Technology peripherals

Technology peripherals AI

AI How U.S. Credit Unions Are Transforming Customer Engagement with Smart Chatbots

How U.S. Credit Unions Are Transforming Customer Engagement with Smart ChatbotsHow U.S. Credit Unions Are Transforming Customer Engagement with Smart Chatbots

Consumers welcome the digital trend at banks and credit unions. Gen Z and Millennials want instant service from anywhere and on any channel—they want a self-service experience. They want financial services providers to be involved in every aspect of their financial journey to understand exactly what they need and provide a seamless experience.

#In response, credit unions, which typically differentiate themselves by offering better local and customized community engagement services, are seeking to be intuitive and intelligent through personalization, interactivity and always-on engagement. ways to connect with customers. However, doing this at scale is a challenge, as millions of consumers may be contacted in real time. This is where conversational engagement technologies, such as AI-enabled chatbots, play an important role.

AI-enabled chatbots can create a real human-like conversational experience for customers while engaging them. The key is developing consistent experiences for a truly omnichannel world. Most customers prefer to have their financial needs met through unstructured micro-conversations. Using smart chatbots, some credit unions are creating richer, more engaging conversational experiences for customers. By enabling intuitive, two-way interactions with customers in real-time on their preferred channels, America’s credit unions can bridge the gap between their need for convenience and personalized service while delivering a simple and trusted relationship.

Having conversational engagement solutions as your first line of defense is good business sense. Through conversational AI-driven automation, credit unions can free up critical resources for more strategic, higher-value tasks and increase overall productivity. For example, shifting traffic from call centers, email agents, and live chat support to conversational AI chatbots/voicebots can help credit unions save costs while continuing to serve customers efficiently.

Here are three ways America’s credit unions are transforming their businesses and continuing to improve customer satisfaction:

1. Make banks smarter and better Personalized

Industry experts believe that 40% of problems managed by bank call centers are routine inquiries. Credit unions can resolve customer inquiries faster and more efficiently with conversational AI chatbots, including voice bots. Frequently asked questions can be automatically organized (and regularly updated) and made immediately available to customers, along with intelligent suggestions. Complex or nuanced customer requests can be transferred to a customer service representative from the same chat session in seconds for a seamless experience.

Additionally, conversational AI solutions can serve as personal banking assistants for customers. Through conversational banking, credit unions can track and monitor user activity on their platform and provide smart, actionable financial recommendations and insights for informed decisions.

2. Improve customer loyalty and increase customer conversions

Conversational AI solutions can help by keeping the cycle consistent and real-time to help traditional banks and financial institutions obtain accurate customer feedback. According to a study by Uberall, 80% of respondents who engaged and interacted with a chatbot said their customer experience was positive. Chatbots demonstrate the potential to enhance user experience and customer loyalty. This increases sales conversion rates and reduces operating costs.

3. Fintech companies keep pace with the new era

CUInsight predicts that by 2029, fintech companies are likely to become global The largest bank. A Bain & Company report shows that 73% of Americans would consider banking with a technology company. The trend is clear. Credit unions need to enable customers to independently discover products and services and complete their buying journey from their favorite channel via chat.

For example, customers can start interacting with a credit union on its website and then easily transition to a WhatsApp or Facebook chatbot with the help of conversational AI. By leveraging omnichannel chatbots, U.S. credit unions can contact customers anytime, anywhere, achieving higher customer conversion rates and greater sales efficiency.

Why the future of banking is conversational

An Accenture survey found that 79% of bankers believe that artificial intelligence Soon will be working alongside humans as colleagues, collaborators, and trusted advisors. Conversational AI is becoming a catalyst for growth. Many credit unions are already leveraging chatbots to streamline operations, automate customer support, and provide a more convenient customer experience. As these institutions increase revenue and reduce operating costs with the help of chatbots, expect more credit unions to join the conversational banking bandwagon and stay competitive.

Ultimately, banks and credit unions leveraging conversational AI solutions can increase customer engagement and resolve customer inquiries faster. They can quickly roll out services across multiple channels, improve support team efficiency, and optimize costs to achieve faster, sustainable growth and profitability without losing sight of the goal of improving customer experience.

The above is the detailed content of How U.S. Credit Unions Are Transforming Customer Engagement with Smart Chatbots. For more information, please follow other related articles on the PHP Chinese website!

How to Run LLM Locally Using LM Studio? - Analytics VidhyaApr 19, 2025 am 11:38 AM

How to Run LLM Locally Using LM Studio? - Analytics VidhyaApr 19, 2025 am 11:38 AMRunning large language models at home with ease: LM Studio User Guide In recent years, advances in software and hardware have made it possible to run large language models (LLMs) on personal computers. LM Studio is an excellent tool to make this process easy and convenient. This article will dive into how to run LLM locally using LM Studio, covering key steps, potential challenges, and the benefits of having LLM locally. Whether you are a tech enthusiast or are curious about the latest AI technologies, this guide will provide valuable insights and practical tips. Let's get started! Overview Understand the basic requirements for running LLM locally. Set up LM Studi on your computer

Guy Peri Helps Flavor McCormick's Future Through Data TransformationApr 19, 2025 am 11:35 AM

Guy Peri Helps Flavor McCormick's Future Through Data TransformationApr 19, 2025 am 11:35 AMGuy Peri is McCormick’s Chief Information and Digital Officer. Though only seven months into his role, Peri is rapidly advancing a comprehensive transformation of the company’s digital capabilities. His career-long focus on data and analytics informs

What is the Chain of Emotion in Prompt Engineering? - Analytics VidhyaApr 19, 2025 am 11:33 AM

What is the Chain of Emotion in Prompt Engineering? - Analytics VidhyaApr 19, 2025 am 11:33 AMIntroduction Artificial intelligence (AI) is evolving to understand not just words, but also emotions, responding with a human touch. This sophisticated interaction is crucial in the rapidly advancing field of AI and natural language processing. Th

12 Best AI Tools for Data Science Workflow - Analytics VidhyaApr 19, 2025 am 11:31 AM

12 Best AI Tools for Data Science Workflow - Analytics VidhyaApr 19, 2025 am 11:31 AMIntroduction In today's data-centric world, leveraging advanced AI technologies is crucial for businesses seeking a competitive edge and enhanced efficiency. A range of powerful tools empowers data scientists, analysts, and developers to build, depl

AV Byte: OpenAI's GPT-4o Mini and Other AI InnovationsApr 19, 2025 am 11:30 AM

AV Byte: OpenAI's GPT-4o Mini and Other AI InnovationsApr 19, 2025 am 11:30 AMThis week's AI landscape exploded with groundbreaking releases from industry giants like OpenAI, Mistral AI, NVIDIA, DeepSeek, and Hugging Face. These new models promise increased power, affordability, and accessibility, fueled by advancements in tr

Perplexity's Android App Is Infested With Security Flaws, Report FindsApr 19, 2025 am 11:24 AM

Perplexity's Android App Is Infested With Security Flaws, Report FindsApr 19, 2025 am 11:24 AMBut the company’s Android app, which offers not only search capabilities but also acts as an AI assistant, is riddled with a host of security issues that could expose its users to data theft, account takeovers and impersonation attacks from malicious

Everyone's Getting Better At Using AI: Thoughts On Vibe CodingApr 19, 2025 am 11:17 AM

Everyone's Getting Better At Using AI: Thoughts On Vibe CodingApr 19, 2025 am 11:17 AMYou can look at what’s happening in conferences and at trade shows. You can ask engineers what they’re doing, or consult with a CEO. Everywhere you look, things are changing at breakneck speed. Engineers, and Non-Engineers What’s the difference be

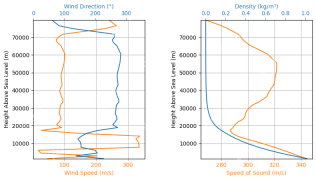

Rocket Launch Simulation and Analysis using RocketPy - Analytics VidhyaApr 19, 2025 am 11:12 AM

Rocket Launch Simulation and Analysis using RocketPy - Analytics VidhyaApr 19, 2025 am 11:12 AMSimulate Rocket Launches with RocketPy: A Comprehensive Guide This article guides you through simulating high-power rocket launches using RocketPy, a powerful Python library. We'll cover everything from defining rocket components to analyzing simula

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

Dreamweaver CS6

Visual web development tools

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

SublimeText3 Chinese version

Chinese version, very easy to use