Technology peripherals

Technology peripherals AI

AI Understand the whole picture of AI pharmaceuticals in one article: annual revenue of 30 billion, with three distinct echelons

Understand the whole picture of AI pharmaceuticals in one article: annual revenue of 30 billion, with three distinct echelonsUnderstand the whole picture of AI pharmaceuticals in one article: annual revenue of 30 billion, with three distinct echelons

How popular are AI pharmaceuticals that have been raising rounds of financing?

A foreign order has reached a maximum of 33.1 billion yuan, which is close to the R&D investment of a traditional pharmaceutical company for a whole year.

The domestic market is conservatively estimated to reach 204 billion yuan. Internet leading companies such as BAT, Byte, Huawei, etc. are vying for investment. Some companies have even completed three rounds of large-scale financing within a year...

△Picture source: Qubit Think Tank

From Peking University’s Frontier Interdisciplinary Research Institute, professors from famous foreign universities, to MIT PhDs, they have joined in entrepreneurship, and some have even received foreign awards. Students with Ph.D. offers from prestigious universities dropped out to join...

However, in sharp contrast to the capital boom, is the current situation of industry development:

The number of domestic AI pharmaceutical companies listed today is 0 , not even one has achieved profitability yet; the stock prices of foreign AI pharmaceutical companies have plummeted wildly after listing.

Currently, no drug successfully developed by AI has been successfully launched in the world. According to public information from various start-up companies, there are only 2 domestic companies and 8 foreign companies whose pipelines have just entered the clinical stage. period stage.

Now that the initial enthusiasm in the industry has passed, voices of doubt have become increasingly prominent:

Is the AI pharmaceutical industry a star track that attracts attention in future investment and financing, or is it a PPT bubble under the disguise of technology?

Can the data bottleneck of AI technology itself and its role in the pharmaceutical field really save the declining profits of traditional pharmaceutical companies?

When will AI pharmaceuticals really come to fruition?

After interviewing dozens of institutions, we wrote the "AI Pharmaceutical In-Depth Industry Report", trying to describe the current situation of the AI pharmaceutical industry at home and abroad, as well as the difficulties and opportunities faced by this industry.

AI Pharmaceutical "Current Situation Map"

AI Pharmaceutical, more accurately, should be "using AI to predict drugs."

Yes, AI at this stage has not really broken the traditional pharmaceutical research and development system. Even from the perspective of the research and development process, AI optimization is less than 40%.

Such positioning intensifies the "ambivalence" of AI pharmaceuticals:

On the one hand, drug discovery is the cornerstone of the entire drug research and development process , is also the most promising breakthrough for drug innovation; on the other hand, 60-80% of the clinical trial costs of drug research and development cannot be optimized by AI.

This sense of contradiction is also reflected in the financing situation, technology pricing and R&D implementation of AI pharmaceuticals.

Just looking at the financing situation, one would think that AI pharmaceuticals is an industry with a lot of money prospects.

According to data from Bank of China Securities, in 2020 alone, the number of AI pharmaceutical financing projects in China doubled, and the total financing in the same year increased by about 10 times year-on-year.

Since then, at least 11 AI pharmaceutical companies around the world have received large financing of more than US$100 million. And this data is still showing a rising trend:

△Data source: BOC Securities

According to Arterial Orange The report shows that "AI pharmaceuticals" has become one of the most popular tracks for capital in 2021, with 77 global financings totaling US$4.56 billion (approximately RMB 30.7 billion), of which US$1.24 billion was raised in the Chinese market.

At the same time, the survival situation of AI pharmaceutical companies is also very optimistic. About 53% of Series A companies entered Series B; 38% of Series B companies successfully entered Series C; 46% of Series C companies successfully entered Series D.

Looking at the monetization methods of AI companies, it seems that they also have investment potential.

Referring to the Benevolent prospectus data, looking at the price of the self-developed pipeline alone, the down payment and milestone payment prices set by AI pharmaceutical companies are not low, especially after the second phase of clinical trials, the down payment alone can reach nearly 1 One hundred million U.S. dollars.

△Picture source: Quantum Think Tank

However, combined with the research and development implementation situation, there is a strong sense of contradiction.

For example, there is still no AI-predicted drug on the market in the industry, and there is not even any drug on the market that has publicly entered the second phase of clinical trials.

At the same time, AI pharmaceuticals has yet to emerge with a breakthrough core technology that can prove that AI for drug discovery (AIDD) is reliable and sustainable and can replace or optimize the traditional computer drug discovery (CADD) process. .

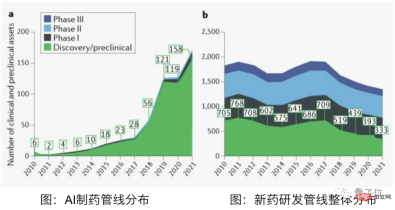

According to data from the Qubit Think Tank, even the fastest-growing AI prediction drugs have only passed animal testing and entered the first phase of clinical trials.

Among these fastest-growing AI prediction drugs, there are only 3 domestic pipelines. Although nearly 16 foreign pipelines have entered clinical trials, they are all still in the first phase.

△Picture source: Qubit Think Tank

This situation has led to a gradual cooling off of capital enthusiasm since 2021:

Currently, no domestic AI pharmaceutical company has completed its listing, and no company has achieved profitability.

The stock prices of at least 7 or 8 foreign listed companies have almost without exception plummeted.

In fact, judging from past experience, the probability of drug research and development failure is extremely high. The investment in clinical trials of countless new drugs has ultimately been wasted, which once again increases the uncertainty of AI prediction of drug launch. sex.

Especially since these drugs have not yet entered the second phase of clinical trials, there is no guarantee whether they can be launched on the market.

Since the "Thalidomide Incident" in 1961, whether the effectiveness of a drug can be verified has always been the biggest threshold for all new drugs to be launched. If "substantial evidence" such as credible safety data and clear benefit data for patients cannot be provided, the drug is very likely to die at this stage.

Obviously, during this period, most capital will be on the sidelines until drugs predicted by AI enter and pass Phase II clinical trials.

Compared with traditional pharmaceutical companies, AI pharmaceutical companies are not large in size. In situations where the risks and costs of clinical trials are extremely high, this “possibility of failure” is either transferred or can only be borne by the company itself.

With this, AI pharmaceutical companies have formed two main business models.

The first is the CRO (Contract Research Organization) model that transfers R&D risks. The company will "outsource" to traditional pharmaceutical companies or other companies and use AI technology to predict the drugs that Party A needs.

The second is the self-development pipeline model that is willing to bear the risk of R&D failure. The company holds the drug and technology patents in its hands. Once it is successfully launched or reaches a specific realization node (such as pre-clinical research), it can Make money by transferring patents or charging fees.

How to decide whether to be a CRO or self-developed pipeline?

One is the funding situation. The funds required for self-research pipelines are extremely high. Companies that are not short of money can directly develop their own pipelines; companies that want to develop their own pipelines but lack funds can first make money through CRO outsourcing, and then use the money earned to develop their own pipelines.

The other is the positioning difference. Compared with the large number of pharmaceutical-related theories mastered by companies originating from traditional pharmaceutical companies, CROs are more suitable for "cross-border entrepreneurial" players to quickly establish their own AI technology signature; self-research pipelines require higher pharmaceutical experience and resources.

In fact, CRO is currently more popular in China. In comparison, it makes profits faster, has a clearer monetization model, and does not need to bear the risk costs of subsequent clinical trials.

In addition, companies that have no interest in holding AI drug patents and only sell technical services can also only be CROs.

This has also led to the third business model - those who specialize in technology platforms and sell AI pharmaceutical software to other companies for predictive research and development. However, currently there are very few domestic companies that actually charge fees.

Obviously, the positioning and technological advantages of AI pharmaceutical companies will largely affect their choice of business model.

There are many players who have entered the game, ranging from doctoral professors from prestigious domestic and foreign universities, to Internet giants and traditional pharmaceutical companies, to capital incubation, showing a diversified trend.

The first is the situation of doctoral professors from famous universities starting their own businesses. Taking Jingtai Technology as an example, it is a typical case of an MIT PhD in quantum physics returning to China to start a business. Since the company's advantage lies in AI technology and its ability to lead the industry with the help of theoretical research in quantum physics, Jingtai Technology has made it clear that it will focus on the CRO model and not develop its own pipeline.

There are also cases of university professors transforming research results. For example, Huashen Intellectual Medicine was founded by UIUC tenured professor Peng Jian. Previously, there have been relevant achievements in the field of protein molecular prediction. This venture will focus on the development of technology platforms. Build and deliver.

After this, Internet giants and traditional pharmaceutical companies have also entered the game.

The former has its own advantages in algorithmic computing power, and it is easy to use the influence of the Internet itself to quickly expand its "sphere of influence." For example, Baidu and Tencent have established Baitu Biotech and Yunshen Pharmaceutical platforms to quickly enter the industry using their accumulated AI algorithm experience. Alibaba quickly established upstream and downstream relationships by virtue of its computing power advantage.

The latter has profound drug research and development experience, and has established an AI pharmaceutical research and development team on this basis. For example, AstraZeneca, Merck, Pfizer and Teva have cooperated with Amazon AION Labs was established jointly with the Israel Biofund.

Finally, there are capital entrepreneurship and fund incubation situations. The cash flow support is sufficient, and even investors themselves have transformed into AI entrepreneurship. For example, Wang Yikai, the founder of Coin Biotech, was the vice president of Fengrui Capital. After establishing the company, It received investment from Fengrui Capital.

According to data from the Qubit Think Tank, the AI pharmaceutical market is expected to reach 7.2 billion in 2025 and 204 billion in 2035.

Suddenly, many players poured into the AI pharmaceutical track. However, judging from the current situation and the current situation of players, it is impossible to judge the development prospects of AI pharmaceutical companies through pure technical strength or financial advantages.

Who is the real player among them and the company most promising to take the lead in launching the first new AI drug?

Who can be the first to market the first AI drug?

There are many standards and dimensions, but there are 4 core dimensions that cannot be bypassed in the industry:

01, number of pipelines and R&D progress

Given the complexity of the pharmaceutical process, the failure rate is high , it is an extremely long process from clinical approval, research to final marketing. For the current stage, the number of pipelines is one of the most direct manifestations of strength.

As mentioned earlier, the pipeline is divided into self-development pipeline and external cooperation pipeline (CRO).

For self-developed pipelines, companies can transfer pipeline results at specific nodes, such as new targets, drug candidates, etc.; they can also use CRO to advance to the clinical stage. Once the research and development is successful and a marketing patent is obtained, profits will increase. Very impressive. However, the risks of self-developed pipelines are also obvious: the payment method is unclear, and there will be competition with other companies on the same pipeline.

Therefore, when paying attention to the self-development pipeline of AI pharmaceutical companies, it is necessary to pay more attention to its research and development progress and the potential of the selected drug direction.

In contrast, the number of cooperation pipelines under the CRO model is a more direct way to judge a company's technical strength. CRO refers to an AI pharmaceutical company completing a specific task of a traditional pharmaceutical company. After the down payment, the cooperation price is determined based on the progress of the task (such as drug discovery-synthesis-completion of clinical research), also known as milestone payment.

According to estimates from the Qubit think tank, the average down payment for domestic pipelines is US$2.8 million. Milestone prices fluctuate greatly depending on the specific drug, and can even reach tens of billions of yuan upon completion. Whoever gets more cooperation pipelines means that whose technical strength is more recognized by pharmaceutical companies, and more funds will be invested in research and development, entering a virtuous cycle.

Refer to a foreign cooperation between Exscientia and Sanofi in early 2022, with an initial payment of US$100 million. After completing the task, they will receive a "sky-high price contract" of US$5.2 billion, equivalent to approximately 33.1 billion yuan.

According to data from the Qubit Think Tank, a batch of AI predictive drugs entering the second phase of clinical trials will appear in 2023-2024, and the first successfully launched AI drug will appear around 2026 at the earliest.

Before the drug is launched, the number of cooperative pipelines and the research and development progress of self-developed pipelines are one of the directions for judging the technical strength of AI pharmaceutical companies.

02. Stable and reliable data sources

For the AI pharmaceutical industry, in addition to money, the most lacking thing is probably data. Traditional pharmaceutical companies are generally unwilling to use research and development as one of their core assets. Data set outflow.

But according to Qubit Think Tank, data is currently not a problem for leading AI pharmaceutical companies, and it can even achieve more competitive performance in the industry.

Therefore, how to obtain stable and reliable data is also an important criterion for judging the competitiveness of AI pharmaceutical companies.

Generally speaking, there are the following four methods to obtain AI data, and their stability and reliability have gradually improved:

(1) Public/third-party data sets

This type of data is of great significance to the current AI pharmaceutical industry, but it does not have long-term benefits and cannot help companies gain core competitiveness. Moreover, the more available data on existing targets means more complete exploration and less development value.

(2) Virtual data

This data acquisition method is through physical modeling and training data generated by AI. It is usually based on older targets such as penicillin to produce data in the short term. It doesn't seem to be of much value. It mainly provides training data for the prediction model to improve the prediction accuracy.

(3) Independent collection/foreign cooperation data

For companies with clear self-development pipelines/basic positioning, they can collect relevant data through independently building teams, or reach data cooperation relationships with pharmaceutical companies.

Abroad, Tempus, founded in 2015, builds its own tumor genome by providing cost-effective gene sequencing, data structuring, pathological image analysis and biological modeling services to hospitals, oncologists, cancer centers, etc. clinical database.

It took 4 years to build one of the largest cancer databases in the world, with nearly 1/3 of the US cancer database.

my country's Janssen Pharmaceutical Factory reached a cooperation with Tempus in 2020 and publicly stated that the main driving force of the cooperation is not algorithms but data.

(4) Independently produce experimental data through smart laboratories

This method mainly refers to directly conducting wet experiments to independently generate data in addition to dry experiments conducted in the laboratory, forming Wet and dry closed loop.

Compared with traditional wet data acquisition speed, the data acquisition speed can be greatly improved by using related technologies such as high-throughput, intelligence, automation, controllability, and CV identification of cell morphology.

In biology, dry experiments are conducted through computer simulation and bioinformatics methods. Wet experiments are conducted in the laboratory using molecular, cellular, and physiological testing methods.

Dry and wet combined experiments can help AI pharmaceutical startups create new competitive barriers in terms of data. This recognition has reached consensus in the industry.

In addition to a cross-team of biological talents and computer talents, the establishment of such a platform also requires strong hardware support, including experimental equipment and computing resources, as well as the ability to integrate these two resources.

Currently, domestic leading AI pharmaceutical companies, including Baidu Shengtu, Jingtai Technology and Yingsi Intelligent, all have such experimental platforms.

With sufficient funds, leading foreign AI pharmaceutical companies have begun to directly acquire upstream companies with exclusive data and technology.

For example, Schrödinger acquired XTAL BioStructures to expand its structural biology capabilities, and Relay Therapeutics acquired ZebiAI to gain its machine learning capabilities and large databases.

Therefore, as analyzed by Qubit Think Tank, traditional pharmaceutical companies as a whole have advantages in data, but it does not come from the data accumulated in the past, but from the complete experimental platform they have. For AI pharmaceutical startups with sufficient funds, this barrier is not high and they can quickly update to the same level.

03. Recognition of cooperative pharmaceutical companies

With the establishment of intelligent teams in traditional pharmaceutical companies, algorithms may not be able to become the long-term competitive advantage of AI pharmaceutical companies.

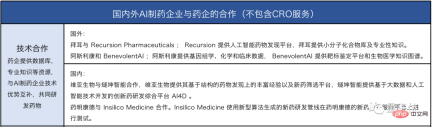

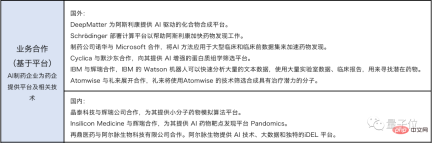

As mentioned earlier, AI pharmaceuticals have not broken the R&D process of the traditional pharmaceutical industry. In addition to building their own laboratory platforms and "working on it", the cooperation between AI pharmaceutical companies and pharmaceutical companies is equally important.

Therefore, the number of cooperative pharmaceutical companies and the industry status of these pharmaceutical companies have also become an intuitive evaluation criterion.

At present, leading AI pharmaceutical startups are gradually showing a monopoly in cooperation with traditional pharmaceutical companies. Overseas, taking Exscientia as an example, it has disclosed cooperation with top pharmaceutical companies including Roche, Bayer, Sanofi, GSK, Sumitomo of Japan, and Evotec.

Of course, the cooperation between traditional pharmaceutical companies and AI pharmaceutical companies is two-way: pharmaceutical companies provide databases and professional knowledge, and in turn require AI pharmaceutical companies Provide technology.

# Therefore, business cooperation with traditional pharmaceutical companies has become one of the most commonly adopted models by AI pharmaceutical companies.

According to Deep Pharma Intelligence, as of 2020, 93% of the 44 world's leading traditional pharmaceutical companies have completed cooperation arrangements. Especially among the world's top 10 pharmaceutical companies such as Roche, Novartis, and Pfizer, they have cooperated with AI pharmaceutical companies more than 6 times on average.

In addition to the status and quantitative recognition of the cooperative pharmaceutical companies, the CRO company selected by the AI pharmaceutical company is also one of the reference sources.

In the traditional pharmaceutical industry, CRO has a special status, and this feature will continue in the AI pharmaceutical industry.

AI pharmaceutical companies can become CROs of traditional pharmaceutical companies, but on the other hand, AI pharmaceutical companies also need their own CROs, including data partners, suppliers for assays and experiments, etc., to complete the application Approval, data collection, clinical trials and other tasks.

For AI pharmaceutical companies, the choice of CRO will greatly affect their clinical projects and commercialization process.

04. Break through the single characteristic of "AI improves efficiency"

As we all know, one of the current application scenarios of AI pharmaceuticals is to improve the efficiency of compound screening, but this is often done based on existing target and compound databases. of.

However, with the establishment of internal AI teams in pharmaceutical companies, the entry barriers for new AI pharmaceutical startups are continuing to rise. In addition, the current overlap in the entire industry is relatively high, and most companies’ pipelines are already Develop based on proven targets.

In other words, using AI to improve the efficiency of drug discovery is nothing new in this industry. At present, leading AI pharmaceutical companies have developed the innovative ability to use AI to explore the "pharmaceutical no man's land".

Therefore, it is very important for new start-ups to have their own unique entry point in business scenarios or technologies.

This may require AI pharmaceutical companies to start from the underlying theory, including redefining medical problems, creatively using multi-disciplinary perspectives such as physics and chemistry, redefining scenarios and problems in drug research and development, and using multiple principles to compensate for AI The errors and uncertainties inherent in the model and improve its efficiency.

Finally, under these four judging criteria, which players can take the lead?

According to the global AI pharmaceutical landscape map of the Qubit Think Tank, although most of the current leading players are foreign companies, domestic players such as Jingtai Technology and Yingsi Intelligent can also be seen:

After the AI pharmaceutical track became popular, many PhD professors from famous foreign universities returned to China to start their own businesses with projects and theories, and they were also quickly making up for the lack of technological innovation capabilities in the domestic pharmaceutical industry.

This time, in the wave of pharmaceutical innovation driven by new technologies, will China give birth to a world-class pharmaceutical factory?

There is a trend and more potential.

The above is the detailed content of Understand the whole picture of AI pharmaceuticals in one article: annual revenue of 30 billion, with three distinct echelons. For more information, please follow other related articles on the PHP Chinese website!

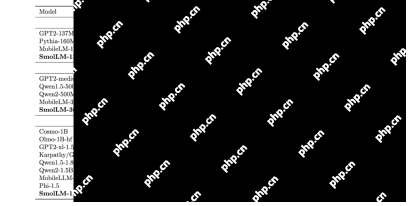

How to Build Your Personal AI Assistant with Huggingface SmolLMApr 18, 2025 am 11:52 AM

How to Build Your Personal AI Assistant with Huggingface SmolLMApr 18, 2025 am 11:52 AMHarness the Power of On-Device AI: Building a Personal Chatbot CLI In the recent past, the concept of a personal AI assistant seemed like science fiction. Imagine Alex, a tech enthusiast, dreaming of a smart, local AI companion—one that doesn't rely

AI For Mental Health Gets Attentively Analyzed Via Exciting New Initiative At Stanford UniversityApr 18, 2025 am 11:49 AM

AI For Mental Health Gets Attentively Analyzed Via Exciting New Initiative At Stanford UniversityApr 18, 2025 am 11:49 AMTheir inaugural launch of AI4MH took place on April 15, 2025, and luminary Dr. Tom Insel, M.D., famed psychiatrist and neuroscientist, served as the kick-off speaker. Dr. Insel is renowned for his outstanding work in mental health research and techno

The 2025 WNBA Draft Class Enters A League Growing And Fighting Online HarassmentApr 18, 2025 am 11:44 AM

The 2025 WNBA Draft Class Enters A League Growing And Fighting Online HarassmentApr 18, 2025 am 11:44 AM"We want to ensure that the WNBA remains a space where everyone, players, fans and corporate partners, feel safe, valued and empowered," Engelbert stated, addressing what has become one of women's sports' most damaging challenges. The anno

Comprehensive Guide to Python Built-in Data Structures - Analytics VidhyaApr 18, 2025 am 11:43 AM

Comprehensive Guide to Python Built-in Data Structures - Analytics VidhyaApr 18, 2025 am 11:43 AMIntroduction Python excels as a programming language, particularly in data science and generative AI. Efficient data manipulation (storage, management, and access) is crucial when dealing with large datasets. We've previously covered numbers and st

First Impressions From OpenAI's New Models Compared To AlternativesApr 18, 2025 am 11:41 AM

First Impressions From OpenAI's New Models Compared To AlternativesApr 18, 2025 am 11:41 AMBefore diving in, an important caveat: AI performance is non-deterministic and highly use-case specific. In simpler terms, Your Mileage May Vary. Don't take this (or any other) article as the final word—instead, test these models on your own scenario

AI Portfolio | How to Build a Portfolio for an AI Career?Apr 18, 2025 am 11:40 AM

AI Portfolio | How to Build a Portfolio for an AI Career?Apr 18, 2025 am 11:40 AMBuilding a Standout AI/ML Portfolio: A Guide for Beginners and Professionals Creating a compelling portfolio is crucial for securing roles in artificial intelligence (AI) and machine learning (ML). This guide provides advice for building a portfolio

What Agentic AI Could Mean For Security OperationsApr 18, 2025 am 11:36 AM

What Agentic AI Could Mean For Security OperationsApr 18, 2025 am 11:36 AMThe result? Burnout, inefficiency, and a widening gap between detection and action. None of this should come as a shock to anyone who works in cybersecurity. The promise of agentic AI has emerged as a potential turning point, though. This new class

Google Versus OpenAI: The AI Fight For StudentsApr 18, 2025 am 11:31 AM

Google Versus OpenAI: The AI Fight For StudentsApr 18, 2025 am 11:31 AMImmediate Impact versus Long-Term Partnership? Two weeks ago OpenAI stepped forward with a powerful short-term offer, granting U.S. and Canadian college students free access to ChatGPT Plus through the end of May 2025. This tool includes GPT‑4o, an a

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

SublimeText3 Linux new version

SublimeText3 Linux latest version

SublimeText3 Chinese version

Chinese version, very easy to use

Atom editor mac version download

The most popular open source editor

SublimeText3 Mac version

God-level code editing software (SublimeText3)