hardware giants have opened up new bases in the software industry, from IBM to Cisco to Nvidia. The most direct way to open up bases across businesses is acquisition.

In the acquisition information document presented to investors by Broadcom, a comparison of the revenue of the software and hardware departments since January 2017 is given . In January 2017, after Avago completed its acquisition of Broadcom and Avago changed its name to Broadcom again, revenue for the 12 months of that year was US$15.6 billion.

As of the end of fiscal 2021, which ended in October, Broadcom has nearly doubled in size, with sales of chips, circuit boards and now systems reaching $20.4 billion. The company's Symantec and CA software businesses have sales of $7.1 billion, but their profit margins are much higher than those of the hardware unit, with operating margins as high as 70%.

After the acquisition of VMware, Broadcom's software revenue is expected to nearly triple to $19.7 billion, which is expected to be equivalent to the revenue of the semiconductor hardware division. Currently, Symantec, currently owned by Broadcom, has overlapping businesses with VMware in the field of network security.

However, even if the acquisition is completed, the field of network security is still a competitive field, and this transaction may not change the competitive situation. Forrester senior analyst Naveen Chhabra believes that the cooperation between VMware and Symantec will not change. Obviously, he is not very optimistic that this acquisition can achieve Broadcom's ideal vision.

First of all, it’s easier said than done. Furthermore, Broadcom's past acquisition strategies did not show much innovation, and were basically simple additions.

For the acquired VMware, whether it can be a "win-win" this time may also be an undecided outcome. Although the current growth of VMware product business is relatively stable, what about after the acquisition? The core of VMware's business is enterprise software subscription business, and the most important thing is "sustainable stability." But being acquired now is to some extent an "unstable change." The uncertainty caused by this instability may affect VMware's long-term customers.

These people may regard VMware's separation from Dell as a rare opportunity, an opportunity for "barrier-free growth." Now that there is an additional boss, it is not as "barrier-free" as before. However, everything has two sides, and some analysts believe that Broadcom’s huge size will help VMware better compete in the field of cloud computing.

“If VMware’s software can create synergy with Broadcom’s hardware, the result will be very powerful.” He said. As of now, Broadcom’s market value is US$224.82 billion.

VMware’s market capitalization is US$52.36 billion, an increase of nearly 30% from US$40.3 billion at the close of trading last Friday.

##

##

The above is the detailed content of Spend 61 billion US dollars! Chip giant Broadcom acquires VMware to achieve a 'fusion' of software and hardware. For more information, please follow other related articles on the PHP Chinese website!

AI Game Development Enters Its Agentic Era With Upheaval's Dreamer PortalMay 02, 2025 am 11:17 AM

AI Game Development Enters Its Agentic Era With Upheaval's Dreamer PortalMay 02, 2025 am 11:17 AMUpheaval Games: Revolutionizing Game Development with AI Agents Upheaval, a game development studio comprised of veterans from industry giants like Blizzard and Obsidian, is poised to revolutionize game creation with its innovative AI-powered platfor

Uber Wants To Be Your Robotaxi Shop, Will Providers Let Them?May 02, 2025 am 11:16 AM

Uber Wants To Be Your Robotaxi Shop, Will Providers Let Them?May 02, 2025 am 11:16 AMUber's RoboTaxi Strategy: A Ride-Hail Ecosystem for Autonomous Vehicles At the recent Curbivore conference, Uber's Richard Willder unveiled their strategy to become the ride-hail platform for robotaxi providers. Leveraging their dominant position in

AI Agents Playing Video Games Will Transform Future RobotsMay 02, 2025 am 11:15 AM

AI Agents Playing Video Games Will Transform Future RobotsMay 02, 2025 am 11:15 AMVideo games are proving to be invaluable testing grounds for cutting-edge AI research, particularly in the development of autonomous agents and real-world robots, even potentially contributing to the quest for Artificial General Intelligence (AGI). A

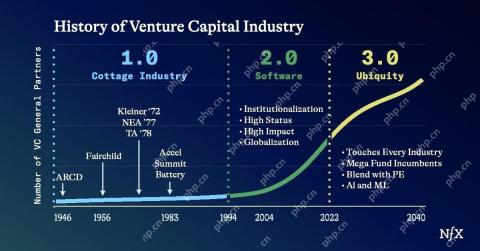

The Startup Industrial Complex, VC 3.0, And James Currier's ManifestoMay 02, 2025 am 11:14 AM

The Startup Industrial Complex, VC 3.0, And James Currier's ManifestoMay 02, 2025 am 11:14 AMThe impact of the evolving venture capital landscape is evident in the media, financial reports, and everyday conversations. However, the specific consequences for investors, startups, and funds are often overlooked. Venture Capital 3.0: A Paradigm

Adobe Updates Creative Cloud And Firefly At Adobe MAX London 2025May 02, 2025 am 11:13 AM

Adobe Updates Creative Cloud And Firefly At Adobe MAX London 2025May 02, 2025 am 11:13 AMAdobe MAX London 2025 delivered significant updates to Creative Cloud and Firefly, reflecting a strategic shift towards accessibility and generative AI. This analysis incorporates insights from pre-event briefings with Adobe leadership. (Note: Adob

Everything Meta Announced At LlamaConMay 02, 2025 am 11:12 AM

Everything Meta Announced At LlamaConMay 02, 2025 am 11:12 AMMeta's LlamaCon announcements showcase a comprehensive AI strategy designed to compete directly with closed AI systems like OpenAI's, while simultaneously creating new revenue streams for its open-source models. This multifaceted approach targets bo

The Brewing Controversy Over The Proposition That AI Is Nothing More Than Just Normal TechnologyMay 02, 2025 am 11:10 AM

The Brewing Controversy Over The Proposition That AI Is Nothing More Than Just Normal TechnologyMay 02, 2025 am 11:10 AMThere are serious differences in the field of artificial intelligence on this conclusion. Some insist that it is time to expose the "emperor's new clothes", while others strongly oppose the idea that artificial intelligence is just ordinary technology. Let's discuss it. An analysis of this innovative AI breakthrough is part of my ongoing Forbes column that covers the latest advancements in the field of AI, including identifying and explaining a variety of influential AI complexities (click here to view the link). Artificial intelligence as a common technology First, some basic knowledge is needed to lay the foundation for this important discussion. There is currently a large amount of research dedicated to further developing artificial intelligence. The overall goal is to achieve artificial general intelligence (AGI) and even possible artificial super intelligence (AS)

Model Citizens, Why AI Value Is The Next Business YardstickMay 02, 2025 am 11:09 AM

Model Citizens, Why AI Value Is The Next Business YardstickMay 02, 2025 am 11:09 AMThe effectiveness of a company's AI model is now a key performance indicator. Since the AI boom, generative AI has been used for everything from composing birthday invitations to writing software code. This has led to a proliferation of language mod

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

SublimeText3 English version

Recommended: Win version, supports code prompts!

Zend Studio 13.0.1

Powerful PHP integrated development environment

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Notepad++7.3.1

Easy-to-use and free code editor